Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor

Description

How to fill out Underwriter Agreement - Self-Employed Independent Contractor?

If you desire to complete, download, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site's simple and convenient search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and suggestions, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor. Each legal document template you purchase is yours permanently. You will have access to every form you saved in your account. Select the My documents section and choose a form to print or download again. Stay competitive and download, and print the Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to locate the Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Utilize the Preview option to review the form's content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other types in the legal form category.

Form popularity

FAQ

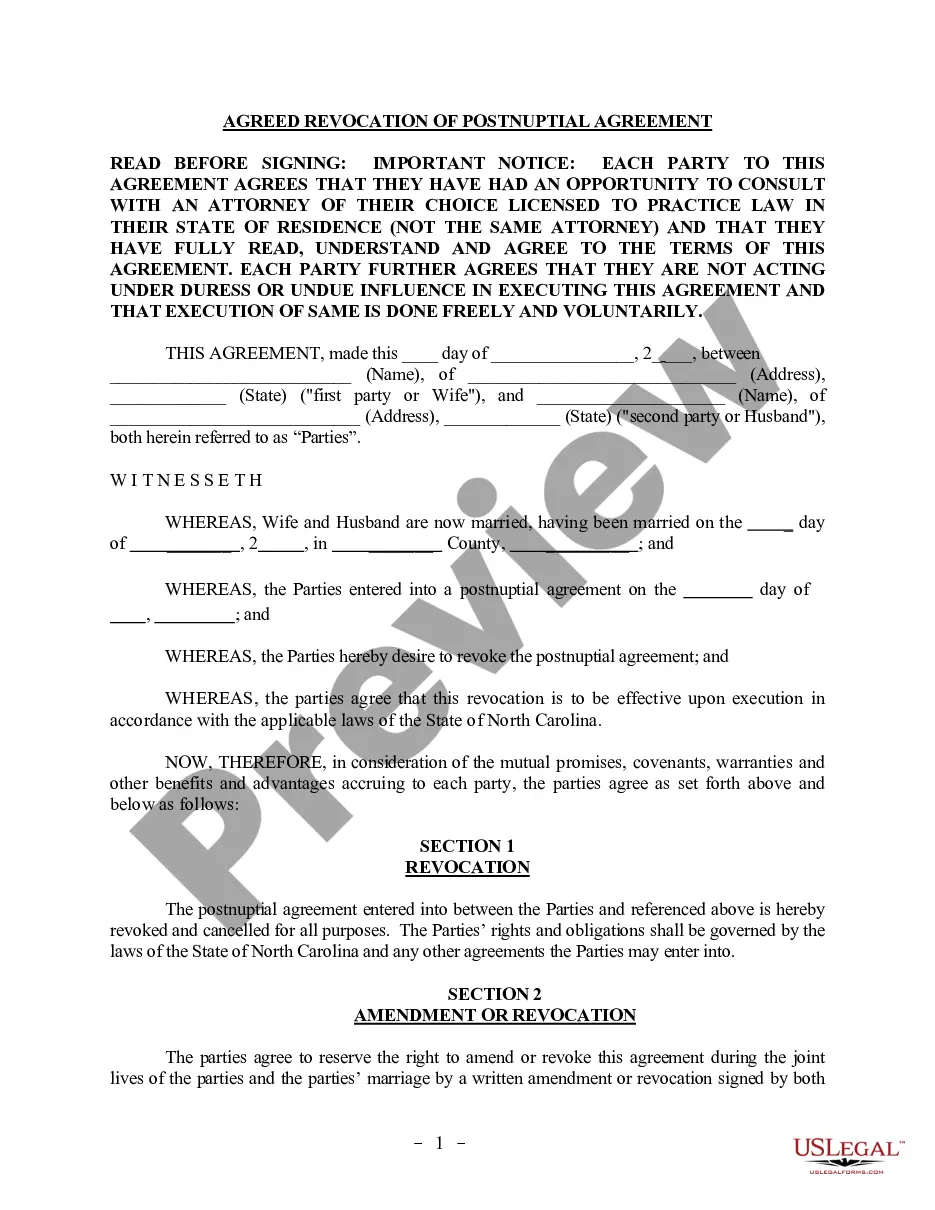

To create an independent contractor agreement, start by specifying the services the contractor will provide, along with the payment terms. Make sure to outline both parties' responsibilities clearly. Including a clause about confidentiality and intellectual property protection can also be beneficial. For those looking to craft a Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor, consider using the US Legal Forms platform to access templates that ensure compliance with local regulations.

