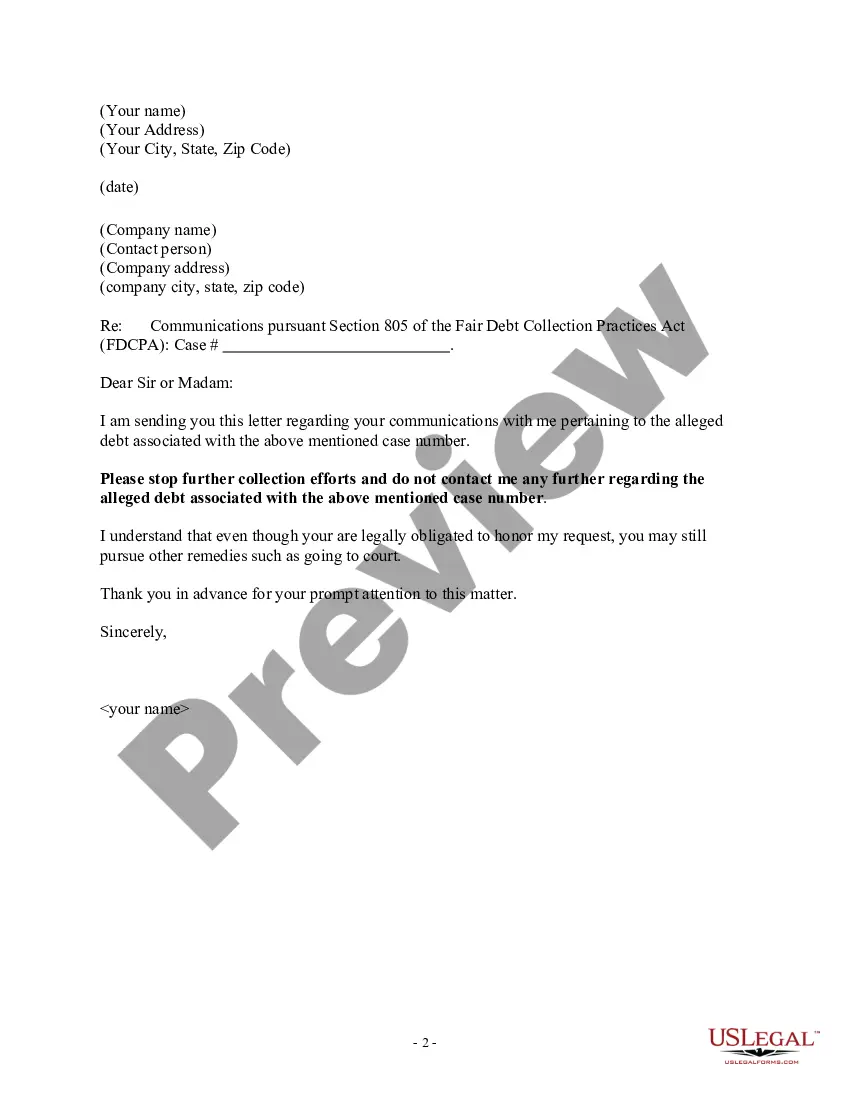

Pennsylvania Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

Are you presently in a role where you need documents for both business or personal tasks almost every day.

There are numerous credible document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides a vast array of form templates, including the Pennsylvania Notice of Violation of Fair Debt Act - Notice to Stop Contact, which are designed to comply with state and federal regulations.

Once you find the appropriate form, click on Get now.

Select the pricing plan you prefer, input the necessary information to create your account, and complete your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Pennsylvania Notice of Violation of Fair Debt Act - Notice to Stop Contact template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/state.

- Use the Preview button to review the form.

- Check the details to confirm that you have selected the correct form.

- If the form is not what you’re looking for, use the Search field to locate the form that fits your needs.

