Pennsylvania Sample Letter for Compromise on a Debt

Description

How to fill out Sample Letter For Compromise On A Debt?

It is feasible to spend hours online looking for the legal document format that meets the state and national requirements you need.

US Legal Forms provides a vast array of legal templates that are reviewed by professionals.

It is easy to download or print the Pennsylvania Sample Letter for Compromise on a Debt from my service.

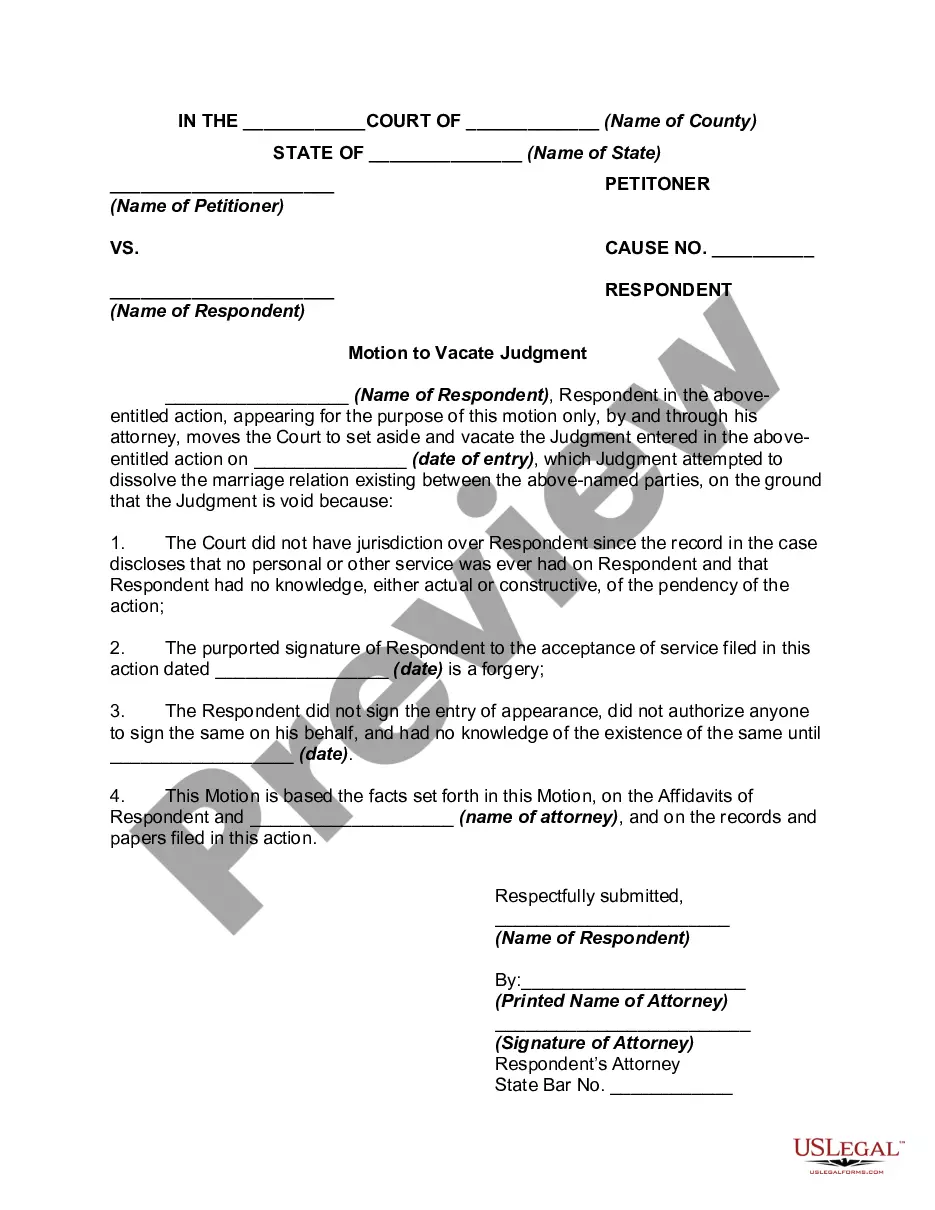

If available, use the Preview button to review the document format as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Pennsylvania Sample Letter for Compromise on a Debt.

- Every legal document template you buy is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for your state/region that you select.

- Check the form details to confirm you have selected the right form.

Form popularity

FAQ

To fill out a debt validation letter, first, include your personal details, such as your name, address, and the date. Next, clearly state that you are requesting validation of the debt, citing the specific Pennsylvania Sample Letter for Compromise on a Debt as a reference. Be sure to list the debt in question and ask for any necessary documentation to verify it. Finally, send the letter via certified mail to ensure that you have proof of delivery.

The 777 rule refers to a guideline under the Fair Debt Collection Practices Act that restricts how often debt collectors can contact you. Specifically, it states that collectors cannot reach out to you more than seven times in a week or seven times related to the same debt. Understanding this rule is vital when dealing with collections, as it can help you determine if your rights are being violated. For those seeking to negotiate terms, a Pennsylvania Sample Letter for Compromise on a Debt can assist in reframing the conversation in a constructive manner with collectors.

A dispute letter for a debt is a written communication that you can send to a creditor or debt collector to formally contest a debt you believe is inaccurate or unfair. In the context of a Pennsylvania Sample Letter for Compromise on a Debt, it typically outlines the reasons for your dispute and provides any supporting documentation. This letter serves as a crucial step in ensuring your rights are protected, and initiating a dialogue about the debt. By using the right format, you can clearly express your position, which can lead to a potential compromise.

When negotiating a debt settlement, be honest about your financial challenges and express your willingness to settle for a lower amount. Clearly articulate your proposed settlement offer and back it up with reasons for its feasibility. Using a Pennsylvania Sample Letter for Compromise on a Debt can help you structure your negotiation effectively and enhance your prospects for agreement.

A debt settlement letter should express your intent to settle the debt, specify the amount you're offering, and include relevant details about your financial struggles. You should also request a written confirmation from the creditor that the agreed settlement will resolve the debt fully. Consider referencing a Pennsylvania Sample Letter for Compromise on a Debt for guidance on what to include.

A reasonable offer to settle a debt typically ranges from 30% to 70% of the total amount owed. This range can vary based on your financial situation and the creditor's willingness to negotiate. When preparing your proposal, consider using a Pennsylvania Sample Letter for Compromise on a Debt to ensure clarity and professionalism in your communication.

To write a proof of debt letter, start with your details and state your request for documentation proving the legitimacy of the debt. Be specific about the details you need and set a deadline for their response. A Pennsylvania Sample Letter for Compromise on a Debt can serve as a practical reference, making it easier for you to create an effective request.

The 777 rule with debt collectors stipulates that after a debt collector contacts you, they cannot call you more than seven times in seven days. Understanding this rule helps maintain your rights while dealing with debt collectors. With this knowledge, you can navigate debt discussions more confidently and even make use of a Pennsylvania Sample Letter for Compromise on a Debt to communicate your intention to settle.

To write a letter to get out of debt, start by acknowledging your financial situation and expressing your desire to settle. Clearly outline your offered payment terms and explain any hardships you are facing. Incorporate a Pennsylvania Sample Letter for Compromise on a Debt to guide your writing and ensure clarity in your proposal.

When writing a letter requesting proof of debt, clearly state your name, address, and account details. Politely ask for verification of the debt in question, and specify a timeline for their response. Utilizing a Pennsylvania Sample Letter for Compromise on a Debt can streamline this process, ensuring that you cover all necessary points.