Yes, an independent contractor is indeed considered self-employed. This means that they operate their own business, manage their own work schedule, and are responsible for paying their own taxes. With a Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor, you can formalize your status, which can provide clarity and legitimacy to your professional endeavors. Utilizing this agreement not only helps structure your business relationships but also ensures compliance with Pennsylvania regulations.

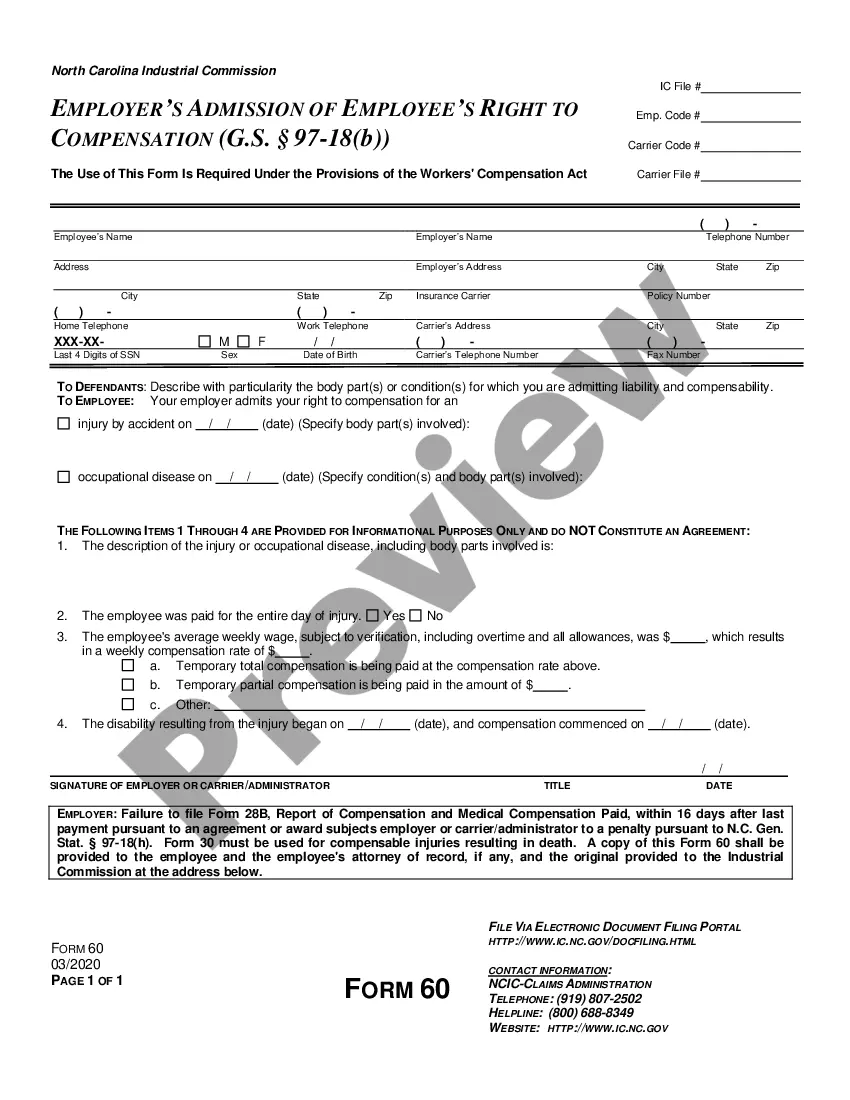

In Pennsylvania, independent contractors may not be required to carry workers' compensation insurance, but it is often a wise choice. This insurance protects contractors from potential work-related injuries or illnesses. Depending on the nature of the work, clients may ask for proof of insurance. To navigate this area confidently, consider using the Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor as part of your business setup.

