28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

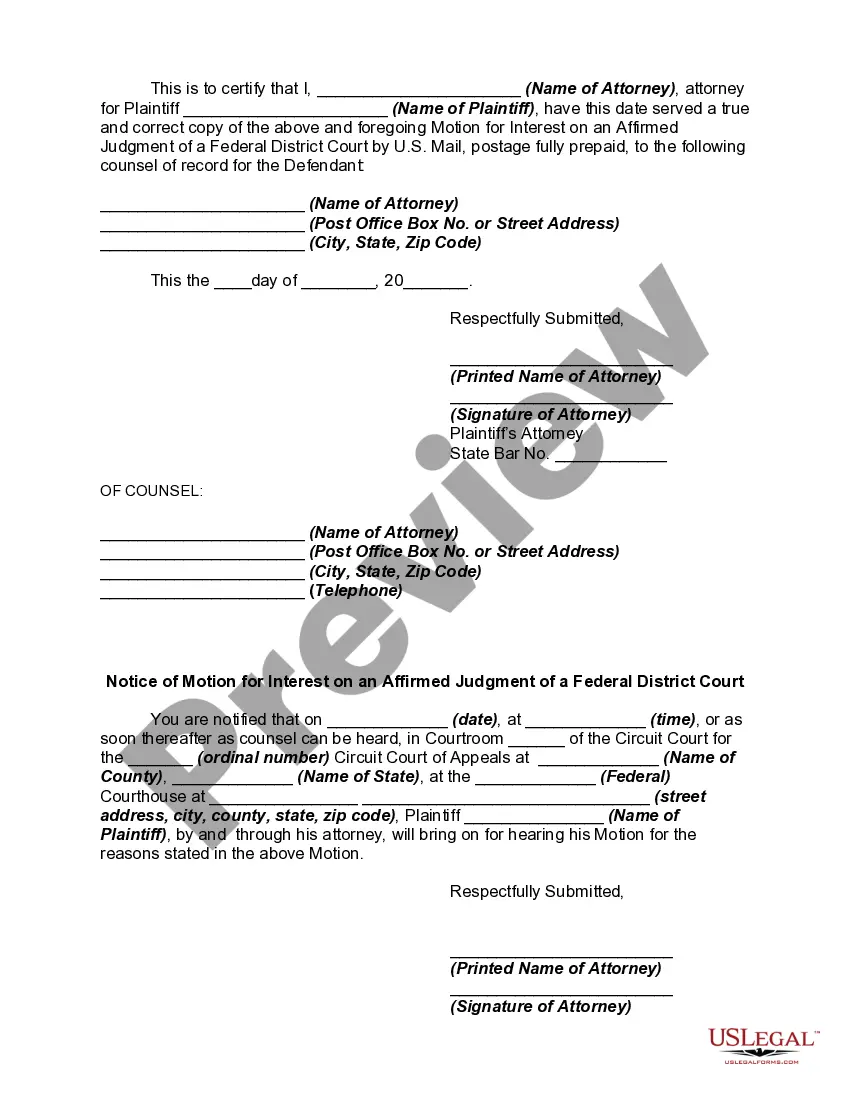

Pennsylvania Motion for Interest on an Affirmed Judgment of a Federal District Court

Description

How to fill out Motion For Interest On An Affirmed Judgment Of A Federal District Court?

Finding the right legitimate record template can be quite a have a problem. Naturally, there are plenty of themes available on the Internet, but how do you get the legitimate type you need? Utilize the US Legal Forms website. The services delivers thousands of themes, for example the Pennsylvania Motion for Interest on an Affirmed Judgment of a Federal District Court, that can be used for organization and personal needs. All of the forms are checked by experts and meet federal and state specifications.

When you are currently authorized, log in for your bank account and click on the Download option to obtain the Pennsylvania Motion for Interest on an Affirmed Judgment of a Federal District Court. Use your bank account to look from the legitimate forms you have purchased formerly. Go to the My Forms tab of your bank account and have one more version from the record you need.

When you are a whole new user of US Legal Forms, here are straightforward guidelines for you to stick to:

- Very first, ensure you have chosen the correct type for your metropolis/area. You can look through the form making use of the Preview option and browse the form description to make certain it is the best for you.

- In the event the type will not meet your preferences, use the Seach field to get the proper type.

- Once you are certain the form is suitable, select the Acquire now option to obtain the type.

- Choose the pricing strategy you would like and enter the required details. Make your bank account and pay for the transaction utilizing your PayPal bank account or bank card.

- Choose the file formatting and down load the legitimate record template for your system.

- Comprehensive, edit and produce and indication the received Pennsylvania Motion for Interest on an Affirmed Judgment of a Federal District Court.

US Legal Forms is definitely the largest local library of legitimate forms that you can see numerous record themes. Utilize the company to down load appropriately-made paperwork that stick to condition specifications.

Form popularity

FAQ

"Prejudgment interest serves two purposes: first, it compensates the plaintiff for the loss of the use of his or her money; and, second, it forces the defendant to relinquish any benefit that it has received by retaining the plaintiff's money in the interim." Brandywine Smyrna, Inc. v. Millennium Builders, LLC, 34 A.

HOW TO CALCULATE POST JUDGMENT INTEREST Take your judgment amount and multiply it by your post judgment rate (%). Take the total and divide it by 365 (the number of days in a year). You will end up with the amount of post judgment interest per day.

HOW TO CALCULATE POST JUDGMENT INTEREST Take your judgment amount and multiply it by your post judgment rate (%). Take the total and divide it by 365 (the number of days in a year). You will end up with the amount of post judgment interest per day.

This is because prejudgment interest can add up, particularly as cases can often take a year or two or longer to get through trial. For example, a one million dollar judgment would accrue $100,000 in interest every year at the "legal rate" of 10%.

The rate of interest used in calculating the amount of post-judgment interest is the weekly average 1-year constant maturity (nominal) Treasury yield, as published by the Federal Reserve System each Monday for the preceding week (unless that day is a holiday in which case the rate is published on the next business day) ...

Interest on Judgment. (a) When the Court Affirms. Unless the law provides otherwise, if a money judgment in a civil case is affirmed, whatever interest is allowed by law is payable from the date when the district court's judgment was entered.

Lenders Have An Interest In The Post-Judgment Rate. In Pennsylvania, once a mortgage foreclosure claim is reduced to judgment, the legal interest rate of six percent per annum applies unless the loan documents evidence a clear intent to continue the contractual interest rate post-judgment.

ABA, Calculation of Prejudgment Interest on Past Losses in Business Litigation. For example, the California Constitution applies a general the rate of interest at 7% per annum, and in Palomar Grading & Paving, Inc.