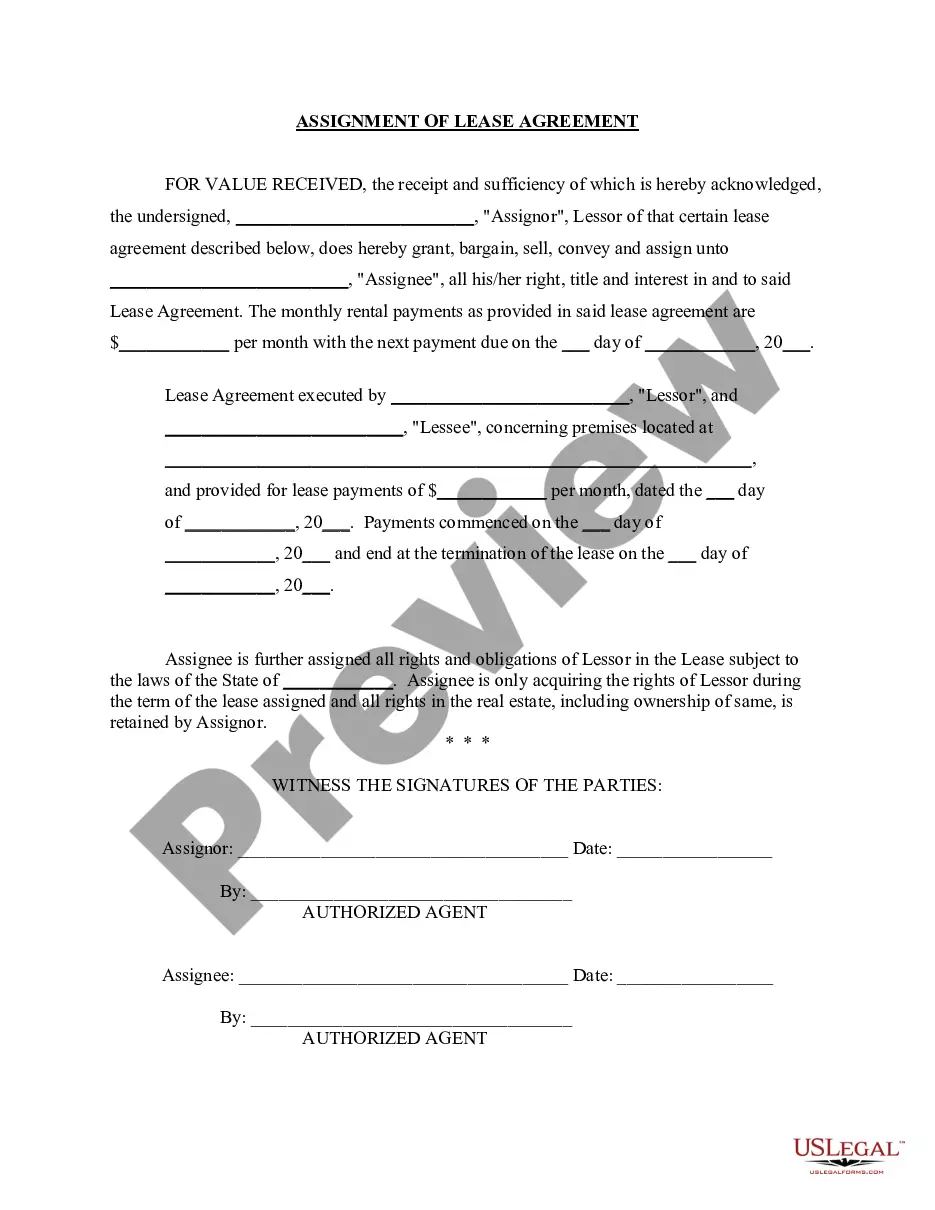

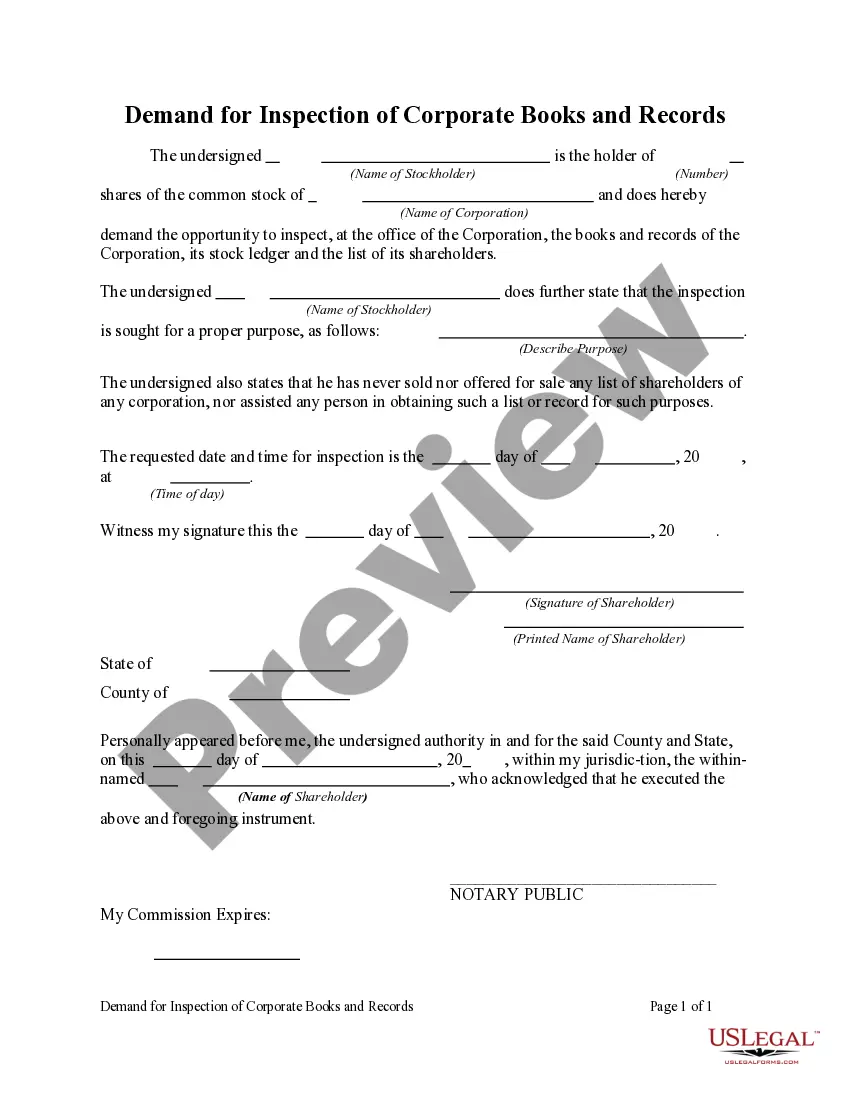

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

Are you in a situation where you require documents for either personal or organizational needs almost every day.

There are numerous legal document templates accessible online, but finding reliable ones isn't easy.

US Legal Forms offers an extensive array of document templates, including the Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, designed to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid errors.

The service offers expertly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it's for the correct area/state.

- Utilize the Review button to evaluate the form.

- Verify the details to make sure you have selected the right document.

- If the form isn't what you're looking for, use the Search section to find the document that meets your needs.

- When you identify the correct form, click Acquire now.

- Choose the pricing option you prefer, enter the required information to create your account, and complete the transaction using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually at any time as needed. Click on the necessary form to download or print the document template.

Form popularity

FAQ

A Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually specifically involves compound interest. This means the interest accumulates on both the principal and any previously earned interest. This feature can significantly increase your total return over time compared to a simple interest setup. Understanding this aspect can help you maximize the financial benefits from your promissory note.

Yes, income from a Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is generally considered taxable. When you receive interest payments, those funds must be reported on your tax returns. Be mindful of documenting any interest income properly to comply with tax regulations. Consulting a tax professional can help you navigate any specific nuances related to your situation.

While promissory notes offer flexibility, they do have disadvantages. For instance, if a borrower fails to repay a Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, they could face legal repercussions like collection actions. Additionally, both parties forfeit some negotiation options, as the terms are solidified when the note is executed. Always consider these risks carefully before entering into an agreement.

