Pennsylvania Freelance Photographer Agreement - Self-Employed Independent Contractor

Description

How to fill out Freelance Photographer Agreement - Self-Employed Independent Contractor?

Selecting the optimal genuine document template can be a challenge. Clearly, there are numerous formats accessible online, but how can you acquire the authentic template you require.

Utilize the US Legal Forms website. The platform offers a multitude of formats, including the Pennsylvania Freelance Photographer Agreement - Self-Employed Independent Contractor, which you can use for both business and personal needs. All of the templates are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Pennsylvania Freelance Photographer Agreement - Self-Employed Independent Contractor. Use your account to browse the valid forms you have acquired previously. Visit the My documents tab of your account to retrieve another copy of the document you need.

Complete, modify, print, and sign the received Pennsylvania Freelance Photographer Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest repository of legal documents where you can find various document formats. Utilize the service to obtain professionally-crafted paperwork that meets state regulations.

- If you are a new user of US Legal Forms, here are simple instructions that you should follow.

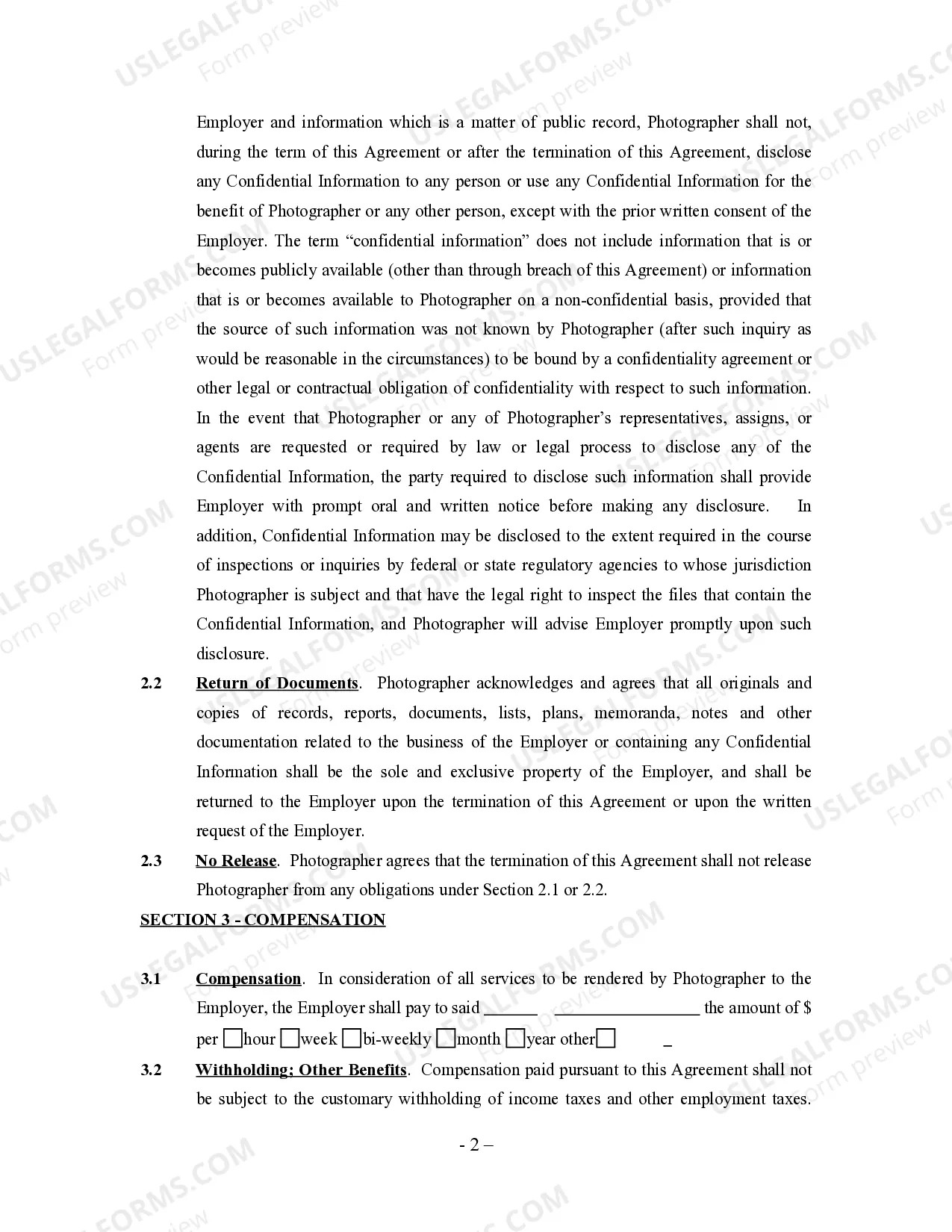

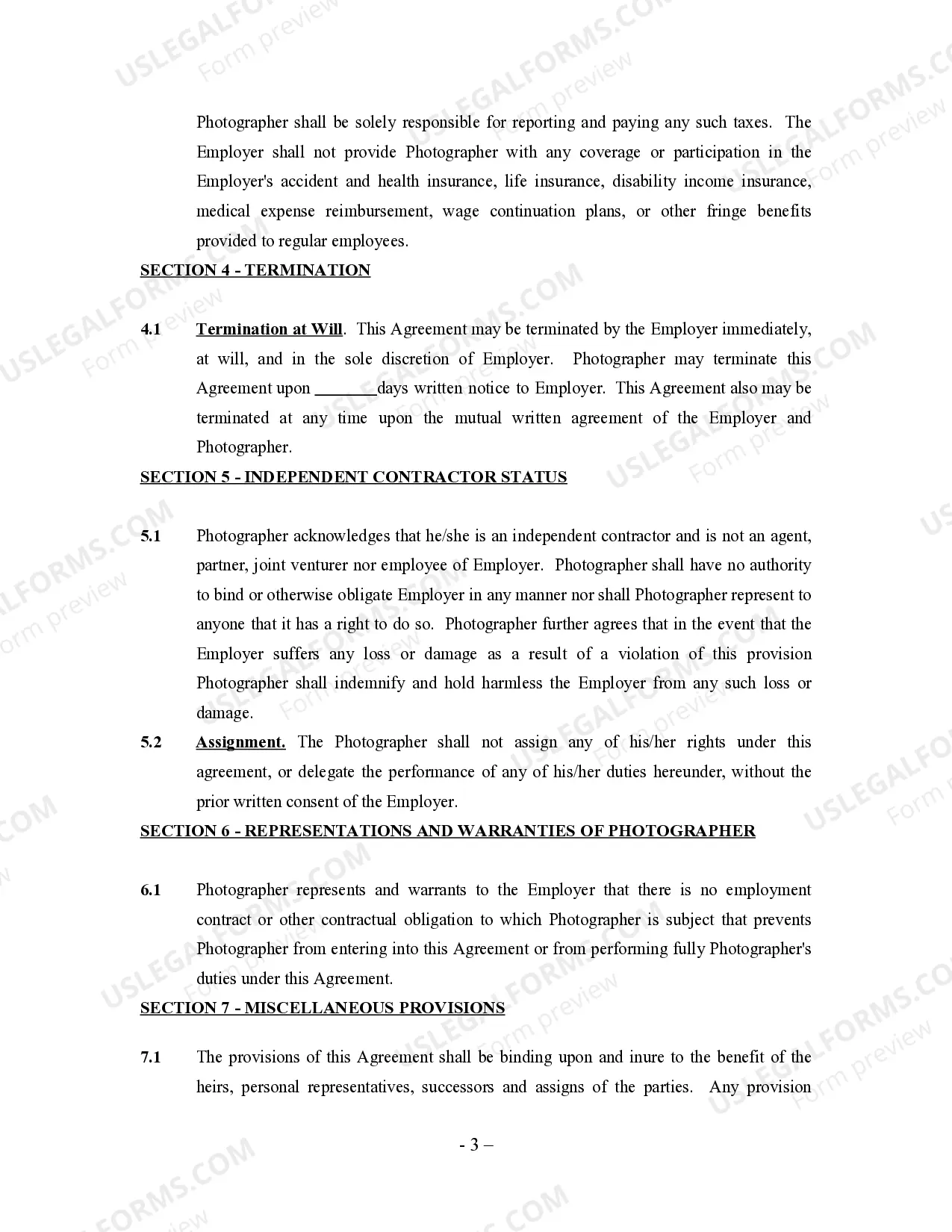

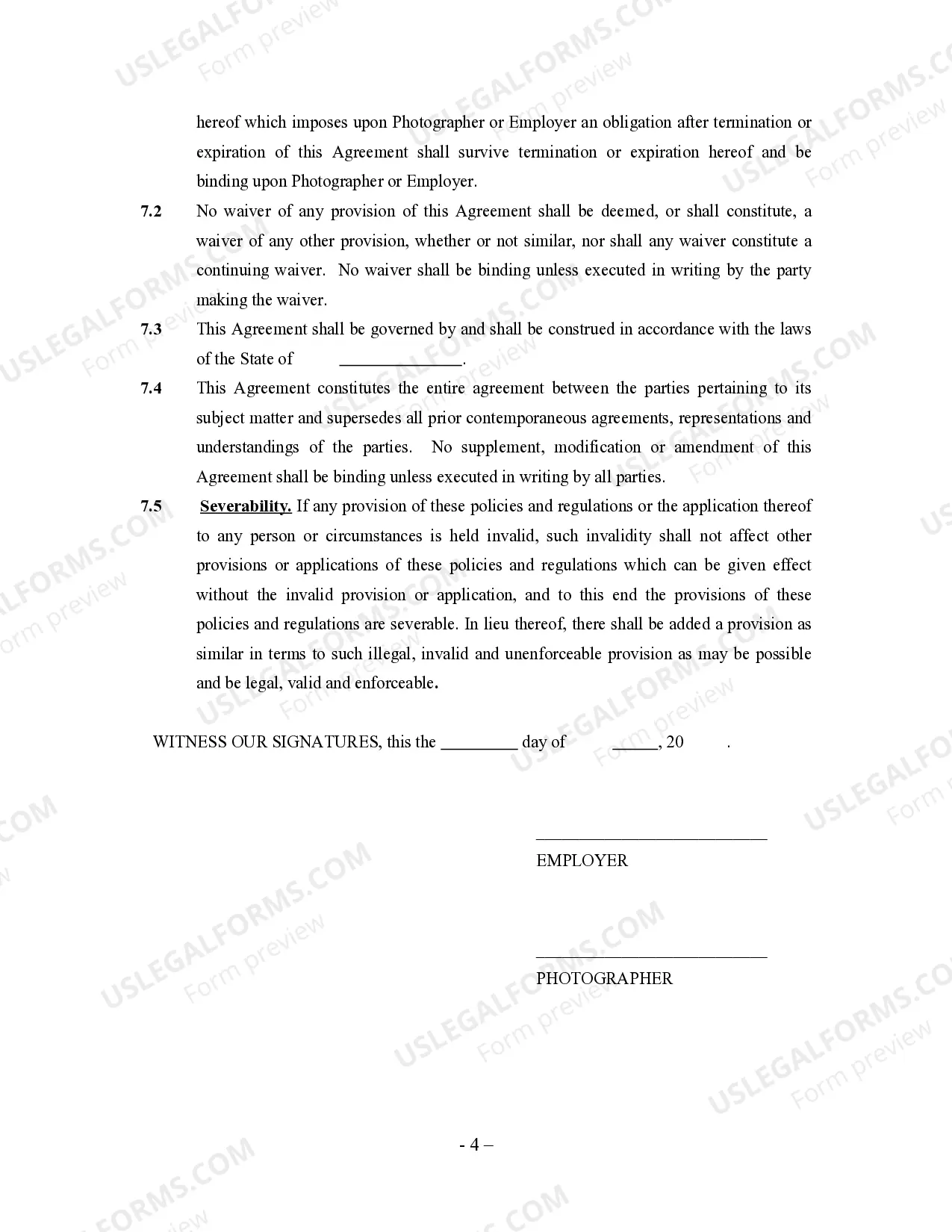

- First, ensure you have chosen the correct document for your city/state. You can review the form using the Preview button and examine the form outline to confirm it is the right one for you.

