Pennsylvania Purchase of common stock for treasury of company

Description

How to fill out Purchase Of Common Stock For Treasury Of Company?

US Legal Forms - one of many biggest libraries of legitimate types in the States - offers a variety of legitimate file layouts it is possible to obtain or printing. Using the site, you may get a large number of types for organization and person uses, sorted by types, suggests, or key phrases.You can get the most recent types of types much like the Pennsylvania Purchase of common stock for treasury of company in seconds.

If you already possess a subscription, log in and obtain Pennsylvania Purchase of common stock for treasury of company through the US Legal Forms collection. The Down load key can look on every form you see. You gain access to all in the past downloaded types from the My Forms tab of your bank account.

In order to use US Legal Forms initially, here are easy instructions to obtain started out:

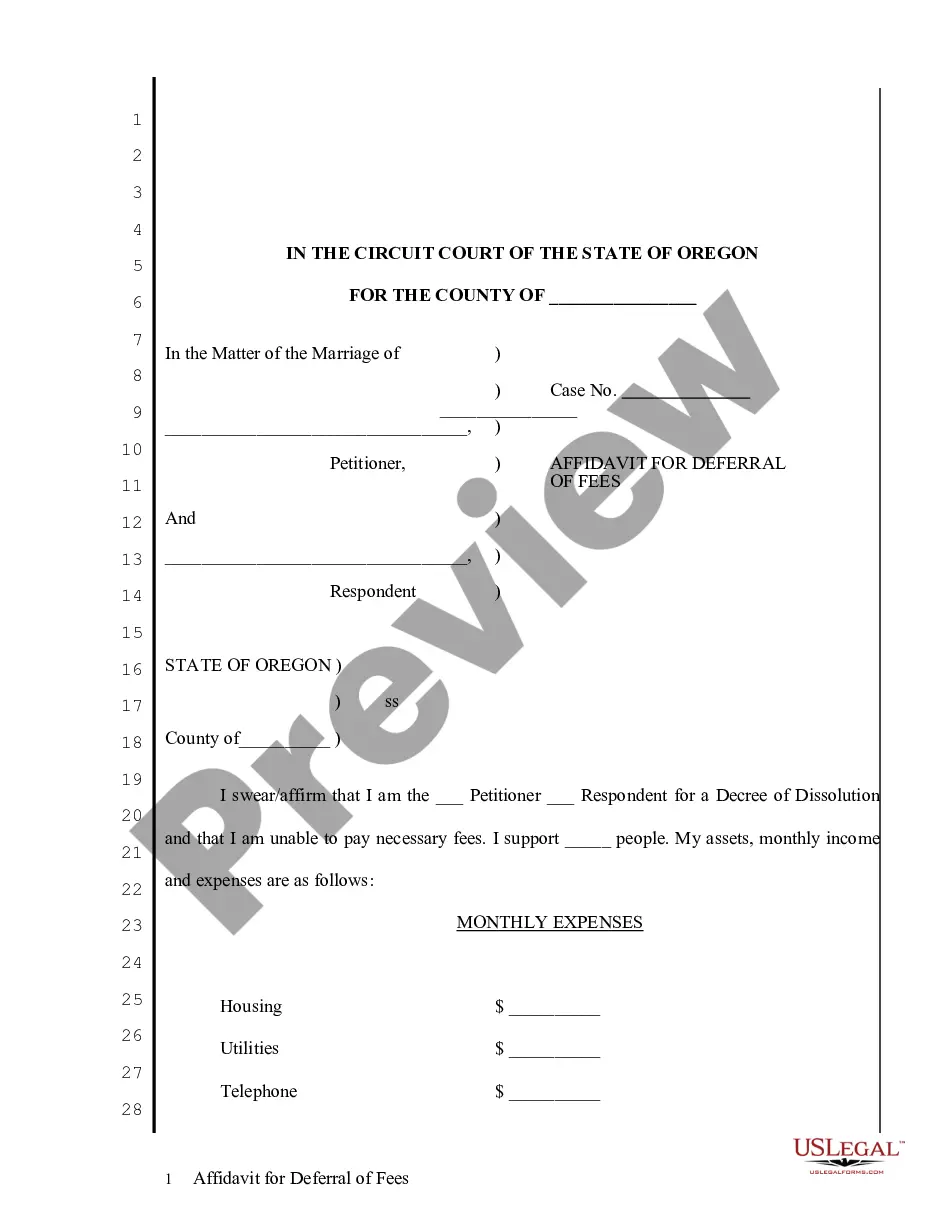

- Ensure you have picked out the correct form for your personal town/area. Select the Review key to examine the form`s articles. Read the form description to actually have selected the proper form.

- In case the form doesn`t suit your specifications, utilize the Research field at the top of the monitor to get the one which does.

- If you are satisfied with the form, validate your choice by visiting the Purchase now key. Then, opt for the prices program you favor and give your references to sign up for an bank account.

- Process the transaction. Make use of bank card or PayPal bank account to accomplish the transaction.

- Find the formatting and obtain the form on your device.

- Make changes. Complete, change and printing and sign the downloaded Pennsylvania Purchase of common stock for treasury of company.

Each and every design you included in your account does not have an expiration particular date and is your own forever. So, if you want to obtain or printing one more backup, just visit the My Forms segment and then click around the form you need.

Get access to the Pennsylvania Purchase of common stock for treasury of company with US Legal Forms, the most considerable collection of legitimate file layouts. Use a large number of specialist and condition-certain layouts that fulfill your business or person demands and specifications.

Form popularity

FAQ

Treasury stock ? also called treasury shares ? is stock that a company has bought back from public investors. When a company does a stock buyback, it puts the repurchased shares back under its own control and reduces the supply of shares available in the market. That often boosts the price.

Treasury stock is shares of stocks that a publicly traded company decides to buy back from shareholders. There are several reasons a company may do this. Some reasons can include reducing cash outflows and countering a potential undervaluing of shares are potential reasons.

The effect of purchase of treasury shares on the company on its equity is that the issue of its stock will increase the assets and the equity as direct effect. While the repurchase of stock will decrease the assets and the equity of the company as inverse effect.

What Happens to Treasury Stock? When a business buys back its own shares, these shares become ?treasury stock? and are decommissioned. In and of itself, treasury stock doesn't have much value. These stocks do not have voting rights and do not pay any distributions.

Treasury stock, or reacquired stock, is the previously issued, outstanding shares of stock which a company repurchased or bought back from shareholders. The reacquired shares are then held by the company for its own disposition.

Public companies use share buybacks to return profits to their investors. When a company buys back its own stock, it's reducing the number of shares outstanding and increasing the value of the remaining shares, which can be a good thing for shareholders.

Treasury stock is stock that is repurchased by the same corporation that issued it. The corporation is buying back its own stock from the stockholders. Since treasury stock shares are no longer owned by stockholders but by the corporation itself, total stockholders' equity decreases.

Treasury stocks (also known as treasury shares) are the portion of shares that a company keeps in its own treasury. They may have either come from a part of the float and shares outstanding before being repurchased by the company or may have never been issued to the public at all.