Pennsylvania Sample Letter for Foreclosure Services Rendered

Description

How to fill out Sample Letter For Foreclosure Services Rendered?

Choosing the best legal file design can be quite a have difficulties. Needless to say, there are tons of layouts accessible on the Internet, but how would you get the legal kind you want? Use the US Legal Forms site. The service gives 1000s of layouts, such as the Pennsylvania Sample Letter for Foreclosure Services Rendered, that you can use for organization and personal needs. All the kinds are examined by pros and satisfy state and federal demands.

When you are presently listed, log in to your profile and click the Download key to have the Pennsylvania Sample Letter for Foreclosure Services Rendered. Use your profile to appear through the legal kinds you possess purchased in the past. Go to the My Forms tab of your profile and get one more copy in the file you want.

When you are a brand new end user of US Legal Forms, listed here are simple recommendations for you to stick to:

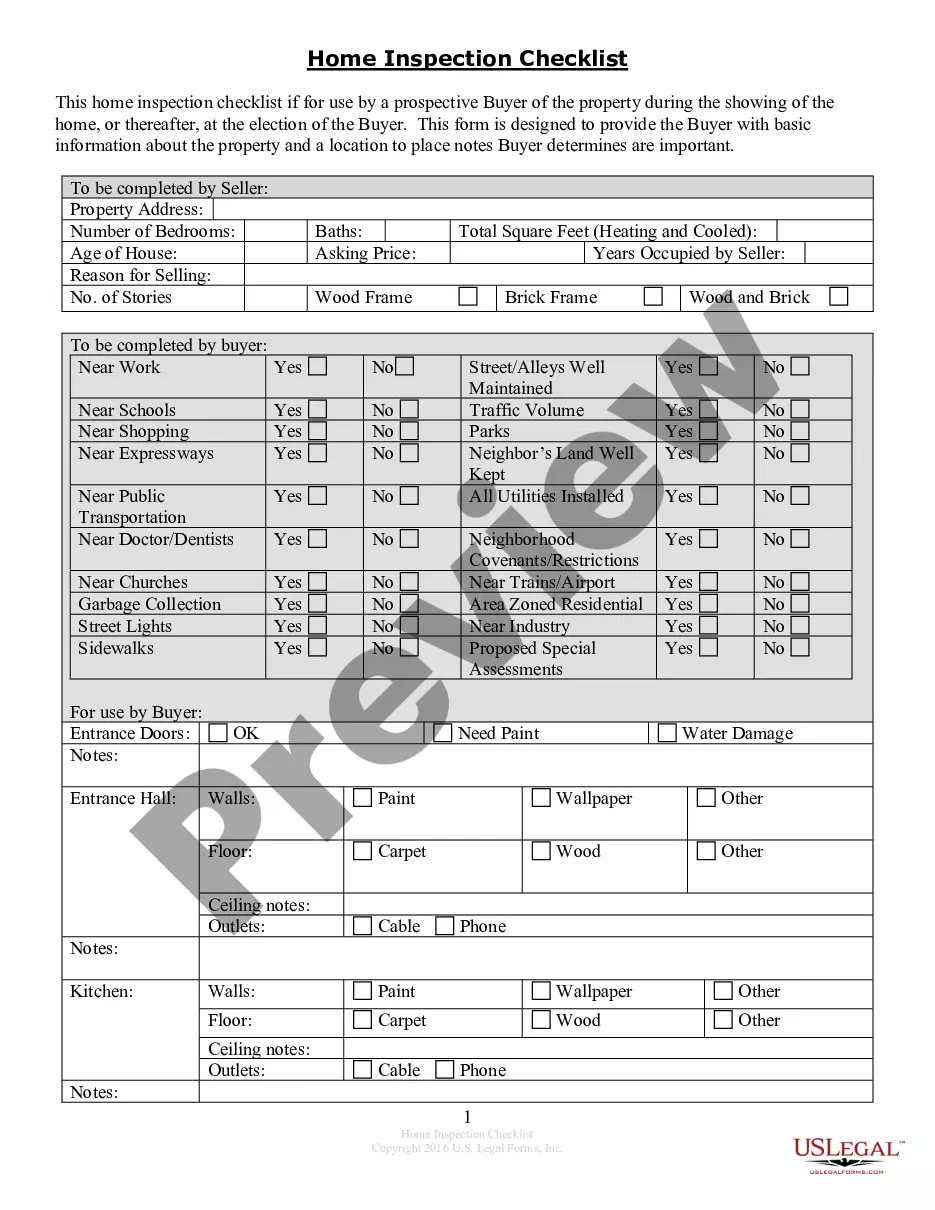

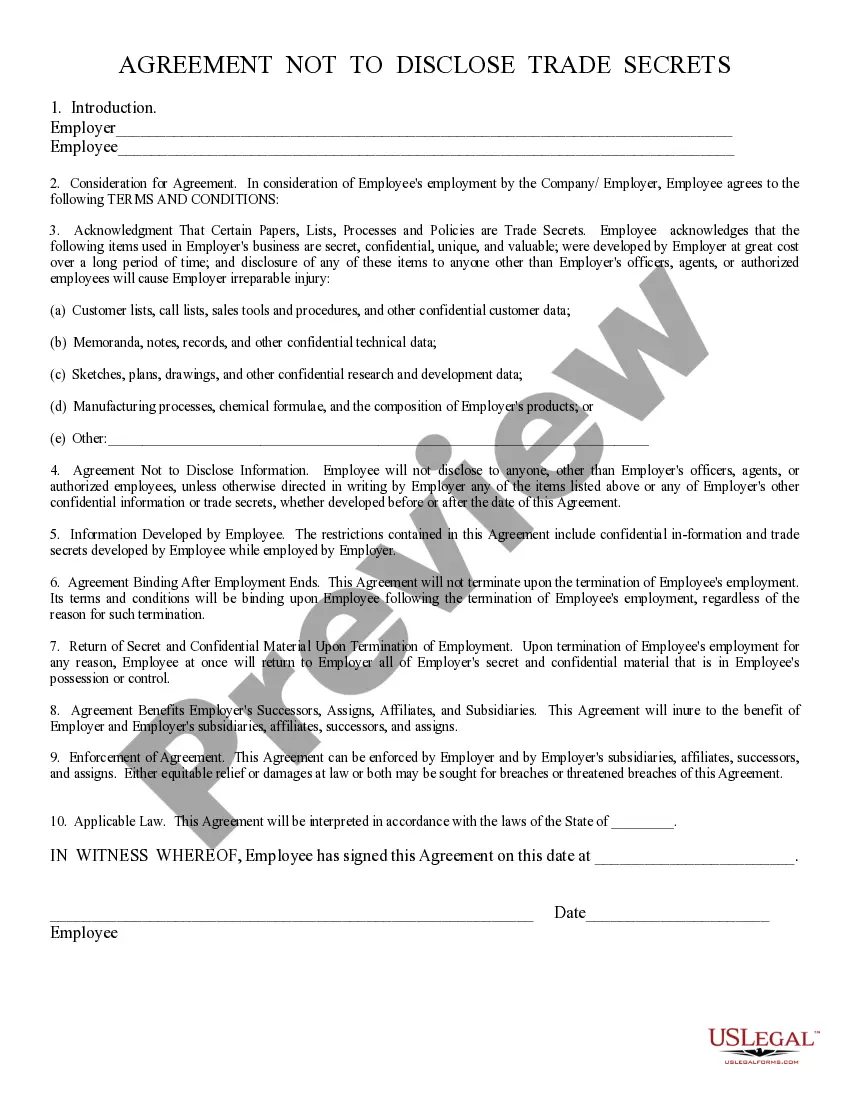

- Very first, make certain you have chosen the correct kind to your area/region. You are able to check out the form using the Review key and look at the form explanation to make certain it will be the right one for you.

- In case the kind fails to satisfy your preferences, make use of the Seach field to obtain the right kind.

- When you are certain the form would work, click on the Buy now key to have the kind.

- Choose the costs prepare you desire and enter in the necessary information. Create your profile and pay money for the order with your PayPal profile or credit card.

- Choose the document structure and obtain the legal file design to your product.

- Complete, change and print and indication the attained Pennsylvania Sample Letter for Foreclosure Services Rendered.

US Legal Forms may be the greatest library of legal kinds in which you can discover a variety of file layouts. Use the company to obtain skillfully-manufactured files that stick to condition demands.

Form popularity

FAQ

Yes. Generally, under Pennsylvania law, if you can catch up on the mortgage payments before the foreclosure sale actually occurs, the foreclosure has to stop. To stop the sale, you will also have to pay court costs and the lender's reasonable attorney's fees, however.

