Pennsylvania Cash Disbursements Journal

Description

How to fill out Cash Disbursements Journal?

You can dedicate numerous hours online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that have been examined by professionals.

You can download or print the Pennsylvania Cash Disbursements Journal from the service.

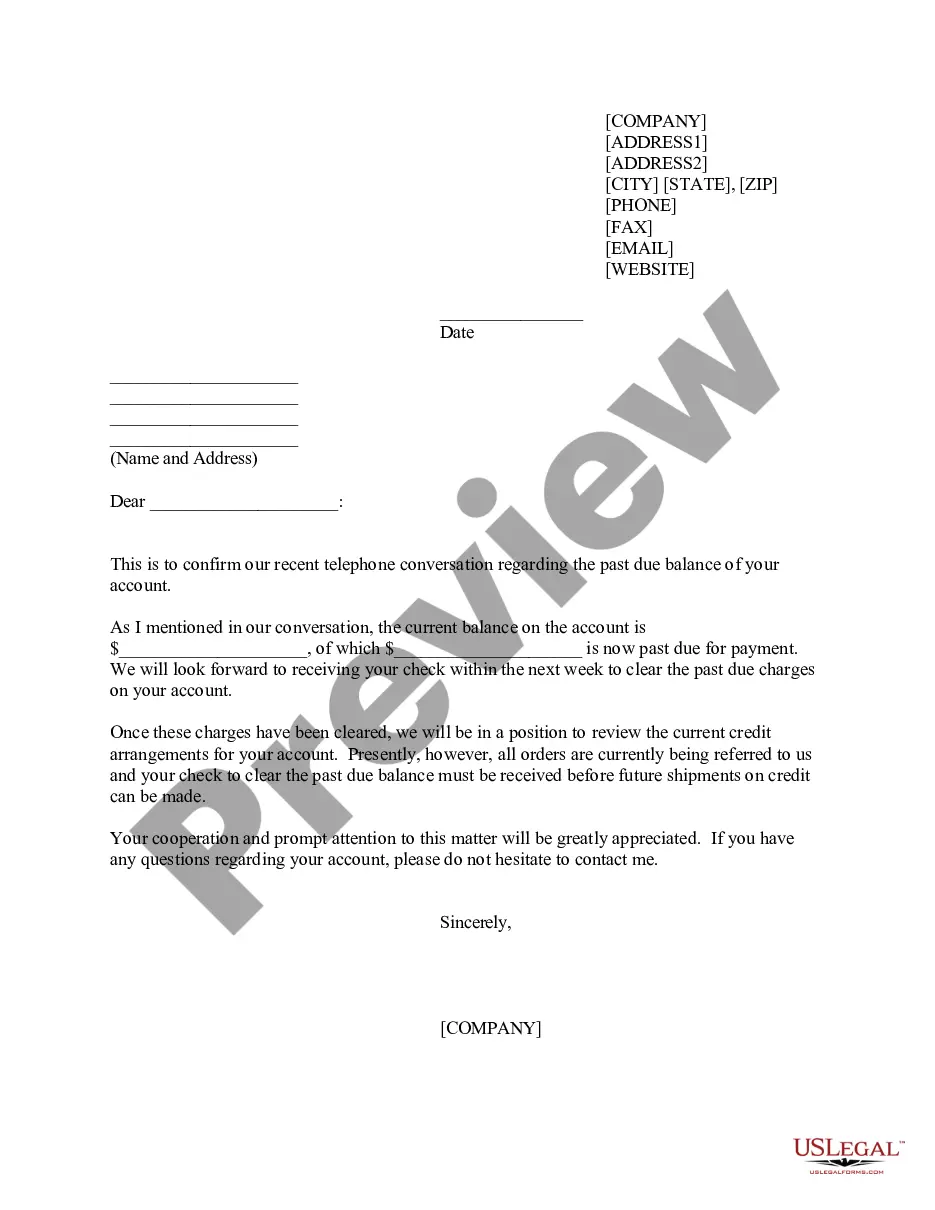

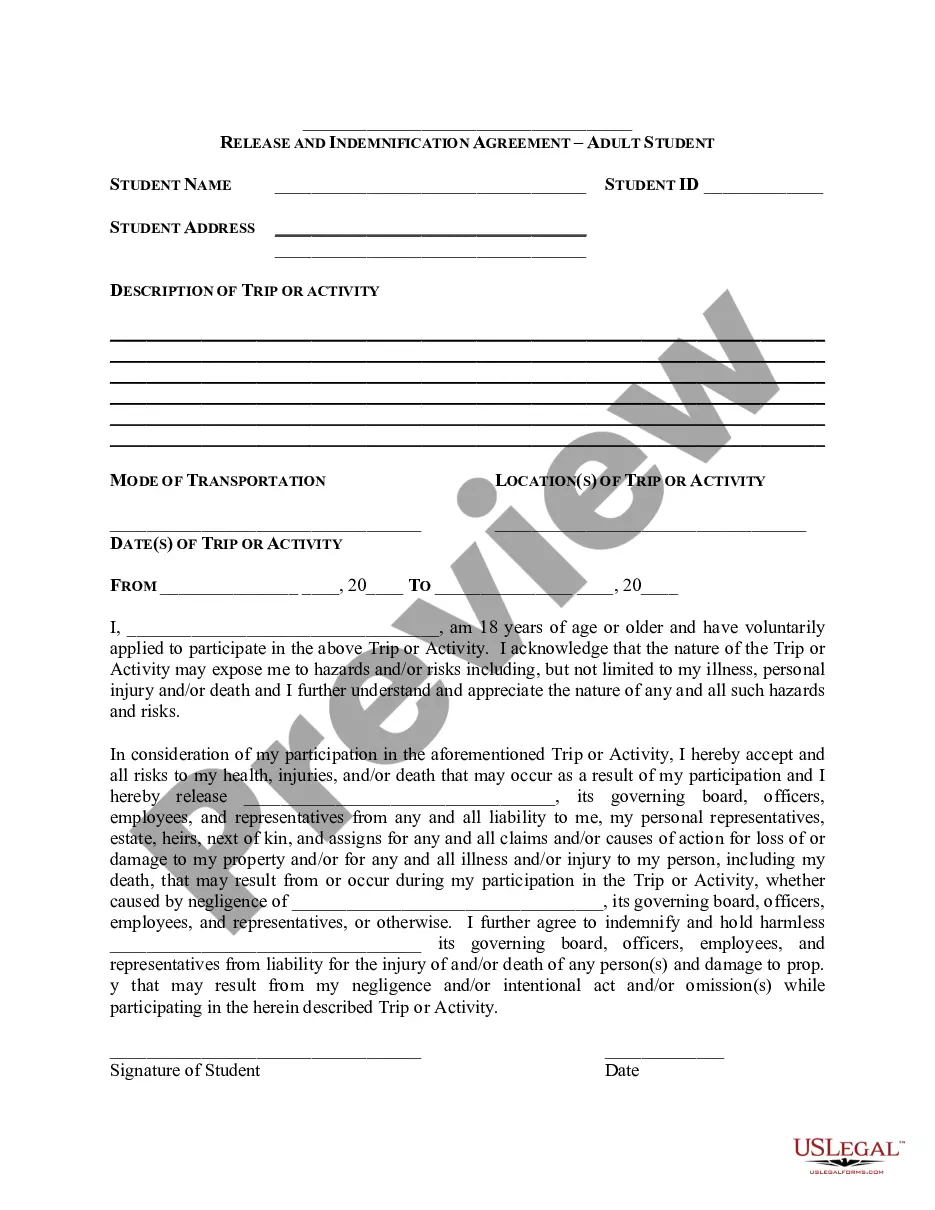

If available, use the Review option to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, modify, print, or sign the Pennsylvania Cash Disbursements Journal.

- Each legal document template you receive is yours indefinitely.

- To obtain another copy of any purchased document, visit the My documents section and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the area/town of your choice.

- Review the document details to ensure you have chosen the right form.

Form popularity

FAQ

The cash disbursements journal (or cash payments journal) is an accounting form used to record all cash outflows. Some examples of outflows are accounts payable, materials payable, and operating expenses, as well as all cash purchases and disbursements to a petty cash fund.

Add up the amount of cash that was disbursed during the reporting time frame. This includes payroll expenses, taxes, office supplies, materials, rent and insurance. Keep each total separate based on the type of purchase.

A cash disbursement journal is done before payments are posted to the general ledger and is used in creating a general ledger. The information included in a cash disbursement journal is the disbursement amount, the check number, the transaction type, the payee, and any other pertinent information.

A cash disbursement journal is done before payments are posted to the general ledger and is used in creating a general ledger. The information included in a cash disbursement journal is the disbursement amount, the check number, the transaction type, the payee, and any other pertinent information.

The cash disbursement journal includes the columns of date, check number, and name of the payee. The amount of disbursement is recorded in the cash column, and the title is recorded in the corresponding account debited column. Each account has a reference number shown in the posting reference (PR) column.

Cash disbursement journals should include:Date.Payee name.Amount debited or credited.Accounts involved (e.g., payment method)Purpose of the transaction.

Create a Cash Disbursements Journal reportFrom the QuickBooks Reports menu, select Custom Reports then click Transaction Detail.Enter the appropriate date range.In the Columns box, check off the following columns:Click the Total by drop-down and select an appropriate criteria like Payee, Account or Month.More items...

What information should you include?Date.Payee name.Amount debited or credited.Accounts involved (e.g., payment method)Purpose of the transaction.

Purchasing inventory or office supplies, paying out dividends, or making business loan payments with cash or cash equivalents are examples of disbursements.