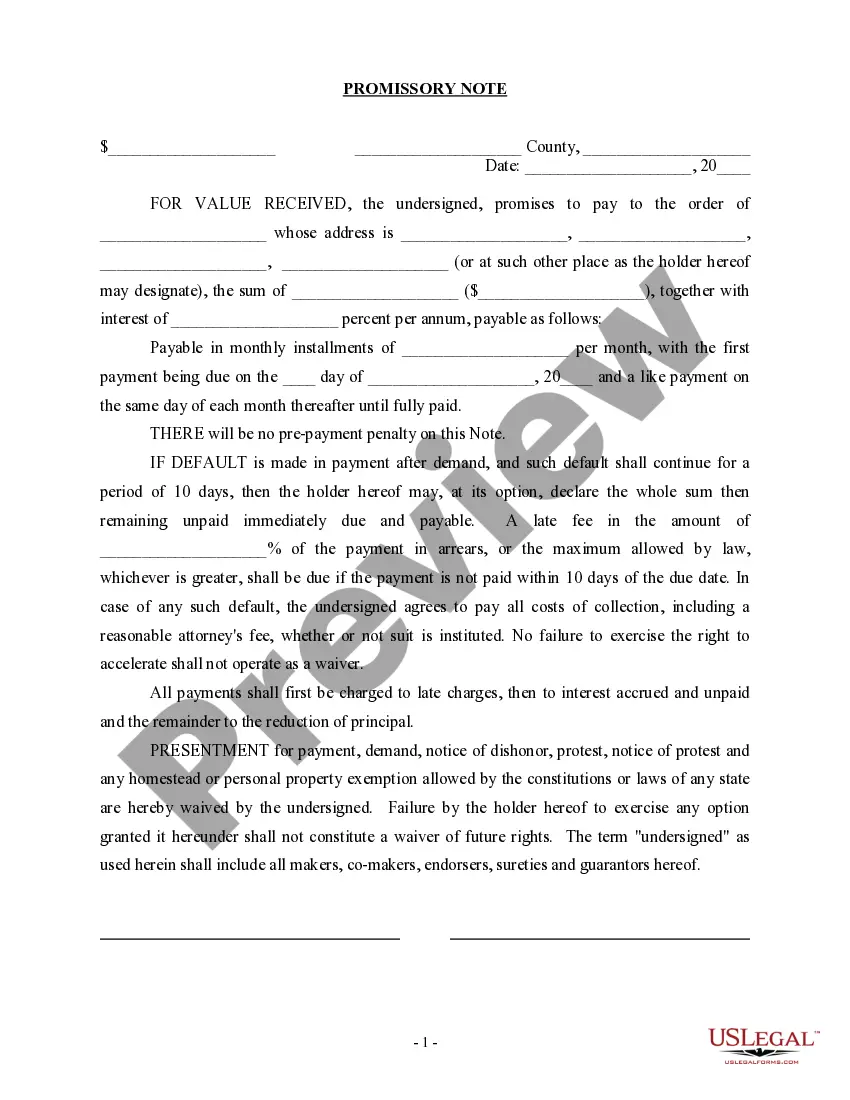

A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

Pennsylvania Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business

Description

How to fill out Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business?

Selecting the finest authentic documents template can be a challenge. Clearly, there are numerous templates accessible online, but how do you identify the genuine type you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the Pennsylvania Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase, that you can employ for both business and personal purposes.

All of the forms are reviewed by experts and meet state and federal standards.

Once you are confident the form is suitable, select the Get now button to obtain the form. Choose the pricing plan you desire and provide the necessary details. Create your account and pay for the order using your PayPal account or credit card. Select the document format and download the legal documents template to your device. Fill out, modify, print, and sign the received Pennsylvania Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase. US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize the service to download properly crafted documents that comply with state regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the Pennsylvania Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments linked to a Business Purchase.

- Use your account to search for the legal documents you have acquired previously.

- Access the My documents tab in your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple guidelines you can follow.