This is basically a document telling you that the lender will foreclose on your property if you do not take action to stop it. Ignoring it will only lead to further legal trouble, and it could prevent you from being able to negotiate with the lender to find a solution that allows you to keep your home.

An Act 91 notice is the signal of the beginning stages of a mortgage foreclosure. Pennsylvania is a judicial state regarding mortgage foreclosures. This means that all paperwork from a mortgage servicer needs to be sent officially and through the court system.

There are particular steps that lenders must follow to foreclose once you fall behind on a mortgage. Foreclosures in Pennsylvania don't have a fixed time frame, but depending on your case's specifics and whether you decide to fight the foreclosure, it might take anywhere from a few months to over a year.

When Can a Pennsylvania Foreclosure Start? Under federal law, the servicer usually can't officially begin a foreclosure until you're more than 120 days past due on payments, subject to a couple of exceptions.

If you currently have a Federal Housing Administration (FHA) or U.S. Department of Agriculture (USDA) loan and have entered into default on your mortgage, you might be sent an Act 6 foreclosure notice. This notice means foreclosure is imminent, and a claim will be filed with the court within a month.

Tips for Writing a Hardship Letter Keep it original. ... Be honest. ... Keep it concise. ... Don't cast blame or shirk responsibility. ... Don't use jargon or fancy words. ... Keep your objectives in mind. ... Provide the creditor an action plan. ... Talk to a Financial Coach.

Notice of intent to foreclose letters are relatively standard documents. The letter you receive from the lender will name you, the property owner, and explain that you are in serious default on your loan. The document will also explain that you have 30 days to cure your mortgage.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

Personal Loan Closure Letter Format Dear Sir/Ma'am, I am Sudharshana Karthik, and I have a personal loan in my account in your bank. I am writing this letter to request you to close my personal loan account with the number 1526xx4656. I have paid all my EMIs, and the loan tenure is complete.