Pennsylvania Physician's Assistant Agreement - Self-Employed Independent Contractor

Description

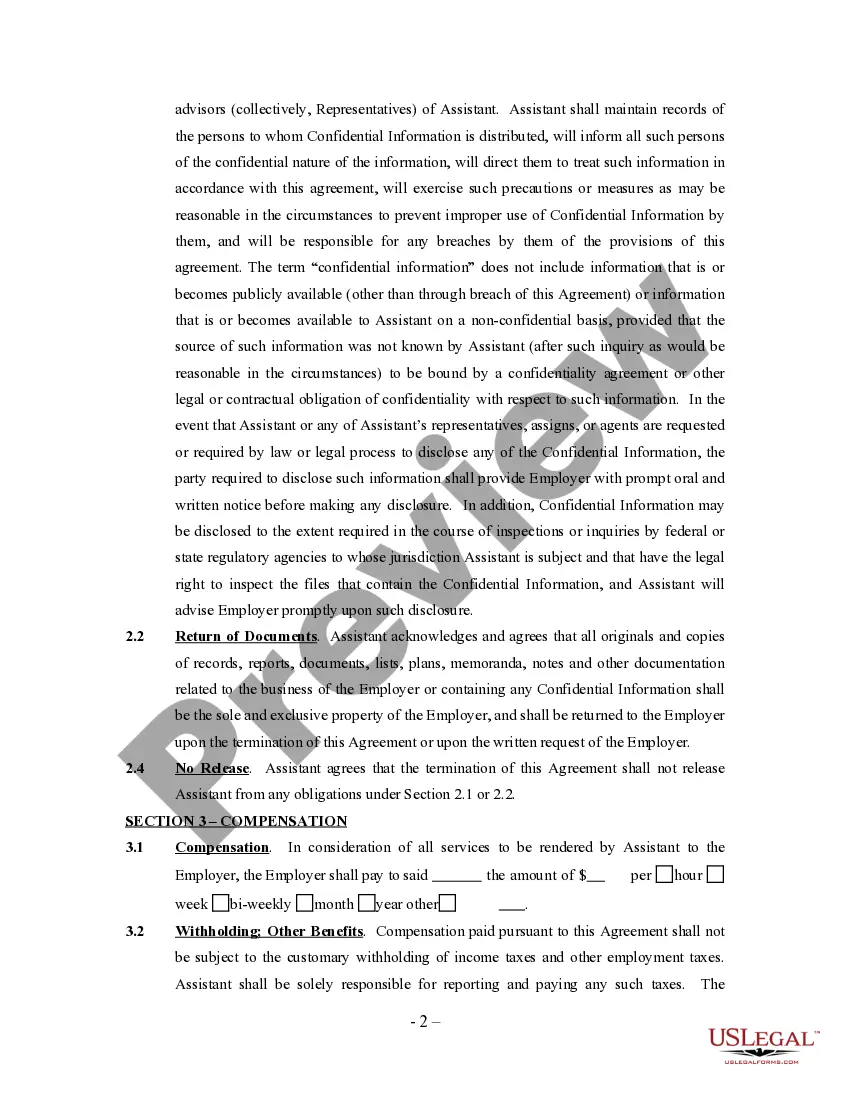

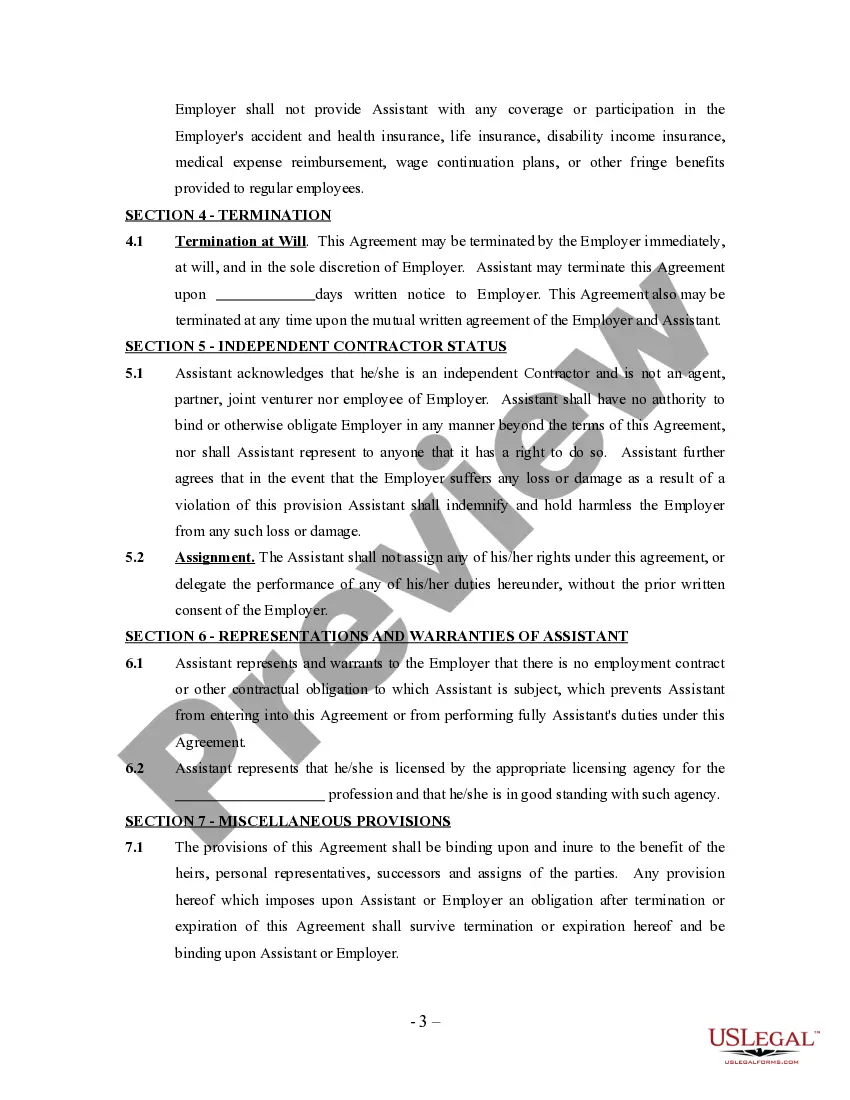

How to fill out Physician's Assistant Agreement - Self-Employed Independent Contractor?

If you want to be thorough, obtain, or produce legal document templates, use US Legal Forms, the largest assortment of legal forms, which are available online.

Utilize the site's straightforward and user-friendly search to find the documents you require. Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to acquire the Pennsylvania Physician's Assistant Agreement - Self-Employed Independent Contractor in just a few clicks.

Every legal document format you purchase is yours permanently. You have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Compete and download, and print the Pennsylvania Physician's Assistant Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to get the Pennsylvania Physician's Assistant Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

