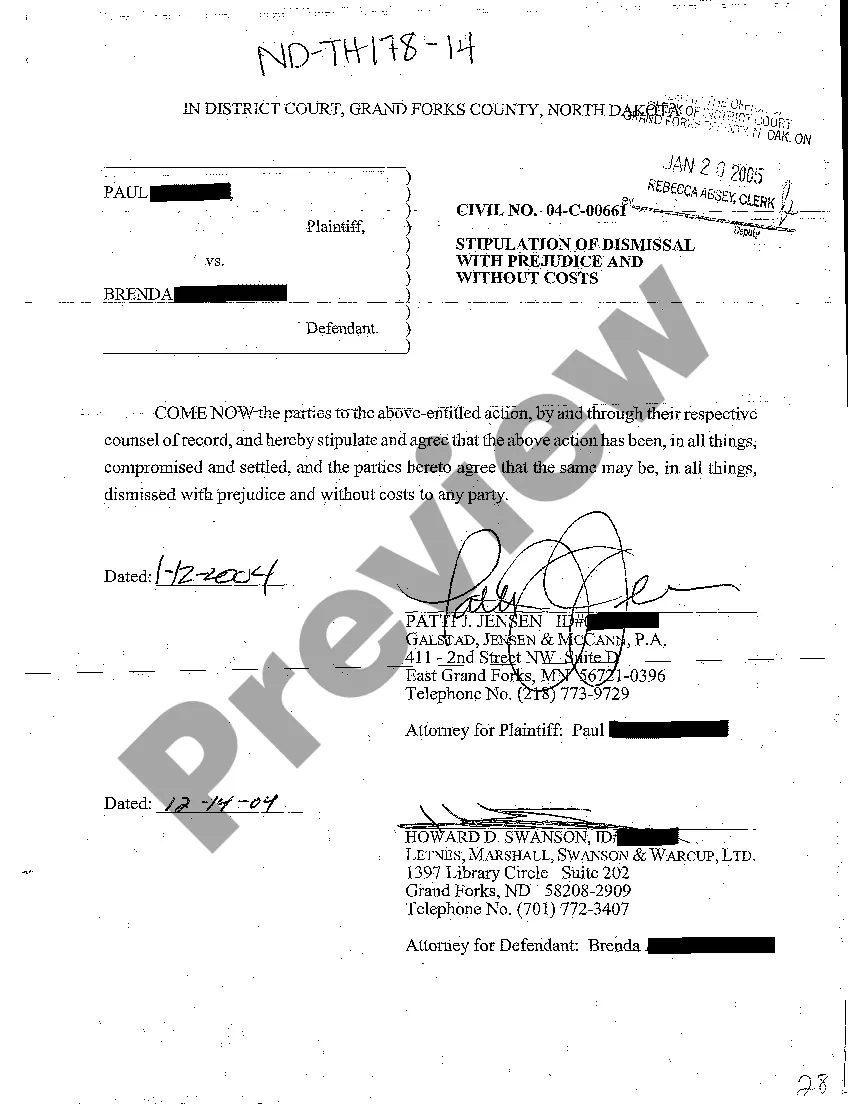

Pennsylvania Sample Letter for Divorce - List of Liabilities and Assets

Description

How to fill out Sample Letter For Divorce - List Of Liabilities And Assets?

If you want to full, obtain, or produce lawful file templates, use US Legal Forms, the greatest assortment of lawful types, that can be found on the Internet. Use the site`s simple and hassle-free look for to find the paperwork you want. Various templates for organization and personal purposes are categorized by groups and says, or keywords. Use US Legal Forms to find the Pennsylvania Sample Letter for Divorce - List of Liabilities and Assets with a few mouse clicks.

Should you be currently a US Legal Forms buyer, log in to the bank account and then click the Obtain option to find the Pennsylvania Sample Letter for Divorce - List of Liabilities and Assets. Also you can accessibility types you formerly delivered electronically from the My Forms tab of your bank account.

If you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape to the correct town/land.

- Step 2. Take advantage of the Preview solution to look through the form`s content material. Don`t forget about to read through the outline.

- Step 3. Should you be unsatisfied using the type, take advantage of the Research field towards the top of the display to get other variations of your lawful type format.

- Step 4. Once you have identified the shape you want, go through the Buy now option. Pick the rates program you choose and add your accreditations to sign up for an bank account.

- Step 5. Procedure the purchase. You can utilize your charge card or PayPal bank account to finish the purchase.

- Step 6. Pick the formatting of your lawful type and obtain it on your own system.

- Step 7. Full, edit and produce or sign the Pennsylvania Sample Letter for Divorce - List of Liabilities and Assets.

Each and every lawful file format you acquire is the one you have for a long time. You possess acces to every type you delivered electronically inside your acccount. Select the My Forms section and decide on a type to produce or obtain once again.

Compete and obtain, and produce the Pennsylvania Sample Letter for Divorce - List of Liabilities and Assets with US Legal Forms. There are thousands of specialist and state-distinct types you can use for your personal organization or personal requirements.

Form popularity

FAQ

How Is Debt Split in a Divorce in California? California is a ?community property? state, which means that any assets acquired and any debts incurred by either spouse during the marriage belong equally to both spouses.

You list all the assets, and debts (debts should be divided as well) acquired during the marriage. Then you figure out the net value of the asset or debt. Then you start dividing the assets or debts and watch the total at the bottom. One spouse can take 100% of the house, while the 401K is divided 60% / 40%.

The Rules for Division of Assets in a California Divorce Each spouse is entitled to 50 percent of marital property. Virtually all property, money and assets acquired during the course of the marriage are considered marital property with a few very limited exceptions such as an inheritance left only to one spouse.

If you get divorced, your legal responsibility for your spouse's debt will depend on the state laws ? whether you live in a common or community law state ? and any prenuptial agreements you signed. If you served as a cosigner or co-borrower, you will be responsible for those debts regardless of where you live.

? This verification must be completed by you, not your attorney. o Affidavit under Section 3301(d) ? This form states that you and your spouse have, in fact, lived separate and apart. for the applicable time period described above. o Blank Counter-Affidavit.

Even though Pennsylvania law does not mandate a 50/50 division of marital property, in practice, a 50/50 division is quite common. If the divorcing spouses have similar incomes from their jobs and the marital assets include a home and modest retirement accounts, the courts will often order a 50/50 division.

A spouse who has a higher income, or is awarded more property, may also be assigned more debt. In the nine ?community property? states, debt incurred during the marriage is divided 50-50, though some of these states also have restrictions or other laws that make it more complicated.

Some states require judges to divide the debts equally between the spouses, while others require or allow judges to allocate the debts in an equitable or fair way.