Pennsylvania Audiologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Audiologist Agreement - Self-Employed Independent Contractor?

Are you presently in a position where you require documents for either professional or personal purposes almost every working day.

There is an array of legal document templates available online, but locating ones you can rely on is not easy.

US Legal Forms offers thousands of document templates, including the Pennsylvania Audiologist Agreement - Self-Employed Independent Contractor, which can be tailored to meet federal and state regulations.

Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Pennsylvania Audiologist Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the document you need and make sure it is for the correct city/region.

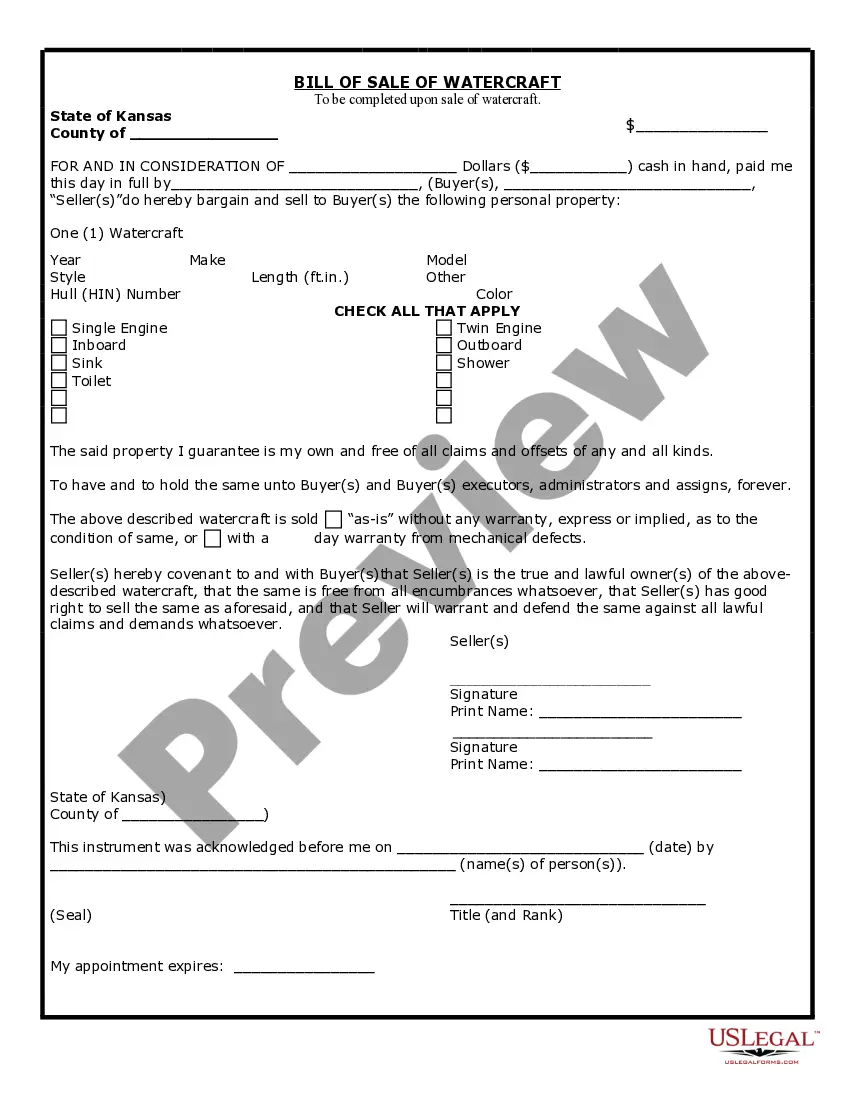

- Use the Preview button to examine the document.

- Check the description to confirm that you have selected the right document.

- If the document is not what you are looking for, utilize the Search area to find the document that fits your needs and requirements.

- Once you find the correct document, click Buy now.

- Choose the pricing plan you want, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents list. You can obtain an additional copy of the Pennsylvania Audiologist Agreement - Self-Employed Independent Contractor at any time if needed. Just select the appropriate document to download or print the template.

Form popularity

FAQ

To write an independent contractor agreement, begin by specifying the names and contact information of all parties involved. Include clear details regarding the work scope, compensation, timeline, and any confidentiality clauses. You can leverage a Pennsylvania Audiologist Agreement - Self-Employed Independent Contractor template to guide you through the essential elements and ensure you establish a solid contractual foundation.

Writing a contract for a 1099 employee involves defining the work relationship, clearly laying out responsibilities, payment terms, and deadlines. It's crucial to specify that the worker is not an employee but an independent contractor, which means they handle their own taxes. A Pennsylvania Audiologist Agreement - Self-Employed Independent Contractor can serve as a model to ensure you cover all necessary aspects and avoid potential disputes.

Independent contractors typically need to fill out forms such as a W-9 for tax purposes and possibly a contract for the services provided. Depending on your location, you may also need specific agreements like the Pennsylvania Audiologist Agreement - Self-Employed Independent Contractor. Ensuring you have the right forms helps maintain compliance and protects both you and your client.

Filling out an independent contractor agreement involves providing specific details about the parties involved, the services to be delivered, and payment terms. Start by entering your name and the name of the audiologist or company hiring you. Then, clearly outline the scope of work, deadlines, and compensation. Using a Pennsylvania Audiologist Agreement - Self-Employed Independent Contractor template can help ensure you include all necessary elements.

Independent contractors in Pennsylvania generally do not need to carry workers' compensation insurance, as they are not considered employees. However, if you hire employees or subcontractors, you may have an obligation to provide this coverage. It is wise to consult with an insurance professional to assess your specific situation. A Pennsylvania Audiologist Agreement - Self-Employed Independent Contractor can guide you in understanding the legal responsibilities and protections related to workers' compensation.

In Pennsylvania, independent contractors typically do not need a formal business license to operate. However, depending on your specific location and the nature of your services as an audiologist, local ordinances may require certain permits or registrations. It is essential to check with your city or county office to ensure compliance. Utilizing a Pennsylvania Audiologist Agreement - Self-Employed Independent Contractor can help clarify your business structure and obligations.

An independent contractor in Pennsylvania is an individual who provides services to clients without being classified as an employee. They typically control how they complete their work and manage their own business expenses. This arrangement must be clearly defined in a legal agreement, such as the Pennsylvania Audiologist Agreement - Self-Employed Independent Contractor, which outlines the rights and responsibilities of both parties involved.

The independent contractor agreement in Pennsylvania serves as a formal contract that outlines the terms of the working relationship between the contractor and their client. It includes obligations, rights, and compensation terms that are specific to the industry. For audiologists, the Pennsylvania Audiologist Agreement - Self-Employed Independent Contractor is designed to meet local regulations while providing clarity on important aspects of the engagement.

A basic independent contractor agreement is a written document that outlines the relationship between a contractor and a client. This document typically includes project details, payment terms, and conditions related to the completion of the work. The Pennsylvania Audiologist Agreement - Self-Employed Independent Contractor is a specialized version that addresses the unique aspects of audiology practices in Pennsylvania, ensuring both parties understand their responsibilities.

A contractor contract in Pennsylvania must include the names and contact details of both parties, a detailed description of the work to be performed, and the compensation structure. Additionally, it should mention any necessary permits or licenses. Utilizing the Pennsylvania Audiologist Agreement - Self-Employed Independent Contractor can provide you with the essential clauses required by law, ensuring your contract meets all legal standards.