With regard to the collection part of this form agreement, the Federal Fair Debt Collection Practices Act prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representations are forbidden, such as representing that the debt collector is associated with the state or federal government, stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

Pennsylvania Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable

Description

How to fill out Agreement For Sale And Purchase Of Accounts Receivable Of Business With Seller Agreeing To Collect The Accounts Receivable?

If you need to fill out, obtain, or print legal document templates, utilize US Legal Forms, the largest compilation of legal documents available on the web. Take advantage of the site’s user-friendly and efficient search to locate the files required.

Various templates for business and personal use are organized by categories and states, or keywords. Use US Legal Forms to find the Pennsylvania Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable in just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Pennsylvania Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable. You can also view forms you previously acquired in the My documents tab of your account.

Every legal document template you obtain is yours indefinitely. You will have access to every form you purchased with your account. Click the My documents section and choose a form to print or download again.

Compete and obtain, and print the Pennsylvania Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s details. Make sure to read the information.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Get now button. Choose your preferred pricing plan and provide your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

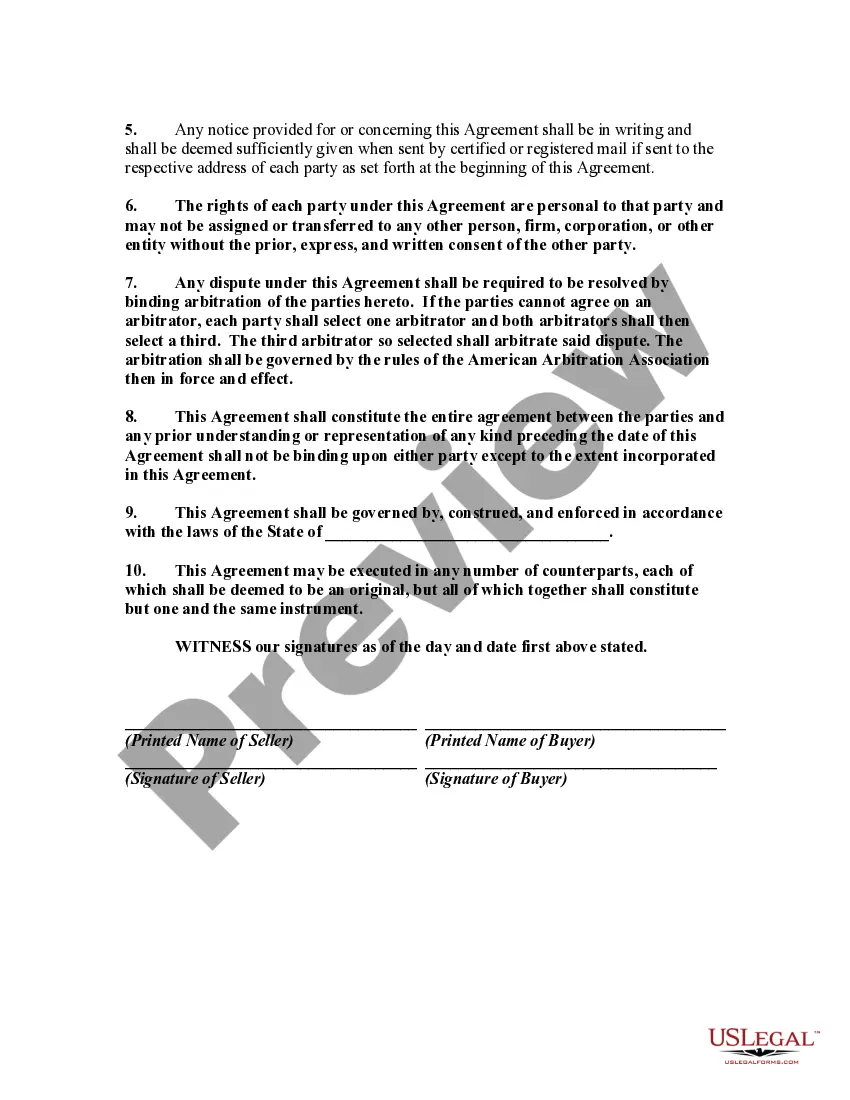

- Step 7. Complete, modify, and print or sign the Pennsylvania Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable.

Form popularity

FAQ

In nearly all small business sales, the seller will retain the cash and accounts receivables, they will pay off the payables, and deliver the business "free and clear" to you. In larger purchases, the buyers will likely acquire these balance sheet items to provide them with immediate working capital.

Also, including accounts receivable as part of the asset purchase agreement can lead to unwanted tension, and possibly litigation, between the buyer and the seller. There is the risk that some of the payors will continue to pay the seller, instead of the buyer, leading to disputes over the after-closing payments.

