Pennsylvania Sample Letter for Bankruptcy Mailing Matrix

Description

How to fill out Sample Letter For Bankruptcy Mailing Matrix?

Are you presently within a place in which you need papers for sometimes business or personal functions nearly every day time? There are plenty of authorized papers web templates available on the Internet, but discovering versions you can rely on is not easy. US Legal Forms provides a huge number of type web templates, like the Pennsylvania Sample Letter for Bankruptcy Mailing Matrix, which are created to fulfill state and federal needs.

If you are currently informed about US Legal Forms web site and possess a merchant account, simply log in. Next, it is possible to down load the Pennsylvania Sample Letter for Bankruptcy Mailing Matrix web template.

If you do not provide an account and need to start using US Legal Forms, adopt these measures:

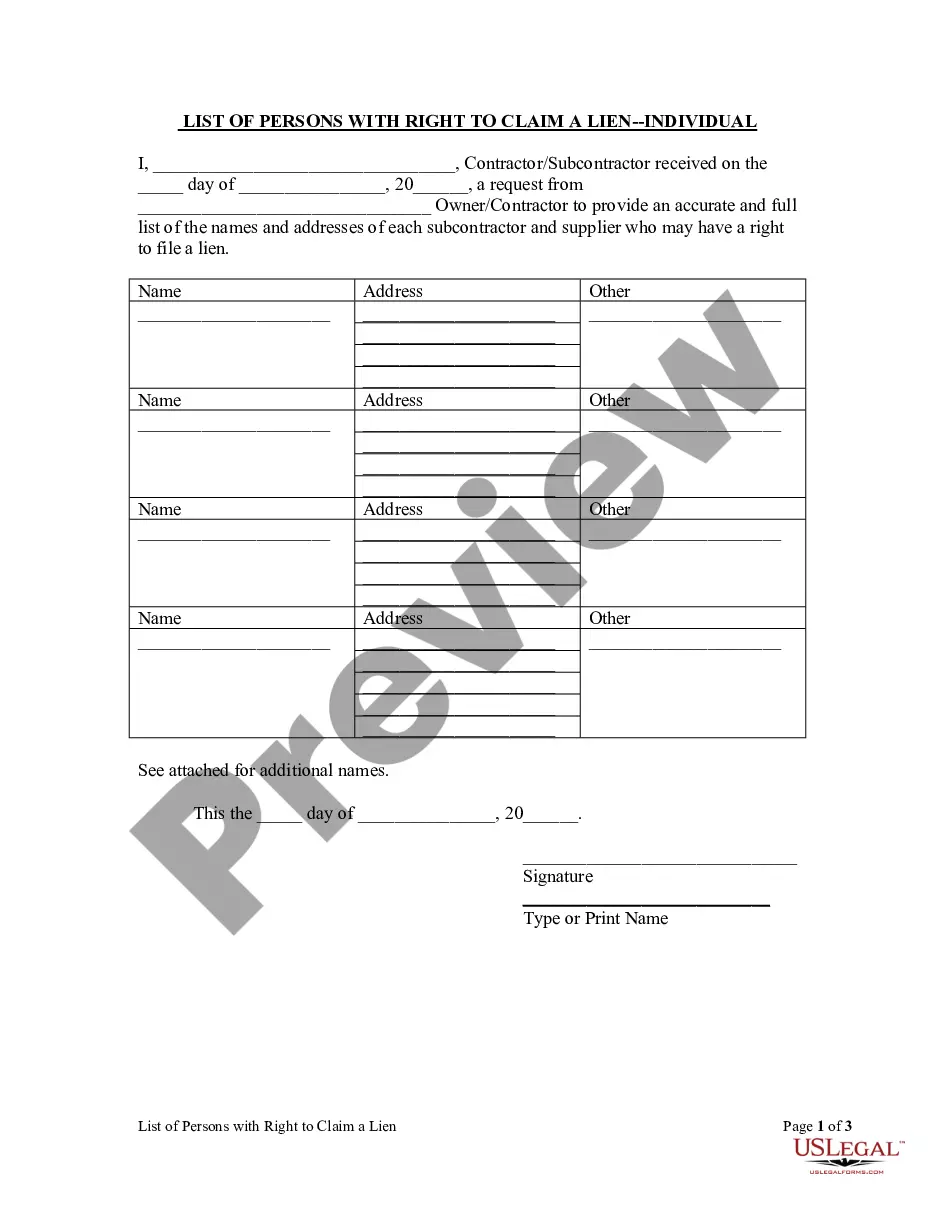

- Find the type you need and ensure it is to the proper metropolis/area.

- Utilize the Preview option to review the form.

- See the description to actually have selected the correct type.

- In case the type is not what you`re trying to find, use the Look for discipline to discover the type that meets your requirements and needs.

- When you discover the proper type, simply click Get now.

- Choose the costs plan you would like, fill out the necessary info to produce your account, and pay for the transaction making use of your PayPal or credit card.

- Choose a hassle-free paper formatting and down load your duplicate.

Discover every one of the papers web templates you have bought in the My Forms food selection. You can get a more duplicate of Pennsylvania Sample Letter for Bankruptcy Mailing Matrix whenever, if required. Just click the required type to down load or printing the papers web template.

