Pennsylvania Stop Annuity Request

Description

How to fill out Stop Annuity Request?

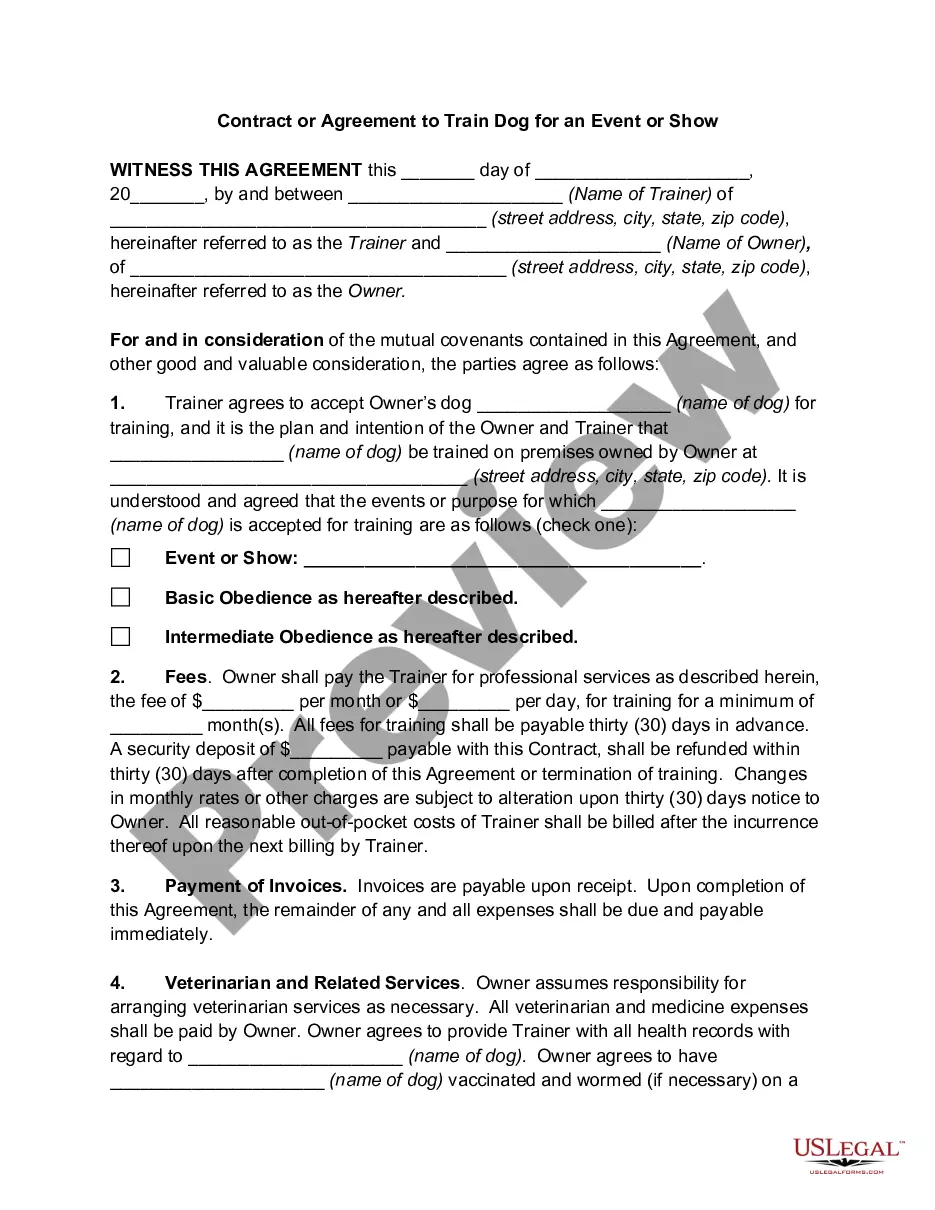

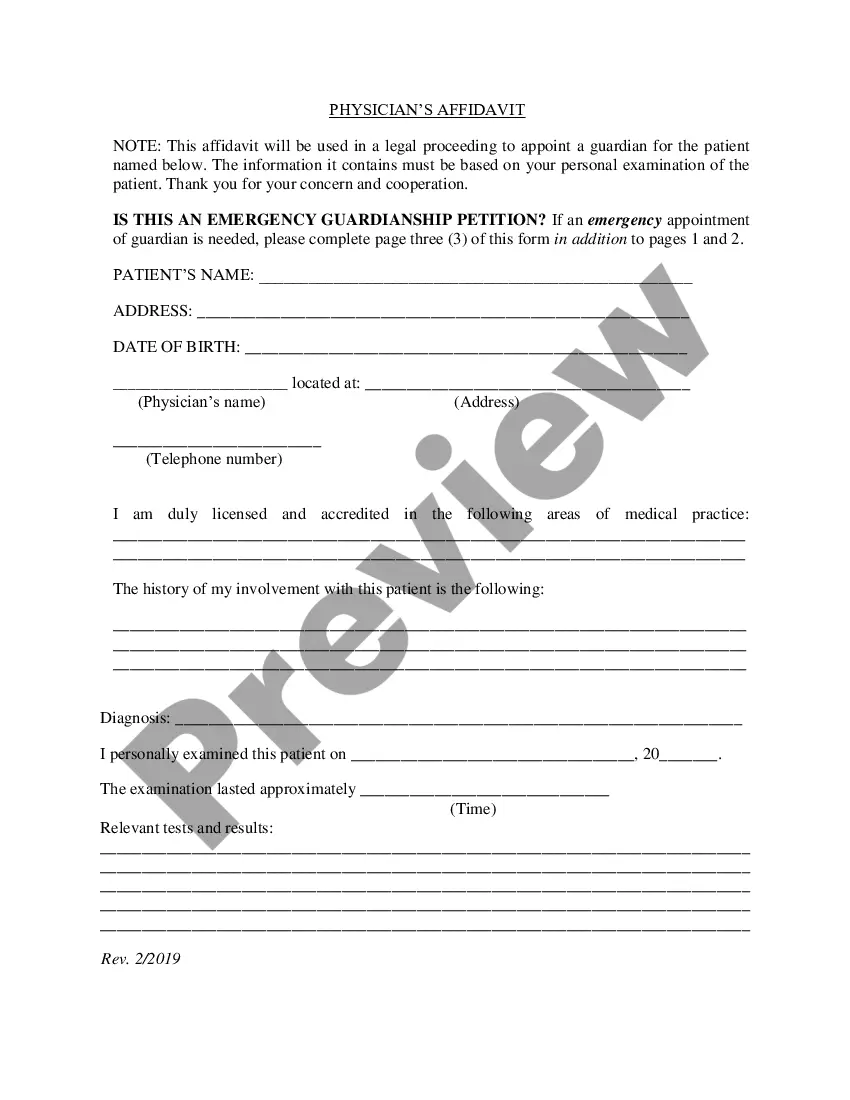

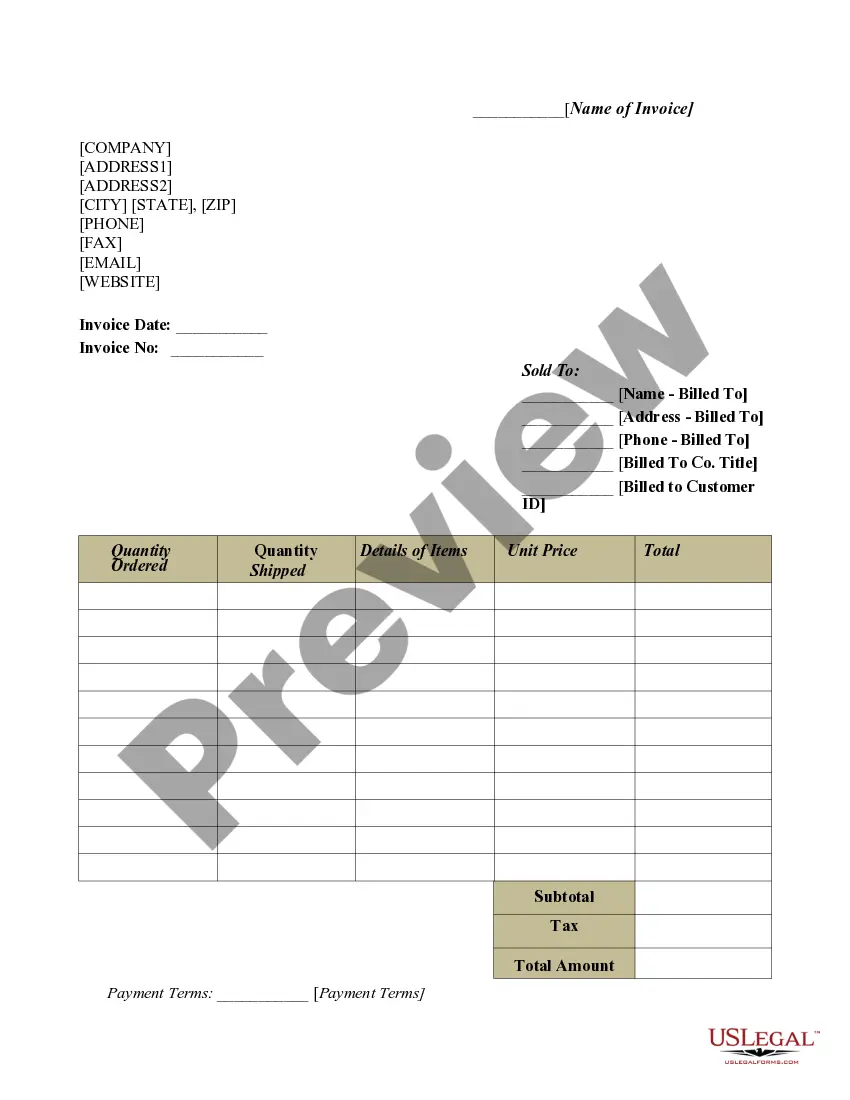

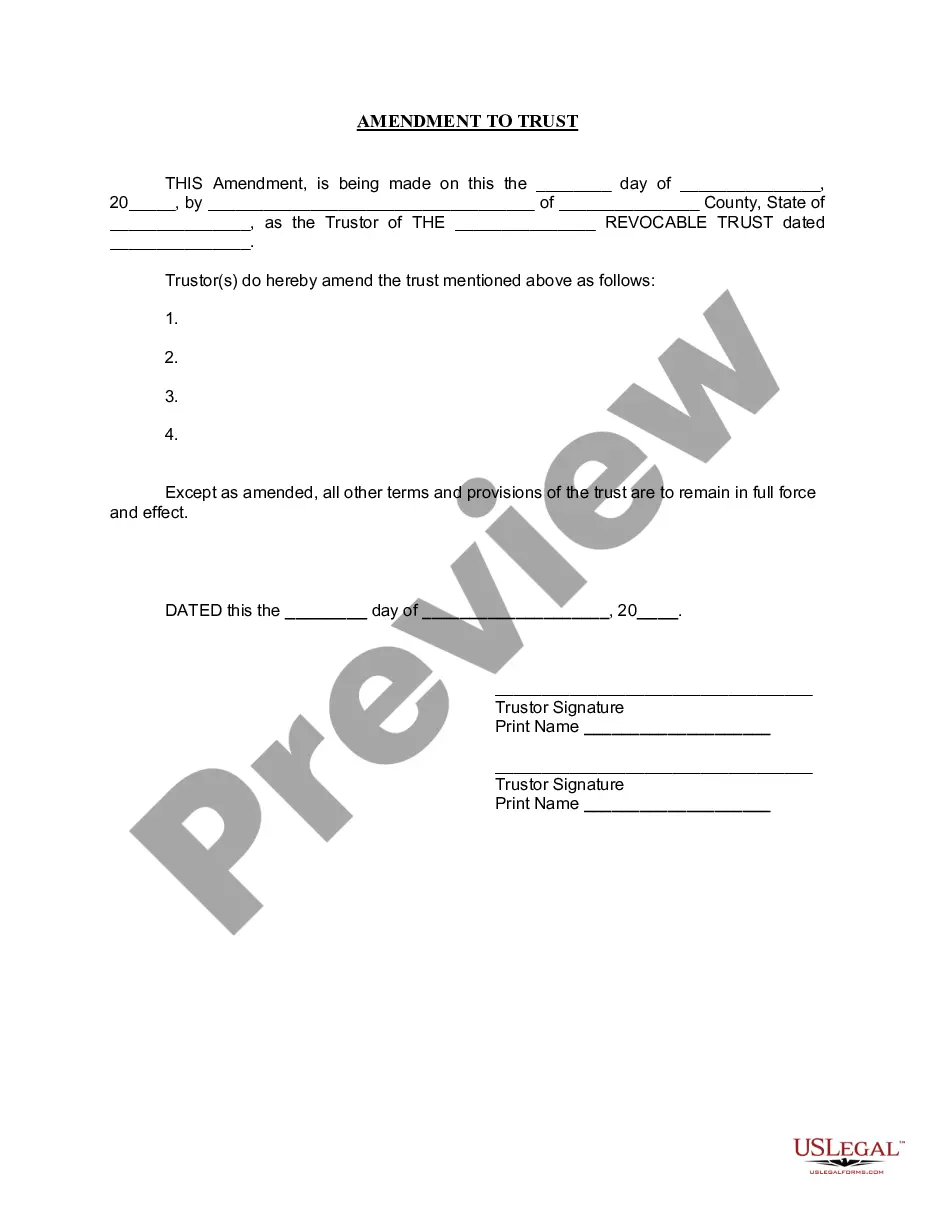

Selecting the optimal valid document template can be a challenge. Naturally, there are numerous designs available online, but how can you obtain the correct template you need? Make use of the US Legal Forms platform. The service offers thousands of templates, including the Pennsylvania Stop Annuity Request, suitable for business and personal purposes. Each document is reviewed by experts and meets federal and state regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the Pennsylvania Stop Annuity Request. Use your account to browse the legal documents you have previously purchased. Go to the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your region/locality. You can review the form using the Preview button and read the form description to confirm this is the one you require. If the form does not meet your needs, use the Search field to find the appropriate document.