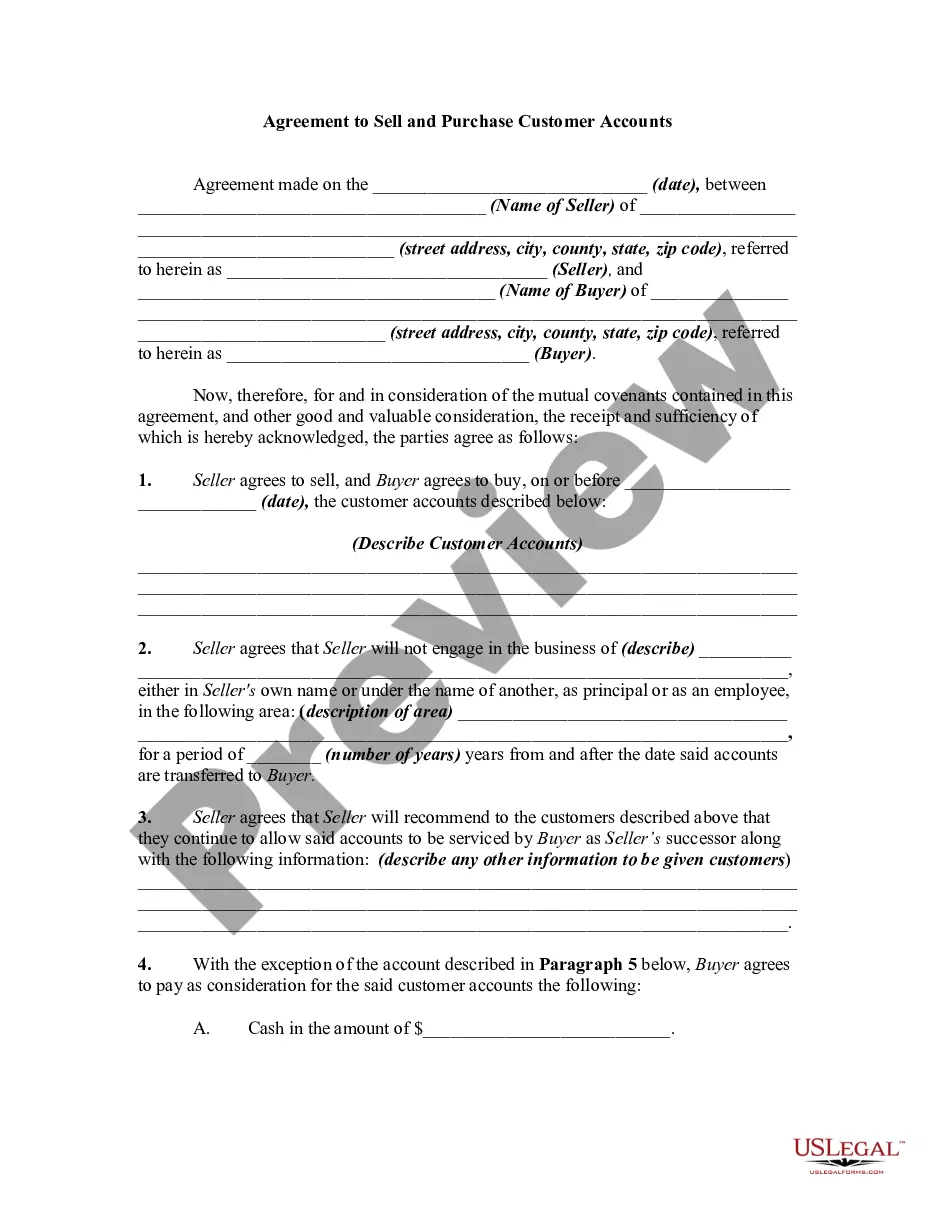

Receivables purchase agreements (RPAs) are financing arrangements that can unlock the value of a company's accounts receivable. Here's how they work: A "Seller" will sell its goods to a customer (1). The customer becomes an "Account Debtor" since it owes the Seller a Debt for those goods (2).

You can save taxes on sales by keeping accounts receivables. When you maintain receivables, you only pay taxes after receiving income. You also enjoy write-offs for collectible payments. When the buyer acquires accounts receivables, you file the amount as income after-sales.

With invoice factoring, you sell your invoices to a factoring company that charges a fee for their services. After they review your invoice documentation and check your customers' credit, they will advance you a portion (typically 70-90%) of the funds in the amount of your invoices.

A receivables purchase agreement is a contract between two or more parties, usually a buyer or a customer and a seller. This contract is often a kind of purchase arrangement that outlines the terms and conditions of the sale.

Accounts receivable are held by a seller and refer to promises of payment from customers to sellers. These transactions are often called credit sales or sales on account (or on credit). Accounts receivable are increased by credit sales and billings to customers, but are decreased by customer payments.

For many business sales, the buyer receives the receivable accounts. Service businesses such as doctor's practices or heating and air conditioning companies that rely on repeat business often must assume the debt to maintain the client base. The buyer assumes the risk as well as the customers.