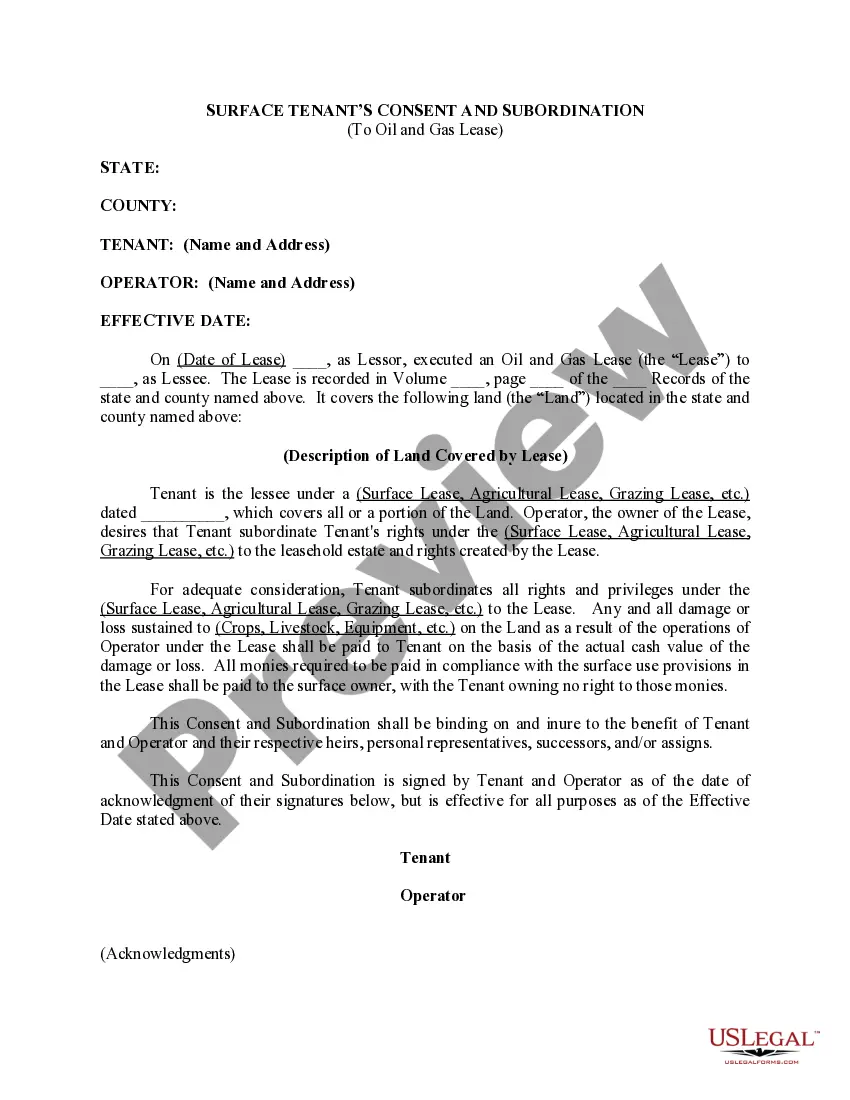

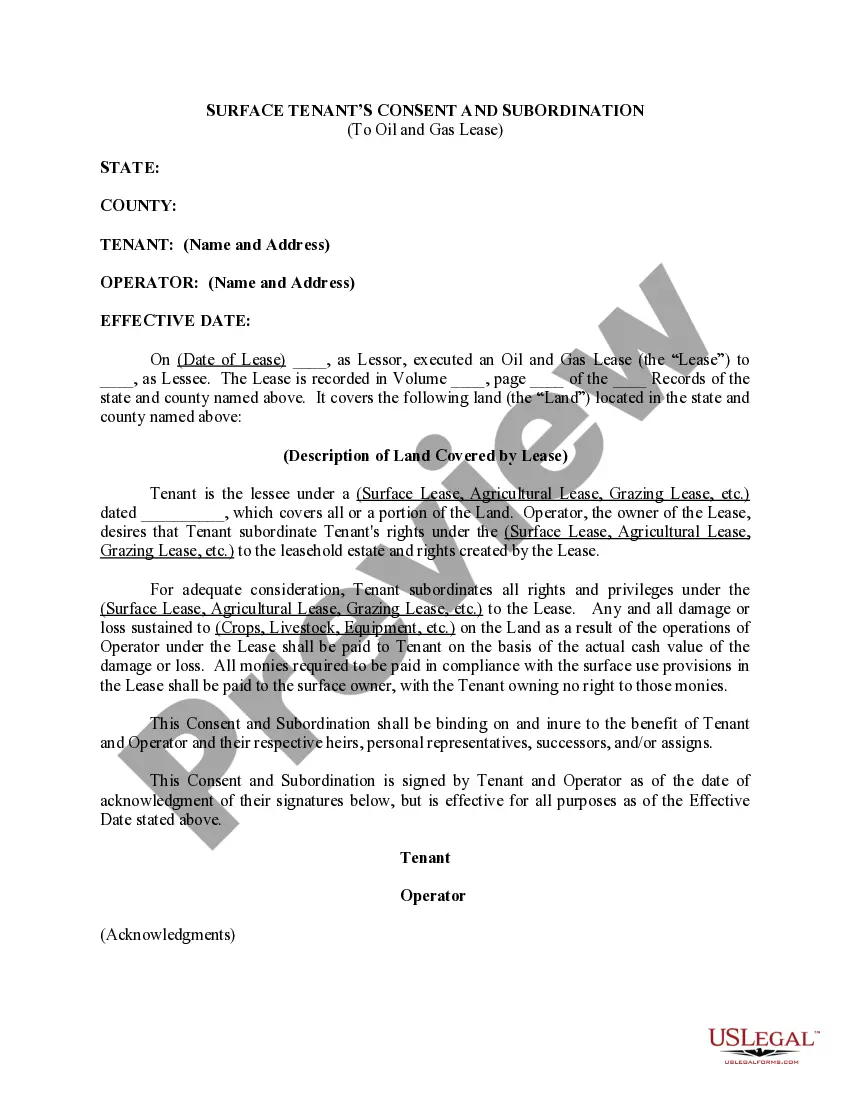

This form is used when a Tenant is the lessee under a (Surface Lease, Agricultural Lease, Grazing Lease, etc.) which covers all or a portion of the Land and the Operator, the owner of the Lease and the Lessee, desires that the Tenant subordinate the Tenant's rights to the leasehold estate and rights created by the Lease.

Pennsylvania Surface Tenant's Consent for Subordination to An Oil, Gas, and Mineral Lease

Description

How to fill out Surface Tenant's Consent For Subordination To An Oil, Gas, And Mineral Lease?

If you need to total, down load, or print out legitimate papers layouts, use US Legal Forms, the greatest selection of legitimate kinds, that can be found online. Take advantage of the site`s simple and convenient look for to discover the paperwork you will need. Numerous layouts for company and personal uses are sorted by categories and suggests, or keywords and phrases. Use US Legal Forms to discover the Pennsylvania Surface Tenant's Consent for Subordination to An Oil, Gas, and Mineral Lease with a number of clicks.

When you are currently a US Legal Forms buyer, log in to the accounts and then click the Acquire button to obtain the Pennsylvania Surface Tenant's Consent for Subordination to An Oil, Gas, and Mineral Lease. You may also gain access to kinds you earlier acquired from the My Forms tab of the accounts.

If you work with US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the form to the right metropolis/country.

- Step 2. Use the Review option to examine the form`s articles. Don`t forget to learn the information.

- Step 3. When you are not satisfied with all the develop, use the Research discipline at the top of the monitor to locate other variations in the legitimate develop web template.

- Step 4. Once you have found the form you will need, click the Purchase now button. Choose the pricing strategy you choose and put your credentials to register for an accounts.

