Pennsylvania Self-Employed Utility Services Contract

Description

How to fill out Self-Employed Utility Services Contract?

It is feasible to spend hours online trying to locate the valid document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of valid forms that are reviewed by experts.

You can easily download or print the Pennsylvania Self-Employed Utility Services Contract from the service.

- If you have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can fill out, modify, print, or sign the Pennsylvania Self-Employed Utility Services Contract.

- Every valid document template you acquire is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/city of your choice.

- Review the form description to ensure you have chosen the right type.

- If available, use the Review button to search through the document template as well.

- If you wish to find another version of your form, use the Lookup field to get the template that meets your needs and requirements.

- Once you have found the template you want, click Get now to continue.

- Select the pricing plan you want, enter your details, and register for an account on US Legal Forms.

- Complete the transaction.

- You can use your credit card or PayPal account to purchase the valid form.

- Choose the format of your document and download it to your device.

- Make changes to the document if necessary.

- You can fill out, modify, sign, and print the Pennsylvania Self-Employed Utility Services Contract.

- Download and print thousands of document templates using the US Legal Forms site, which offers the largest collection of valid forms.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

In Pennsylvania, while an operating agreement is not legally required for an LLC, it is highly recommended. This document outlines the management structure and operating procedures of the LLC. Having an operating agreement can help prevent misunderstandings among members, especially in a Pennsylvania Self-Employed Utility Services Contract. Consider using resources from USLegalForms to draft an agreement that meets your needs.

