Pennsylvania Memo - Using Self-Employed Independent Contractors

Description

How to fill out Memo - Using Self-Employed Independent Contractors?

Locating the proper approved document template can be fairly challenging.

Certainly, there are numerous templates accessible online, but how do you find the legal form you need.

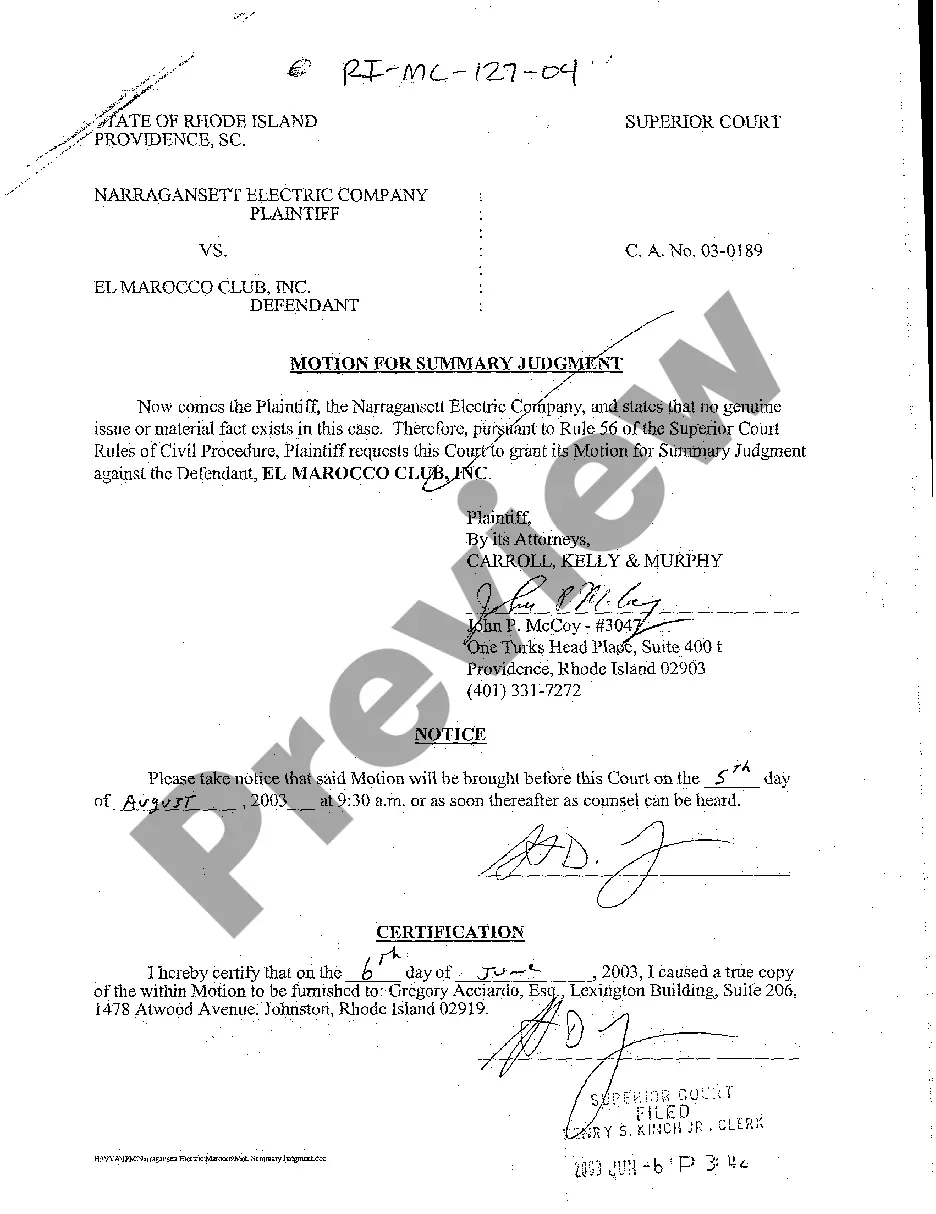

Utilize the US Legal Forms website. This service provides thousands of templates, including the Pennsylvania Memo - Engaging Self-Employed Independent Contractors, which you can use for business and personal purposes.

First, make sure you have selected the correct form for your locality. You can preview the template using the Review button and read the form details to confirm this is indeed the right one for you.

- All documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Acquire button to obtain the Pennsylvania Memo - Engaging Self-Employed Independent Contractors.

- Use your account to review the legal forms you have previously ordered.

- Go to the My documents tab of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

In Pennsylvania, the classification of a worker as either an employee or an independent contractor hinges on various factors. These factors include the degree of control the employer has over the work and how much independence the worker has in performing tasks. The Pennsylvania Memo - Using Self-Employed Independent Contractors provides guidance on understanding these distinctions. Utilizing this memo can help both workers and employers ensure appropriate classification to comply with state laws.

You may be ineligible for benefits if you are self-employed, setting up a business, or have ownership interest in a business.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Bottom line up front -- if you are an independent contractor or self-employed, you may now be eligible for Unemployment Insurance. While the enrollment process is still in development, the Pennsylvania's Department of Labor & Industry (L&I) has posted the application process on their website as of 4-17-2020.

The PA Supreme Court interpreted the Pennsylvania Unemployment Statute, which states that a worker is an independent contractor if the individual is free from control and direction over the performance of the services both under his contract of service and in fact and, in regard to such services, if the individual is

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Those individuals who are eligible for benefits under PUA are the self-employed, independent contractors, and gig workers, who are not eligible under Pennsylvania state law, and individuals who lack sufficient work history or have previously exhausted their state benefits.