Pennsylvania Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest

Description

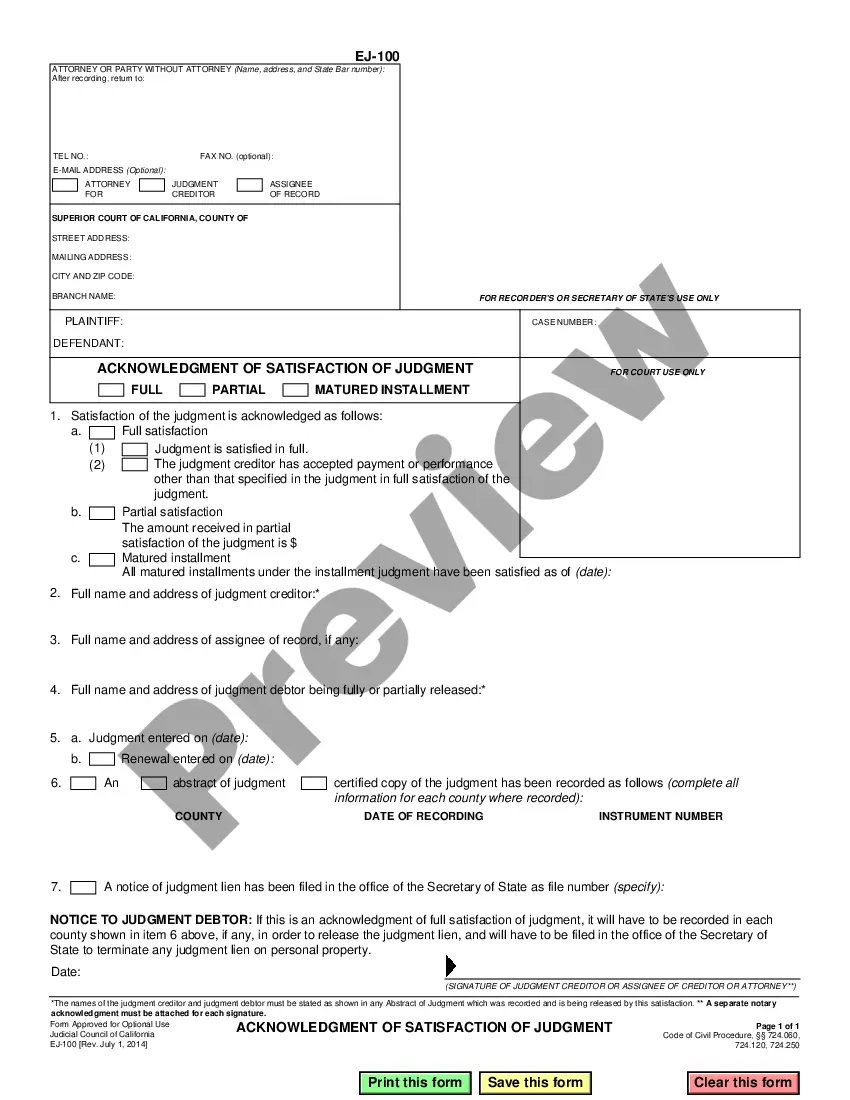

How to fill out Mineral Deed With Grantor Reserving Nonparticipating Royalty Interest?

Are you presently in the place in which you need papers for both enterprise or specific functions virtually every working day? There are plenty of lawful document templates accessible on the Internet, but discovering kinds you can trust isn`t easy. US Legal Forms provides a large number of type templates, just like the Pennsylvania Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest, which are created to meet state and federal needs.

When you are currently familiar with US Legal Forms web site and also have an account, merely log in. Next, you are able to acquire the Pennsylvania Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest design.

Should you not provide an bank account and want to begin using US Legal Forms, abide by these steps:

- Find the type you need and ensure it is for your right city/area.

- Use the Preview key to analyze the form.

- Read the information to actually have selected the correct type.

- In case the type isn`t what you are trying to find, make use of the Search industry to discover the type that suits you and needs.

- Whenever you get the right type, simply click Purchase now.

- Pick the prices plan you want, fill out the specified details to create your account, and pay money for the transaction with your PayPal or credit card.

- Select a hassle-free data file format and acquire your version.

Locate each of the document templates you possess purchased in the My Forms menus. You can obtain a further version of Pennsylvania Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest anytime, if necessary. Just click on the essential type to acquire or print the document design.

Use US Legal Forms, probably the most comprehensive selection of lawful forms, to save lots of time and avoid blunders. The assistance provides professionally produced lawful document templates which can be used for a selection of functions. Generate an account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

A royalty is a fee that is imposed by local, state or federal governments on either the amount of minerals produced at a mine or the revenue or profit generated by the minerals sold from a mine. A royalty can be imposed as either a ?net? or ?gross? royalty.

Overriding Royalty Interest (ORRI) Oil and gas royalties are typically calculated based on the value of the production. The royalty rate is negotiated between the owner of the mineral rights and the company extracting the oil and gas, and can range from 12.5% to 25% of the production value.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

An Overriding Royalty Interest IORRI), commonly referred to as an override, is a fractional, undivided interest granting the right to receive proceeds from the sale of oil and gas. It is not an interest in the minerals themselves, but rather in the proceeds of the sale of oil and gas.

The IRS treats the royalty income like any other income from employment or a business. You'd be responsible for paying tax on it based on your tax bracket. If you are single and only claim the standard tax deduction, your tax rate would be 22%.

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

A mineral interest is simply a real property interest obtained from the severance or exploitation of minerals ? say natural gas ? from the surface. On the other hand, a royalty interest is the property interest that grants an owner a portion of the production revenue generated.

Natural gas rights and mineral rights must be reported like all other types of assets on Schedule E of the Inheritance Tax returns. Mineral rights taxable value is determined by the same method used to value any real or tangible personal property.