Pennsylvania Job Sharing Agreement Form

Description

How to fill out Job Sharing Agreement Form?

Are you currently situated in a location where you need documentation for both business or personal purposes almost every day.

There are several legal document templates accessible online, but finding ones you can trust isn't easy.

US Legal Forms offers a vast array of template documents, including the Pennsylvania Job Sharing Agreement Form, which is designed to meet state and federal requirements.

When you find the right form, click Purchase now.

Choose the payment plan you prefer, enter the necessary information to create your transaction, and complete the purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Pennsylvania Job Sharing Agreement Form template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it is for your specific city/state.

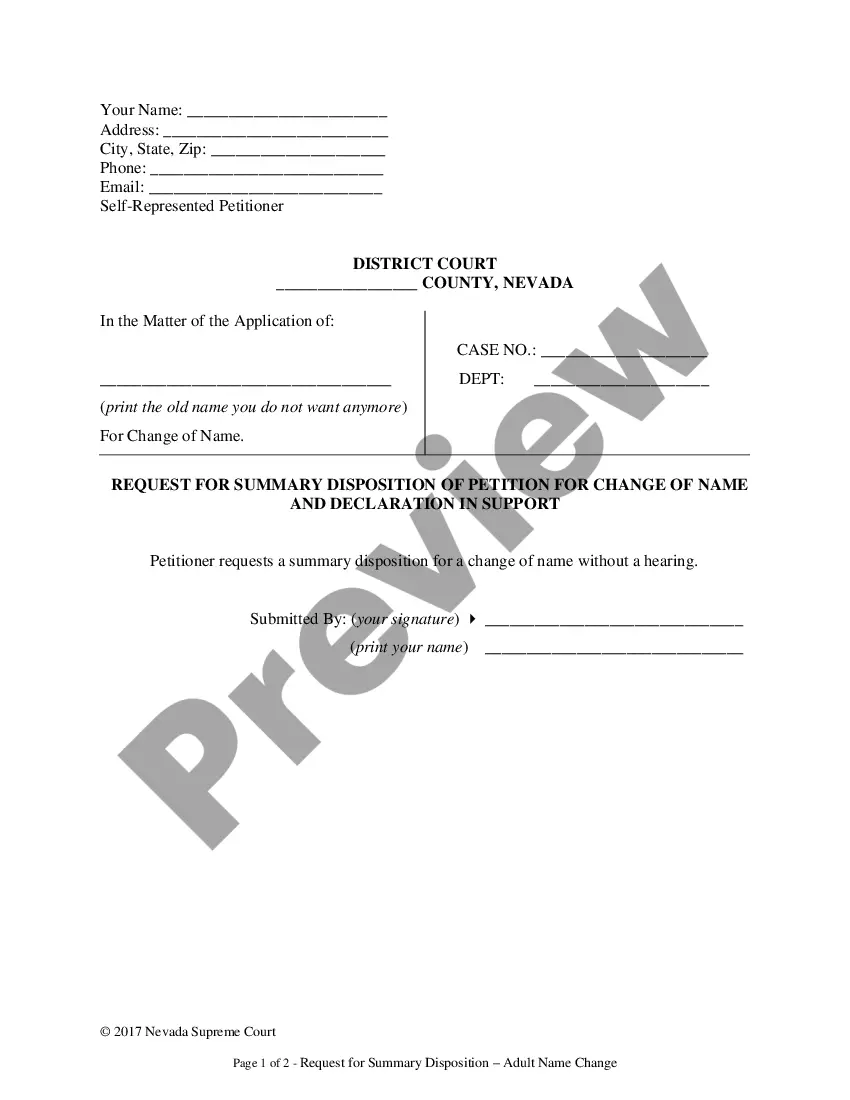

- Use the Review button to examine the document.

- Check the summary to make sure you have selected the correct form.

- If the form isn't what you are looking for, utilize the Research section to find the form that suits your needs.

Form popularity

FAQ

PA Employer UC Account Number This seven-digit number is shown on the New Employer Confirmation Letter (Form UC-1408), Notice of Pennsylvania Unemployment Compensation Responsibilities (Form UC-851), and the Contribution Rate Notice (Form UC-657).

The Unemployment Compensation (UC ) program provides temporary income support if you lose your job through no fault of your own or if you are working less than your full-time hours. If you qualify, you will receive money for a limited time to help you meet expenses while you seek new employment.

Shared-Work allows you to retain your workforce during a slowdown while providing significantly more UC benefits to employees, compared to employees who have simply had their hours reduced and filed for partial UC benefits.

This form is used by NON-TPA's to change an employer's UC benefit's address. UC-1609 (PDF): Employer Information Form Size=153k You must provide this completed form to separating employees and/or employees working reduced hours. It provides accurate information for use when unemployment claims are filed.

An individual employment agreement should be signed by the employer and employee, although it can still be valid even if it isn't. For example, when there is verbal or written acceptance. Electronic signatures, if agreed between the employer and employee, are acceptable to meet this requirement.

A new Pennsylvania law (Act 9 of 2020) requires Pennsylvania employers to provide notice to employees about unemployment compensation benefits at the time of separation from employment or when an employee's work hours are reduced.

Pennsylvania's Shared-Work Program Keeps You Working. Shared-Work allows your employer to keep you employed during a slowdown while providing you significantly more Unemployment Compensation (UC) benefits compared to if your hours were reduced and you applied for partial UC benefits.

In order to be eligible to receive unemployment benefits, you must have sufficient earnings in your base period from a covered employer. The base period is defined as the first four of the last five completed calendar quarters. Without sufficient earnings, you will not be eligible to receive benefits.

The Shared-Work program allows an employer to divide the available hours equally rather than laying off any employees. Employees covered by a Shared-Work plan receive a percentage of their Unemployment Compensation (UC) Weekly Benefit Rate while they work a reduced schedule, if they are otherwise eligible for UC.

If the employer does not reply to the Unemployment Compensation office within the time allowed, the Unemployment Compensation office will move forward with a determination and will base the eligibility for unemployment compensation benefits on the information before it, which is typically the information provided by