Pennsylvania Pledge of Personal Property as Collateral Security

Description

As the pledge is for the benefit of both parties, the pledgee is bound to exercise only ordinary care over the pledge. The pledgee has the right of selling the pledge if the pledgor make default in payment at the stipulated time. In the case of a wrongful sale by a pledgee, the pledgor cannot recover the value of the pledge without a tender of the amount due.

How to fill out Pledge Of Personal Property As Collateral Security?

Are you presently in a position where you require documents for either business or specific purposes almost every day.

There are numerous legal document templates accessible online, but locating ones you can depend on is not simple.

US Legal Forms provides thousands of form templates, including the Pennsylvania Pledge of Personal Property as Collateral Security, that are designed to meet state and federal requirements.

Once you find the correct form, click Purchase now.

Choose the pricing plan you want, enter the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Pennsylvania Pledge of Personal Property as Collateral Security template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your appropriate city/county.

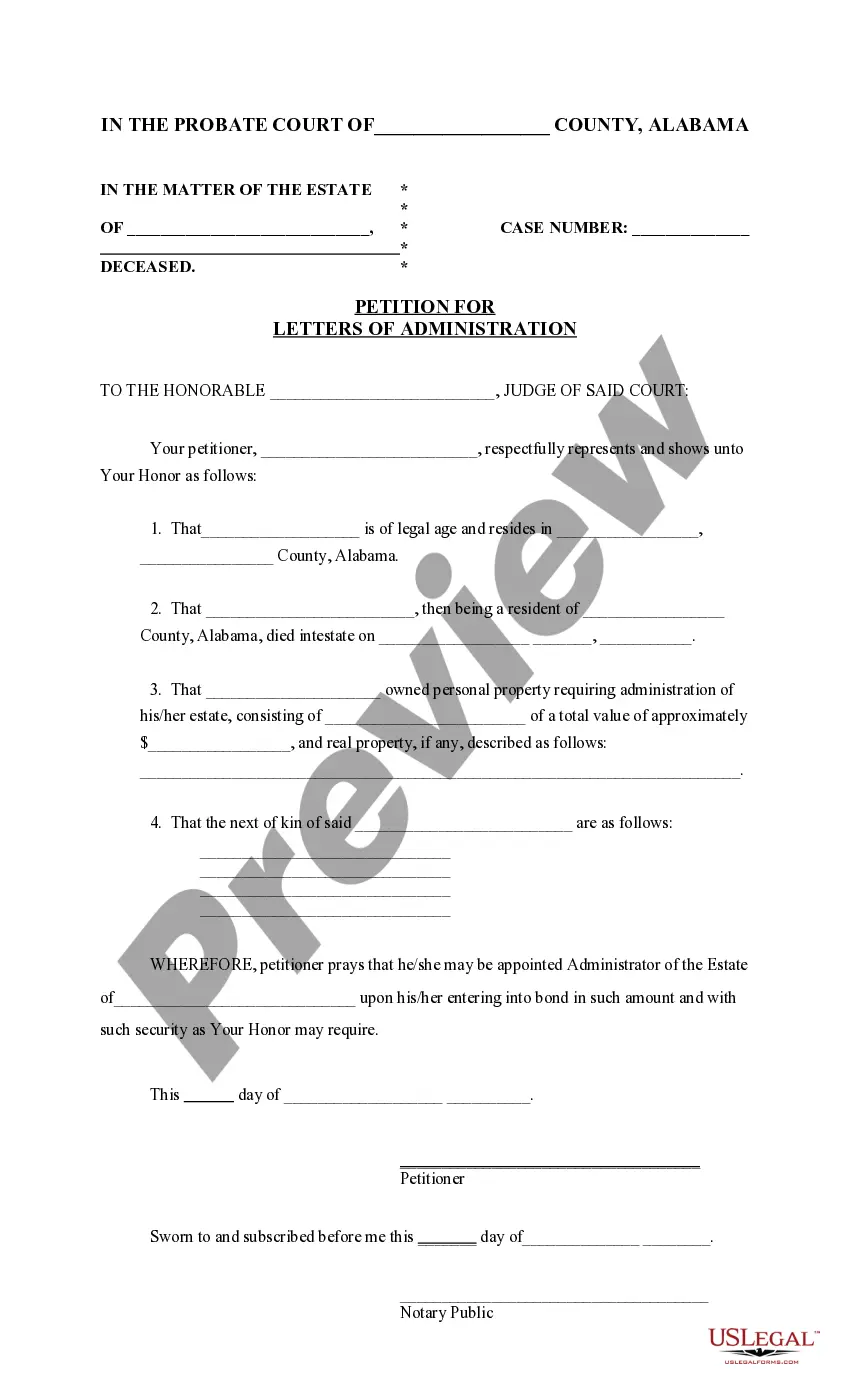

- Use the Preview button to review the form.

- Read the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

To create a security interest in personal property, you must follow specific legal steps, such as drafting a security agreement that outlines the terms. Then, you typically need to file a financing statement to notify third parties of your interest. The Pennsylvania Pledge of Personal Property as Collateral Security guides you through this process, ensuring legal compliance and protection.

Yes, personal property can indeed be used as collateral. This is particularly important in securing loans, as lenders often require collateral to reduce their risk. The Pennsylvania Pledge of Personal Property as Collateral Security allows borrowers to leverage their personal assets for greater financial flexibility.

While a pledged asset mortgage can provide access to funds, it carries risks related to the pledged collateral. If the borrower defaults, the lender can seize the collateral, which may lead to the loss of valuable personal property. Additionally, borrowers may face higher interest rates and stricter repayment terms, making it important to weigh your options carefully.

A security interest is created when a debtor grants the lender a legal claim to the collateral in an agreement known as a security agreement. Under the Pennsylvania Pledge of Personal Property as Collateral Security, this agreement needs to specify the collateral and the obligations of both parties. You may also be required to file a financing statement to perfect the interest and inform other creditors of your security claim.

To establish a valid security interest under the Pennsylvania Pledge of Personal Property as Collateral Security, you need a clear agreement between the parties involved, a signed contract, and the collateral must be identifiable. The security interest must also be properly perfected to secure its priority against other creditors. Ensuring these criteria are met can protect your rights in the pledged property.

Certain items generally cannot be accepted as collateral, including illegal items or those that hold no market value. Additionally, personal property that is necessary for daily living may not qualify. The Pennsylvania Pledge of Personal Property as Collateral Security provides clarity on acceptable items and helps ensure both parties make informed decisions. Knowing what is off-limits can streamline the collateral agreement process.

The term used for pledging something as collateral is 'pledge.' This involves transferring possession of the item to the lender while retaining ownership rights. The Pennsylvania Pledge of Personal Property as Collateral Security specifically refers to this arrangement and provides guidance on how to proceed. It ensures both parties understand their responsibilities.

In most cases, it is not illegal to hold someone's personal property as collateral. However, the arrangement must comply with state laws and regulations. The Pennsylvania Pledge of Personal Property as Collateral Security outlines the rights and obligations of both parties involved. It is essential to have a clear agreement to avoid any potential legal issues.