- Step 5. Method the financial transaction. You may use your charge card or PayPal accounts to accomplish the financial transaction.

- Step 6. Pick the structure in the legitimate develop and down load it on your own device.

- Step 7. Comprehensive, revise and print out or indication the Pennsylvania Surface Tenant's Consent for Subordination to An Oil, Gas, and Mineral Lease.

Each legitimate papers web template you acquire is your own property permanently. You may have acces to every single develop you acquired in your acccount. Click on the My Forms area and choose a develop to print out or down load once again.

Be competitive and down load, and print out the Pennsylvania Surface Tenant's Consent for Subordination to An Oil, Gas, and Mineral Lease with US Legal Forms. There are millions of expert and express-particular kinds you may use to your company or personal requirements.

Form popularity

FAQ

Mineral rights can be sold in any Pennsylvania county for anything from $500/acre to $5,000+/acre. Isn't that a pretty wide range? The reason for such a range is because the ranges depend on where you are located in Pennsylvania. The cost of your property is heavily influenced by where you are located.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

Receive Payment Royalties are a form of payment made to the owner of the mineral rights, in exchange for the right to extract and sell the resource. In the context of mineral rights, royalties are typically a percentage of the revenue generated from the sale of minerals extracted from the property.

Pennsylvania allows property owners to separate the surface rights and the subsurface rights, which are oil, gas or mineral rights. When nothing is done, the property owner owns everything, surface and subsurface rights. The property owner may choose to sell or lease these subsurface rights.

72 P.S. § 7303(a)(3). If a mineral rights estate owner sells the mineral rights, the consideration less the owner's basis in the mineral rights and other costs associated with the sale is taxable. The gain is reported on Schedule D of the PA-40.