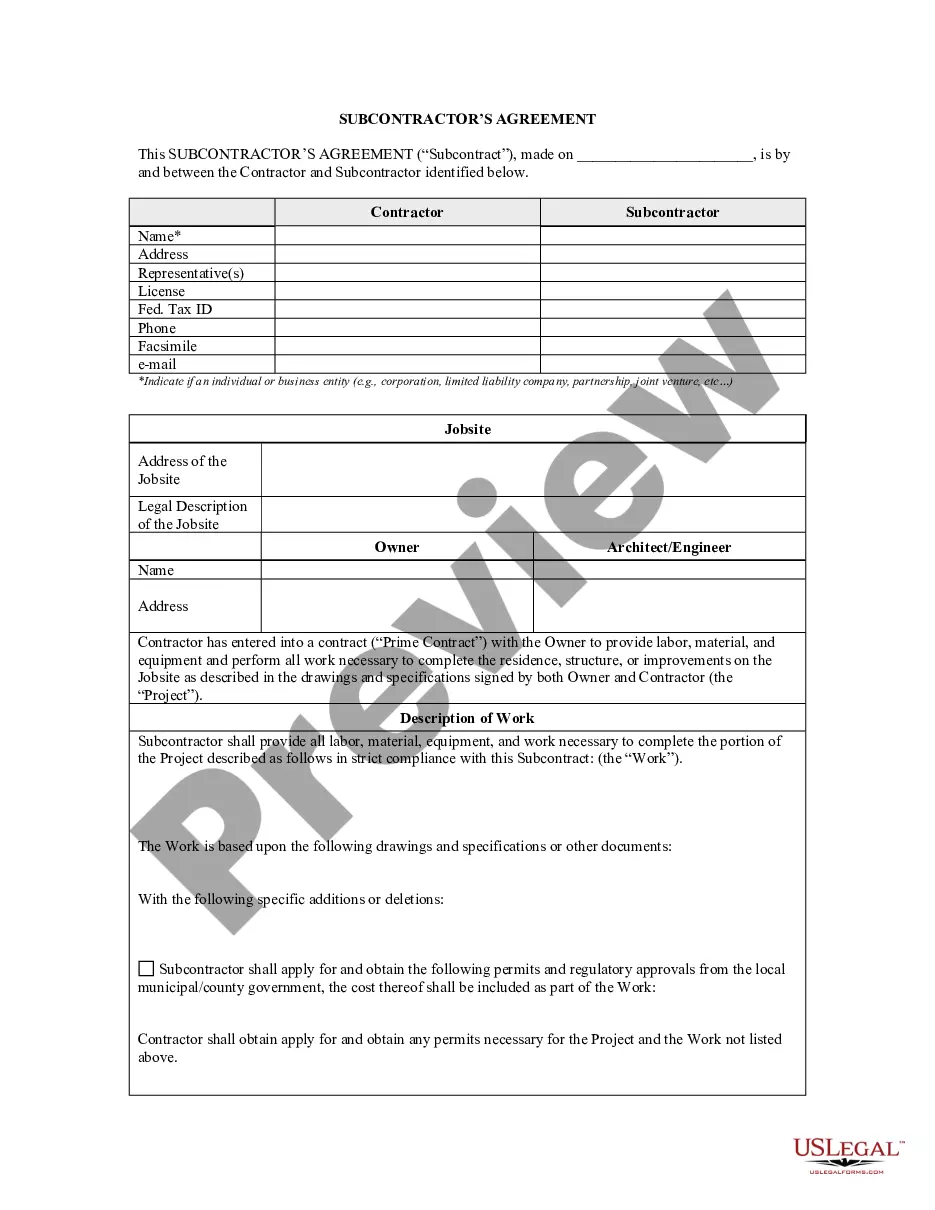

A contractor contract in Pennsylvania must include several key components to be effective. First, it should clearly outline the scope of work, payment terms, and deadlines. It is also important to specify any relevant licenses or permits required for the services offered. By using a comprehensive template from USLegalForms, you can easily create a Pennsylvania Self-Employed Utility Services Contract that meets all legal requirements.

To form a legally binding contract in Pennsylvania, you need five essential elements. These include an offer, acceptance, consideration, capacity, and legality. Each element plays a vital role in ensuring that the Pennsylvania Self-Employed Utility Services Contract is enforceable. By understanding these components, you can create a solid agreement that protects your interests.

In Pennsylvania, a contract is legally binding when it meets specific criteria. First, the agreement must involve an offer and acceptance between parties. Additionally, there must be consideration, meaning something of value exchanged. Lastly, both parties must have the legal capacity to enter into the Pennsylvania Self-Employed Utility Services Contract, and the contract must adhere to state laws.

Whether you should add tax to your invoice for services in Pennsylvania depends on the nature of the services provided. If your services fall under taxable categories, you will need to include sales tax in your invoice. Consulting resources like the US Legal Forms platform can provide guidance on compliance and invoicing practices to ensure you meet state requirements.

Service agreements in Pennsylvania can be taxable, depending on the specifics of the agreement and the services rendered. If you are operating under a Pennsylvania Self-Employed Utility Services Contract, you should evaluate whether your services are subject to sales tax. It is wise to seek professional advice to navigate these complexities.

Pennsylvania excludes various types of income from state taxation, such as certain retirement benefits and some forms of government assistance. As someone engaged in a Pennsylvania Self-Employed Utility Services Contract, it is crucial to understand which types of income you can exclude when filing your taxes. Keeping accurate records will help you maximize your deductions.

In Pennsylvania, certain services may be exempt from sales tax, including professional services and some utility services. However, if you are providing services under a Pennsylvania Self-Employed Utility Services Contract, you should verify the specific exemptions that apply to your case. Consulting with a tax advisor can help clarify your obligations.

Filing the 1099-NEC form in Pennsylvania requires you to report payments made to non-employees. When working under a Pennsylvania Self-Employed Utility Services Contract, you must ensure that the form is filled out correctly and submitted to the IRS by the deadline. Additionally, you may need to provide a copy to the state tax authority if you meet certain thresholds.

Yes, Pennsylvania has a self-employment tax that applies to individuals earning income from self-employment activities. As someone operating under a Pennsylvania Self-Employed Utility Services Contract, you will need to report this income accurately on your tax returns. It is important to keep detailed records of your earnings and expenses throughout the year.