Pennsylvania Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms such as the Pennsylvania Hardship Letter to Mortgagor or Lender to Prevent Foreclosure within moments.

If you are a member, Log In and download the Pennsylvania Hardship Letter to Mortgagor or Lender to Prevent Foreclosure from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Proceed with the transaction. Use your credit card or PayPal account to complete the payment.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Pennsylvania Hardship Letter to Mortgagor or Lender to Prevent Foreclosure. Each document you save in your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Pennsylvania Hardship Letter to Mortgagor or Lender to Prevent Foreclosure with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- Ensure you have chosen the correct form for your city/state.

- Click the Preview button to review the form's details.

- Check the form description to confirm you have selected the right one.

- If the form does not meet your needs, use the Search field at the top of the page to locate one that does.

- Once satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose your payment plan and provide your information to create an account.

Form popularity

FAQ

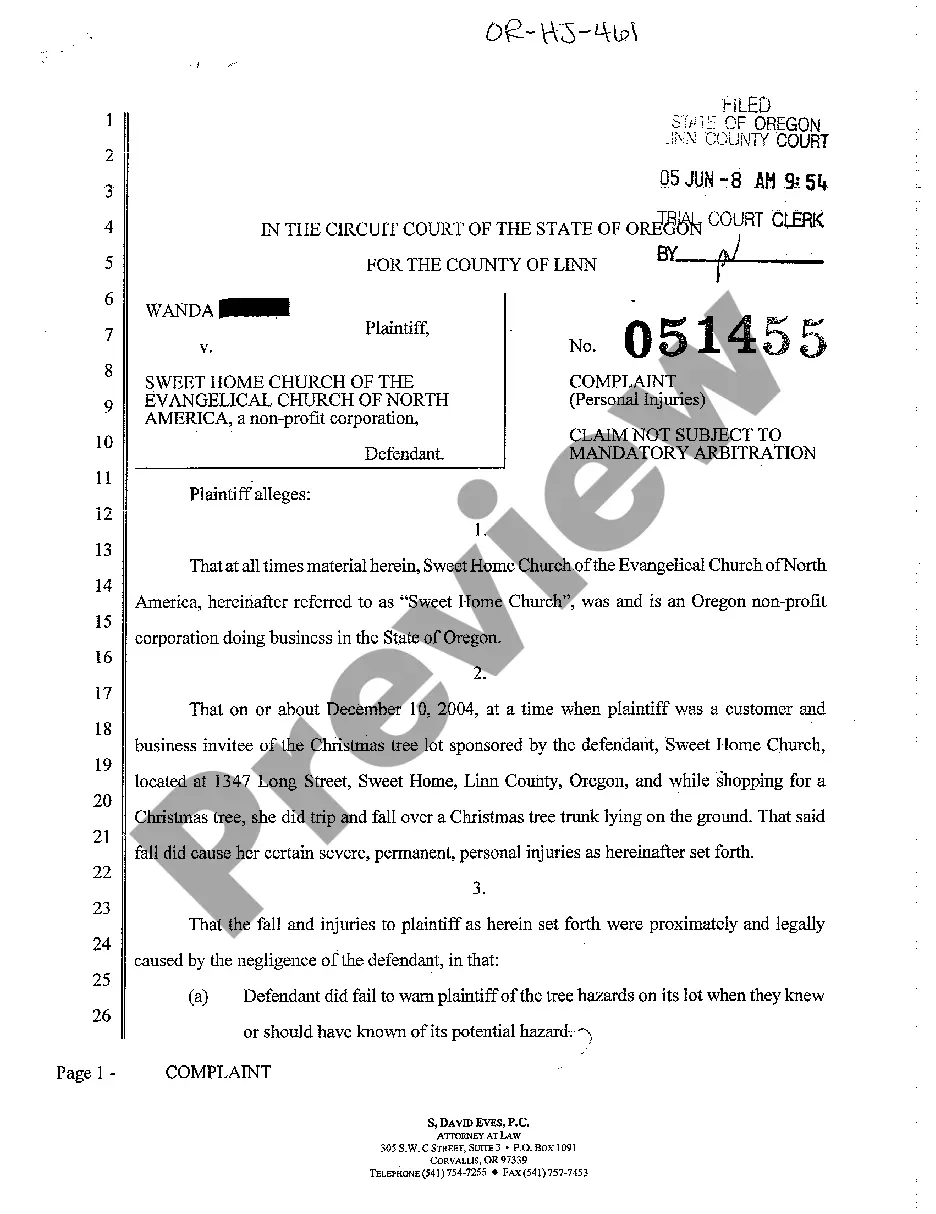

To prove hardship for a mortgage, you should gather documentation that clearly outlines your financial struggles. Common documents include job loss letters, medical bills, or any other evidence that shows how your situation has changed. A Pennsylvania Hardship Letter to Mortgagor or Lender to Prevent Foreclosure can present this information compellingly, helping to convey your circumstances effectively. By using a well-structured letter, you can enhance your chances of receiving the assistance you need.

An example of a hardship letter for a mortgage includes a clear explanation of your current financial difficulties and how they affect your ability to make payments. In this letter, you should outline your situation, such as job loss or medical expenses, and express your desire to work with your lender. The Pennsylvania Hardship Letter to Mortgagor or Lender to Prevent Foreclosure can serve as a structured template to articulate your needs effectively. Utilizing platforms like US Legal Forms can help you craft a compelling letter that conveys urgency and honesty.

In a proof of hardship letter, detail your financial situation with supporting evidence like income statements and expense documents. Explain the circumstances that led to your hardship, being honest and direct. Ensuring clarity in your Pennsylvania Hardship Letter to Mortgagor or Lender to Prevent Foreclosure will help you communicate your needs effectively.

To stop foreclosure in Pennsylvania, it is crucial to communicate with your lender as soon as you face difficulties. You can submit a Pennsylvania Hardship Letter to Mortgagor or Lender to Prevent Foreclosure that explains your situation and requests alternatives. Seeking assistance from legal experts or financial counselors can also guide you through your options.

Begin your foreclosure hardship letter by outlining your financial challenges and state how they affect your mortgage payments. Clearly articulate your desire to find a solution and propose specific terms or assistance that might help. This clarity and directness can enhance your Pennsylvania Hardship Letter to Mortgagor or Lender to Prevent Foreclosure.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

A hardship letter should Start by stating the purpose of the letter whether it is a loan modification or a short sale so the lender knows what homeowners want. It should say something like I need to restructure my mortgage and obtain a lower, fixed interest rate2026, in a way that force them to find out why.

The PA foreclosure process can take anywhere from several months to over a year, depending on the specific circumstances and any legal challenge to the foreclosure filing. From the first missed payment, it takes 120 days before the bank can file a foreclosure.

Three of the most common methods of walking away from a mortgage are a short sale, a voluntary foreclosure, and an involuntary foreclosure. A short sale occurs when the borrower sells a property for less than the amount due on the mortgage.

6 Ways To Stop A ForeclosureWork It Out With Your Lender.Request A Forbearance.Apply For A Loan Modification.Consult A HUD-Approved Counseling Agency.Conduct A Short Sale.Sign A Deed In Lieu Of Foreclosure.