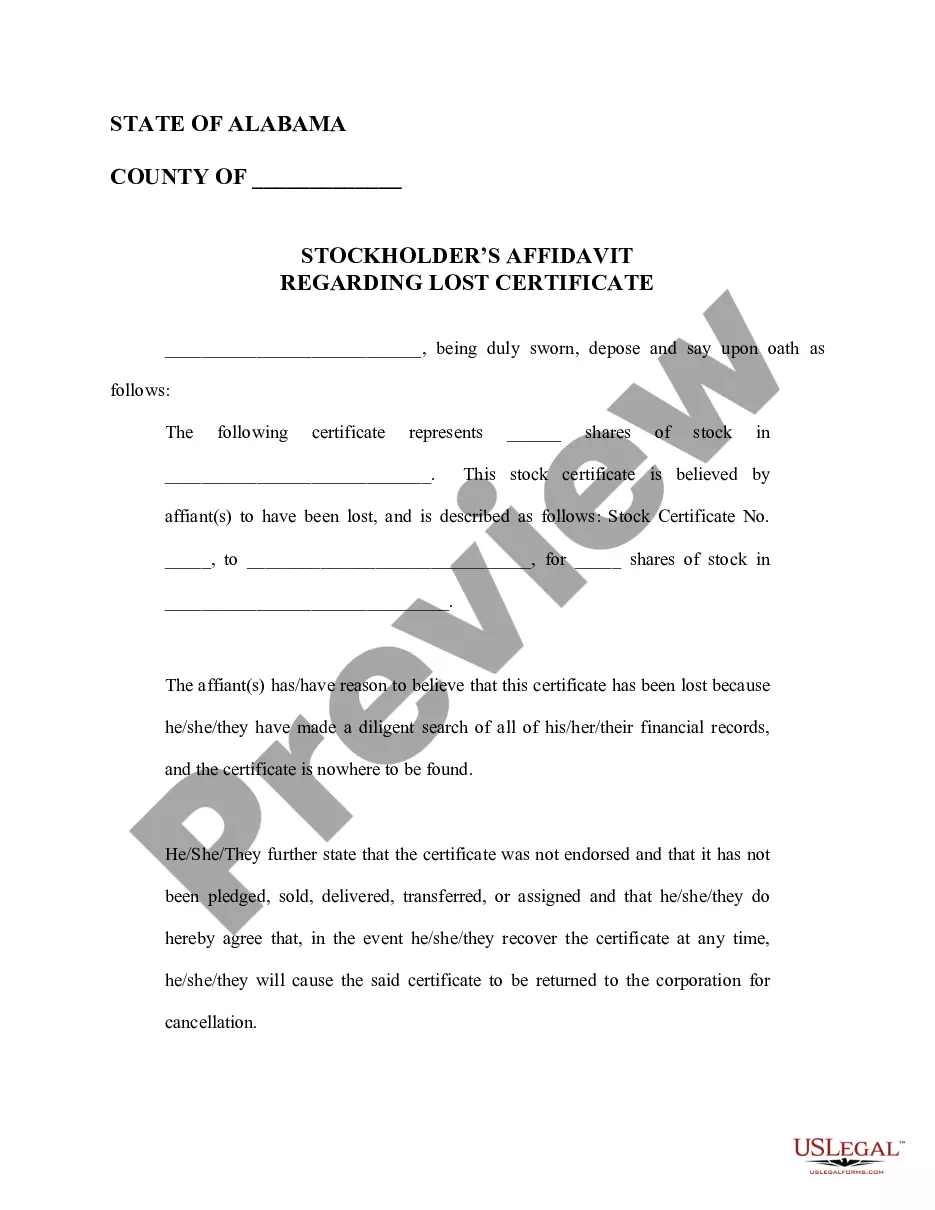

Pennsylvania Ratification of Oil and Gas Lease

Description

How to fill out Ratification Of Oil And Gas Lease?

US Legal Forms - among the biggest libraries of legal forms in the States - provides an array of legal record themes you can down load or produce. Making use of the internet site, you can find 1000s of forms for business and specific purposes, categorized by categories, claims, or key phrases.You can get the most up-to-date types of forms such as the Pennsylvania Ratification of Oil and Gas Lease within minutes.

If you already have a monthly subscription, log in and down load Pennsylvania Ratification of Oil and Gas Lease from your US Legal Forms local library. The Download switch will show up on every single type you see. You have accessibility to all formerly acquired forms in the My Forms tab of your own account.

In order to use US Legal Forms for the first time, listed below are basic instructions to help you started off:

- Be sure to have chosen the correct type for your area/region. Select the Preview switch to check the form`s information. Look at the type explanation to ensure that you have chosen the appropriate type.

- In the event the type does not suit your requirements, make use of the Search discipline at the top of the screen to find the one who does.

- Should you be satisfied with the form, verify your option by simply clicking the Get now switch. Then, choose the costs plan you prefer and supply your references to register on an account.

- Process the purchase. Utilize your Visa or Mastercard or PayPal account to finish the purchase.

- Select the format and down load the form on your own device.

- Make modifications. Fill out, modify and produce and indication the acquired Pennsylvania Ratification of Oil and Gas Lease.

Every design you added to your money does not have an expiration particular date which is the one you have eternally. So, if you wish to down load or produce another backup, just check out the My Forms portion and then click on the type you will need.

Gain access to the Pennsylvania Ratification of Oil and Gas Lease with US Legal Forms, the most substantial local library of legal record themes. Use 1000s of professional and state-specific themes that meet your organization or specific requirements and requirements.

Form popularity

FAQ

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

in clause (or shutin royalty clause) traditionally allows the lessee to maintain the lease by making shutin payments on a well capable of producing oil or gas in paying quantities where the oil or gas cannot be marketed, whether due to a lack of pipeline connection or otherwise.

The period of time in the life of an oil & gas lease that begins after the expiration of the primary term. Production, operations, continuous drilling, or shut-in royalty payments are most often used to extend an oil & gas lease into its secondary term.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

A clause in an oil & gas lease that provides that if the leased land is later owned by separate parties, such as in a sale of part of the property, the lessee can continue to operate, develop, and treat the lease as a whole and pay royalties to each owner based on its percentage of ownership of the entire area.

A ?special warranty? is a covenant made by the lessor to defend the lessee against encumbrances or clouds on the oil and gas title created by the lessor during his ownership of the estate. The protection offered by this warranty is therefore limited to those title defects caused or created by the lessor himself.

Typical granting clauses include language such as ?oil, gas, and other minerals,?2 ?oil and all gas of whatsoever nature or kind,?3 or some variation of these simplistic descriptions.