Pennsylvania Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage

Description

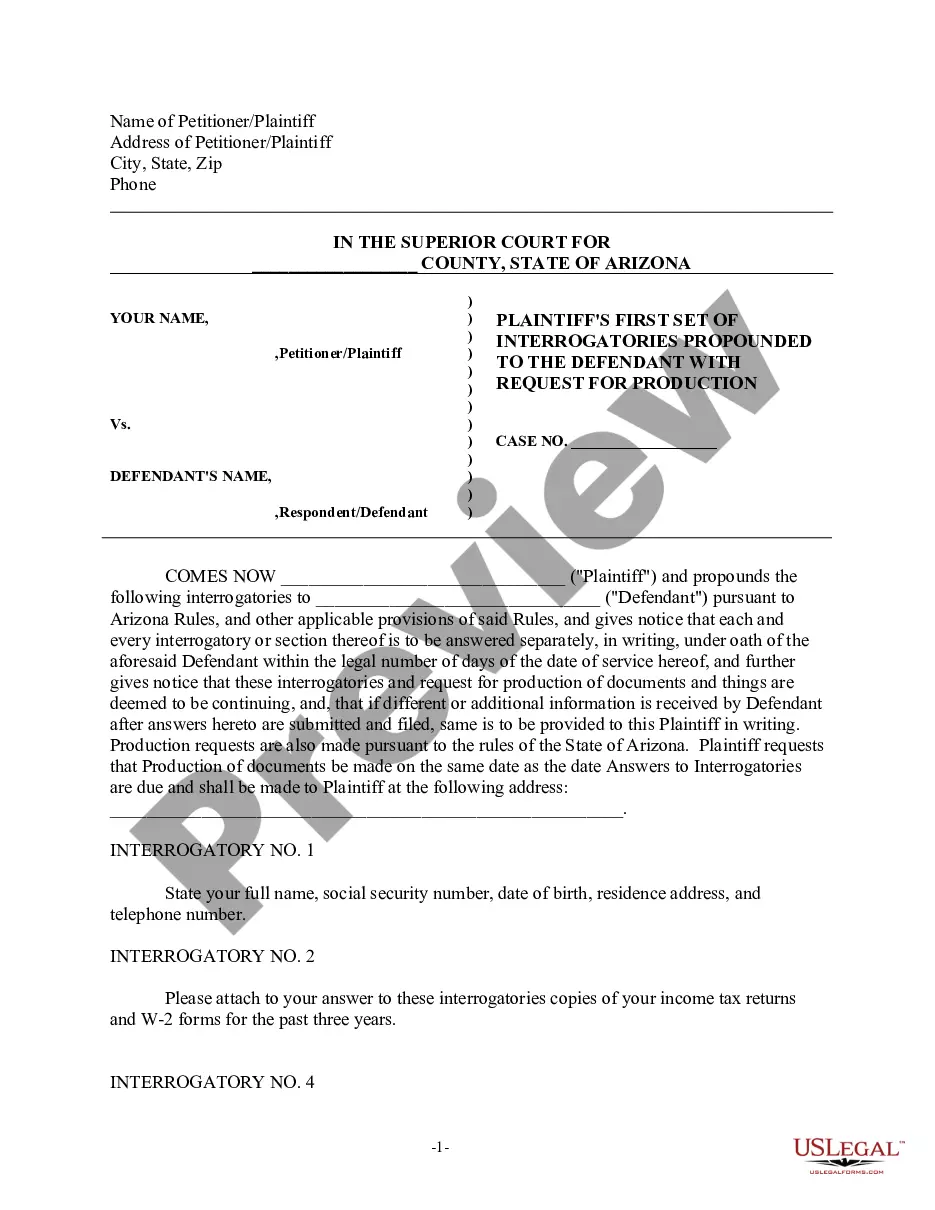

How to fill out Notice Of Intention To Foreclose And Of Liability For Deficiency After Foreclosure Of Mortgage?

US Legal Forms - one of several biggest libraries of legitimate kinds in the USA - gives a wide array of legitimate papers web templates it is possible to acquire or print. Using the website, you may get 1000s of kinds for business and person functions, sorted by types, claims, or keywords and phrases.You will discover the most up-to-date types of kinds much like the Pennsylvania Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage in seconds.

If you already possess a monthly subscription, log in and acquire Pennsylvania Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage through the US Legal Forms local library. The Acquire option can look on every type you view. You gain access to all earlier downloaded kinds in the My Forms tab of your own accounts.

If you want to use US Legal Forms for the first time, here are basic recommendations to help you started:

- Be sure to have selected the correct type for your city/area. Select the Review option to check the form`s articles. See the type outline to actually have selected the appropriate type.

- When the type does not satisfy your needs, use the Search discipline towards the top of the screen to discover the one who does.

- Should you be satisfied with the form, validate your selection by visiting the Get now option. Then, choose the costs prepare you like and provide your accreditations to sign up for the accounts.

- Approach the financial transaction. Use your charge card or PayPal accounts to finish the financial transaction.

- Find the file format and acquire the form in your product.

- Make changes. Fill out, edit and print and indication the downloaded Pennsylvania Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage.

Each and every format you included in your bank account lacks an expiration particular date and it is your own forever. So, if you wish to acquire or print an additional version, just visit the My Forms section and click about the type you want.

Gain access to the Pennsylvania Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage with US Legal Forms, one of the most considerable local library of legitimate papers web templates. Use 1000s of expert and state-distinct web templates that satisfy your small business or person needs and needs.

