Pennsylvania Leasehold Interest Workform

Description

How to fill out Leasehold Interest Workform?

If you need to access, download, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are categorized by type and state, or by keywords.

Each legal document template you purchase is yours indefinitely. You have access to every form you downloaded within your account. Select the My documents section and choose a form to print or download again.

Acquire and download, and print the Pennsylvania Leasehold Interest Workform with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to obtain the Pennsylvania Leasehold Interest Workform with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and select the Download option to retrieve the Pennsylvania Leasehold Interest Workform.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your appropriate city/state.

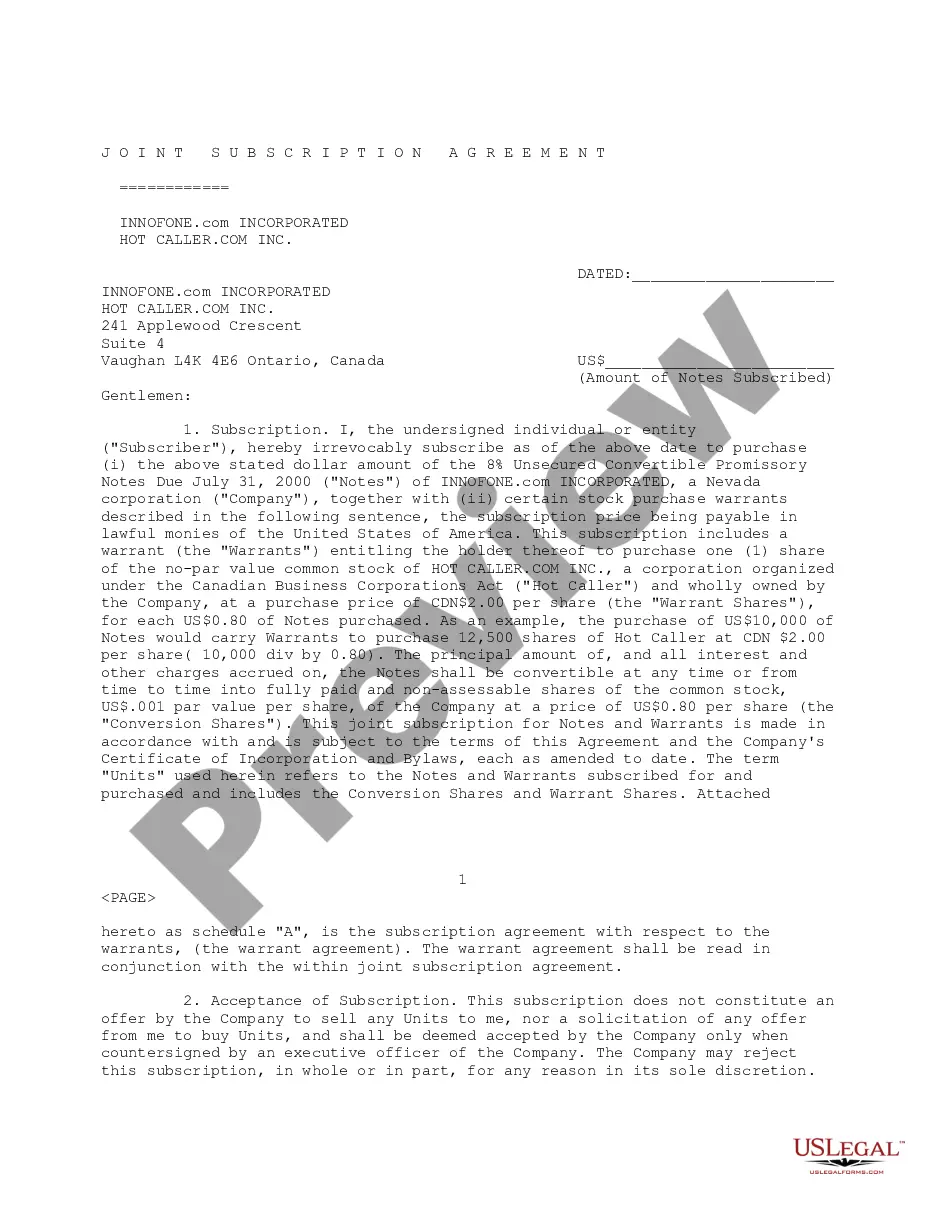

- Step 2. Use the Preview option to review the contents of the form. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions in the legal form design.

- Step 4. Once you have identified the form you need, click on the Buy now option. Choose your pricing plan and enter your details to register for an account.

- Step 5. Proceed with the transaction. You may use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Pennsylvania Leasehold Interest Workform.

Form popularity

FAQ

In Pennsylvania, all interest income must typically be reported on your tax return. This includes interest from various sources such as banks and investments. Failing to report this income could lead to penalties or audits. To simplify this process, the Pennsylvania Leasehold Interest Workform on US Legal Forms helps you track and report your financial activities efficiently.

Yes, interest income is generally taxable in Pennsylvania. This includes income from savings accounts, bonds, and other interest-bearing investments. It is important to accurately report this income to ensure compliance with state tax laws. Utilizing the Pennsylvania Leasehold Interest Workform can assist in correctly documenting your income and managing your tax obligations.

Leasehold improvements in Pennsylvania can be taxable, depending on how they are classified and utilized. Generally, if these improvements enhance the space permanently, they may be assessed for tax purposes. Therefore, it is essential to consult with a tax professional to determine the specific tax implications. The Pennsylvania Leasehold Interest Workform can help clarify these details and provide guidance.

Appraising a leasehold interest involves assessing the value of the lease based on the remaining lease term, rental payments, and market conditions. Such an appraisal may require a comparison to similar properties with leasehold arrangements. Leveraging the Pennsylvania Leasehold Interest Workform can ensure you have the proper documentation to facilitate an accurate appraisal.

Buying a leasehold property can be a smart investment, but it comes with certain risks. You do not own the land; instead, you hold a lease for a specific duration, which may affect your property value and financing options. Therefore, it's important to generate a Pennsylvania Leasehold Interest Workform to ensure clarity around the terms of ownership and lease duration.

Yes, it is possible to mortgage a leasehold interest, but it often comes with specific considerations. Lenders may require additional documents and may check the terms of your lease to ensure it allows for mortgage financing. Utilizing a Pennsylvania Leasehold Interest Workform can help streamline this process and clarify your obligations.

In a leasehold interest, the owner is typically the tenant who has entered into a lease agreement with the property owner or landlord. This agreement grants the tenant the right to occupy and use the property for a specified period, without owning the underlying property itself. In Pennsylvania, understanding this structure is crucial for managing your Pennsylvania Leasehold Interest Workform effectively.

Leasehold interest refers to the rights a tenant has under a lease agreement for a property they rent. This includes the right to occupy the property and use it according to the lease terms. Understanding your leasehold interest is vital, and using the Pennsylvania Leasehold Interest Workform can ensure you articulate these rights effectively in your lease documentation.

In Pennsylvania, lease agreements do not typically require notarization to be enforceable. However, having a lease notarized can help in documenting the transaction and providing additional legal protection. The Pennsylvania Leasehold Interest Workform allows you to create a clear and comprehensive agreement, which can be beneficial regardless of notarization.

Leasehold title interest in land refers to a tenant's legal rights to occupy and use the land for a defined period based on their lease agreement. It's essential to differentiate this from ownership, as it does not confer full property rights. The Pennsylvania Leasehold Interest Workform offers tenants a structured way to clarify this type of interest in their agreement.