Pennsylvania Sample Letter concerning State Tax Commission Notice

Description

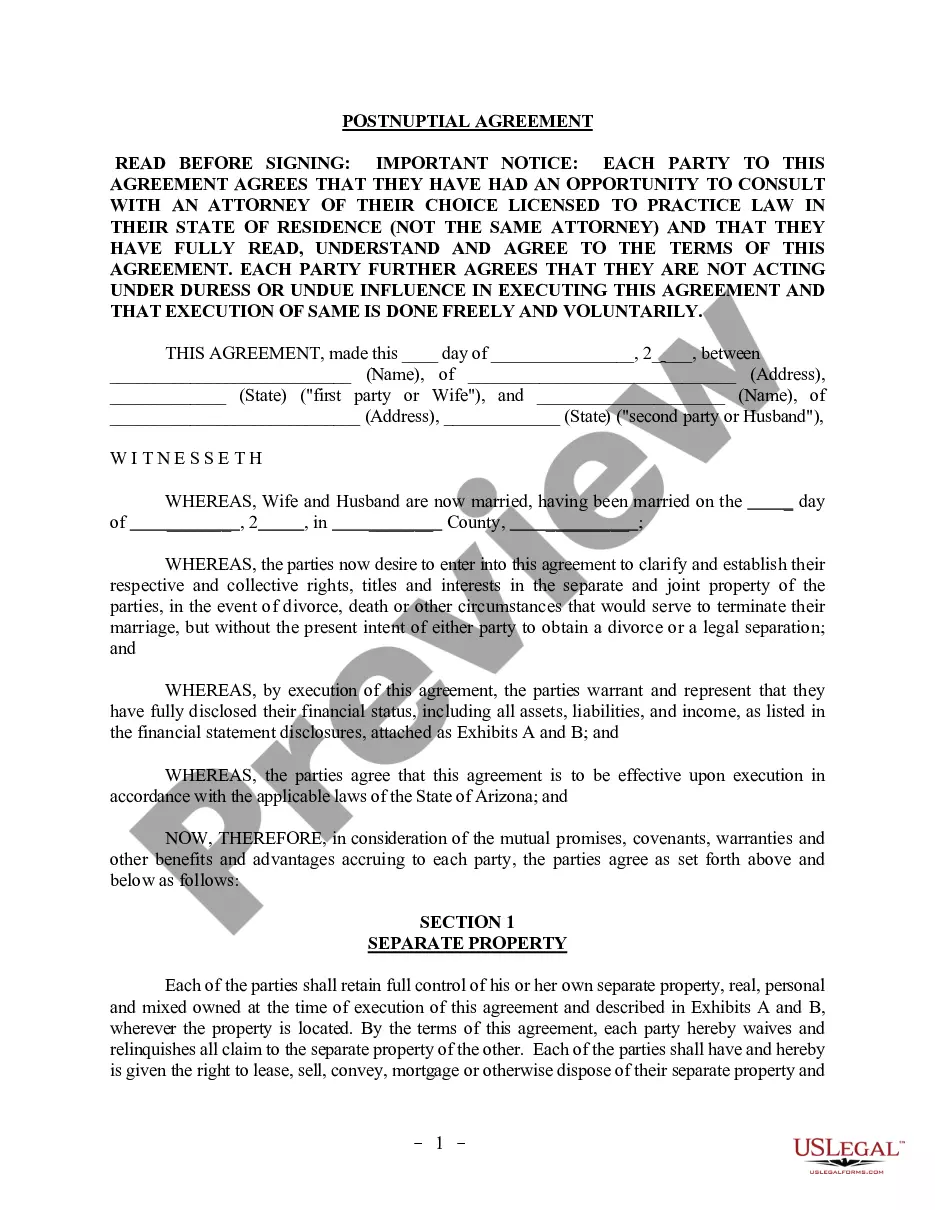

How to fill out Sample Letter Concerning State Tax Commission Notice?

