Pennsylvania Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman

Description

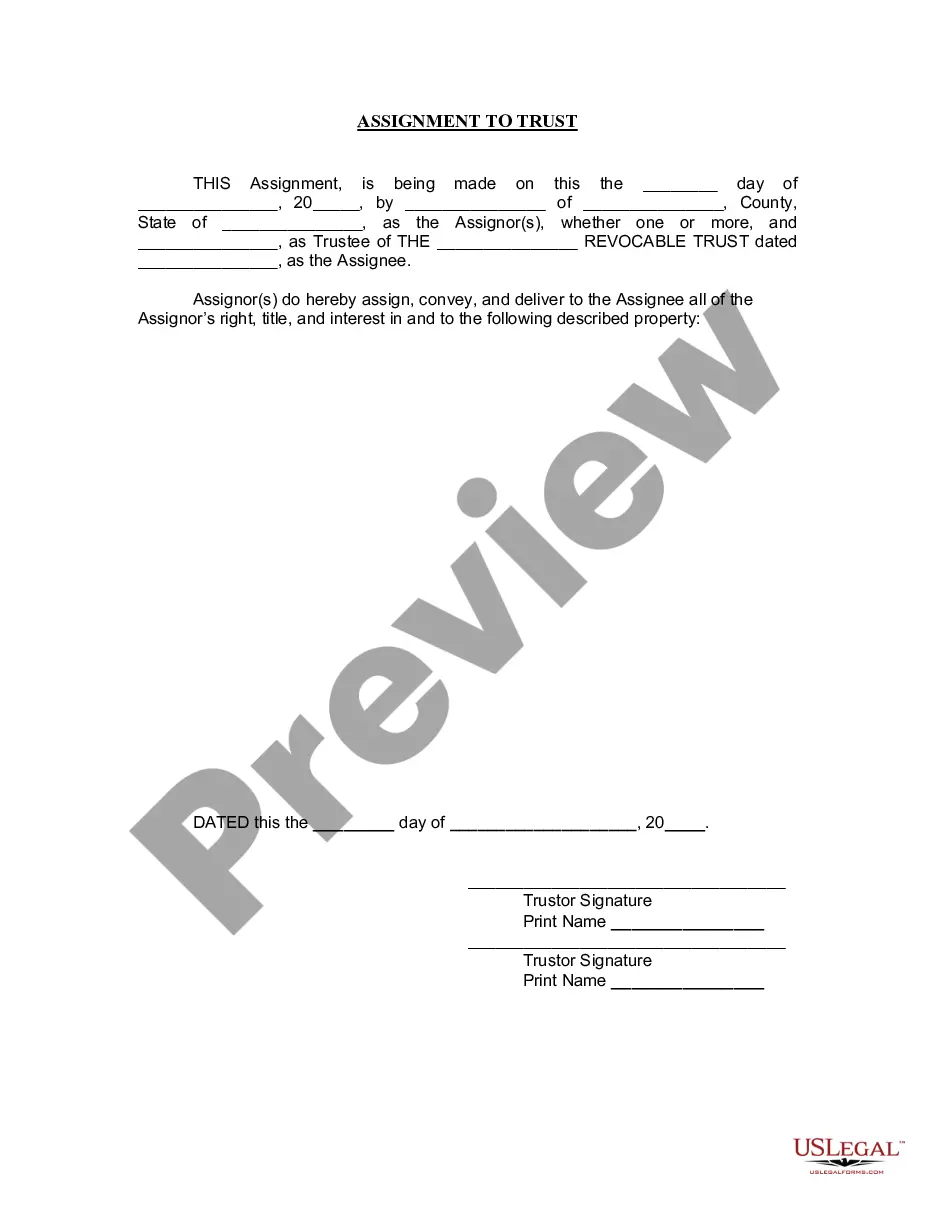

How to fill out Quitclaim Deed Of Life Estate Interest Created Under A Will, To The Remainderman?

US Legal Forms - among the greatest libraries of legitimate varieties in America - provides a wide array of legitimate file layouts it is possible to down load or produce. Making use of the website, you may get thousands of varieties for organization and personal uses, categorized by groups, suggests, or search phrases.You can get the most up-to-date variations of varieties such as the Pennsylvania Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman within minutes.

If you already possess a monthly subscription, log in and down load Pennsylvania Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman in the US Legal Forms collection. The Down load button will show up on each and every type you perspective. You get access to all in the past downloaded varieties within the My Forms tab of your own bank account.

In order to use US Legal Forms the first time, listed here are straightforward guidelines to obtain started off:

- Ensure you have picked the best type for the city/area. Go through the Review button to check the form`s content. Browse the type description to actually have selected the right type.

- If the type does not match your specifications, utilize the Lookup area near the top of the display to obtain the one that does.

- If you are satisfied with the shape, verify your option by clicking the Buy now button. Then, select the pricing plan you favor and give your accreditations to sign up on an bank account.

- Method the deal. Make use of credit card or PayPal bank account to accomplish the deal.

- Find the structure and down load the shape on your gadget.

- Make changes. Fill out, edit and produce and indicator the downloaded Pennsylvania Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman.

Every single format you included in your account lacks an expiration time and it is the one you have eternally. So, in order to down load or produce one more duplicate, just proceed to the My Forms area and click around the type you require.

Gain access to the Pennsylvania Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman with US Legal Forms, one of the most substantial collection of legitimate file layouts. Use thousands of specialist and status-specific layouts that meet your small business or personal requires and specifications.

Form popularity

FAQ

The life tenant is the person who has the life estate, or entitlement to the use of property during their lifetime. The second party is the remainderman, or person with a remainder interest who is entitled to full ownership upon the death of the life tenant. Rights and responsibilities of a remainderman - ? ... ? Estate Planning ? ... ? Estate Planning

A terminable interest is one that ends at some specified time. For example, a husband might leave his wife the use of a residence, but specify that the residence shall pass to the husband's children at the spouse's death.

A life estate may limit the transferability of the property, as the life tenant can only sell or transfer their interest in the property for the duration of their life or the designated measuring life.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen. How to Remove Someone from a Life Estate | SmartAsset SmartAsset ? estate-planning ? how-to-rem... SmartAsset ? estate-planning ? how-to-rem...

An exception to the rule that terminable interests do not qualify for the marital deduction is qualified terminable interest property (QTIP). QTIP is property in which the surviving spouse has a qualifying income interest for life and the executor elects on the estate tax return to treat the property as a QTIP (Sec.

The mother has a life estate inherited from her spouse. A life estate grants her the right to use and enjoy the property during her lifetime. Upon the mother's death, her life estate terminates, and ownership of the property passes to the son. This is known as the son's remainder interest. what interest does a son hold in property, if the mother held ... - Brainly brainly.com ? question brainly.com ? question

Life estates, terms for years, annuities, patents, and copyrights are therefore terminable interests. However, a bond, note, or similar contractual obligation, the discharge of which would not have the effect of an annuity or term for years, is not a terminable interest. 26 CFR § 25.2523(b)-1 - Life estate or other terminable interest. cornell.edu ? cfr ? text cornell.edu ? cfr ? text

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.