Pennsylvania Loan Agreement for Vehicle

Description

How to fill out Loan Agreement For Vehicle?

Have you been in the position that you need papers for both organization or individual purposes almost every day time? There are plenty of lawful record layouts accessible on the Internet, but discovering versions you can depend on is not straightforward. US Legal Forms offers 1000s of form layouts, just like the Pennsylvania Loan Agreement for Vehicle, that are created in order to meet federal and state specifications.

When you are previously familiar with US Legal Forms internet site and get a free account, simply log in. After that, it is possible to acquire the Pennsylvania Loan Agreement for Vehicle web template.

Should you not have an accounts and want to begin to use US Legal Forms, adopt these measures:

- Discover the form you need and make sure it is for your correct area/region.

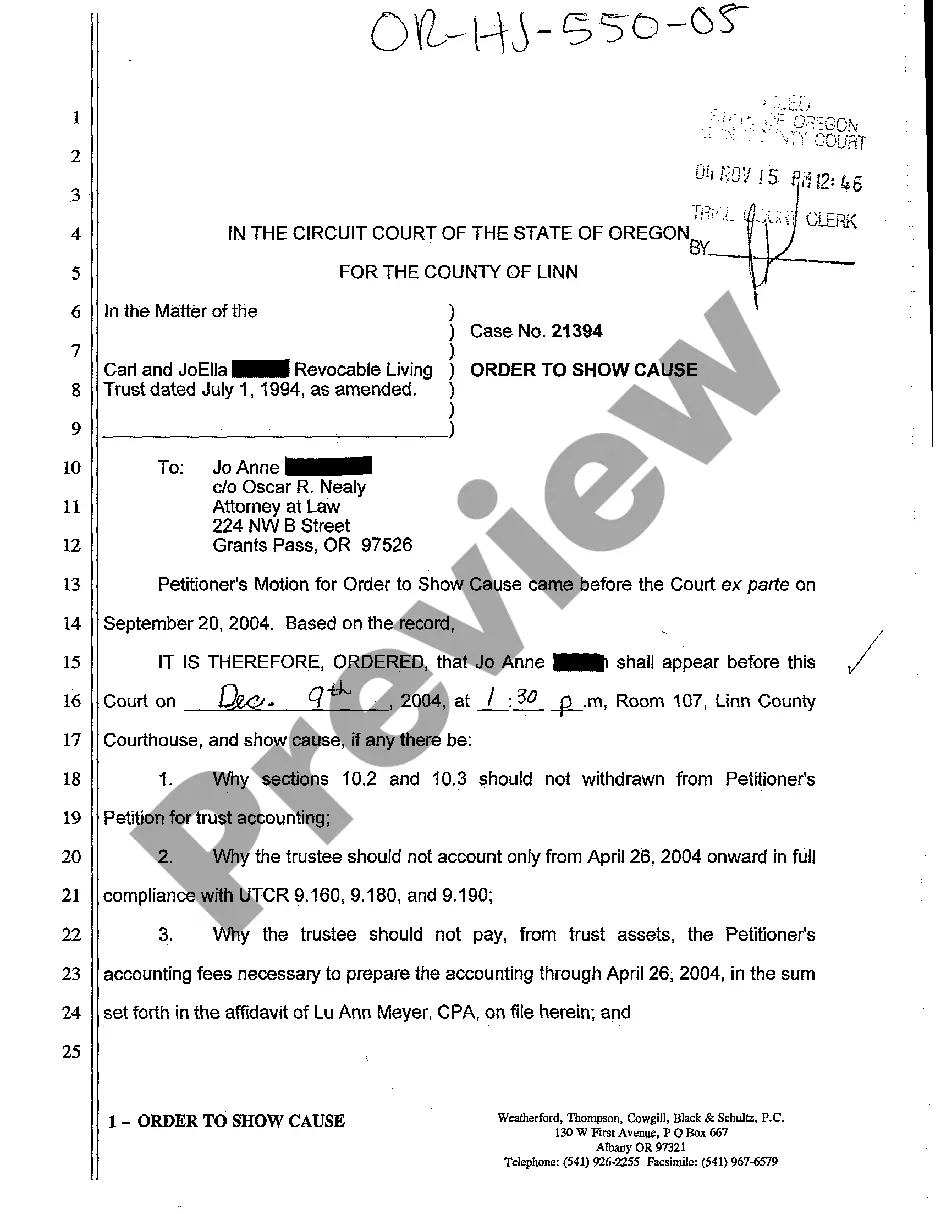

- Make use of the Review option to examine the shape.

- Read the information to ensure that you have selected the appropriate form.

- If the form is not what you are looking for, make use of the Look for area to discover the form that meets your needs and specifications.

- If you obtain the correct form, simply click Buy now.

- Pick the pricing prepare you desire, fill in the required details to produce your money, and purchase an order with your PayPal or Visa or Mastercard.

- Choose a handy data file formatting and acquire your version.

Get each of the record layouts you may have bought in the My Forms menus. You may get a further version of Pennsylvania Loan Agreement for Vehicle any time, if needed. Just click the essential form to acquire or print the record web template.

Use US Legal Forms, one of the most substantial selection of lawful varieties, to save lots of time as well as steer clear of errors. The support offers professionally manufactured lawful record layouts which you can use for an array of purposes. Produce a free account on US Legal Forms and start making your lifestyle a little easier.

Form popularity

FAQ

If the car is financed, the certificate of title in your name will be mailed to the lienholder. If the vehicle is not financed, the certificate of title in your name will be sent directly to you.

Here's a step-by-step on writing a simple Loan Agreement with a free Loan Agreement template. Step 1 ? Name the Parties. ... Step 2 ? Write Down the Loan Amount. ... Step 3 ? Specify Repayment Details. ... Step 4 ? Choose How the Loan Will Be Secured (Optional) ... Step 5 ? Provide a Guarantor (Optional) ... Step 6 ? Specify an Interest Rate.

Car Promissory Note With a ca promissory note, a borrower promises to make payments on a car loan in exchange for a vehicle. The borrower typically makes even payments throughout the car loan term but often makes an initial lmp sum down payment.

A payment agreement should always be in writing and include information regarding the type of payment to be given, when it should be given, how it will be paid, and what happens should the borrower default on the terms specified in the agreement.

For auto loans in Pennsylvania, interest rates depend on the age of the vehicle being purchased. Loans for vehicles made within the last two years have a maximum interest rate of 18% per year. Loans for vehicles older than two years have a maximum interest rate of 21% per year.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates.