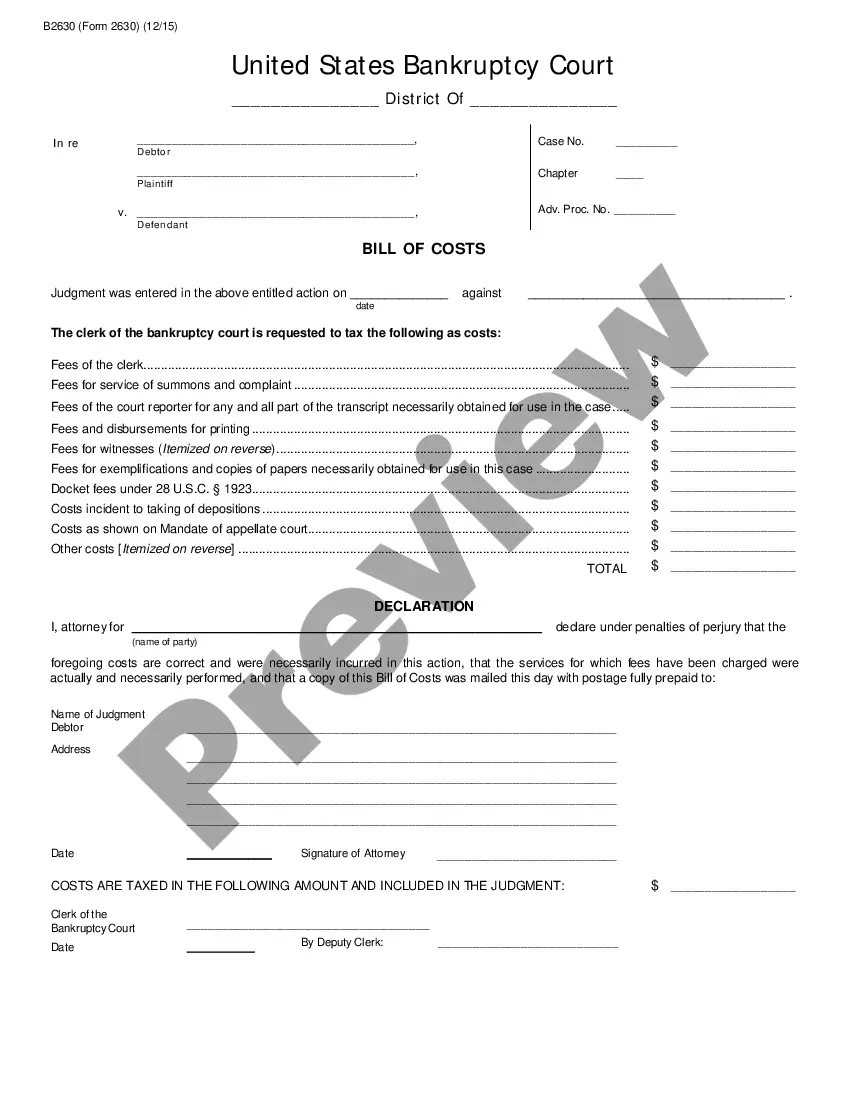

Pennsylvania Bill of Costs - B 263

Description

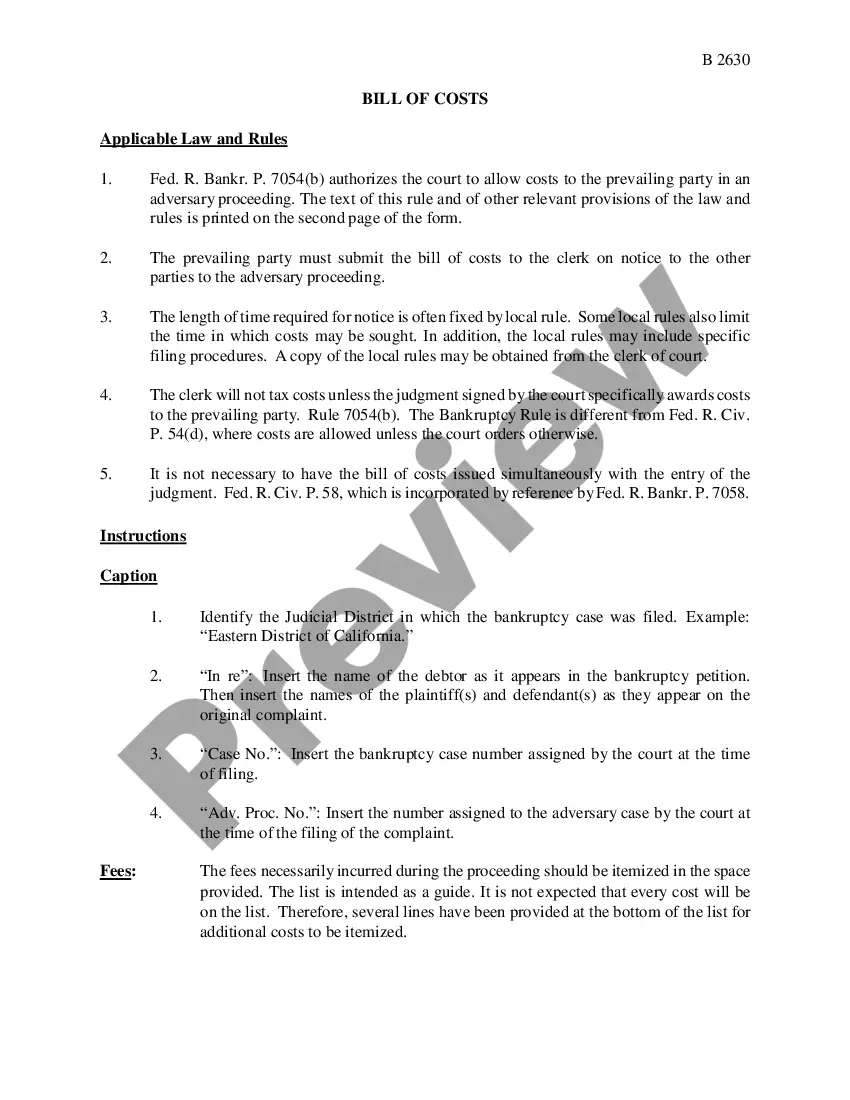

How to fill out Bill Of Costs - B 263?

US Legal Forms - one of several biggest libraries of legitimate kinds in the USA - offers a wide range of legitimate papers layouts it is possible to down load or produce. Utilizing the website, you can get a large number of kinds for company and individual functions, sorted by classes, suggests, or search phrases.You will find the newest models of kinds such as the Pennsylvania Bill of Costs - B 263 within minutes.

If you already have a registration, log in and down load Pennsylvania Bill of Costs - B 263 from your US Legal Forms collection. The Down load option will show up on every kind you look at. You have access to all formerly acquired kinds from the My Forms tab of the account.

In order to use US Legal Forms for the first time, listed here are simple guidelines to get you started out:

- Ensure you have picked the proper kind to your city/state. Go through the Preview option to examine the form`s content material. Look at the kind explanation to ensure that you have chosen the appropriate kind.

- If the kind does not fit your specifications, use the Lookup field on top of the display to discover the one which does.

- Should you be satisfied with the shape, validate your selection by clicking the Purchase now option. Then, choose the rates prepare you prefer and offer your credentials to sign up for the account.

- Procedure the deal. Make use of your bank card or PayPal account to accomplish the deal.

- Pick the file format and down load the shape on your system.

- Make modifications. Fill out, edit and produce and indication the acquired Pennsylvania Bill of Costs - B 263.

Each and every template you added to your account does not have an expiration date which is your own property permanently. So, if you wish to down load or produce yet another copy, just visit the My Forms segment and then click on the kind you require.

Obtain access to the Pennsylvania Bill of Costs - B 263 with US Legal Forms, the most extensive collection of legitimate papers layouts. Use a large number of expert and state-specific layouts that meet up with your company or individual requirements and specifications.