US Legal Forms is the largest repository of legal documents where you can find various file templates. Use the service to download professionally-crafted documents that adhere to state requirements.

- Once you are confident that the form is suitable, click the Buy now button to purchase the form.

- Choose the pricing plan you prefer and enter the necessary information.

- Create your account and pay for the transaction using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, edit, print, and sign the finalized Pennsylvania Stop Annuity Request.

Form popularity

FAQ

For example, a family of four (couple with two dependent children) can earn up to $34,250 a year and qualify for some Tax Forgiveness. A single-parent, two-child family with annual income up to $27,750 can also qualify for some Tax Forgiveness. Who is eligible for Tax Forgiveness?

Pennsylvania does not tax its residents' retirement income. It is one of only two states, and the only state on the East Coast, that considers pension income completely tax exempt. The Keystone State also has the lowest flat tax rate in the country at just 3.07 percent.

40 form is the Pennsylvania Department of Revenue's official paper form that the state's residents use to file state income taxes. Pennsylvania is one of the 41 U.S. states that require residents to pay a personal income tax each year.

In the next couple weeks you'll receive your Notice of Annuity Adjustment by mail. This year's notice contains information about the cost of living adjustment (COLA) and any changes that will affect the amount of your monthly annuity. And remember, it's very important for you to keep your mailing address current.

No. Life insurance on the life of the decedent is not taxable in the estate of the decedent. In addition, the proceeds are not taxable according the state income tax law.

The Pennsylvania personal income tax statute does not conform to Internal Revenue Code Sections 61(a)(12) and 108. For Pennsylvania personal income tax purposes, taxpayers report taxable debt forgiveness in the class of income for which the debt was cancelled.

Annuity income that is part of a qualified retirement plan, and the recipient has reached age 59 1/2, is not subject to Pennsylvania income tax. For nonqualified annuities, the earnings are taxable but the return of contributions would not be taxable to Pennsylvania.

Annuities are tax deferred. But that doesn't mean they're a way to avoid taxes completely. What this means is taxes are not due until you receive income payments from your annuity. Withdrawals and lump sum distributions from an annuity are taxed as ordinary income.

Form 1099-R shows distributions from pensions, annuities, retirement plans, IRAs, and insurance contracts. Pennsylvania does not tax commonly recognized pension, old age, or retirement benefits paid after becoming eligible to retire and retiring.

In order to qualify for an IRS Tax Forgiveness Program, you first have to owe the IRS at least $10,000 in back taxes. Then you have to prove to the IRS that you don't have the means to pay back the money in a reasonable amount of time. See if you qualify for the tax forgiveness program, call now 877-788-2937.