Form popularity

FAQ

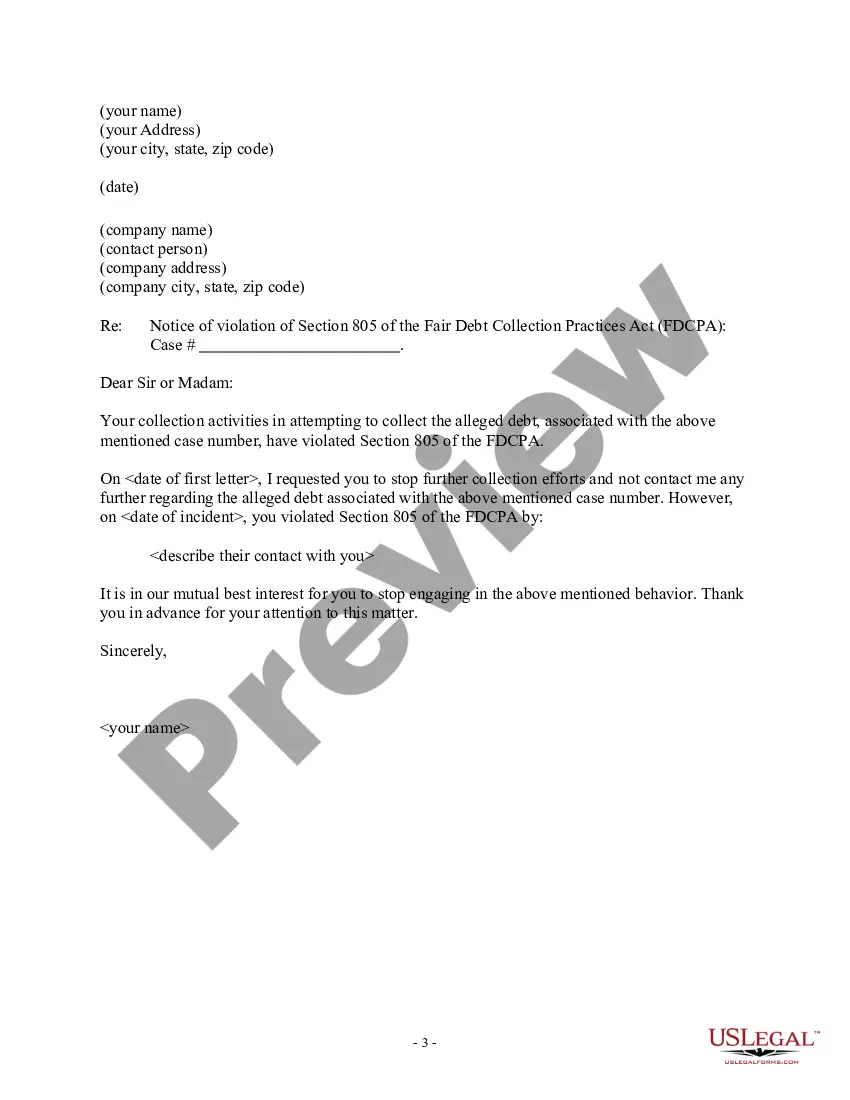

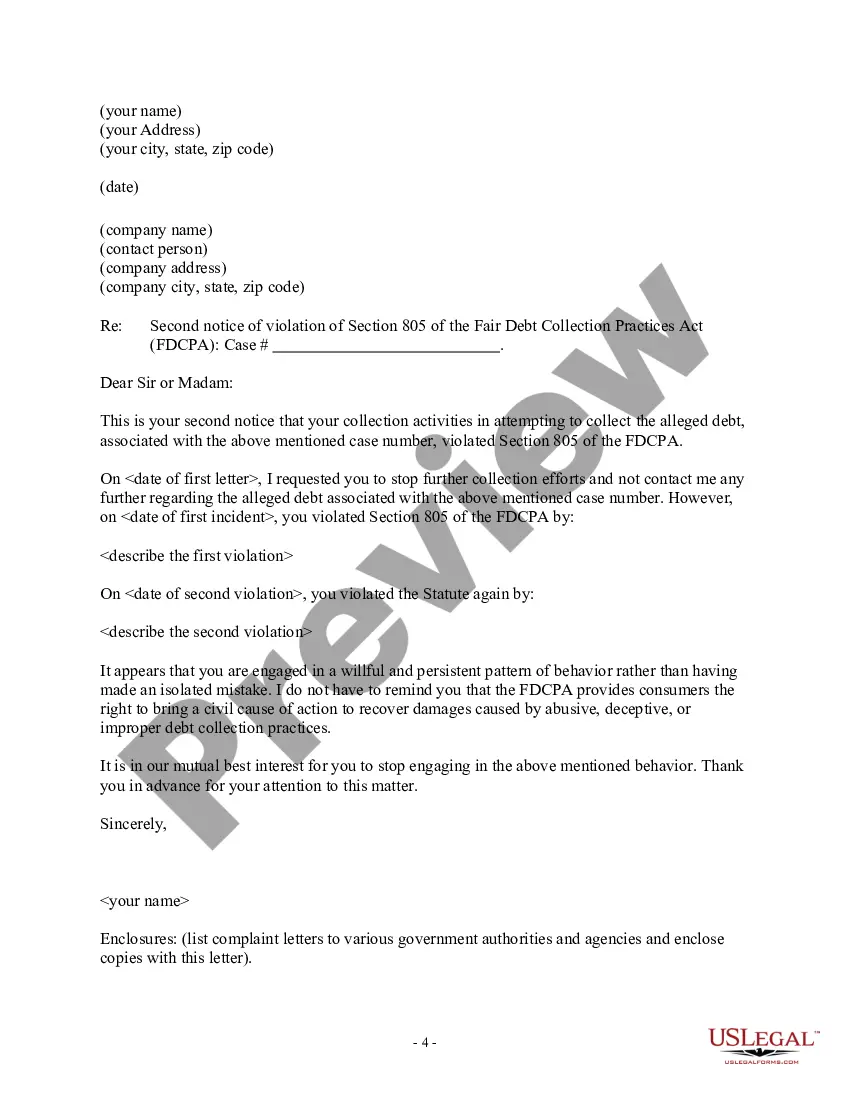

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

Debt collectors cannot call you at an unusual time or place or at a time or place they know is inconvenient to you. You might be dealing with a scammer if you are called before 8 a.m. or after 9 p.m.

If you continue to ignore communicating with the debt collector, they will likely file a collections lawsuit against you in court. If you are served with a lawsuit and ignore this court filing, the debt collection company will then be able to get a default judgment against you.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

What Does a Debt Verification Notice Include? A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

Sending a Cease-and-Desist Letter Sending a debt verification letter or a simple cease-and-desist letter can stop debt collectors from contacting you. There are many templates available online including those from the Consumer Financial Protection Bureau (CFPB).

A debt collector must tell you the name of the creditor, the amount owed, and that you can dispute the debt or seek verification of the debt. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

You have the right to tell a debt collector to stop communicating with you. To stop communication, send a letter to the debt collector and keep a copy of the letter. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.