Form popularity

FAQ

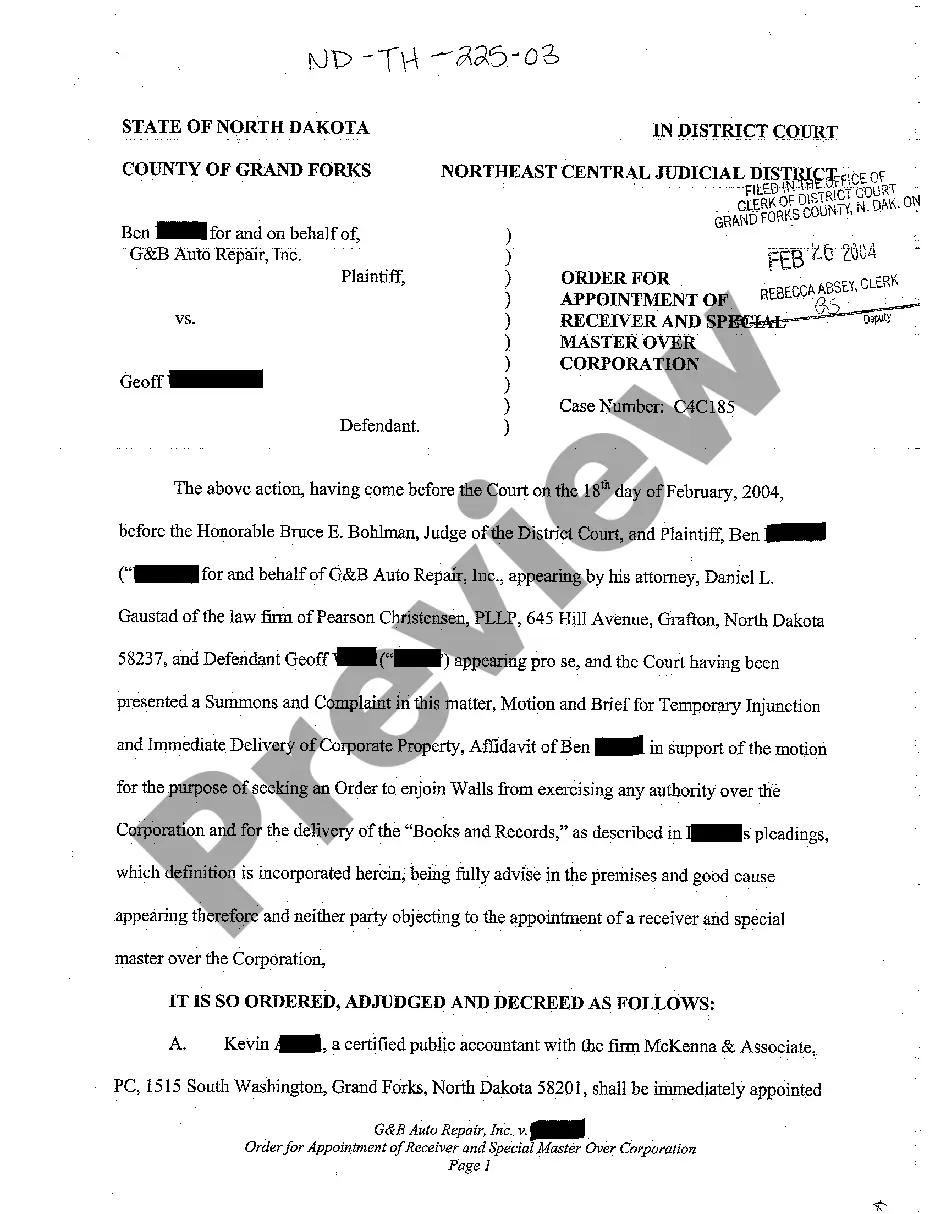

In a judicial foreclosure, the lender can get a deficiency judgment to collect any money they're owed after the sale. In a judicial foreclosure, after the judge orders the sale of a home, it's usually auctioned off to the highest bidder.

Primary tabs. Deficiency judgment is money awarded to creditors when assets securing a loan do not cover the debt owed by a debtor. When a debtor becomes insolvent, a creditor can repossess the asset securing the loan, and then sell the asset to recover the debt.

In return for the lender having the power to sell the property, the Power of Sale clause protects the borrower by stating that when the lender sells the property, the lender may not hold the borrower liable for any cost not covered by the sale unless the lender is able to obtain a deficiency judgment in their favor, ...

The foreclosed property is auctioned to the highest bidder, whereby the sheriff completes necessary paperwork and officially transfers the ownership to the new owner. After the sheriff sale has completed, the bank will request that the court order you to be evicted from the property.

An Act 91 notice is the signal of the beginning stages of a mortgage foreclosure. Pennsylvania is a judicial state regarding mortgage foreclosures. This means that all paperwork from a mortgage servicer needs to be sent officially and through the court system.

In Pennsylvania, lenders must send notice of intent to foreclose letters to homeowners 30 days before the foreclosure begins. This gives borrowers time to contact our Pennsylvania bankruptcy lawyers and create a plan to prevent foreclosure.

A deficiency judgment is a personal judgment against a borrower for the balance of a debt owed when the security for the loan is not sufficient to pay the debt.

If a foreclosure is nonjudicial, the foreclosing lender must file a lawsuit following the foreclosure to get a deficiency judgment. On the other hand, with a judicial foreclosure, most states allow the lender to seek a deficiency judgment as part of the underlying foreclosure lawsuit.