Pennsylvania Assignment Creditor's Claim Against Estate

Description

How to fill out Assignment Creditor's Claim Against Estate?

Have you experienced the scenario where you require documents for either your business or particular purposes nearly every day.

There are numerous legal document templates accessible online, but finding ones you can depend on is challenging.

US Legal Forms offers thousands of form templates, including the Pennsylvania Assignment Creditor's Claim Against Estate, that are crafted to comply with federal and state regulations.

Choose the pricing plan you want, provide the necessary information to create your account, and complete the purchase using your PayPal or credit card.

Select a suitable document format and download your copy. You can find all the document templates you have purchased in the My documents section. You can access another copy of the Pennsylvania Assignment Creditor's Claim Against Estate at any time if needed. Click the required document to download or print the template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service provides professionally designed legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and begin making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Pennsylvania Assignment Creditor's Claim Against Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is appropriate for your area/state.

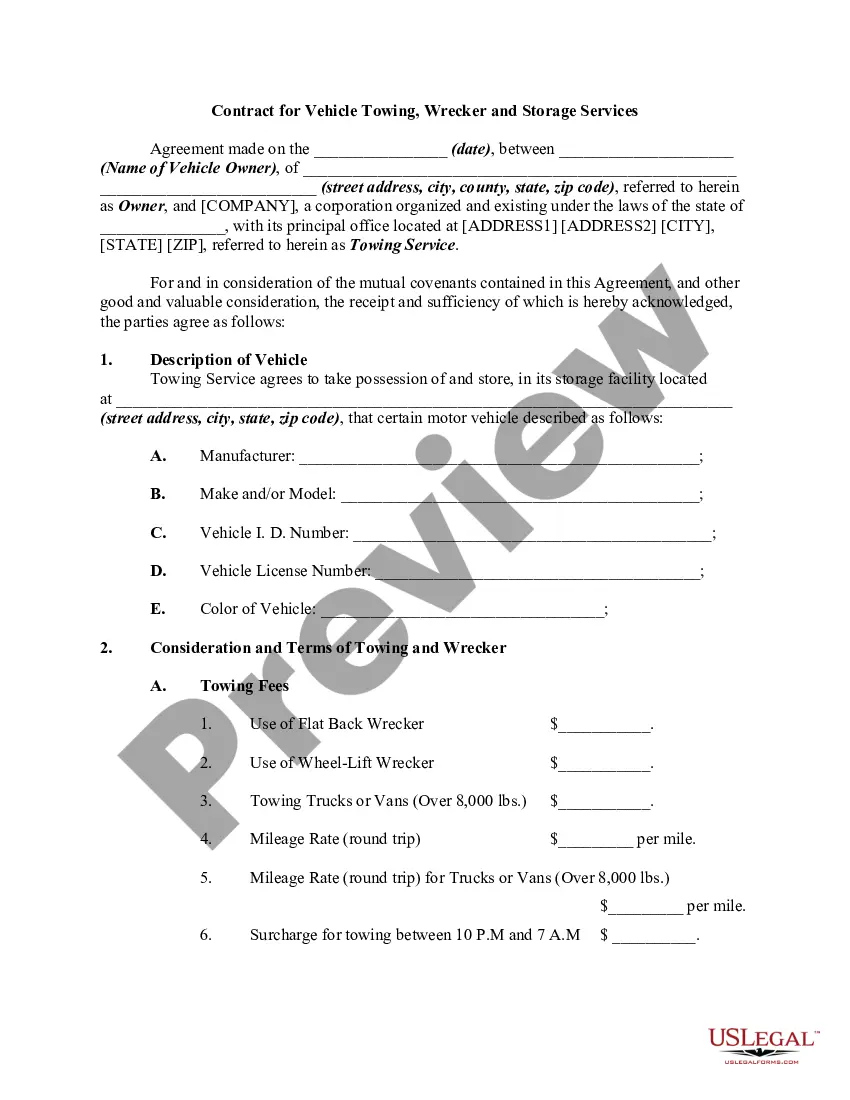

- Utilize the Preview feature to review the form.

- Check the details to make sure you have selected the correct document.

- If the form does not match your needs, use the Lookup field to find the document that caters to your requirements.

- Once you obtain the right form, click Acquire now.

Form popularity

FAQ

What debt is forgiven when you die? Most debts have to be paid through your estate in the event of death. However, federal student loan debts and some private student loan debts may be forgiven if the primary borrower dies.

In Pennsylvania, a creditor has one year from the date of first publication of the grant of letters to bring a claim against the estate. This deadline is important for two reasons if you are administering an estate.

In Pennsylvania, there is a 4 to 6 year statute of limitations, meaning 3 years after the estate administration is done, a creditor could have a valid claim, but had you advertised, the creditor could have known beforehand.

A creditor with a claim against a Pennsylvania probate estate is someone who was owed money by the decedent prior to decedent's death. In Pennsylvania, the personal representative of the estate is not required to send direct notice of the estate administration to a decedent's creditors.

Fully documented claims (including documents of ID and personal representative documents) must be received within 30 years of the date of death.

Timeframe For Filing Claims That four-month timeframe runs from the time that notice is first published to creditors. However, with respect to the IRS, it has a 10-year collection period that runs from the date it assesses tax. I.R.C.

The executors may have to deal with claims against the estate from other people, for example under the Inheritance (Provision for Family & Dependents) Act 1975 or a challenge to the validity of a will itself. These are just a few examples of the problems which can arise which may result in claims against an executor.

There is normally a six-month period from the deceased's death for creditors to advise the executor of any sums due to them from the estate.