Pennsylvania Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions

Description

How to fill out Confirmation Of Orally Accepted Employment Offer From Applicant To Company - Exempt Or Nonexempt Positions?

Have you been in a situation where you need documents for organizational or personal purposes almost every day.

There are many legal document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms presents thousands of form templates, such as the Pennsylvania Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions, which are designed to comply with federal and state regulations.

Once you find the right form, click Purchase now.

Select the pricing plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Pennsylvania Confirmation of Orally Accepted Employment Offer from Applicant to Company - Exempt or Nonexempt Positions template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct state/region.

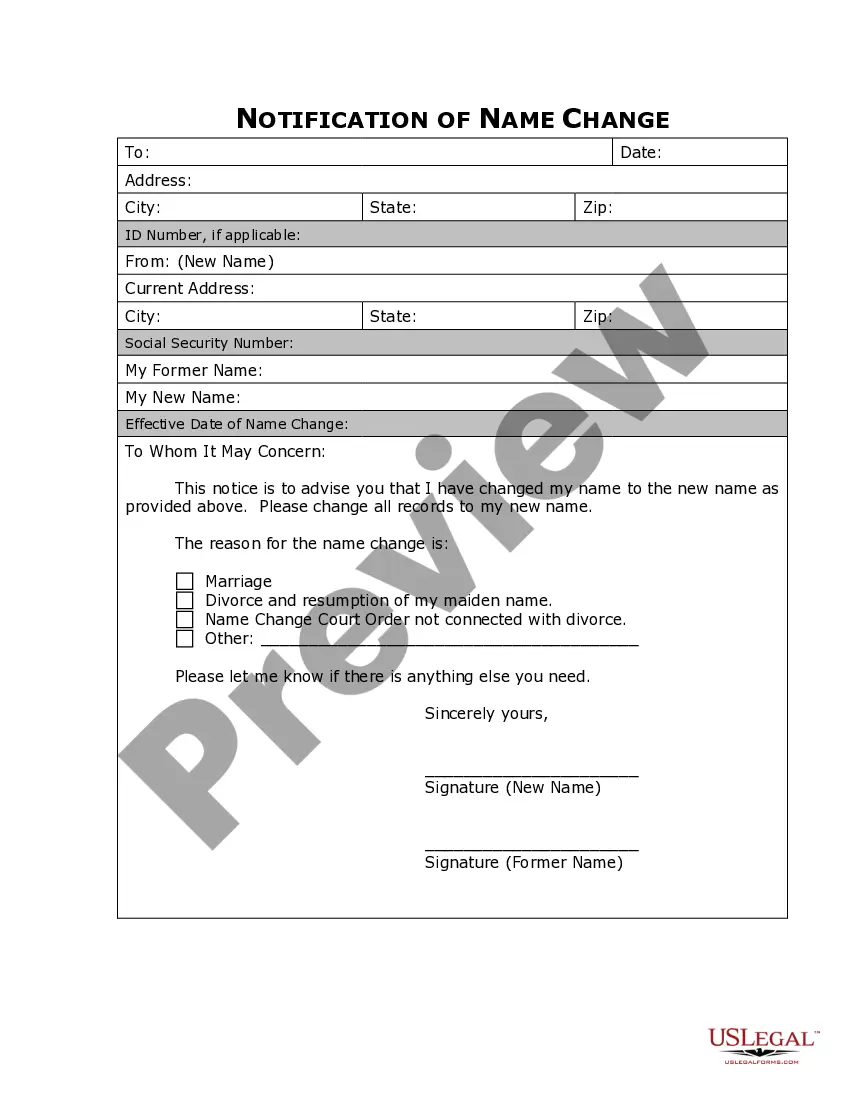

- Utilize the Preview button to review the form.

- Check the description to confirm you have selected the right form.

- If the form isn’t what you are looking for, use the Search field to locate a form that meets your needs and requirements.

Form popularity

FAQ

$684 per week ($35,568 annually) effective Oct. 3, 2020. $780 per week ($40,560 annually) effective Oct. 3, 2021.

Exempt positions are excluded from minimum wage, overtime regulations, and other rights and protections afforded nonexempt workers. Employers must pay a salary rather than an hourly wage for a position for it to be exempt.

The threshold specifics:October 3, 2020: $684 per week, $35,568 annually.October 3, 2021: $780 per week, $40,560 annually.October 3, 2022: $875 per week, $45,500 annually.Beginning in 2023, the salary threshold will adjust based on the average wages of exempt occupations in the state.

In order to qualify for exemptions under FLSA, employees must meet the criteria in three tests: a salary basis test, a salary level test, and a duties test.

Anyone not paid at least $780 per week will not qualify for the white-collar exemptions and will therefore be treated as a non-exempt employee, who must have their hours tracked and be paid overtime at the rate of one-and-one-half-times their hourly rate for all hours worked over 40 in a workweek.

Simply put, an exempt employee is someone exempt from receiving overtime pay. It is a category of employees who do not qualify for minimum wage or overtime pay as guaranteed by Fair Labor Standard Act (FLSA). Exempt employees are paid a salary instead of hourly wages and their work is professional in nature.

Simply put, an exempt employee is someone exempt from receiving overtime pay. It is a category of employees who do not qualify for minimum wage or overtime pay as guaranteed by Fair Labor Standard Act (FLSA). Exempt employees are paid a salary instead of hourly wages and their work is professional in nature.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

The FLSA exemption test refers to the status of a job as outlined in the Fair Labor Standards Act. The FLSA determines whether a job is exempt or nonexempt as it relates to overtime obligations.

To be exempt in Pennsylvania, employees must earn at least $684 per week in addition to passing specific duties tests. Beginning on October 3, 2021, to be exempt, employees must earn at least $780 per week.