Pennsylvania Affiliate Program Agreement

Description

How to fill out Affiliate Program Agreement?

If you require extensive, acquire, or print legal document formats, utilize US Legal Forms, the largest selection of legal templates, available online.

Employ the site’s straightforward and convenient search to find the documents you need.

Various templates for commercial and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the Pennsylvania Affiliate Program Agreement with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the Pennsylvania Affiliate Program Agreement.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions listed below.

- Step 1. Ensure you have selected the form for the correct area/region.

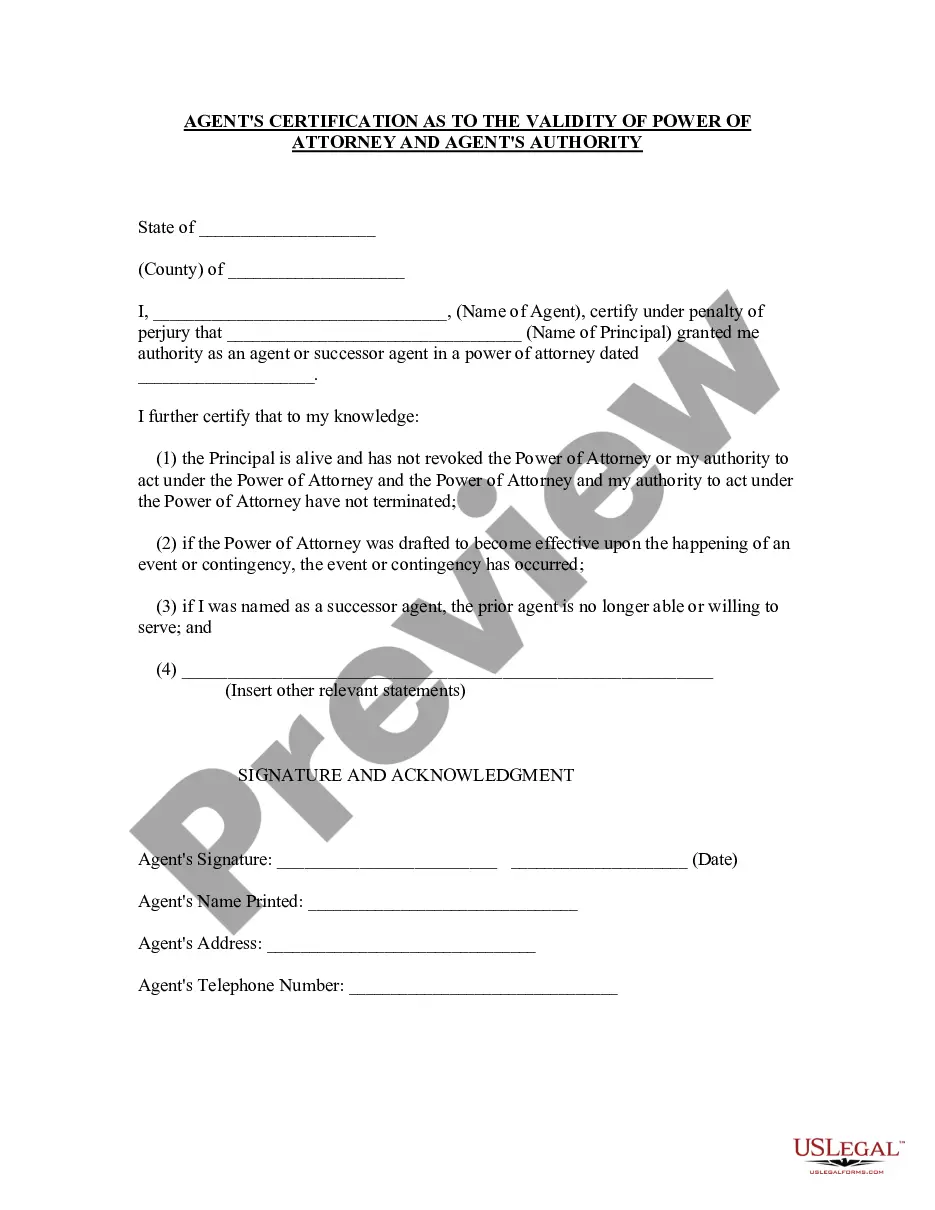

- Step 2. Use the Preview feature to view the form’s content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other types in the legal form format.

Form popularity

FAQ

While an LLC in Pennsylvania does not need an operating agreement to be formed, having one is highly beneficial. It clearly defines the roles and responsibilities of members, reducing the likelihood of conflicts. Establishing this agreement fosters a professional environment and aligns with the principles of the Pennsylvania Affiliate Program Agreement.

Pennsylvania does not legally require LLCs to have an operating agreement, but it is wise to create one. An operating agreement outlines the management structure and operating procedures of the LLC, protecting the interests of all members. Following this practice can enhance compatibility with the Pennsylvania Affiliate Program Agreement.

Yes, an LLC can technically operate without an operating agreement in Pennsylvania; however, doing so is not recommended. An operating agreement provides structure and clarity about the management of the LLC, which is crucial for avoiding disputes among members. Moreover, having this document aligns with the best practices associated with the Pennsylvania Affiliate Program Agreement.

If you are a partnership operating in Pennsylvania, you must file a PA-65 report. This includes both general partnerships and limited partnerships. The PA-65 allows the state to collect taxes from partnerships based on their income distribution. It is essential to comply to maintain good standing under the Pennsylvania Affiliate Program Agreement.

An affiliation agreement is similar to an affiliate agreement, but it often includes broader terms related to collaboration between businesses. It may cover aspects beyond just commissions, such as branding cooperation or joint marketing efforts. To ensure clarity and mutual benefits, parties should consider a detailed Pennsylvania Affiliate Program Agreement to outline their specific roles.

The affiliate agreement is a formal contract that sets the framework for the affiliate relationship, including compensation, responsibilities, and promotional guidelines. This document is crucial as it protects both parties and clarifies their roles within the partnership. A well-crafted Pennsylvania Affiliate Program Agreement offers peace of mind and a roadmap for success.

A participating affiliate agreement is a specific type of affiliate agreement where affiliates are allowed to participate in a program with defined benefits. This agreement outlines how affiliates can earn rewards for promoting products or services. Navigating these details is easier with a comprehensive Pennsylvania Affiliate Program Agreement that clarifies expectations for all involved.

An affiliate arrangement refers to the partnership between the affiliate and the business that specifies how they will work together. This includes the agreed-upon methods for promotion, compensation details, and the duration of the partnership. Having clarity in a Pennsylvania Affiliate Program Agreement helps prevent misunderstandings and fosters a successful relationship.

An affiliate agreement is a contract that outlines the terms and conditions between an affiliate and a company. This document details how the affiliate will promote the company’s products or services, the compensation structure, and any obligations involved. A well-structured Pennsylvania Affiliate Program Agreement is vital for protecting both the affiliate and the business.

An affiliate is a person or business that earns a commission by promoting another company's products or services. When an affiliate generates a sale or leads through their promotional efforts, they receive a payment, often referred to as a commission. Understanding the Pennsylvania Affiliate Program Agreement can help you navigate these relationships effectively and ensure all parties benefit.