Pennsylvania Engineering Agreement - Self-Employed Independent Contractor

Description

How to fill out Engineering Agreement - Self-Employed Independent Contractor?

Locating the appropriate legal document template can pose a challenge. Certainly, there are numerous templates available online, but how can you find the legal document you need? Utilize the US Legal Forms website. This service offers thousands of templates, including the Pennsylvania Engineering Agreement - Self-Employed Independent Contractor, which you can utilize for business and personal purposes. All forms are reviewed by experts and meet federal and state regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Pennsylvania Engineering Agreement - Self-Employed Independent Contractor. Use your account to search through the legal forms you have previously purchased. Navigate to the My documents section of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward guidelines for you to follow: First, ensure you have selected the correct document for your location. You can review the form using the Review button and examine the form summary to confirm it is suitable for you. If the document does not meet your requirements, utilize the Search field to find the appropriate form. Once you are confident that the form is correct, click the Buy now button to purchase the document. Choose the payment plan you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or Visa or Mastercard. Select the document format and download the legal document template to your device. Complete, edit, print, and sign the obtained Pennsylvania Engineering Agreement - Self-Employed Independent Contractor.

- US Legal Forms is the largest collection of legal documents where you can find a variety of document templates.

- Utilize the service to download professionally crafted papers that adhere to state requirements.

Form popularity

FAQ

Yes, an engineer can also assume the role of a contractor, especially if they manage construction projects or other engineering-related tasks. This dual role can enhance their expertise and marketability in the industry. However, it's vital to formalize this relationship through a Pennsylvania Engineering Agreement that outlines duties and expectations clearly.

Yes, engineers can work independently, often leading to a more fulfilling professional life. As independent professionals, they can pursue projects that resonate with their skills and interests. This independence requires careful management of clients and contracts, for which a Pennsylvania Engineering Agreement can provide essential structure and protection.

