Pennsylvania General Partnership Agreement - version 2

Description

How to fill out General Partnership Agreement - Version 2?

Finding the correct legal document format can be quite a challenge.

Of course, there are numerous templates available online, but how can you obtain the legal form you seek.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Pennsylvania General Partnership Agreement - version 2, that can be utilized for both business and personal needs.

If the form does not satisfy your requirements, utilize the Search field to find the correct form.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to receive the Pennsylvania General Partnership Agreement - version 2.

- Use your account to search through the legal forms you have purchased previously.

- Visit the My documents tab of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have chosen the correct form for your city/county. You can review the form using the Preview button and examine the form details to confirm it is suitable for you.

Form popularity

FAQ

In Pennsylvania, general partnerships do not need to register with the state, but filing a statement of partnership authority can enhance credibility. While registration is not required, creating a Pennsylvania General Partnership Agreement - version 2 is highly advisable. This agreement clarifies each partner's rights and responsibilities, minimizing disputes and ensuring smooth operations.

A partnership often has simpler setup and management compared to an LLC. Partnerships allow for direct pass-through taxation, which means profits are reported on partners' personal tax returns. Additionally, partners typically enjoy more straightforward operational flexibility. To help define your partnership structure, consider creating a Pennsylvania General Partnership Agreement - version 2.

Yes, a general partnership can consist of two or more general partners. Each partner shares in the management of the business and contributes to its profits and losses. Collaboration between two partners can enhance decision-making and resource sharing. For clarity on roles and expectations, establish a Pennsylvania General Partnership Agreement - version 2.

The main difference between a general partnership and an LLC lies in liability protection. In a general partnership, partners are personally liable for the debts of the business, while an LLC shields personal assets from business liabilities. Also, LLCs have more formal requirements and offer potential tax benefits. A Pennsylvania General Partnership Agreement - version 2 can help clarify roles and responsibilities within your partnership.

One key disadvantage of a general partnership is that all partners share liability for the business's debts and obligations. This means that if the partnership fails or faces legal issues, personal assets of the partners may be at risk. Additionally, you may face challenges in decision-making since each partner typically has equal say. To safeguard your investments, consider a Pennsylvania General Partnership Agreement - version 2.

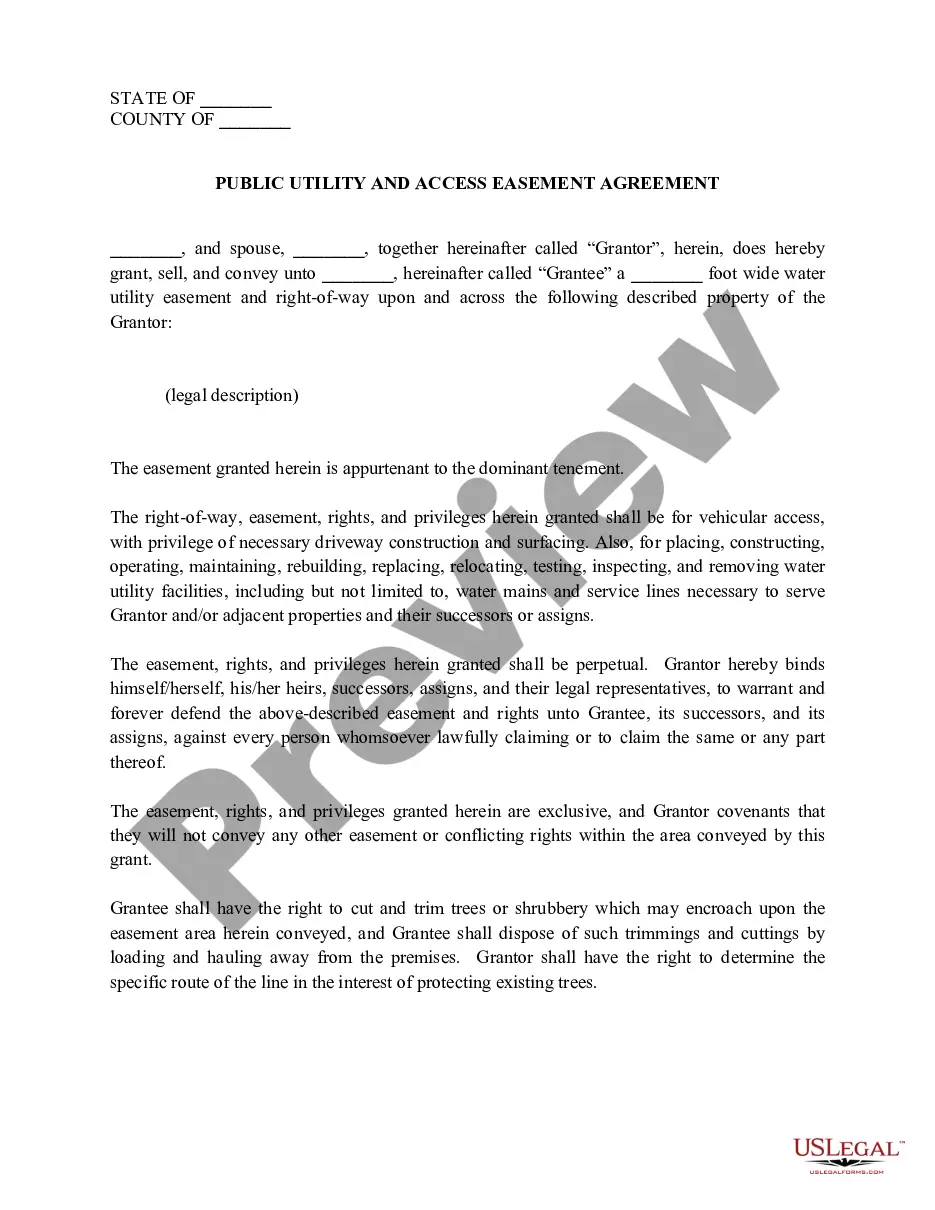

The structure of a Pennsylvania General Partnership Agreement - version 2 typically consists of several key sections. You’ll find introductory clauses that outline the partners and their contributions, followed by operational guidelines for managing the business. Important aspects such as profit sharing, decision-making processes, and provisions for conflict resolution are also included. A well-structured agreement minimizes misunderstandings and provides a clear framework for the partnership.

