Pennsylvania Cabinet And Countertop Contract Agreement - Self-Employed

Description

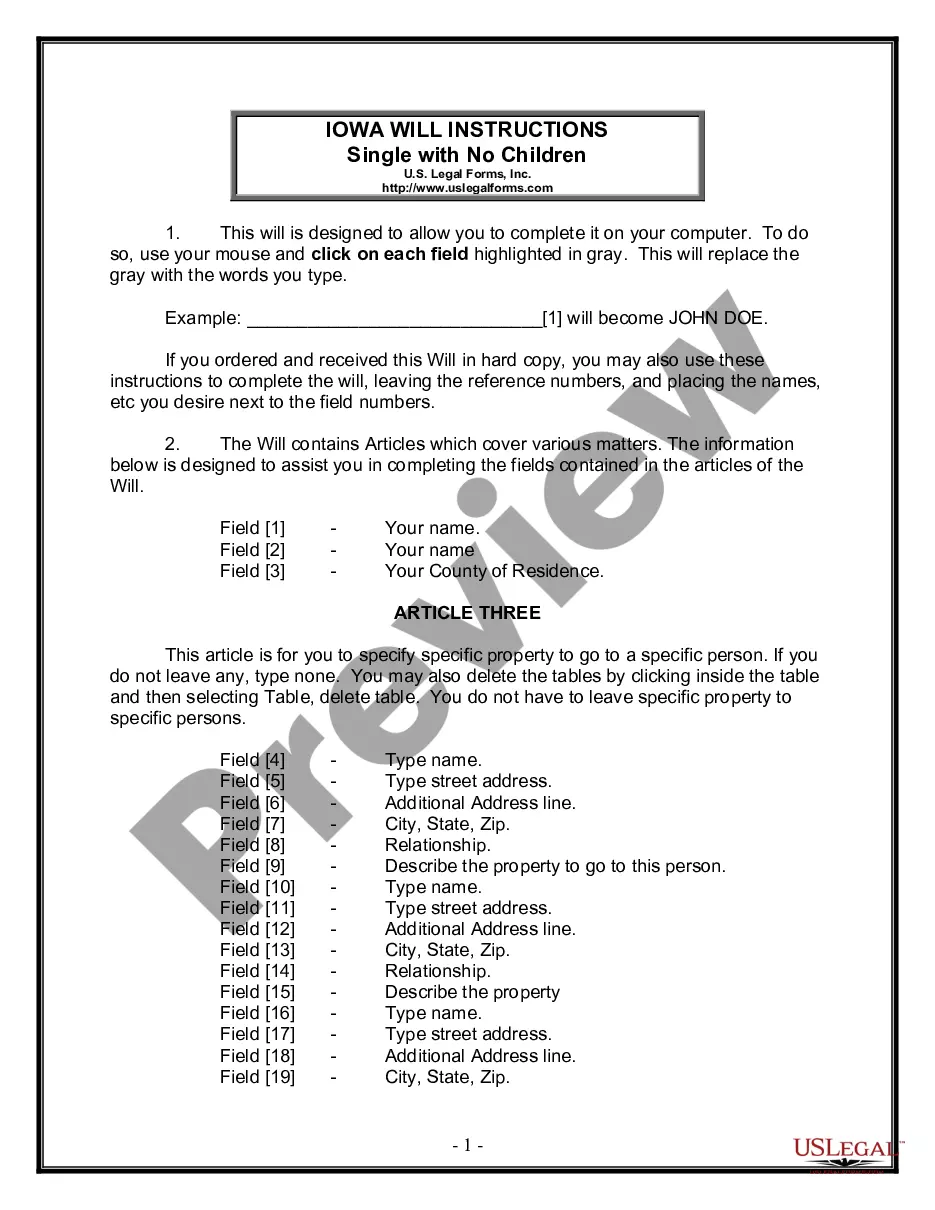

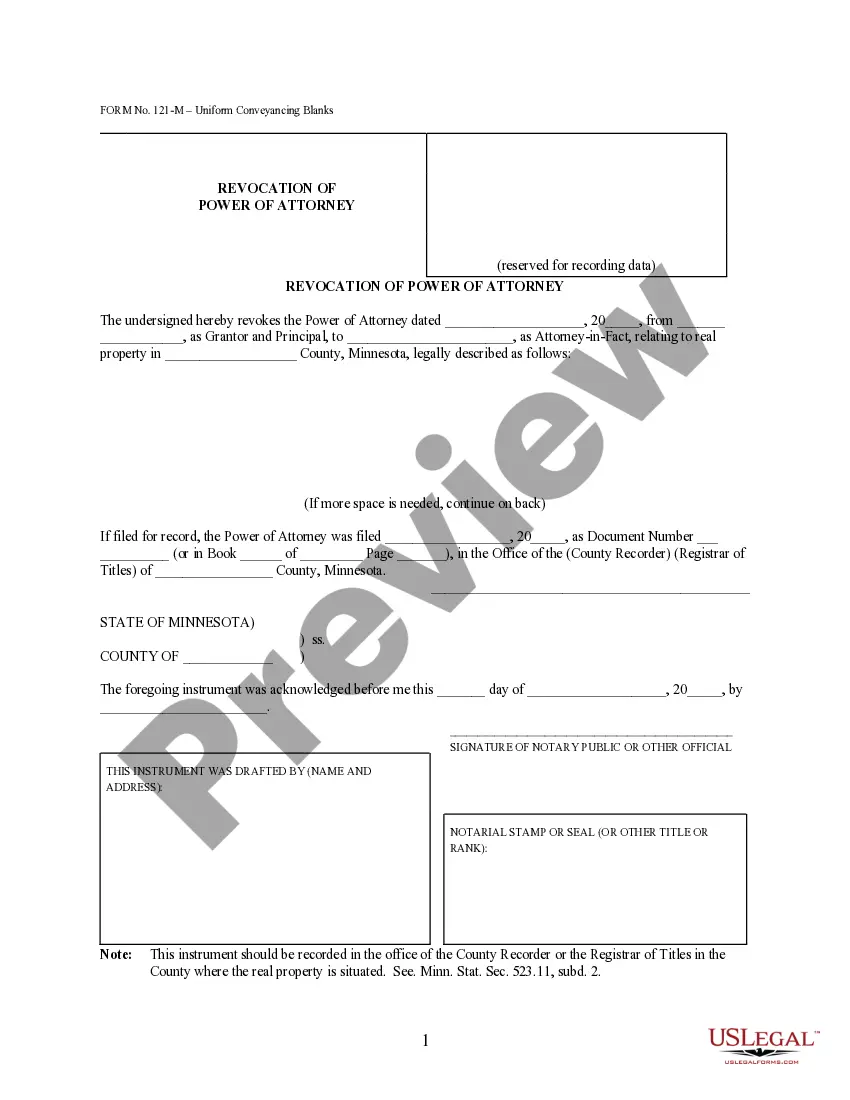

How to fill out Cabinet And Countertop Contract Agreement - Self-Employed?

Selecting the appropriate valid document template can be challenging. Of course, there are numerous designs available online, but how do you find the exact template you require? Utilize the US Legal Forms website. The platform offers thousands of templates, including the Pennsylvania Cabinet And Countertop Contract Agreement - Self-Employed, suitable for business and personal needs. All templates are verified by experts and adhere to federal and state regulations.

If you are already registered, Log In to your account and click the Download button to access the Pennsylvania Cabinet And Countertop Contract Agreement - Self-Employed. Use your account to review the legal templates you have previously purchased. Visit the My documents section of your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions that you can follow: First, ensure you have selected the correct document for your region/area. You can review the document using the Preview button and read the document description to confirm it is suitable for you. If the document does not fulfill your requirements, use the Search field to find the appropriate document. Once you are confident that the document is correct, click the Purchase now button to obtain the document. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the acquired Pennsylvania Cabinet And Countertop Contract Agreement - Self-Employed.

