Utah Option to Purchase - Short Form

Description

How to fill out Option To Purchase - Short Form?

Have you found yourself in situations where you require documents for various business or specific purposes almost daily.

There are numerous legal document templates accessible online, but identifying reliable versions can be challenging.

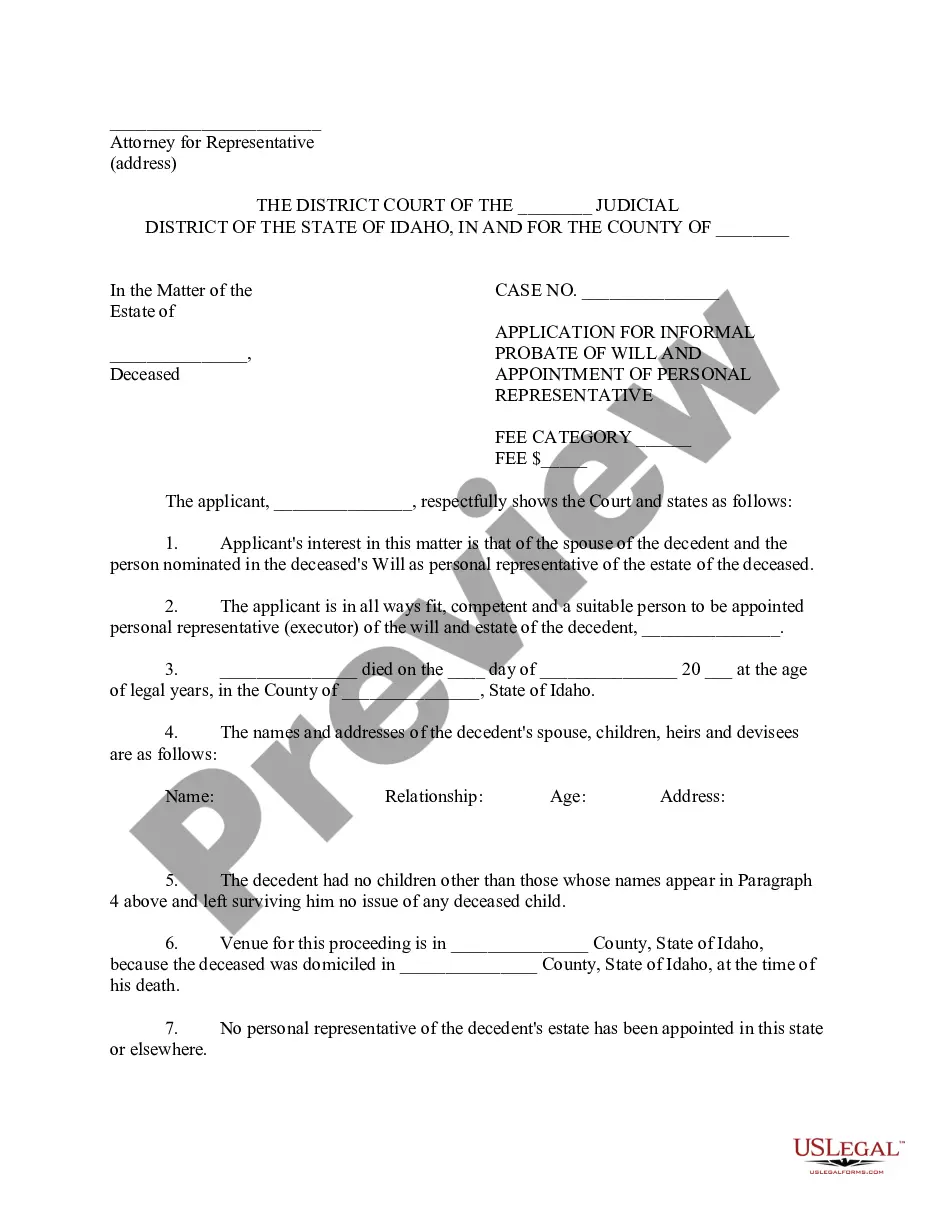

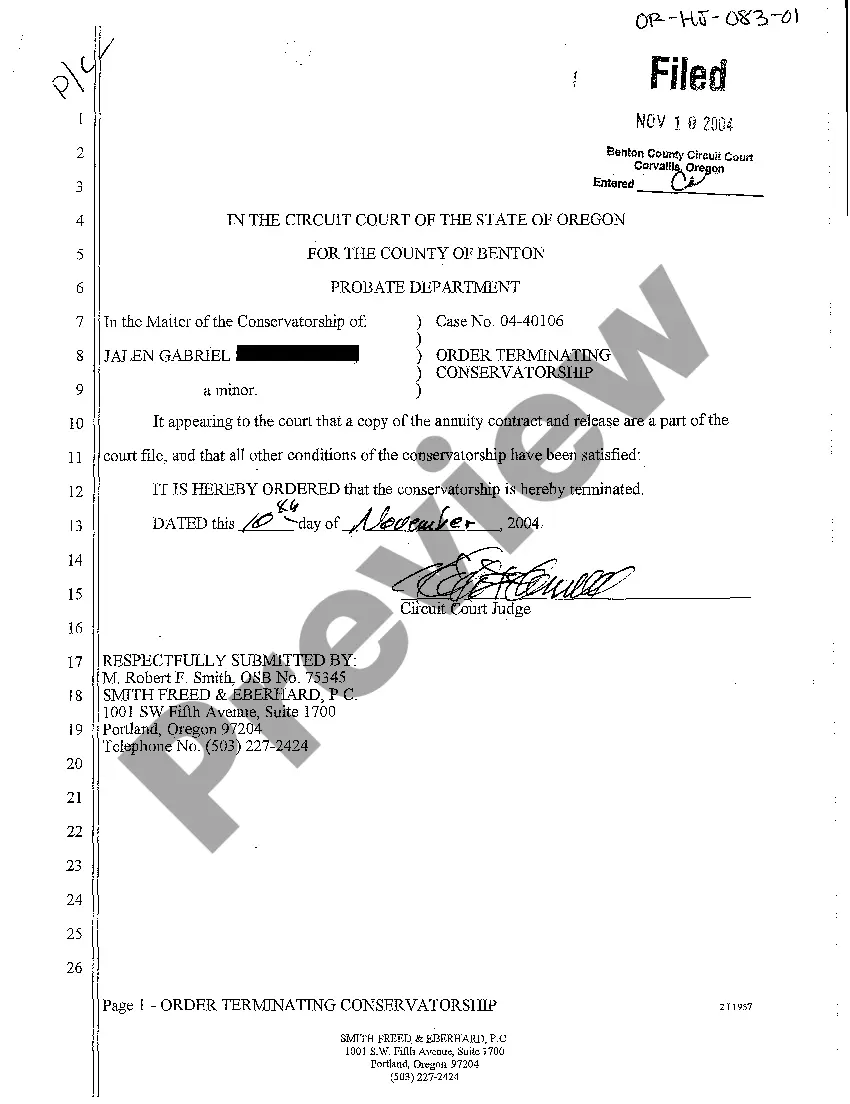

US Legal Forms provides thousands of template options, such as the Utah Option to Purchase - Short Form, which can be printed to comply with state and federal requirements.

Select a convenient format and download your version.

Access all the document templates you have acquired in the My documents section. You can obtain another copy of the Utah Option to Purchase - Short Form at any time. Just click on the desired form to download or print the document template. Use US Legal Forms, one of the most comprehensive selections of legal documents, to save time and prevent mistakes. The service offers professionally crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Utah Option to Purchase - Short Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct area/region.

- Utilize the Review feature to inspect the form.

- Read the description to verify you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs and specifications.

- Once you locate the correct form, click Buy now.

- Choose the pricing plan you need, fill in the required information to process your payment, and make a purchase using PayPal or credit card.

Form popularity

FAQ

What Is An Option To Purchase? An option to purchase agreement gives a home buyer the exclusive right to purchase a property within a specified time period and for a fixed or sometimes variable price. This, in turn, prevents sellers from providing other parties with offers or selling to them within this time period.

The fundamental difference between an Option and a Right of First Refusal is that an Option to Buy can be exercised at any time during the option period by the buyer. With a Right of First Refusal, the right of the potential buyer to complete the transaction is triggered only if the seller wants to complete a sale.