Form popularity

FAQ

Taxation of costs is a ministerial function performed by a court upon the resolution of case. It involves entering the various costs and their amounts against the party (either the claimant or defendant) against whom those costs have been awarded by the court. Taxation of costs - Wikipedia wikipedia.org ? wiki ? Taxation_of_costs wikipedia.org ? wiki ? Taxation_of_costs

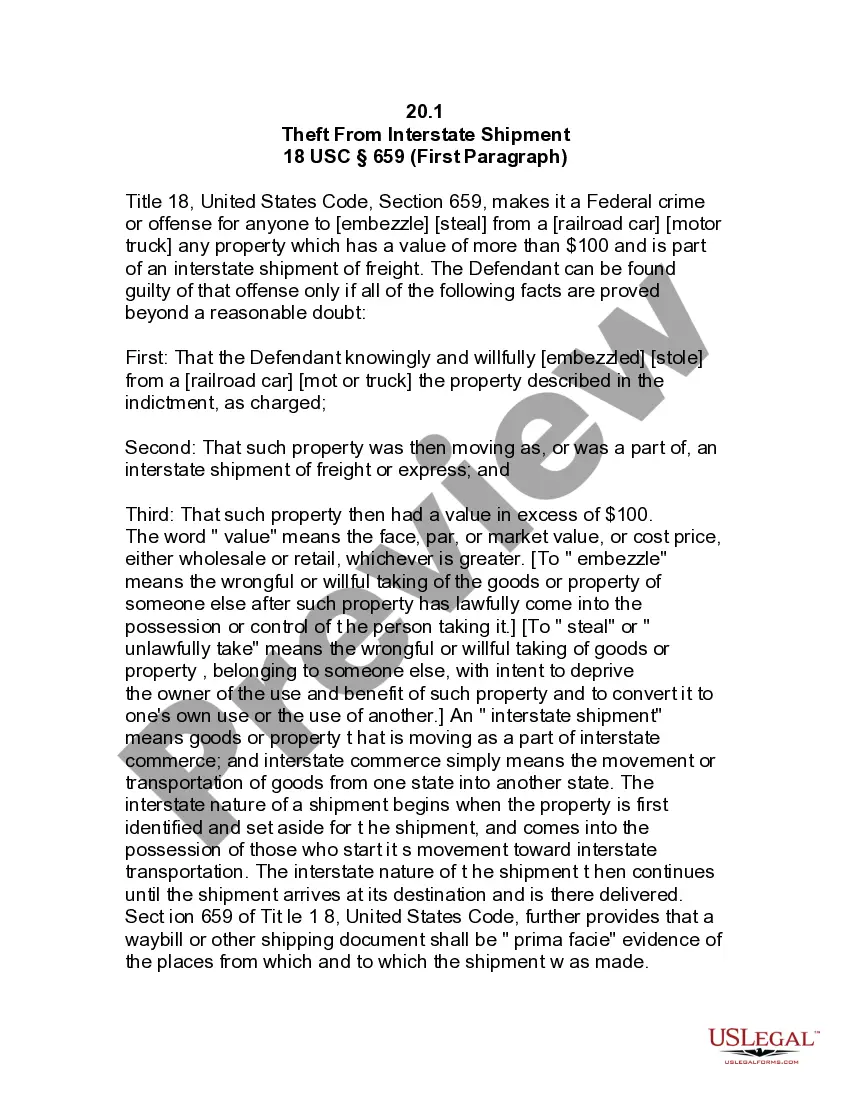

A ?taxable cost? is a cost that a prevailing party may obtain from the losing party for expenses it incurred during the litigation. This cost must be specifically permitted under a rule or statute, such as Federal Rule of Civil Procedure 54 or 28 U.S.C.

Cost bill, also referred to as bill of costs, is an itemized list of court costs incurred by the prevailing party in a lawsuit. The prevailing party submits this list to the court and the losing party after a judgment has been issued in the case. cost bill | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? cost_bill cornell.edu ? wex ? cost_bill

A competent person over the age of 18, who is not a party on the case, or a family member; can serve the other party for you. This person could be a friend, sheriff, constable, etc. You can also serve them via mail or serve their attorney.

Federal Rule of Civil Procedure 54(d) outlines which party can recover costs, and it includes prevailing parties, subject to certain limitations. Recoverable costs may include deposition costs, printing expenses, postage, and other necessary expenditures detailed in 28 U.S.C. § 1920. What You Should Know about the Taxation of Costs americanbar.org ? newsletters ? minority-trial americanbar.org ? newsletters ? minority-trial

Tax costs generally refers either to increased tax liabilities resulting from a corporate transaction or more frequently as a motion of a losing party to challenge paying certain costs of the winning party in litigation. tax costs | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? tax_costs cornell.edu ? wex ? tax_costs