Yes, it is possible to create a promissory note with no interest. Many individuals draft a Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually at a zero percent rate. This can simplify the borrowing process and make it more attractive for those who prefer straightforward arrangements, as long as both parties consent to the terms.

Promissory notes must contain certain essential elements to be legally binding. For a Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, you should clearly outline the principal amount, maturity date, interest rate, and repayment terms. Compliance with state laws is vital, so ensure that your note adheres to Pennsylvania regulations and reflects the intention of both parties.

A note does not have to have a maturity date, particularly in the context of a Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. This structure allows for deferred payment until a specified time, offering flexibility in financial planning. However, clarity in terms is vital to avoid any potential disputes, and uslegalforms can assist you in clarifying these details.

While many promissory notes include a maturity date, it is not strictly necessary for a Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. The absence of a maturity date can provide more flexibility for both parties. It is, however, advisable to establish clear expectations for repayment, which uslegalforms can help facilitate.

Yes, a Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually can indeed lack a maturity date. Such notes allow for flexible repayment terms. However, it's essential to specify the conditions under which repayment will occur. Always consider your options carefully and consult the resources available at uslegalforms for guidance.

To calculate compound interest on a Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, you'll need to know your principal amount, the interest rate, and the time involved in the investment. Use the formula A = P(1 + r/n)^(nt), making sure to account for how frequently interest compounds. With this insight, you can determine your total obligations at maturity. Employing resources like uslegalforms can simplify this calculation and provide templates for your notes.

Interest on a Pennsylvania Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is typically calculated on the outstanding principal balance over a specified time period. The interest is added to the principal when payment is due and can build up substantially if not monitored. Understanding this calculation allows you to manage your finances effectively. Tools available from uslegalforms can assist you in tracking interest to avoid surprises at maturity.