Pennsylvania Request for Accounting of Disclosures of Protected Health Information

Description

How to fill out Request For Accounting Of Disclosures Of Protected Health Information?

You have the ability to spend numerous hours online looking for the legal document template that meets the federal and state standards you require.

US Legal Forms offers a vast array of legal forms that can be reviewed by professionals.

You can obtain or print the Pennsylvania Request for Accounting of Disclosures of Protected Health Information from our services.

If you want to get another version of the form, use the Search field to find the template that fits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, edit, print, or sign the Pennsylvania Request for Accounting of Disclosures of Protected Health Information.

- Every legal document template you purchase is yours forever.

- To obtain another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/area of your choice. Review the form details to confirm you have chosen the right form.

- If available, use the Preview button to browse through the document template as well.

Form popularity

FAQ

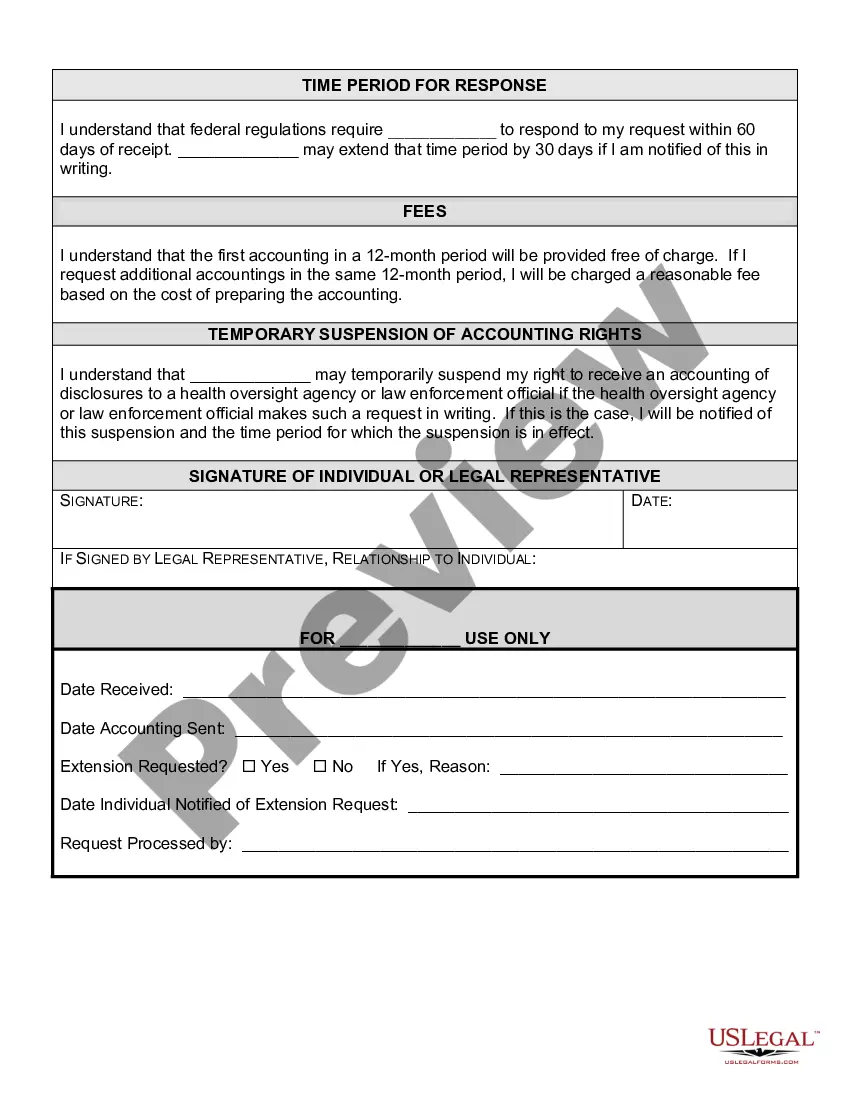

The information must be provided to the data subject within 60 days of their request for an accounting of disclosures. This requirement emphasizes the urgency and importance of transparency regarding health information. Using the Pennsylvania Request for Accounting of Disclosures of Protected Health Information can help streamline your access to this information.

The required information must be provided within 30 days after a request is made for the accounting of disclosures. If the information cannot be supplied within this timeframe, an extension of 30 days may be granted, but the data subject must be notified. Utilizing the Pennsylvania Request for Accounting of Disclosures of Protected Health Information ensures you receive this important information timely.

Patients (or their Personal Representatives see Yale Policy 5038 - Personal Representatives) may request an accounting of disclosures by submitting a request in writing using the Request for Accounting of Disclosures of Protected Health Information form, or other sufficient written documentation requesting the

For each disclosure, the accounting must include: (1) The date of the disclosure; (2) the name (and address, if known) of the entity or person who received the protected health information; (3) a brief description of the information disclosed; and (4) a brief statement of the purpose of the disclosure (or a copy of the

HIPAA Disclosure Accounting or Accounting of Disclosures (AOD) is the action or process of keeping records of disclosures of PHI for purposes other than Treatment, Payment, or Healthcare Operations. You are required by law to provide patients a list of all the disclosures of their PHI that you have made outside of TPO.

With limited exceptions, the HIPAA Privacy Rule (the Privacy Rule) provides individuals with a legal, enforceable right to see and receive copies upon request of the information in their medical and other health records maintained by their health care providers and health plans.

How do I track disclosures? The PI should track and maintain a record of any disclosures that includes the date of the disclosure, name of person/entity that received the PHI, description of what PHI was disclosed and brief statement regarding the purpose of the disclosure.

In the financial world, disclosure refers to the timely release of all information about a company that may influence an investor's decision. It reveals both positive and negative news, data, and operational details that impact its business.

Other instances necessitating Accounting of Disclosures (AOD) include: Those Required by Law (Court Orders, subpoenas, state reporting, emergencies) Public Health Activities (Prevention of disease, public health investigations) Victims of abuse, neglect, or domestic violence.

The Accounting of Disclosures log serves to maintain a comprehensive list of these types of disclosures that the patient is entitled to be informed of through their Accounting of Disclosures right.