Pennsylvania Assignment of Assets

Description

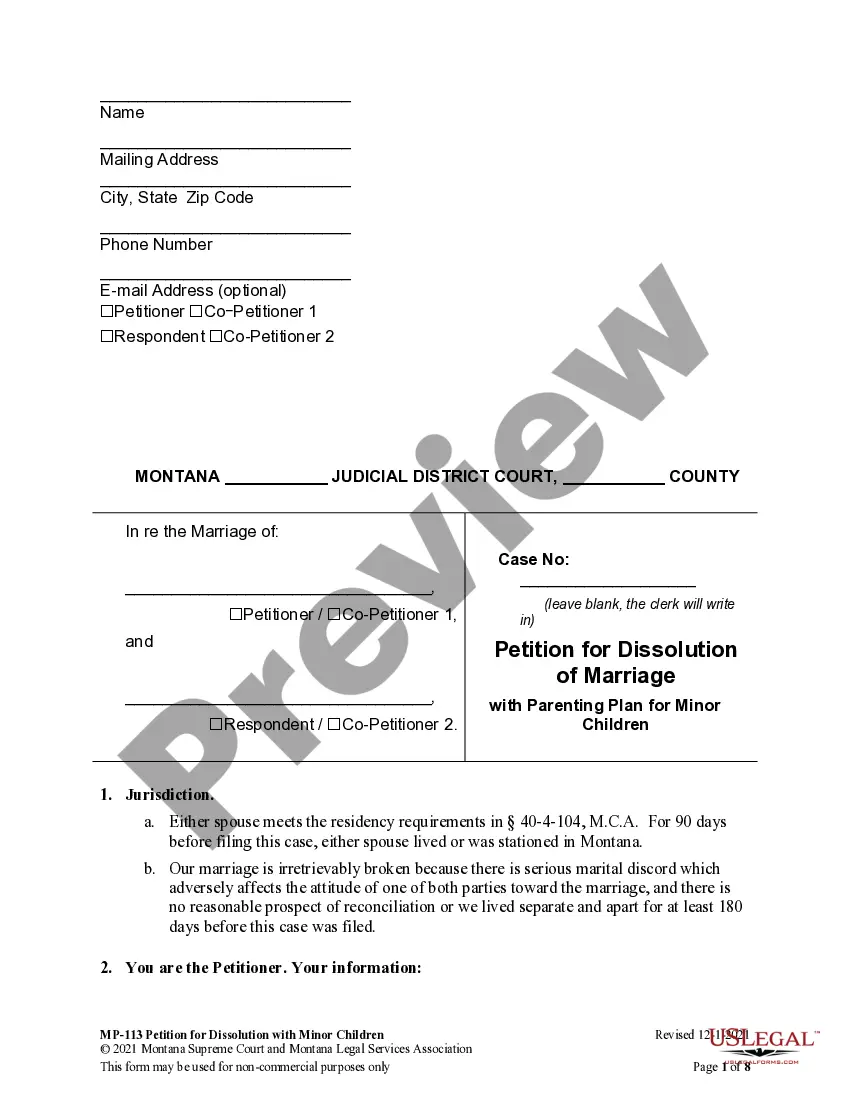

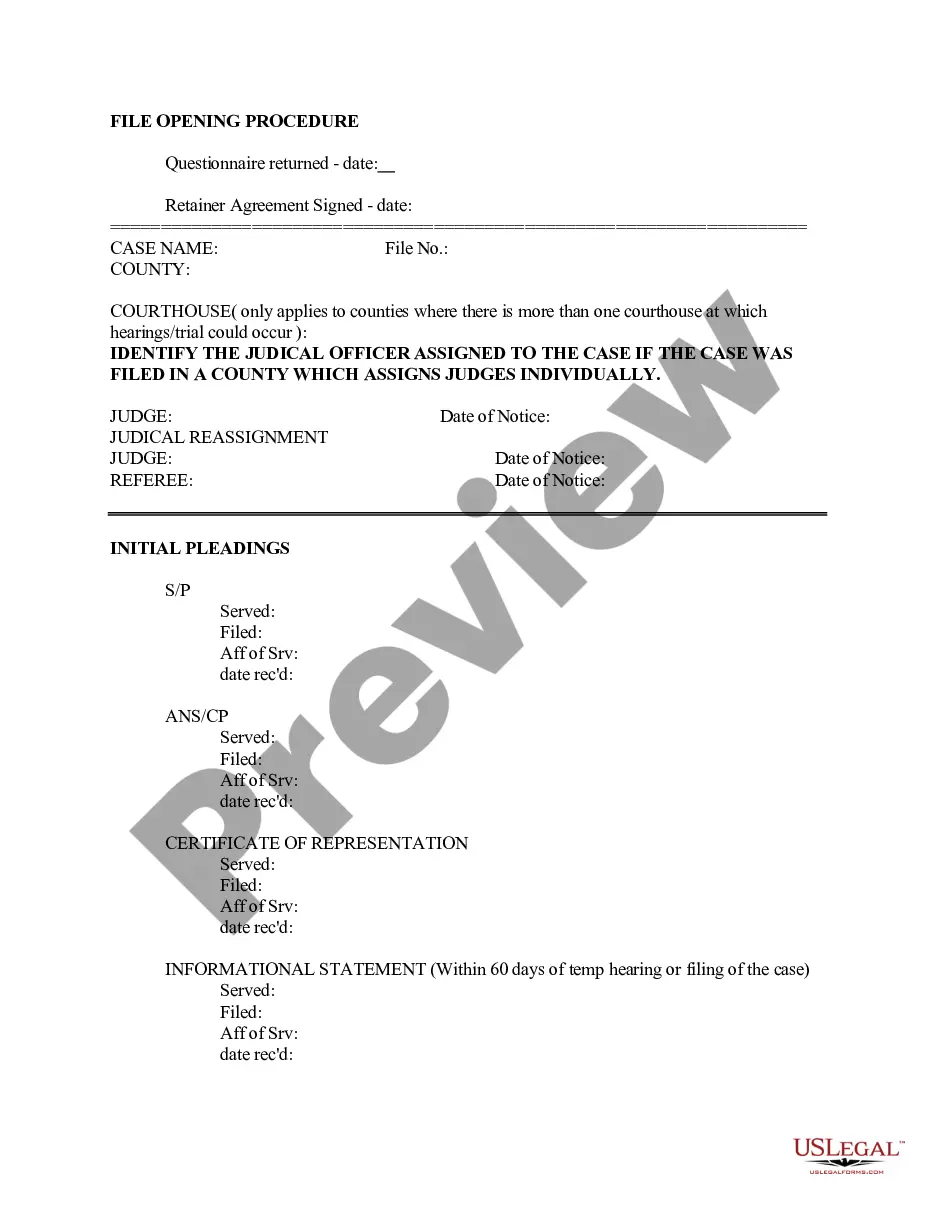

How to fill out Assignment Of Assets?

It is feasible to invest time online looking for the appropriate legal document template that satisfies both federal and state requirements you require.

US Legal Forms offers thousands of legal forms that are evaluated by experts.

You can retrieve or print the Pennsylvania Assignment of Assets from my service.

If available, use the Review button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- Subsequently, you can fill out, modify, print, or sign the Pennsylvania Assignment of Assets.

- Each legal document template you obtain is yours indefinitely.

- To obtain another copy of any purchased document, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/area of your choice.

- Check the document description to confirm that you have selected the appropriate form.

Form popularity

FAQ

To avoid transfer tax in Pennsylvania, ensure that you qualify for exemptions such as gifts or transfers between family members under specific circumstances. Additionally, structuring transactions carefully can also help in reducing tax liability. Leveraging legal resources, like those offered on the US Legal Forms platform, can provide valuable insights to navigate these options effectively.

The transfer tax on the assignment of contracts in Pennsylvania varies depending on the property’s value and local tax rates. Generally, the tax is a small percentage, similar to standard property transfers. It's crucial to verify your specific situation, as different counties may have varying rates. Utilize US Legal Forms for comprehensive guidance on the implications of your contract assignments.

To avoid Pennsylvania capital gains tax on real estate, you can consider several strategies, such as 1031 exchanges, which defer taxes by reinvesting in similar properties. Another means is using exemptions like the primary residence exclusion if you meet specific criteria. Being informed about Pennsylvania Assignment of Assets can guide you through these strategies efficiently.