Use US Legal Forms, by far the most extensive variety of authorized forms, to conserve efforts and avoid blunders. The service provides professionally made authorized papers web templates which you can use for a variety of functions. Produce a merchant account on US Legal Forms and commence generating your life easier.

Form popularity

FAQ

A mailing matrix, sometimes called a "mailing list" or "matrix," is a list of the names and mailing address of creditors and parties in interest in a bankruptcy case.

What is a discharge in bankruptcy? A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.

What happens when a creditor files an objection? A creditor's objection does not automatically prevent a discharge of debt. The debtor gets a chance to file an answer to the objection, and the court may hold a hearing to decide the issue. This is called an adversary proceeding, and it works much like any other lawsuit.

In Chapter 13, you'll receive a debt discharge after completing your three- or five-year repayment plan. The court will close the case by mailing a "final decree" after the trustee submits a final payment distribution report. The final decree discharges the trustee and closes the case.

Even when the bankruptcy is discharged?meaning you won't be liable for that debt anymore?it won't be removed from credit reports. The status of the bankruptcy will be updated, but it could still take up to seven to 10 years from the bankruptcy filing date for the bankruptcy to be removed from credit reports.

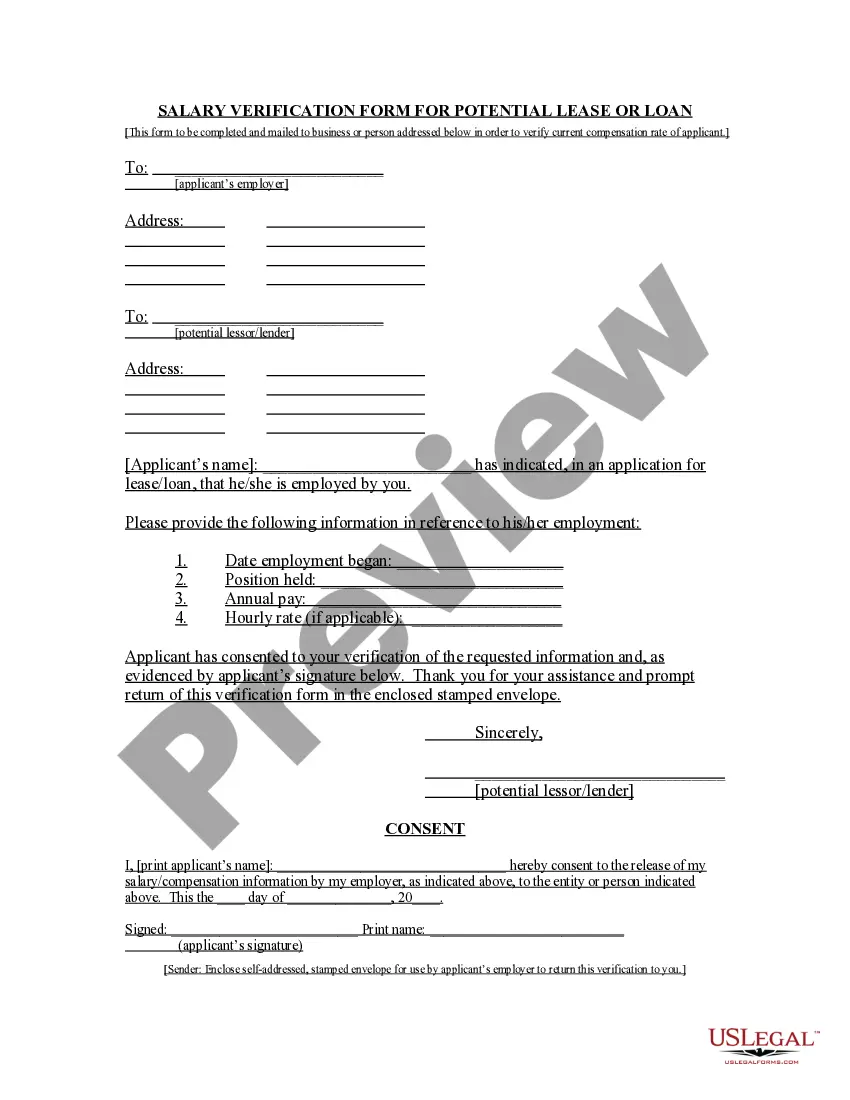

Key Elements to Include in the Letter It should include the name and contact information of the debtor, the date of the filing, the court where the bankruptcy was filed, the case number, and the type of bankruptcy filed. It should also provide information about the bankruptcy trustee and the meeting of creditors.

A "discharge" erases your debt, a "discharge order" is the official court form erasing your debt, and the "final decree" is the official court form that closes your case. In Chapter 7 bankruptcy, the court usually closes the filer's case with a final decree shortly after mailing the discharge order.

Most Chapter 7 bankruptcy cases take between 4 - 6 months to complete after filing the case with the court. The order erasing eligible debts can be granted as early as 90 days from the date the case was filed. No-asset cases are typically closed a couple of weeks after the discharge date.