- If the document does not meet your expectations, utilize the Search field to find the suitable document.

- Once you are confident that the form is appropriate, click the Purchase now button to obtain the document.

- Select the pricing plan you desire and enter the required information. Create your account and complete the order with your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

Writing an independent contractor agreement is straightforward when you outline key elements clearly. Start by detailing the services you will provide, payment terms, and the duration of the contract. It's essential to include clauses that address ownership of work, confidentiality, and termination conditions. Using a Pennsylvania Freelance Photographer Agreement - Self-Employed Independent Contractor template from uslegalforms can streamline this process, ensuring you cover all necessary points effectively.

Yes, a freelance photographer operates as a self-employed independent contractor. This means you manage your own business, set your own rates, and choose your clients. By working independently, you have the flexibility to take on projects that align with your vision and goals. A Pennsylvania Freelance Photographer Agreement - Self-Employed Independent Contractor helps define your relationship with clients and ensures both parties understand their rights and responsibilities.

Yes, photography services can be taxable in Pennsylvania, particularly when they involve the sale of physical products. It's important to understand which aspects of your services are taxable to avoid unexpected liabilities. Utilizing resources like USLegalForms can help you navigate these complexities while drafting your Pennsylvania Freelance Photographer Agreement - Self-Employed Independent Contractor.

Yes, freelance photographers should always use a contract to protect their interests and clarify the scope of work. A well-drafted Pennsylvania Freelance Photographer Agreement - Self-Employed Independent Contractor can define terms such as payment, deadlines, and usage rights. This contract not only safeguards your work but also fosters trust with clients.

In Pennsylvania, you may need a business license depending on where you operate. Local municipalities often have specific requirements for freelance photographers. It’s a good idea to check with your local government to ensure compliance. Additionally, having a Pennsylvania Freelance Photographer Agreement - Self-Employed Independent Contractor can reinforce your legitimacy as a business.

Yes, photographers often operate as independent contractors, especially when they work freelance. This arrangement allows them to manage their own schedules and client relationships. Establishing a clear Pennsylvania Freelance Photographer Agreement - Self-Employed Independent Contractor is vital to outline the terms of this professional relationship.

Photography services in Pennsylvania are typically taxable if they involve tangible personal property, such as prints or albums. However, if you provide only digital images, these may not be taxable. To ensure compliance, reviewing state guidelines is advisable. This understanding can also help when formulating a Pennsylvania Freelance Photographer Agreement - Self-Employed Independent Contractor.

In Pennsylvania, professional services generally do not incur sales tax. However, specific services may have different tax implications. It is essential to consult the Pennsylvania Department of Revenue for clarity. Understanding these regulations is crucial, especially when drafting a Pennsylvania Freelance Photographer Agreement - Self-Employed Independent Contractor.

A basic independent contractor agreement is a straightforward document that outlines the terms of engagement between a contractor and a client. It typically covers the services to be provided, payment details, and the duration of the contract. For photographers, a Pennsylvania Freelance Photographer Agreement - Self-Employed Independent Contractor serves as a solid foundation, allowing flexibility while ensuring critical aspects are legally addressed.

The independent contractor agreement in Pennsylvania is a legal document that outlines the relationship between a contractor and a client. This agreement specifies the services provided, payment structure, and other key details like deadlines. Utilizing a Pennsylvania Freelance Photographer Agreement - Self-Employed Independent Contractor helps ensure clarity and protects the rights of both the photographer and the client.