- Firstly, ensure that you have selected the correct form for your city/region. You can review the form by clicking the Review button and reading the form description to confirm that it is indeed suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

Form popularity

FAQ

In Pennsylvania, a promissory note does not necessarily need to be notarized to be legally binding. However, having it notarized can add an extra layer of authenticity and may be required for certain mortgage documents or real estate transactions. It’s advisable to check local regulations or consult a legal expert to ensure compliance. You can find resources and guidance on US Legal Forms to clarify these legal nuances.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

As when applying for a traditional mortgage, a promissory note is signed which obligates the buyer to make principal and interest payments according to a preset schedule. Should the buyer default on payments, the seller can foreclose on the property and sell the home.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

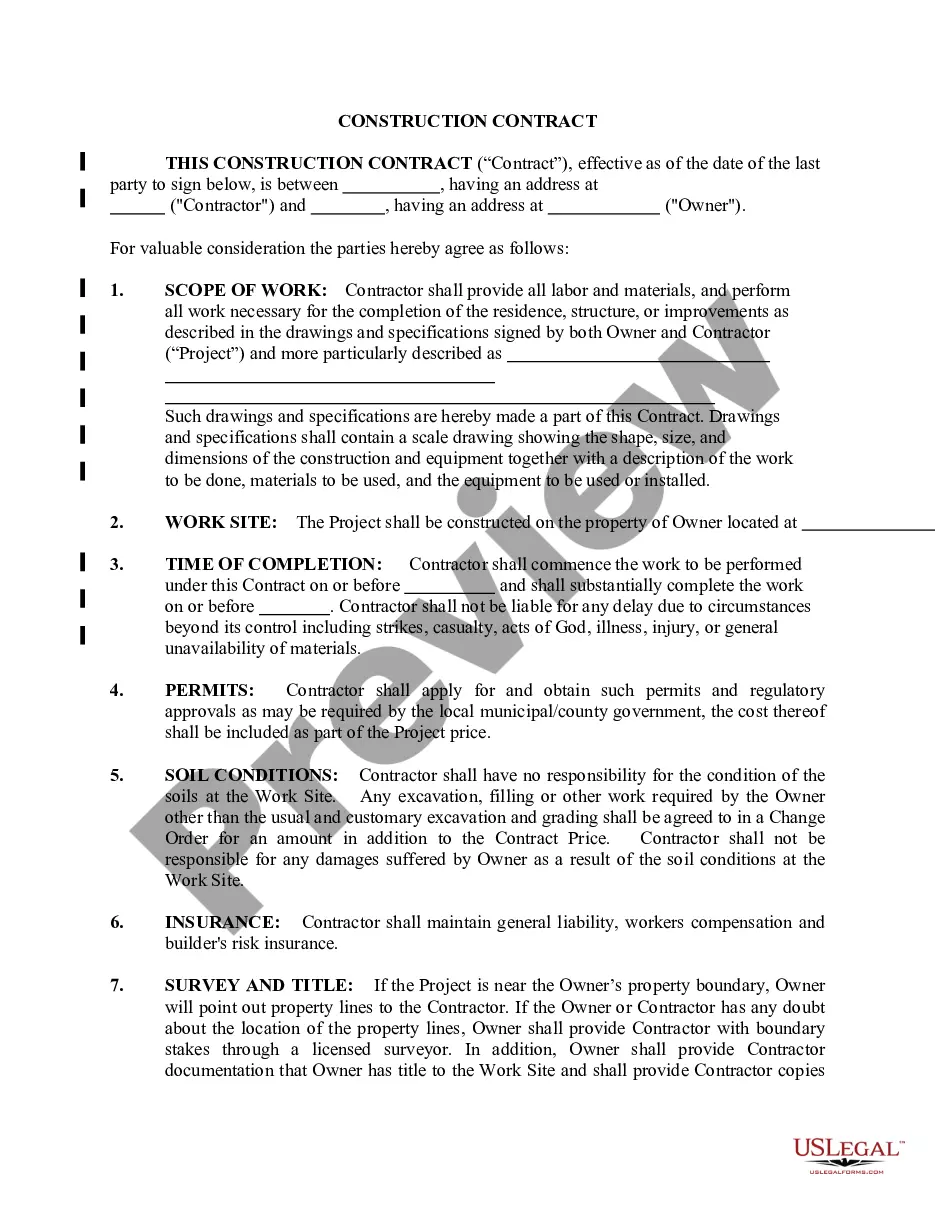

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document.

A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

A Promissory Note may be secured or unsecured. In case of a secured note, the borrower will be required to provide a collateral such as property, goods, services, etc., in the event that they fail to repay the borrowed amount.

A mortgage is a loan secured by property that is used as collateral, which the lender can seize if the borrower defaults on the loan. The promissory note is exactly what it sounds like the borrower's written, signed promise to repay the loan.

Q. What are Real Estate Secured loans? A. Often referred to as private money, hard money, or bridge financing, these short-term loans offer greater flexibility than traditional bank financing.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.