To calculate transfer tax in Pennsylvania, you should first identify the value of the property being transferred. The state imposes a 1% tax on sales, while local municipalities may impose additional rates. Therefore, the total tax will vary based on the property's location. If you need assistance with this, consider utilizing the resources available through the US Legal Forms platform.

In contract law, the transfer of a duty occurs when one party delegates their responsibilities to another party. This can happen under specific conditions outlined in the contract. It's essential to clearly document this transfer to ensure that all parties are aware and agreeable to the changes. Understanding these details can help in managing obligations effectively during a Pennsylvania Assignment of Assets.

An assignment of assets is a legal process where a party transfers rights to their assets to another party, often for purposes such as debt settlement or legal claims. This concept is crucial in Pennsylvania Assignment of Assets, as it delineates ownership and rights. Knowing how this process works can aid in making informed financial decisions.

In Pennsylvania, certain assets are protected in lawsuits, such as retirement accounts, primary residences, and personal property under specific thresholds. Understanding the Pennsylvania Assignment of Assets can provide insights into these protections. A legal professional can help ensure that you're aware of what is safeguarded under state laws.

Legally protecting your assets in a Pennsylvania divorce involves strategic planning and documentation. You should consider both asset declaration and proper agreements before marriage. Utilizing the Pennsylvania Assignment of Assets framework can help you navigate these legal waters effectively.

To protect assets from divorce in Pennsylvania, it's vital to keep your assets separate and fully documented. Engaging in practices such as creating trusts or using other estate planning tools can be beneficial. The Pennsylvania Assignment of Assets plays a key role in these processes, helping you maintain control over your financial interests.

In Pennsylvania, assignment of benefits refers to the transfer of rights to receive benefits or payments under an insurance policy. This process can offer advantages when dealing with claims related to personal injury or other legal matters. Understanding the nuances of Pennsylvania Assignment of Assets is essential for properly navigating this process.