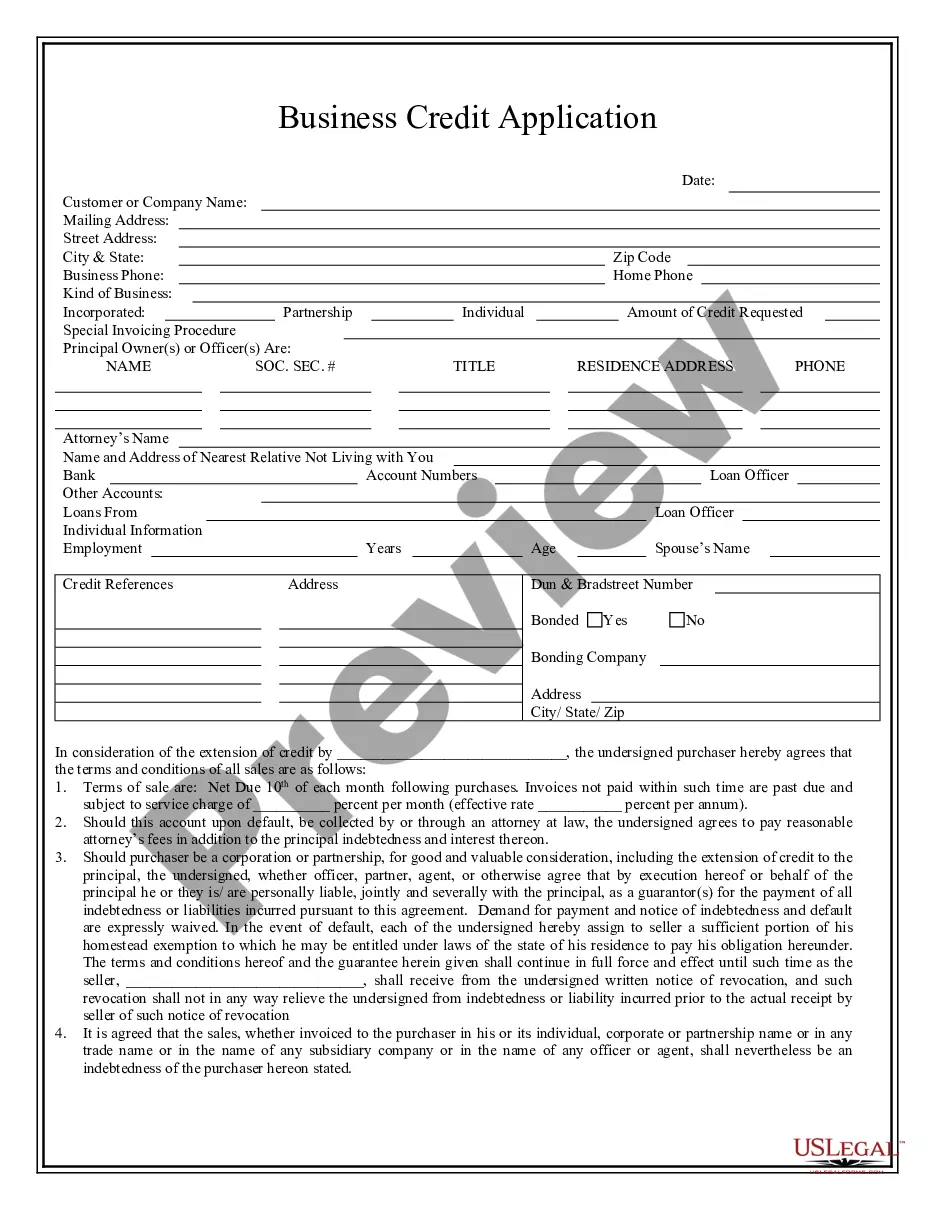

To fill a partnership form accurately, you must collect all necessary information beforehand. This includes details about each partner, business activities, and financial contributions. The Pennsylvania General Partnership Agreement - version 2 template from uslegalforms simplifies this process, allowing you to easily insert required details and maintain formal structure. Following this template ensures you’ll have a comprehensive and legal partnership form.

Filling out a partnership form typically involves entering information about the partners and the business. Start with the names, addresses, and contact information of each partner, and provide a brief description of the business purpose. Next, indicate how profits and losses will be shared among partners. Using a structured format, such as the Pennsylvania General Partnership Agreement - version 2 from uslegalforms, can guide you through these steps efficiently.

To write a sample of a Pennsylvania General Partnership Agreement - version 2, begin by understanding essential components like partner information, business objectives, and asset distribution. Draft sections that cover decision-making processes, dispute resolution, and exit strategies for partners. This will serve as a template that you can customize to fit your specific partnership needs. Remember, having a sample can simplify the drafting process for all parties involved.

Filling out a Pennsylvania General Partnership Agreement - version 2 involves clearly defining the roles and responsibilities of each partner. You should start by providing the names and addresses of the partners, then outline the purpose of the partnership. Don't forget to include details on profit sharing and the duration of the partnership. This structured approach ensures clarity and helps prevent future disputes.