The primary difference is that an option contract entitles the buyer to the option to purchase the items at a later time, whereas a firm offer gives the buyer the right to buy the items outright at any time.

Option Contract ExampleYou expect Company XYZ's stock price to go up to $90 within the next month. You find out that you can buy an option contract for this company at $4.50 with a strike price of $75 per share. That means you'll pay $450 for your options contract ($4.50 x 100 shares).

An option agreement is a contract between the owner of a property and a potential buyer, giving the buyer the right to serve notice upon the seller to sell the property either at an agreed price or at its market value. Often, the purchaser will pay the seller a fee for entering into an option agreement.

Sometimes referred to as a right of first opportunity or first right to purchase, this provision requires the owner to give the holder the first chance to buy a property after the owner decides to sell. Unlike the option to purchase, the holder cannot force the owner to sell.

The answer to who is option writer is that it is someone who creates a new options contract and sells it to a trader seeking to buy that contract. The underlying security sold could be either a covered or an uncovered or naked option. If the writer owns the security underlying then it becomes a covered option.

The standard range by which most sellers follow is between one and five years. Buyers have the opportunity to purchase the real estate asset at any point during the option period. However, if the period expires, the agreement terminates, and the buyer loses option fees paid to the seller.

No matter the format, an option to purchase must: 1) state the option fee, 2) set the duration of the option period, 3) outline the price for which the tenant will purchase the property in the future, and 4) comply with local and state laws.

Options are derivatives of financial securitiestheir value depends on the price of some other asset. Examples of derivatives include calls, puts, futures, forwards, swaps, and mortgage-backed securities, among others.