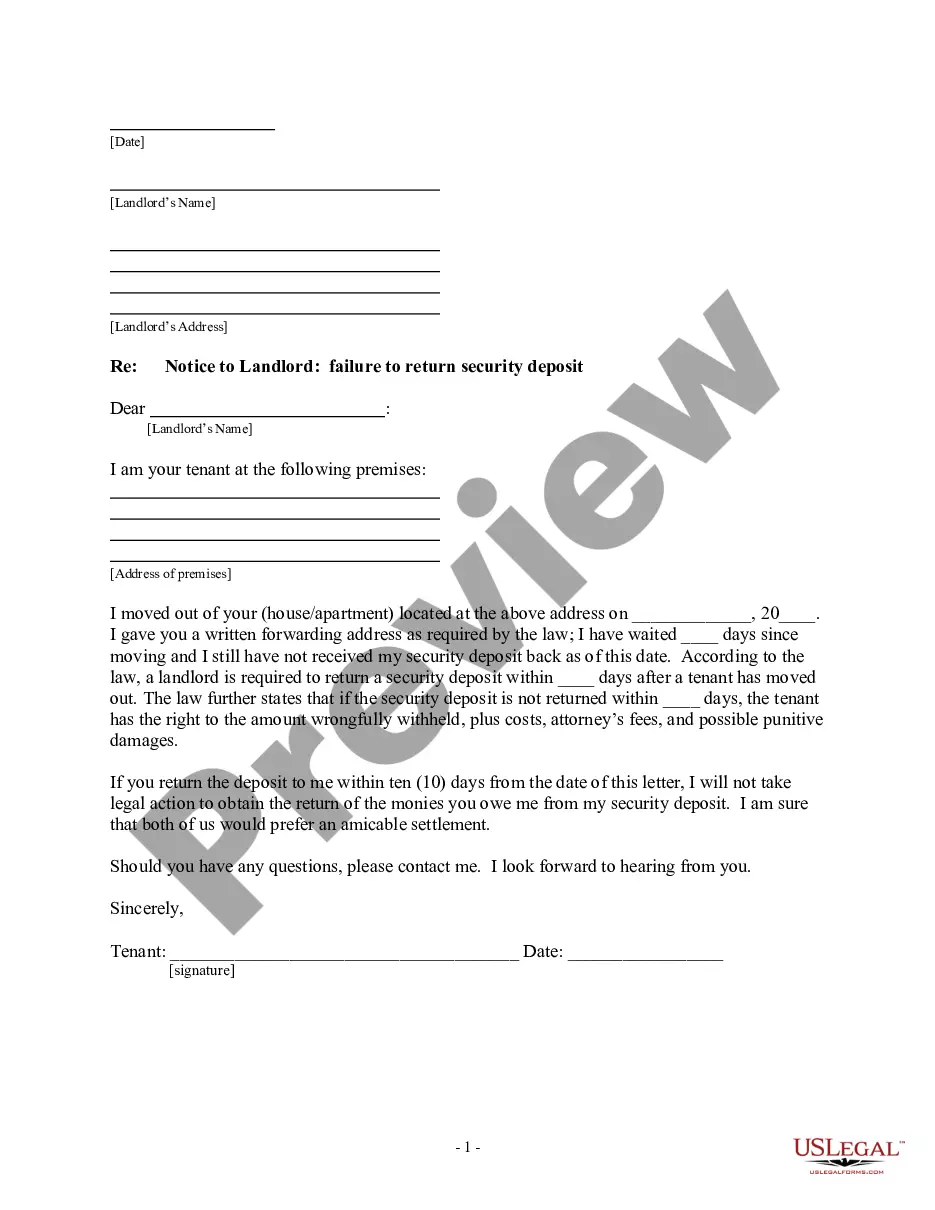

Filling out an independent contractor agreement requires attention to detail and clarity. Start by specifying the parties involved, followed by the services to be provided, payment details, and any deadlines. It’s crucial to include clauses that address confidentiality and disputes. Utilizing a template from uslegalforms can simplify this process, ensuring your Pennsylvania Engineering Agreement - Self-Employed Independent Contractor is both comprehensive and compliant.

Absolutely, an engineer can be an independent contractor, which offers unique benefits like increased control over their work. As an independent contractor, they can negotiate fees, select projects that align with their expertise, and work with various clients. This arrangement often requires a clear Pennsylvania Engineering Agreement to ensure all parties understand their roles and expectations.

Yes, engineers can be self-employed, allowing for greater autonomy in their work. By operating as a self-employed independent contractor, engineers can choose their projects and set their schedules. This flexibility often leads to increased job satisfaction and income potential. A well-structured Pennsylvania Engineering Agreement can help define the terms of their self-employment.

Yes, engineering services are subject to sales tax in Pennsylvania, though there are some exceptions. Services provided in conjunction with tangible personal property may be taxed, while purely professional services might not be. It's essential for self-employed independent contractors to understand these nuances to comply with state tax laws. Seeking assistance from a knowledgeable tax advisor can be beneficial for those working under a Pennsylvania Engineering Agreement.

The independent contractor agreement in Pennsylvania outlines the working relationship between a contractor and a client. This agreement clarifies the services to be provided, payment terms, and responsibilities of each party. It serves as a legal document protecting both parties by minimizing misunderstandings and disputes. If you're considering working as a self-employed independent contractor in engineering, consider using a tailored Pennsylvania Engineering Agreement.

Yes, an independent contractor is classified as a self-employed individual. This distinction allows contractors to work independently without the traditional employer-employee relationship. When you establish a Pennsylvania Engineering Agreement - Self-Employed Independent Contractor, you define the terms of your engagement and responsibilities clearly. This formal agreement can serve as protection and assurance for both parties involved, emphasizing the independence of your work.

In Pennsylvania, independent contractors are generally not required to carry workers' compensation insurance. However, it is wise for self-employed individuals in the construction industry to consider it, particularly if they have employees. A Pennsylvania Engineering Agreement - Self-Employed Independent Contractor can outline specific terms and stipulations regarding insurance needs. Utilizing platforms like USLegalForms can help ensure that all legal requirements are met specifically for your contract.

The basic independent contractor agreement includes essential elements like the description of services, payment terms, and conditions for termination. It establishes a clear understanding between the contractor and client. This agreement ensures that both parties are on the same page regarding expectations and deliverables. If you need a solid foundation for a Pennsylvania Engineering Agreement - Self-Employed Independent Contractor, uslegalforms has various templates to choose from.