Pennsylvania Employer Training Memo - Payroll Deductions

Description

How to fill out Employer Training Memo - Payroll Deductions?

Finding the appropriate legal document template can be a challenge.

Certainly, there is an abundance of designs available online, but how do you acquire the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Pennsylvania Employer Training Memo - Payroll Deductions, which can be utilized for business and personal purposes.

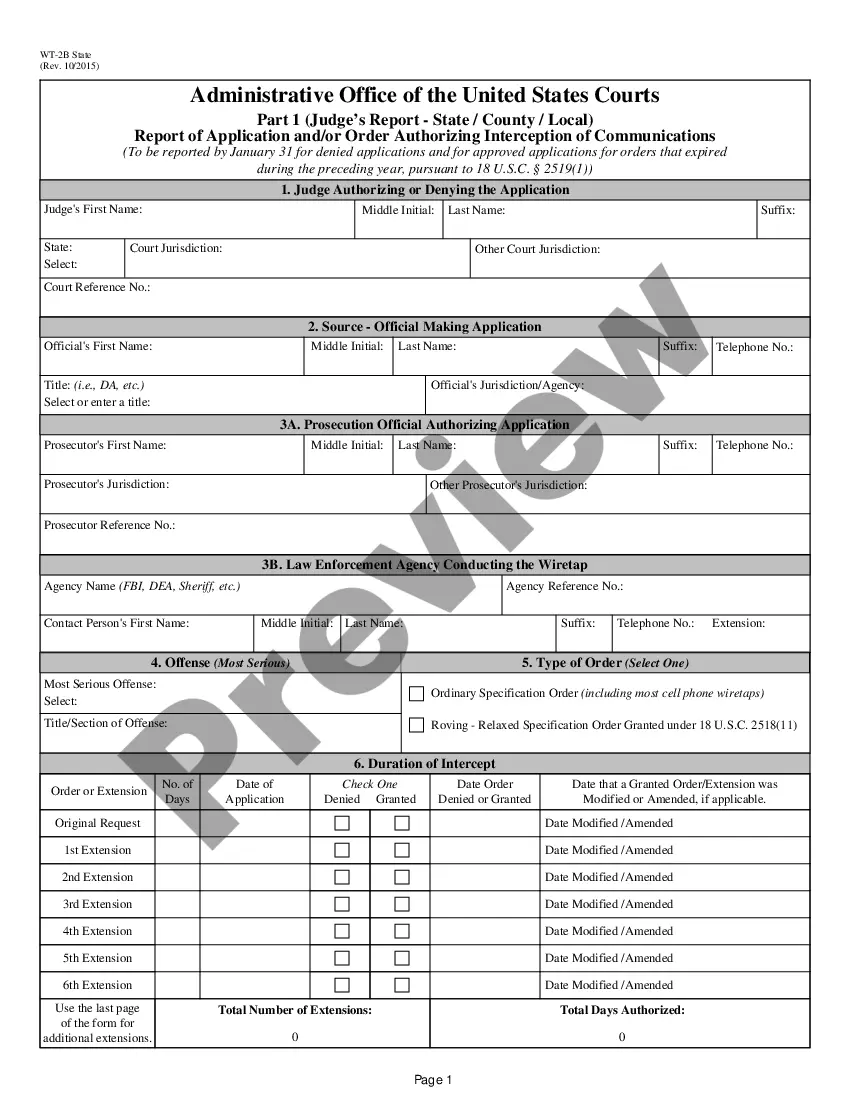

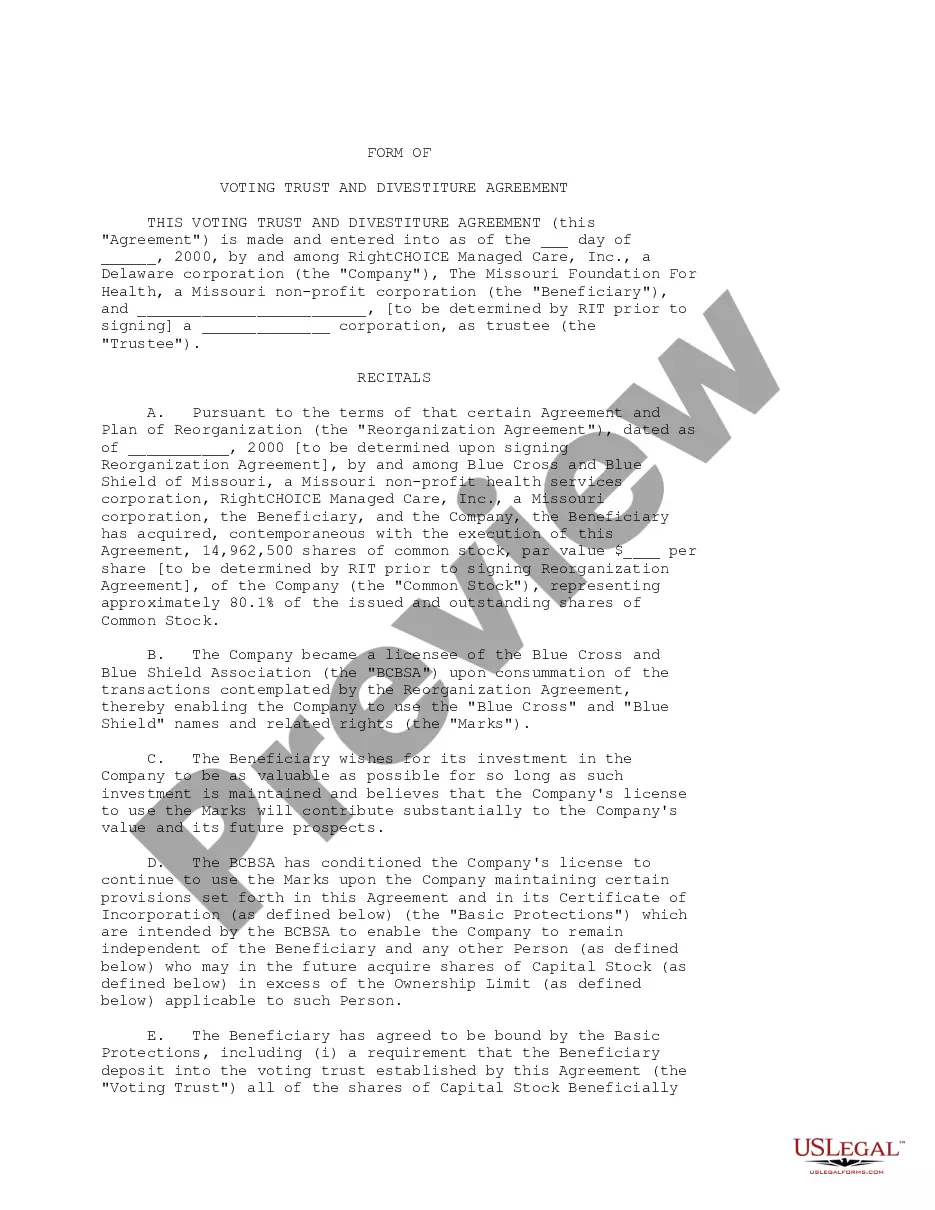

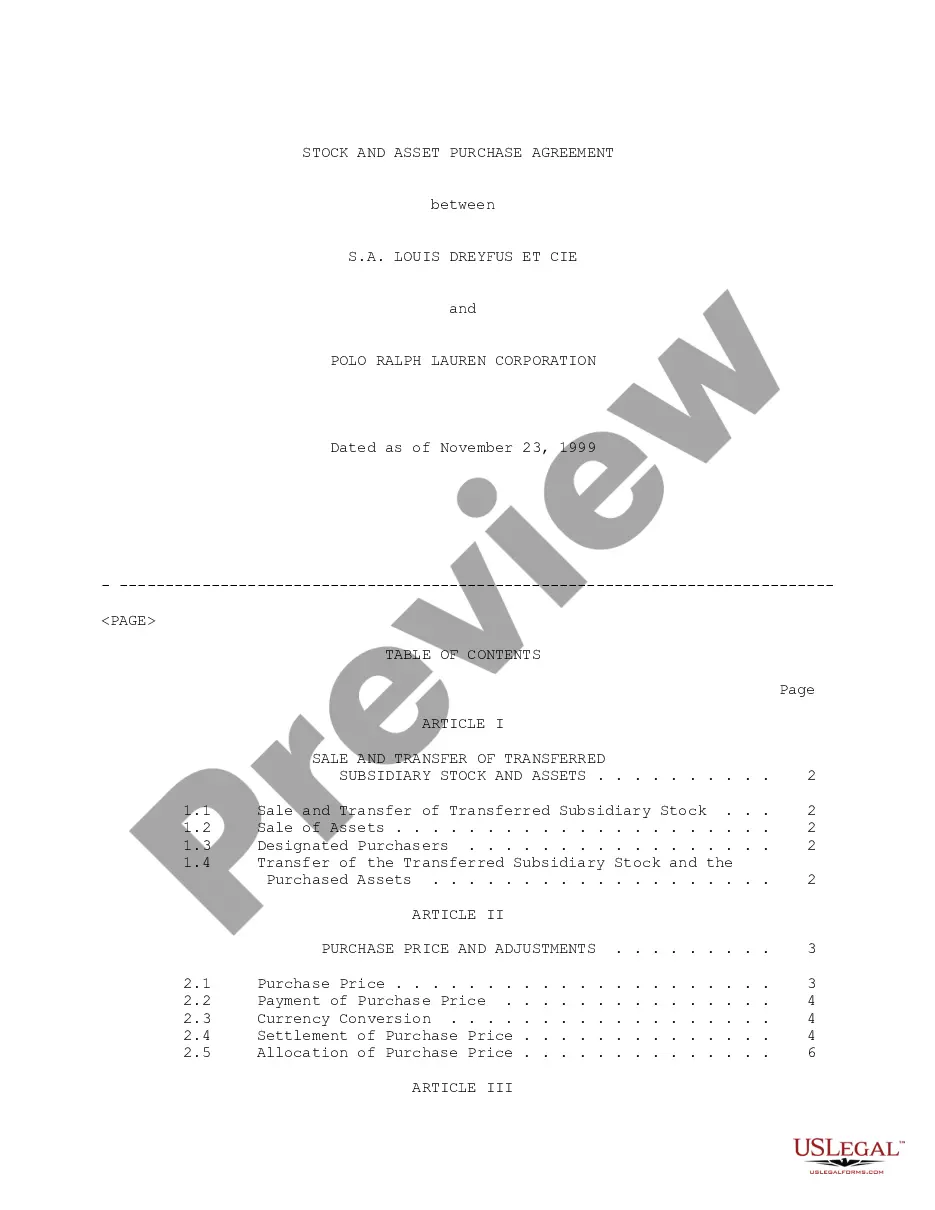

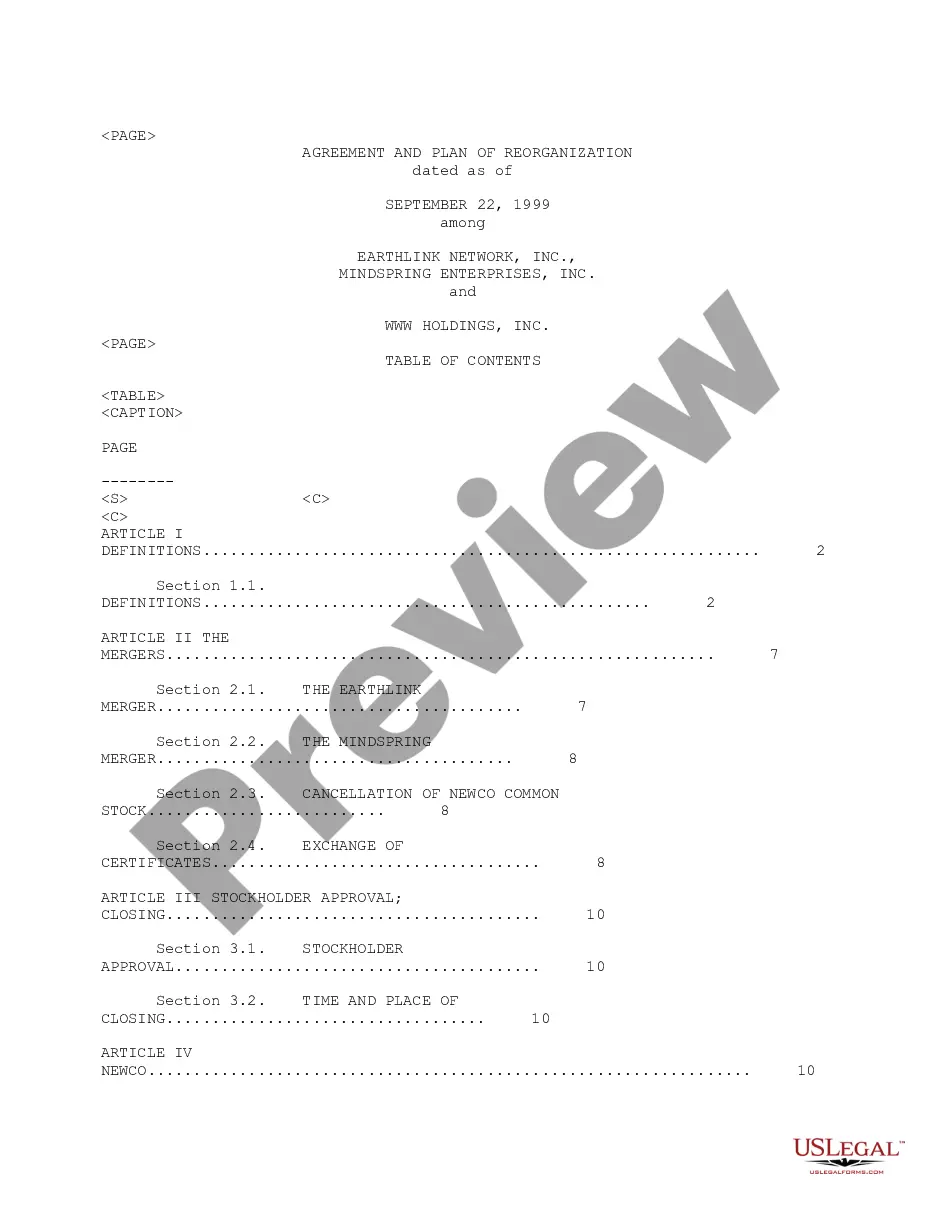

You can examine the form using the Preview button and read the form description to confirm it is suitable for your needs.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Pennsylvania Employer Training Memo - Payroll Deductions.

- Use your account to browse the legal forms you have previously purchased.

- Go to the My documents tab in your account to download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