US Legal Forms is the largest repository of legal documents where you can find various document templates. Leverage the service to download professionally created paperwork that complies with state regulations.

- Utilize the US Legal Forms website for valid document templates.

- Thousands of templates available for business and personal use.

- Verify the document with experts and ensure compliance.

- Access previously purchased documents through your account.

- Follow simple instructions for new users to find the right document.

- Download professionally crafted documents that meet state requirements.

Form popularity

FAQ

The purpose of an independent contractor agreement is to clearly define the terms of collaboration between a contractor and a client. This agreement sets expectations regarding deliverables, payment, and responsibilities, thereby reducing the risk of misunderstandings. A well-structured Pennsylvania Cabinet And Countertop Contract Agreement - Self-Employed can streamline the working process and provide legal protection for both parties. By establishing clear terms, you foster a better working relationship and increase project success.

For a contract to be legally binding in Pennsylvania, it must include an offer, acceptance, mutual consent, and a lawful purpose. Consideration, or the value exchanged, is also essential. A Pennsylvania Cabinet And Countertop Contract Agreement - Self-Employed must meet these criteria to be enforceable. By ensuring your contract meets these requirements, you create a solid foundation for your business relationship.

An independent contractor agreement in Pennsylvania is a legal document that outlines the terms of the working relationship between a self-employed individual and a client. This agreement typically details the services to be provided, payment information, and any termination clauses. Crafting a solid Pennsylvania Cabinet And Countertop Contract Agreement - Self-Employed is vital for establishing clear guidelines and expectations. Such agreements can prevent misunderstandings and safeguard both parties.

A contractor contract in Pennsylvania must include key elements such as the names of the parties, the scope of work, payment terms, and timelines. Additionally, it should outline any obligations and rights of both the contractor and the client. Incorporating these elements into a Pennsylvania Cabinet And Countertop Contract Agreement - Self-Employed ensures that all legal bases are covered. This thoroughness helps foster trust between both parties.

The standard independent contractor clause typically outlines the nature of the relationship between the contractor and the client. It specifies that the contractor is not an employee and details payment terms, responsibilities, and any confidentiality requirements. Including this clause in your Pennsylvania Cabinet And Countertop Contract Agreement - Self-Employed clarifies expectations and reduces legal risks for both parties.

Yes, employment contracts are generally enforceable in Pennsylvania, provided they meet legal criteria. Contracts must have mutual consent and a lawful purpose to be binding. A well-drafted Pennsylvania Cabinet And Countertop Contract Agreement - Self-Employed provides clarity and protects both parties in the agreement. This legal framework helps in avoiding potential disputes down the road.

An independent contractor in Pennsylvania is a self-employed individual who offers services or performs tasks under a contract. They operate independently, meaning they have control over how they complete their work. This arrangement allows for flexibility and can be beneficial for both contractors and clients. A Pennsylvania Cabinet And Countertop Contract Agreement - Self-Employed is essential to outline the terms of this independent relationship.

Yes, as an independent contractor, completing a W-9 is important for tax documentation purposes. This form provides your clients with your taxpayer details, ensuring that they can accurately report any payments made to you. For a Pennsylvania Cabinet And Countertop Contract Agreement - Self-Employed, filling out the W-9 correctly can help in seamless payment processes and tax compliance.

In Pennsylvania, construction contracts are generally subject to sales tax, especially when tangible personal property is involved. If your Pennsylvania Cabinet And Countertop Contract Agreement - Self-Employed includes the sale of materials, you may need to collect sales tax on those items. It's wise to consult a tax professional to ensure compliance and avoid unexpected liabilities.

Independent contractors must fill out essential paperwork, including a W-9 for payment reporting and a 1099-MISC for income reporting. It's also advisable to keep records of your contracts, especially if they pertain to a Pennsylvania Cabinet And Countertop Contract Agreement - Self-Employed. This documentation not only helps manage tax obligations but also strengthens your standing in professional relationships.