Pennsylvania Private Investigator Agreement - Self-Employed Independent Contractor

Description

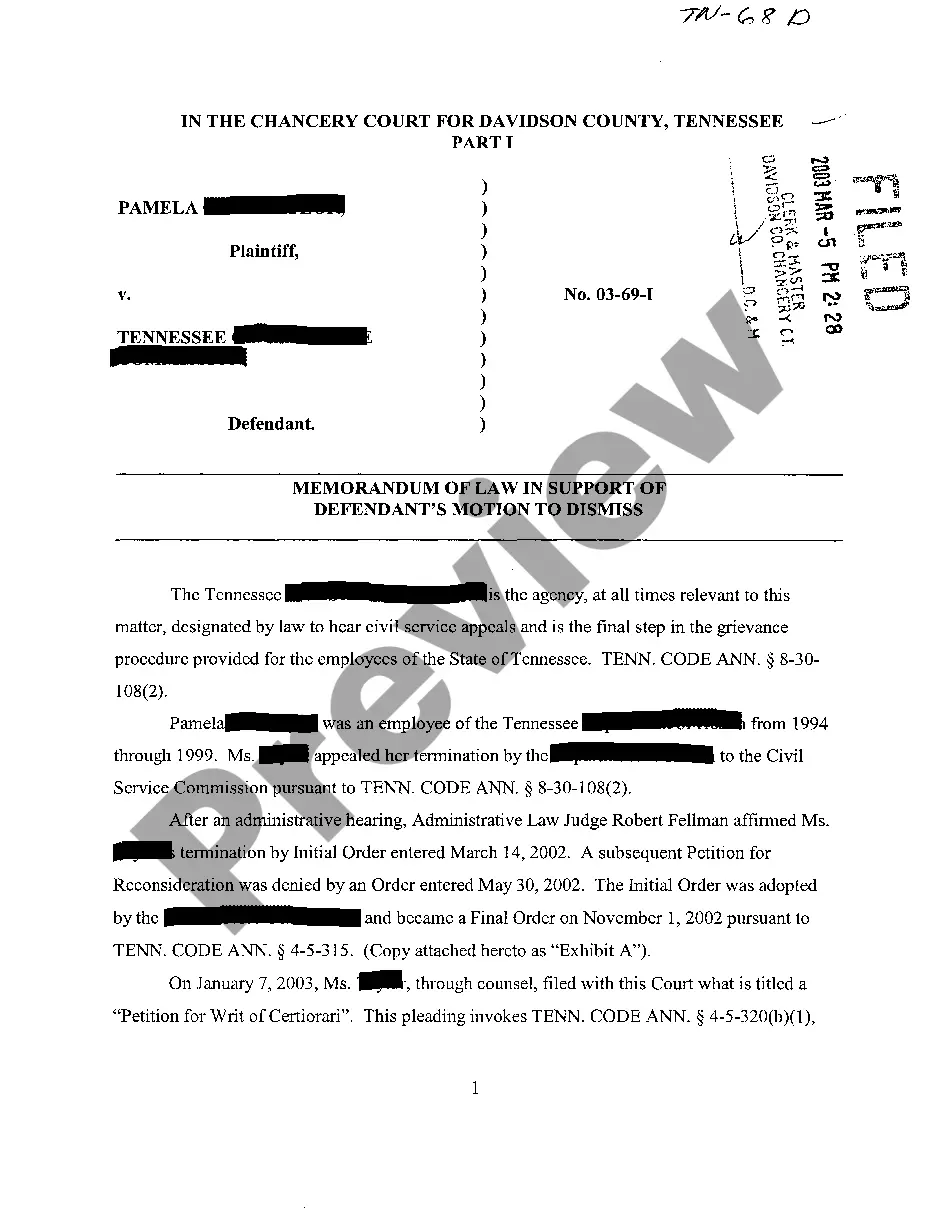

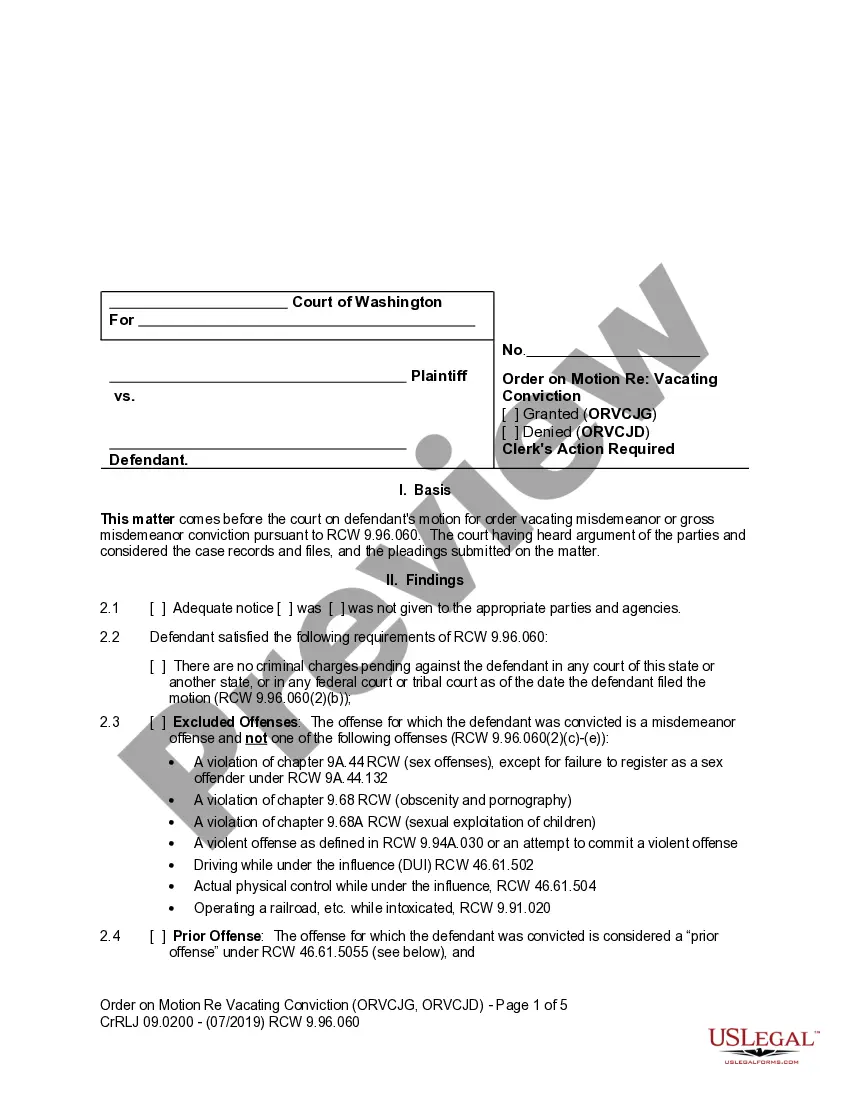

How to fill out Private Investigator Agreement - Self-Employed Independent Contractor?

If you aim to finish, obtain, or print authentic document templates, utilize US Legal Forms, the foremost type of valid forms, available online.

Use the site’s straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Select your preferred pricing plan and enter your information to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Employ US Legal Forms to find the Pennsylvania Private Investigator Agreement - Self-Employed Independent Contractor in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Download button to obtain the Pennsylvania Private Investigator Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Utilize the Review option to examine the form’s details. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the official form template.

Form popularity

FAQ

The U.S. Bureau of Labor Statistics reports that the median pay for a private investigator or detective, as of 2018, is about $50,000 annually or $24 per hour. The highest 10% of investigators earned close to $90,000 per year. The lowest 10% earned just under $30,000 a year.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

These clauses serve a similar purpose to Partnership and Agency Clauses. They expressly state the intended nature of the legal relationship. Independent Contractor clauses are frequently used in consultancy agreements to make it clear that the contractor is not intended to be an employee.

Start a private investigation firm by following these 10 steps:Plan your Private Investigation Firm.Form your Private Investigation Firm into a Legal Entity.Register your Private Investigation Firm for Taxes.Open a Business Bank Account & Credit Card.Set up Accounting for your Private Investigation Firm.More items...?16-Jan-2022

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.14-Feb-2022

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Basic Requirements For Individual and Agency LicensingBe between at least 18 and 25 years old.Pass a background investigation (have a clean criminal record and good moral character)21 states require you to have between two and five years of relevant work experience and/or education.

An independent contractor is an independent business person or entity who runs his/her own business and who does work for another business. An employee is an individual who is hired by a company to perform a specific work assigned by an employer.

Indemnity Clause: The purpose of this clause is to ensure that the independent contractor will be held liable for any damage or injury resulting from the independent contractor's work performed under the contract.