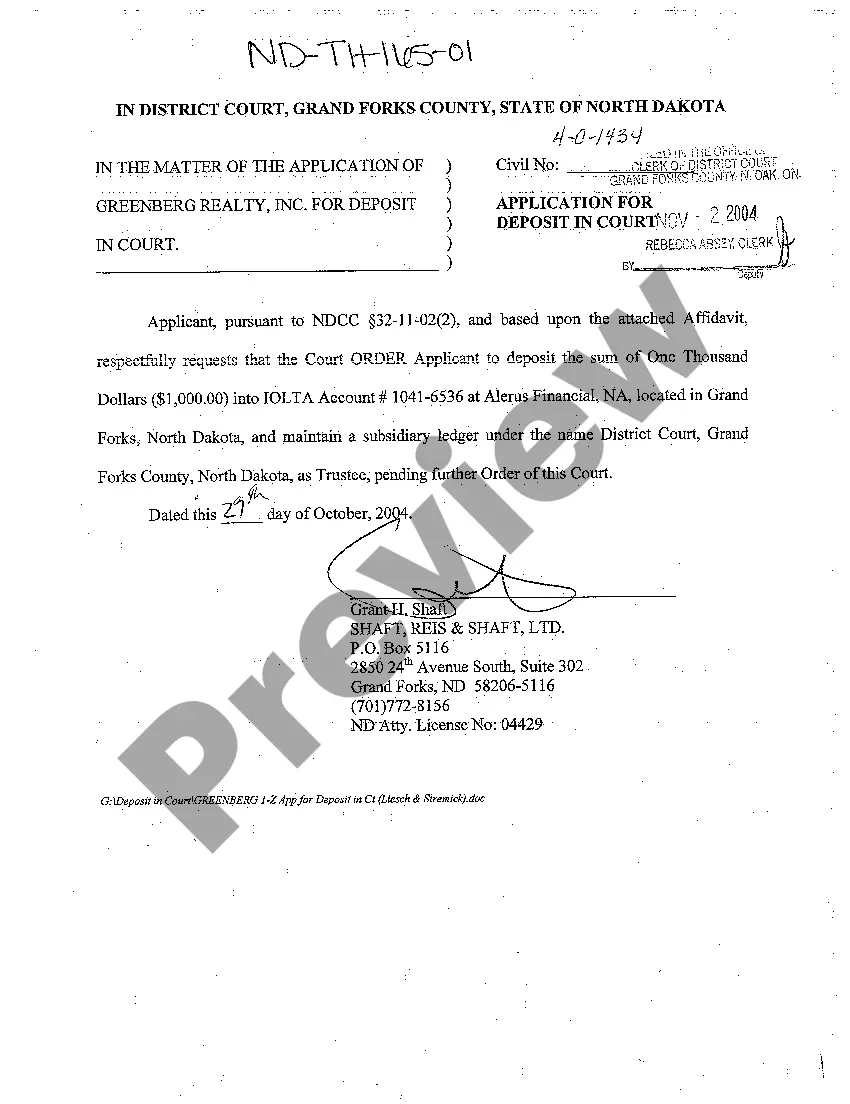

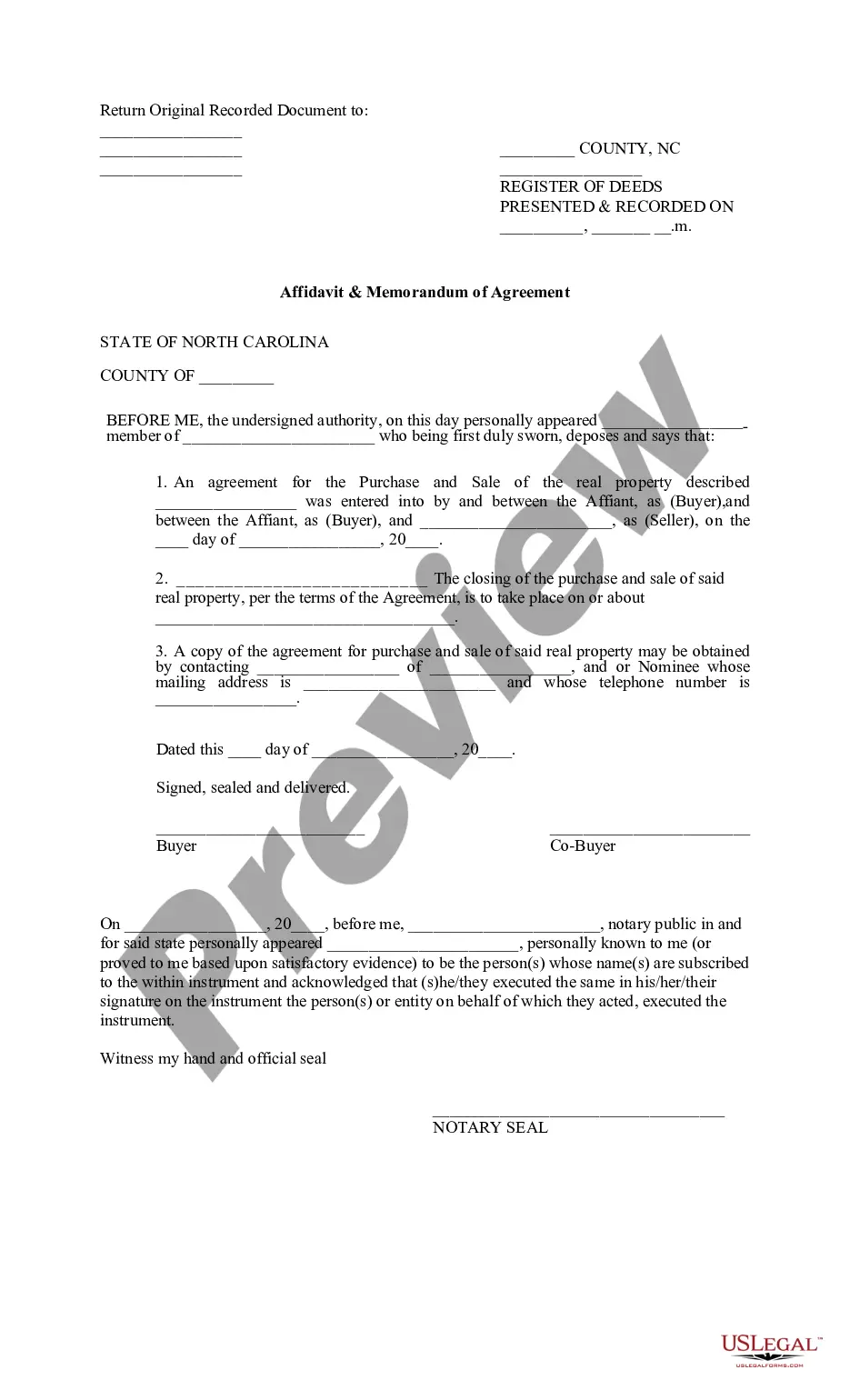

- Step 2. Utilize the Review feature to examine the form's details. Don't forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find additional types in the legal form format.

- Step 4. After locating the form you need, click the Get now button. Choose the payment method you prefer and enter your credentials to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, edit and print or sign the Pennsylvania Physician's Assistant Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Physician assistants are not independent practitioners but practice-focused autonomous professionals delivering care in partnership with physicians, in a role described as negotiated performance autonomy.5 This relationship allows them to staff satellite clinic offices, provide on-call services in the practice, and

While AB 5 has exemptions for physicians, dentists, podiatrists and psychologists, it currently does not provide any exemption for nurse practitioners, nurse anesthetists, pharmacists, occupational/physical/speech/respiratory therapists, medical technicians or physician's assistants many of whom serve as independent

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

While AB 5 has exemptions for physicians, dentists, podiatrists and psychologists, it currently does not provide any exemption for nurse practitioners, nurse anesthetists, pharmacists, occupational/physical/speech/respiratory therapists, medical technicians or physician's assistants many of whom serve as independent

Many states permit PAs to be semi-autonomous and function in remote locations. In Alaska, physician supervision has been changed to collaboration to be consistent with NPs. The federal government, the largest single employer of PAs, has decided that autonomy is appropriate.

There are a number of unique benefits to working as an independent contractor (IC) you may not have considered. PAs who function as an IC have more choices than those who work under contract to a medical practice.

For some business-minded physician assistants (PAs), independent contracting offers a versatile and entrepreneurial way to practice medicine allowing for significant flexibility in hours, increased freedom of choice and income.

The PA Supreme Court interpreted the Pennsylvania Unemployment Statute, which states that a worker is an independent contractor if the individual is free from control and direction over the performance of the services both under his contract of service and in fact and, in regard to such services, if the individual is

The basic test for determining whether a worker is an independent contractor or an employee is whether the principal has the right to control the manner and means by which the work is performed.