The taxation of training services in Pennsylvania can depend on various factors, such as the purpose of the training. If the training directly relates to job performance and is provided for the benefit of the employer, it may not be taxable. To navigate these complexities, consider leveraging the Pennsylvania Employer Training Memo - Payroll Deductions for comprehensive guidance.

Most professional services in Pennsylvania, such as legal and accounting services, are not subject to sales tax. However, certain services may be taxable depending on the nature of the service offered. As an employer, it's important to be aware of what is taxable to avoid compliance issues. The Pennsylvania Employer Training Memo - Payroll Deductions can help clarify these distinctions.

In Pennsylvania, training courses may be subject to specific tax regulations. Generally, if the training is job-related and required by an employer, it may be exempt from taxation. However, it’s important to verify the tax status of each training program. For detailed information, refer to the Pennsylvania Employer Training Memo - Payroll Deductions, which outlines the tax implications for employers.

Employers in Pennsylvania can take various deductions from an employee's paycheck, including federal and state income taxes, Social Security, and Medicare contributions. Additionally, deductions may include contributions to employee benefits, such as health insurance and retirement plans. It’s crucial to understand the implications of these deductions, and the Pennsylvania Employer Training Memo - Payroll Deductions offers useful information for payroll management.

In Pennsylvania, certain income types are excluded from income tax. This includes Social Security benefits, unemployment compensation, and many types of retirement income. As an employer, understanding these exclusions is essential for properly managing payroll deductions. The Pennsylvania Employer Training Memo - Payroll Deductions can guide you in ensuring compliance with state tax regulations.

A mandatory deduction is a subtraction from your paycheck that federal or state laws require. Common examples include income taxes and social security contributions. The Pennsylvania Employer Training Memo - Payroll Deductions provides clarity on these mandatory deductions, helping you understand what to expect and how they affect your earnings.

You can obtain a PA 40 form through the Pennsylvania Department of Revenue website, or you might find it directly through your employer. This form is important for filing your personal income tax in Pennsylvania. Referencing the Pennsylvania Employer Training Memo - Payroll Deductions can provide additional context on how it relates to your deductions.

Not all payroll deductions are mandatory. While federal and state taxes are required, other deductions, like contributions to retirement plans, may be voluntary. Understanding the guidelines provided in the Pennsylvania Employer Training Memo - Payroll Deductions can help you differentiate between mandatory and optional deductions.

A rev 419 form, which is used for Pennsylvania Personal Income Tax purposes, may be necessary for certain deductions. If your employer requests this documentation for accurate payroll processing, please ensure you complete it. This form is essential in facilitating compliance with the Pennsylvania Employer Training Memo - Payroll Deductions.

In some cases, you can opt out of specific payroll deductions, but it largely depends on the type of deduction. Mandatory deductions, such as taxes, cannot be opted out of as dictated by the Pennsylvania Employer Training Memo - Payroll Deductions. Review your employer’s policies and consult the memo for detailed information on deductions you might be able to manage.