Pennsylvania Directors and Officers Indemnity Trust

Description

How to fill out Directors And Officers Indemnity Trust?

Discovering the right authorized papers web template could be a have difficulties. Needless to say, there are a lot of templates available on the Internet, but how will you find the authorized kind you require? Take advantage of the US Legal Forms web site. The service provides thousands of templates, such as the Pennsylvania Directors and Officers Indemnity Trust, that you can use for enterprise and personal demands. Each of the forms are checked by professionals and fulfill federal and state requirements.

If you are presently signed up, log in for your account and click the Obtain button to have the Pennsylvania Directors and Officers Indemnity Trust. Use your account to search through the authorized forms you may have bought formerly. Check out the My Forms tab of your respective account and have another version in the papers you require.

If you are a fresh consumer of US Legal Forms, listed here are straightforward guidelines so that you can adhere to:

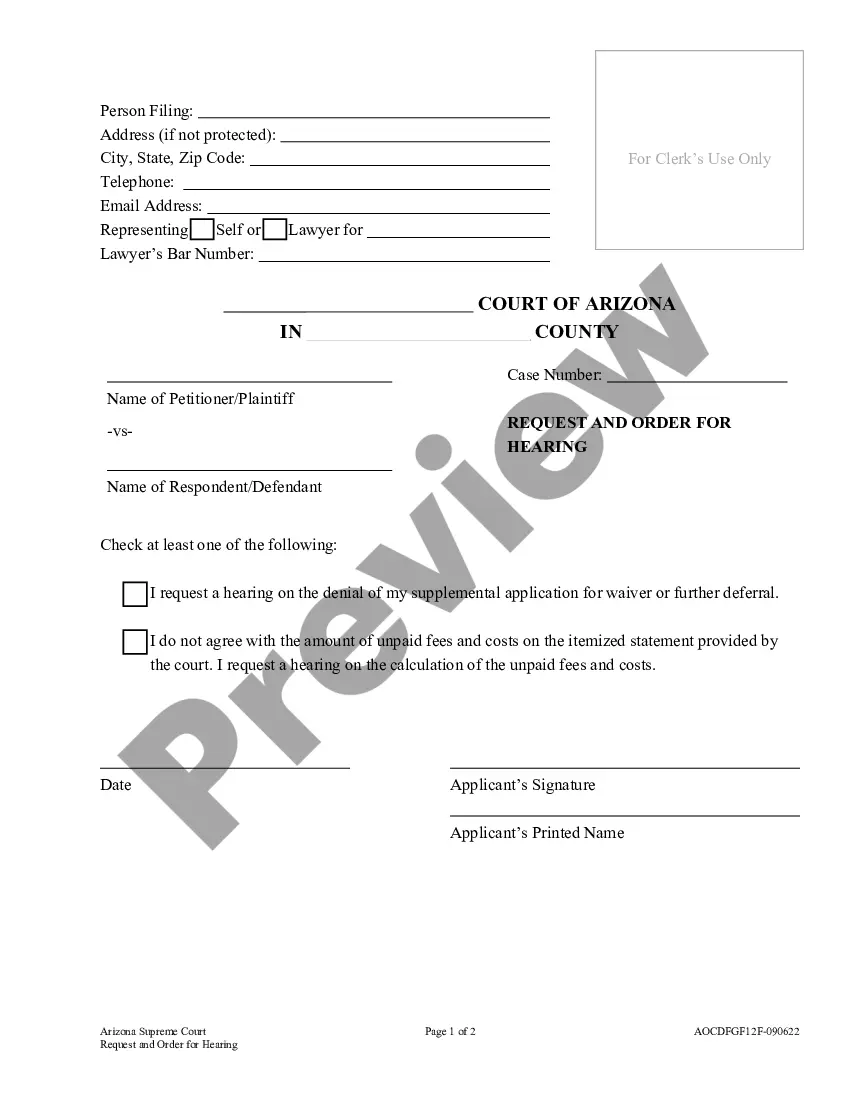

- Initially, ensure you have chosen the appropriate kind for your town/region. It is possible to look over the shape utilizing the Preview button and read the shape description to make certain it is the right one for you.

- If the kind is not going to fulfill your requirements, take advantage of the Seach discipline to find the appropriate kind.

- When you are certain the shape is proper, click on the Purchase now button to have the kind.

- Choose the prices program you would like and enter in the essential information and facts. Make your account and pay for your order making use of your PayPal account or bank card.

- Choose the file file format and obtain the authorized papers web template for your device.

- Complete, revise and printing and sign the acquired Pennsylvania Directors and Officers Indemnity Trust.

US Legal Forms is the most significant collection of authorized forms that you can discover different papers templates. Take advantage of the service to obtain expertly-created documents that adhere to state requirements.

Form popularity

FAQ

Section 145(c)(1) provides that to the extent a director has been successful on the merits or otherwise in defense of any action, suit, or proceeding referenced in Section 145(a) or Section 145(b), the director shall be indemnified against expenses actually and reasonably incurred by the director in connection ...

Insurance ? The indemnification agreement typically will require that the company provide D&O liability insurance that protects the indemnitee to the same extent as the most favorably insured of the company's and its affiliates' current directors and officers.

Indemnification refers to the right to have a company reimburse current or former directors or officers for all losses, including legal fees, incurred in connection with litigation arising from actions taken in service to the company or at the company's direction.

Indemnification is often very broad, often extending ?to the maximum extent permitted by law?, whereas D&O insurance polices contain numerous exclusions and conditions. In addition, D&O insurance must be renewed each year, with possible changes in terms and conditions.

A company may, however, lend money to a director to fund the director's defence costs. Frequently, an indemnity will include a provision under which the company agrees to lend the director the amounts necessary to fund the director's defence costs.

D&O insurance specifically covers members on a board of directors and officers. Professional liability insurance, on the other hand, covers professionals (of nearly any position within a company) that offer specialized services.

A D&O policy protects a director or officer's assets and reimburses them for settlements and legal expenses resulting from such litigation and cases. The purpose of professional indemnity insurance is to protect professionals against claims resulting from mistakes or omissions they have made.

Indemnification clauses are contractual provisions that require one party (the ?Indemnitor?) to indemnify another party (the ?Indemnitee?) for losses that the Indemnitee may suffer. In prime contracts, the owner usually is the Indemnitee and the contractor is the Indemnitor.