This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Pennsylvania Second Amendment of Trust Agreement

Description

How to fill out Second Amendment Of Trust Agreement?

US Legal Forms - among the largest collections of legal documents in the United States - offers a vast array of legal template formats that you can download or print.

By using the website, you can access thousands of forms for commercial and personal use, organized by categories, states, or keywords. You can find the latest editions of forms such as the Pennsylvania Second Amendment of Trust Agreement in no time.

If you already have a monthly subscription, Log In and obtain the Pennsylvania Second Amendment of Trust Agreement from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously acquired forms within the My documents section of your account.

Process the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Complete, modify, print, and sign the downloaded Pennsylvania Second Amendment of Trust Agreement.

Every document you added to your account has no expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the form’s details.

- Read the form summary to confirm that you've chosen the right form.

- If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- Once satisfied with the form, confirm your choice by clicking the Order now button.

- Then, choose the payment plan you prefer and provide your information to sign up for an account.

Form popularity

FAQ

The PA inheritance tax return must be filed by the executor or administrator of an estate when the estate's value exceeds a specific limit. Even if no tax is owed, filing remains necessary, especially for estates established under the Pennsylvania Second Amendment of Trust Agreement. For assistance with inheritance tax filings, consider exploring solutions offered by UsLegalForms to streamline the process.

Individuals and entities with taxable income generated within Pennsylvania must file a PA tax return. This includes residents, non-residents earning income in the state, and entities such as partnerships and corporations. If your business or estate involves the Pennsylvania Second Amendment of Trust Agreement, understanding tax obligations is key. Platforms like UsLegalForms can help clarify your filing responsibilities.

Similar to the previous question, PA 41 must be filed by estates and trusts that generate income above the state's minimum threshold. If you are representing a trust or estate established under the Pennsylvania Second Amendment of Trust Agreement, proper reporting is crucial. By utilizing services like those offered by UsLegalForms, you can ensure compliance with all necessary filing requirements.

The PA 41 form is necessary for estates or trusts that have income sources exceeding certain thresholds within Pennsylvania. Additionally, any estates or trusts engaging in business transactions, as specified by the Pennsylvania Second Amendment of Trust Agreement, must file this form. If you’re managing an estate, seeking legal help can ensure proper filing. Resources from UsLegalForms can guide you through this process efficiently.

In Pennsylvania, certain individuals are exempt from the local services tax. This includes members of the armed forces, individuals with low income, and those who are disabled. Understanding these exemptions can simplify the financial responsibilities you have under the Pennsylvania Second Amendment of Trust Agreement. If you have questions about your situation, consider consulting with a tax professional or using the services available at UsLegalForms.

As previously mentioned, Pennsylvania has indeed adopted the Uniform Trust Code, which standardizes trust administration within the state. This comprehensive code reinforces the rights of both trustees and beneficiaries. Individuals planning their estate with a Pennsylvania Second Amendment of Trust Agreement will find it easier to comply with these established laws.

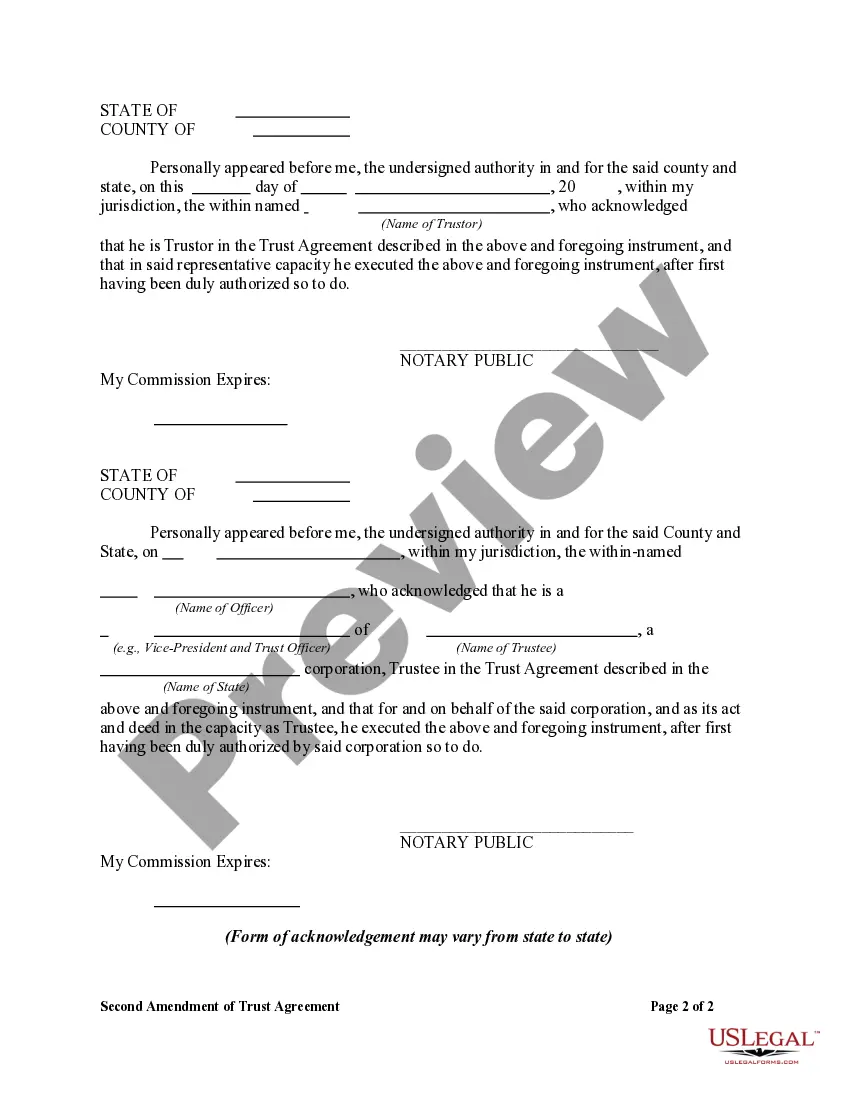

An amendment to the trust agreement is a legal document that modifies the terms of an existing trust. This allows the grantor to change various aspects of the trust without creating a new document. If you are considering updating your estate plan, incorporating a Pennsylvania Second Amendment of Trust Agreement can facilitate the necessary changes with ease.

Yes, Pennsylvania has adopted the Uniform Commercial Code (UCC), which governs commercial transactions. The UCC streamlines and standardizes various aspects of business practices within the state. For those creating a Pennsylvania Second Amendment of Trust Agreement, knowledge of the UCC can be crucial if commercial assets are involved.

The Uniform Directed Trust Act provides a framework for creating directed trusts in Pennsylvania, allowing specific parties to manage certain aspects of the trust. This act enhances flexibility in trust administration by separating investment and distribution functions. Understanding how this act interacts with your Pennsylvania Second Amendment of Trust Agreement ensures effective management of your trust properties.

Yes, in Pennsylvania, a trust can hold title to real property. This structure allows for better management of assets and can help in the efficient transfer of property upon an individual's passing. Including real estate in your Pennsylvania Second Amendment of Trust Agreement may be a wise approach to estate planning.