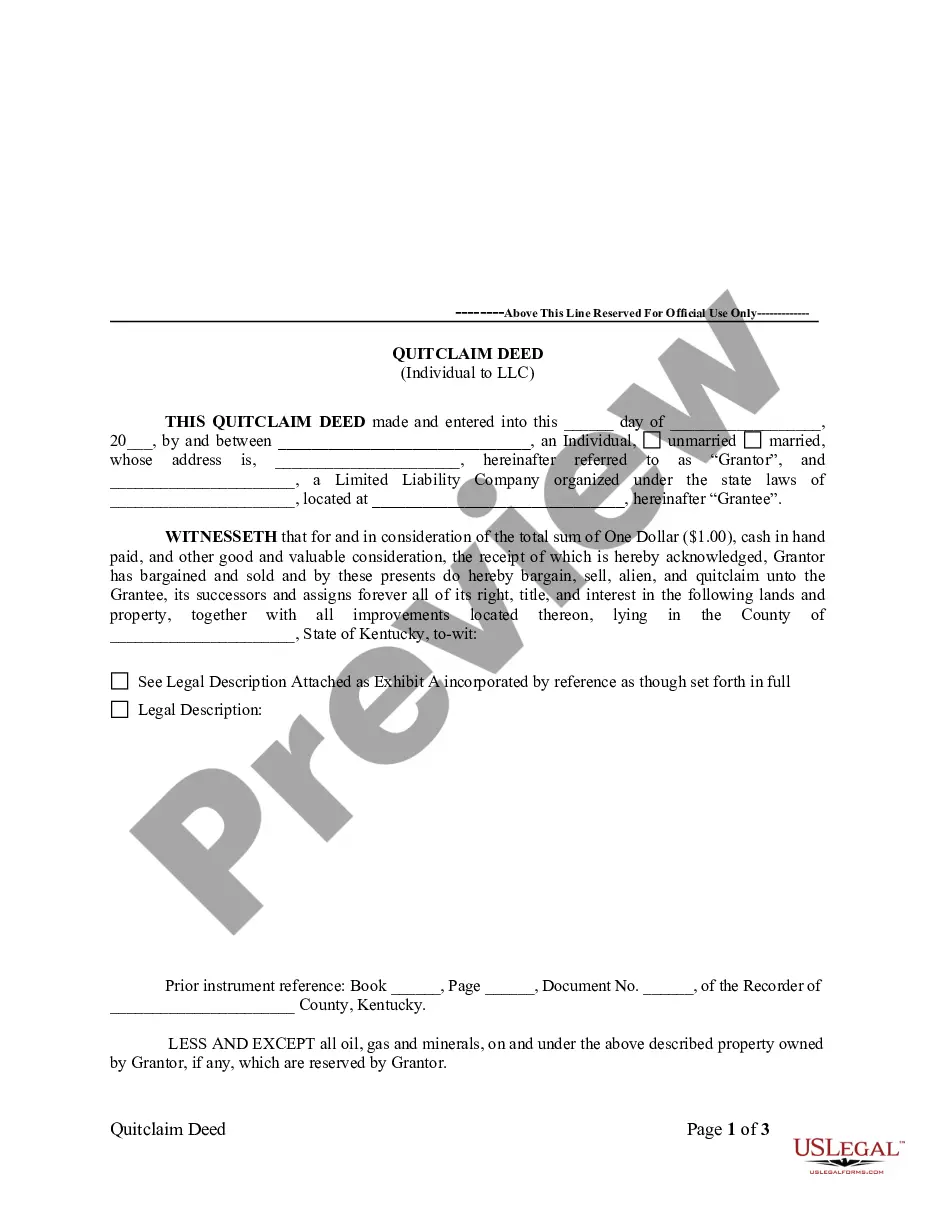

If you need to compile, download, or print valid document templates, utilize US Legal Forms, the leading collection of legal forms available online. Take advantage of the site's simple and convenient search to find the documents you require. Various templates for business and personal needs are organized by categories and states, or keywords. Use US Legal Forms to locate the Pennsylvania Sample Letter regarding State Tax Commission Notice in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Get button to access the Pennsylvania Sample Letter regarding State Tax Commission Notice. You can also retrieve forms you have previously saved in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for your appropriate city/region. Step 2. Use the Preview option to review the form's content. Don't forget to read the information. Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other versions in the legal form template. Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your credentials to sign up for an account. Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Pennsylvania Sample Letter regarding State Tax Commission Notice.

- Each legal document template you obtain is yours permanently.

- You have access to every form you saved in your account.

- Select the My documents section and choose a form to print or download again.

- Stay competitive and download, and print the Pennsylvania Sample Letter regarding State Tax Commission Notice using US Legal Forms.

- There are millions of professional and state-specific forms you can use for your business or personal needs.

Form popularity

FAQ

Pennsylvania Income Tax Rate The withholding rate for 2023 remains at 3.07%.

Your Notice of Assessment specifies the time in which an appeal must be filed with the Board of Appeals. Petitions for refund must be filed within the timeframe provided by the statute governing the tax requested for refund.

Pennsylvania law requires employers to withhold Pennsylvania personal income tax from employees' compensation in two common cases: When resident employees perform services within or outside Pennsylvania; and. When nonresident employees perform services within Pennsylvania.

Complete Form REV-419 so that your employer can withhold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial sit- uation changes.

2022 Pennsylvania Income Tax Return (PA-40)

How to fill out a 2023 W-4 form Step 1: Enter your personal information. Fill in your name, address, Social Security number and tax-filing status. ... Step 2: Account for multiple jobs. ... Step 3: Claim dependents, including children. ... Step 4: Refine your withholdings. ... Step 5: Sign and date your W-4.

If you are trying to locate, download, or print state of Pennsylvania tax forms, you can do so on the Pennsylvania Department of Revenue. The most common Pennsylvania income tax form is the PA-40. This form is used by Pennsylvania residents who file an individual income tax return.

After your identity is confirmed, the department will process your tax return. If you answered the questions incorrectly, a message will appear stating that additional information is required. The department will send you a separate letter detailing what is needed to complete the process of your tax return.