In some states, a seller is required to disclose known facts that materially affect the value of the property that are not known and readily observable to the buyer. The Seller is required to disclose to a buyer all known facts that materially affect the value of the property which are not readily observable and are not known to the buyer. That disclosure requirement exists whether or not the seller occupied the property. A

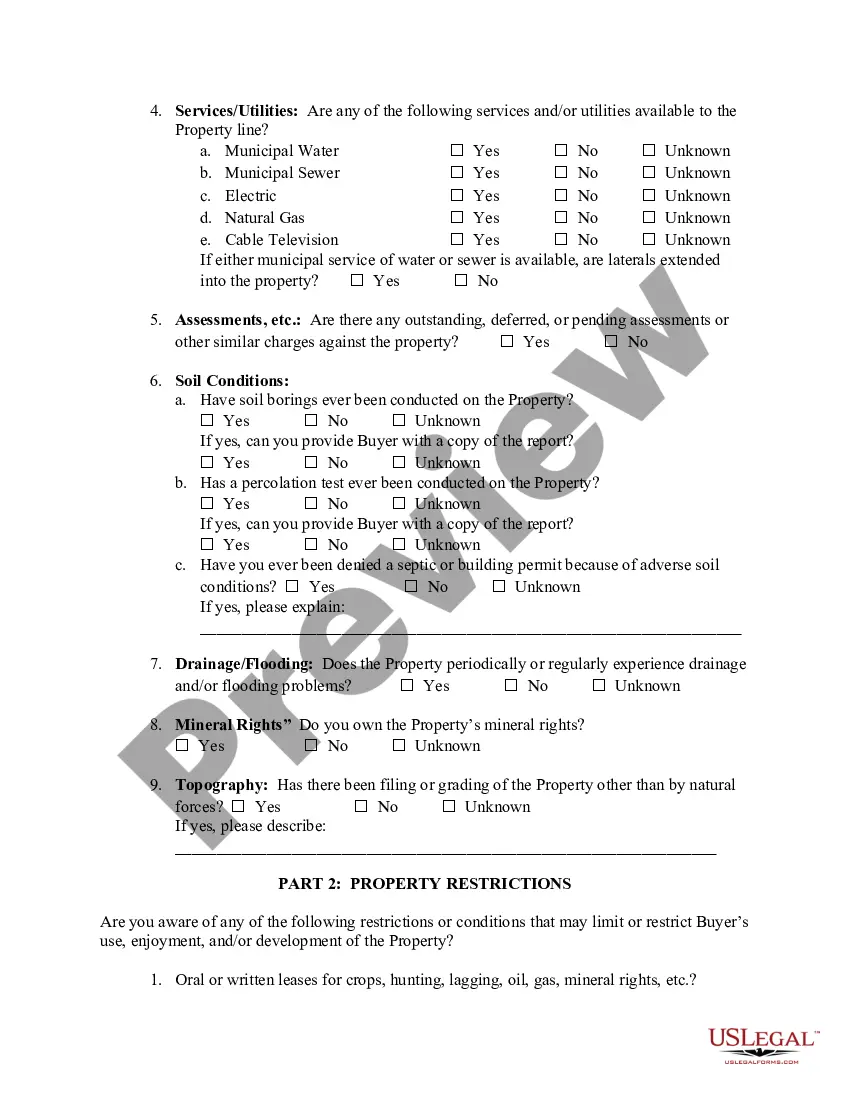

Vacant Land Disclosure Statement specifically designed for the disclosure of facts related to vacant land is used in such states.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.