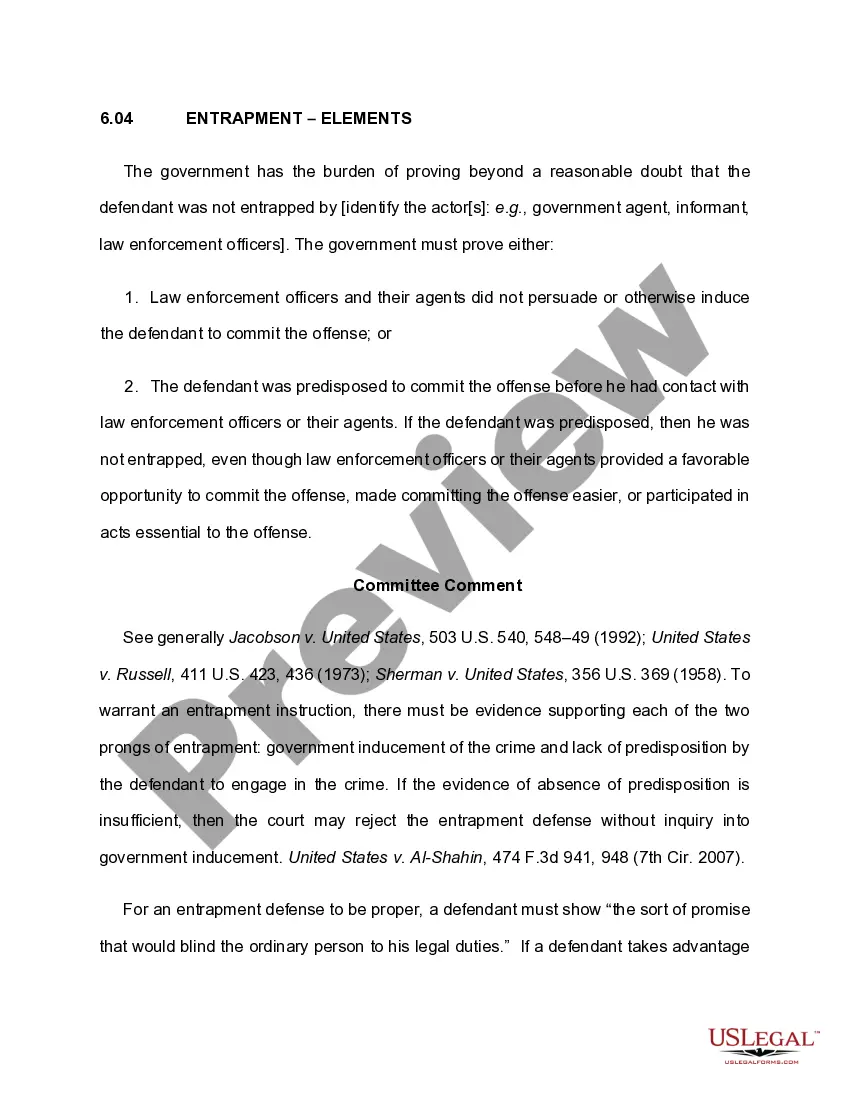

An independent contractor in Pennsylvania operates as a self-employed individual providing services to clients. These contractors typically manage their own business operations and have the freedom to choose their projects. Understanding the distinctions between employees and independent contractors is crucial for tax and liability purposes. The Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor can help clarify these roles.

The independent contractor agreement in Pennsylvania defines the relationship between self-employed individuals and their clients. This contract specifies the rights and responsibilities of both parties, protecting them legally. It can also outline payment terms and project timelines, ensuring clarity in business relationships. The Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor is a reliable template to help you draft your agreement.

In Pennsylvania, a contractor contract must include essential elements to be enforceable. Key details include the names of the parties, a description of the services, payment terms, and the duration of the contract. Additionally, it's beneficial to include clauses that outline dispute resolution and confidentiality. Make use of the Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor to ensure compliance with state regulations.

A basic independent contractor agreement outlines the essential terms of a working relationship between a contractor and a client. It typically includes the scope of services, payment structures, and duration of the agreement. This document serves to protect both parties and clarify their expectations. The Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor effectively captures these terms.

Filling out an independent contractor agreement involves several important steps. First, clearly identify the parties involved, including the contractor and client. Next, specify the nature of the work, payment terms, and deadlines. Utilizing tools like the Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor from uslegalforms can simplify this process further.

Writing an independent contractor agreement requires careful consideration of several key components. First, outline the services to be provided and the compensation terms. Include a clause that refers to the Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor, emphasizing the nature of the contractor relationship. Lastly, ensure both parties sign the agreement to formalize the arrangement.

Filling out an independent contractor form involves several simple steps. Start by downloading the correct form from a trusted site such as US Legal Forms. Clearly state your name, contact information, and the services you provide. Be sure to include any necessary tax information to ensure compliance, particularly if you are entering into a Pennsylvania Underwriter Agreement - Self-Employed Independent Contractor.