Pennsylvania Agreement to Establish Committee to Wind up Partnership

Description

How to fill out Agreement To Establish Committee To Wind Up Partnership?

Are you presently in a situation where you require documents for various business or personal reasons almost every workday.

There is a range of legal document templates accessible online, but finding forms you can trust isn’t easy.

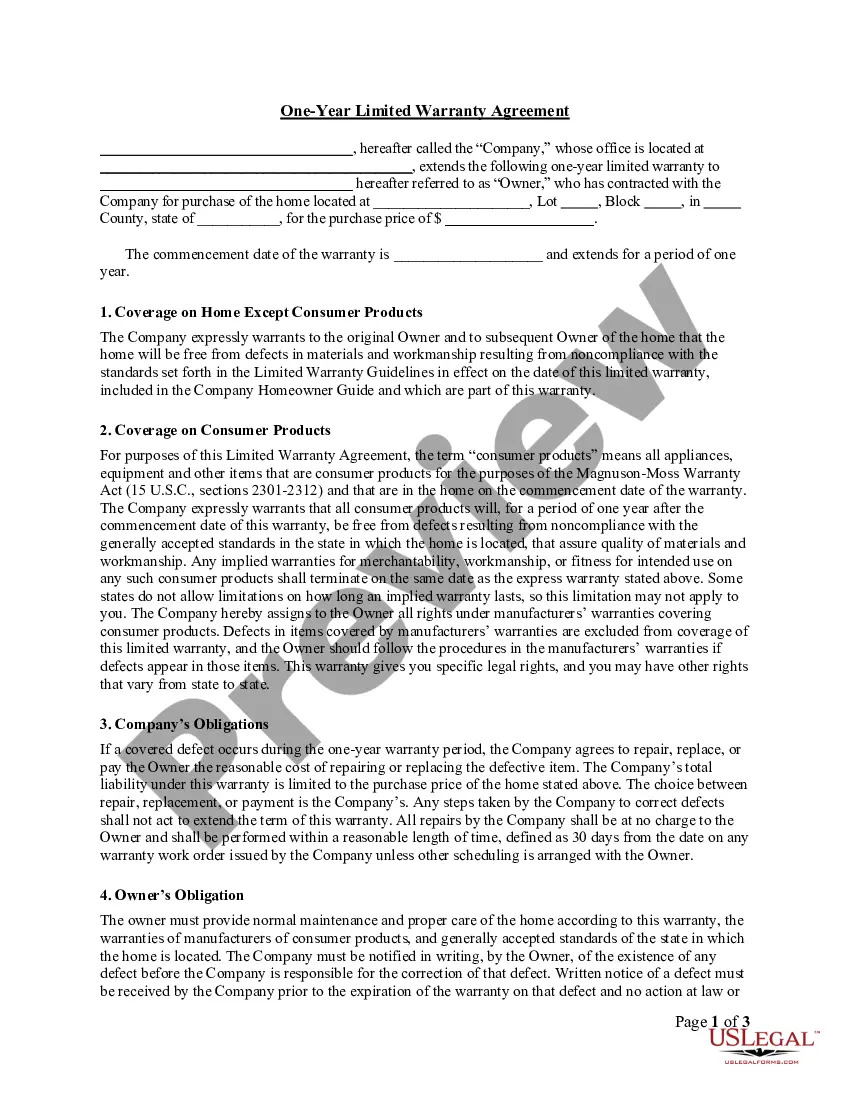

US Legal Forms offers thousands of document templates, such as the Pennsylvania Agreement to Form Committee to Wind Up Partnership, specifically designed to comply with federal and state regulations.

If you find the suitable document, click Get now.

Select your preferred pricing plan, enter the necessary details to set up your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Pennsylvania Agreement to Form Committee to Wind Up Partnership template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the template you require and ensure it is for your correct city/state.

- Use the Review feature to examine the document.

- Check the summary to confirm that you have selected the correct form.

- If the form isn’t what you are looking for, utilize the Search field to locate the template that satisfies your needs.

Form popularity

FAQ

There are 5 main ways to dissolve a partnership legally :Dissolution of Partnership by agreement.Dissolution by notice.Termination of Partnership by expiration.Death or bankruptcy.Dissolution of a Partnership by court order.

How is a partnership dissolved? Limited and general partnerships desiring to withdraw from Pennsylvania must obtain a clearance certificate from the PA Department of Revenue. Limited liability partnerships must obtain a clearance certificate from the PA Department of Revenue and Department of Labor and Industry.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

How is a partnership dissolved? Limited and general partnerships desiring to withdraw from Pennsylvania must obtain a clearance certificate from the PA Department of Revenue. Limited liability partnerships must obtain a clearance certificate from the PA Department of Revenue and Department of Labor and Industry.

To close their business account, partnerships need to send the IRS a letter that includes the complete legal name of their business, the EIN, the business address and the reason they wish to close their account.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Easy to dissolve. In the event business owners need to close their business for any reason, such as one partner files for bankruptcy or one wants to retire, dissolving a general partnership is easy.

In a General Partnership, all partners are financially obligated to any debts incurred by the partnership. When a partner leaves, the partnership dissolves and the partners equally split debts and assets.

Dissolution of partnership means putting an end to a business partnership between all the partners of the firm. Any partnership can be dissolved by the mutual consent of all the partners and is carried out by way of executing a written agreement, referred to as a Partnership Dissolution Agreement.

Terminating the BusinessThe partners may agree by unanimous consent in a general partnership to terminate the business and wind up the business affairs upon a change in the relation between the partners. Alternatively, the partnership may be automatically dissolved according the terms of the partnership agreement.