Pennsylvania Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment

Description

How to fill out Agreement For Assignment And Sale Of Partnership Interest And Reorganization With Purchaser As New Partner Including Assignment?

Are you in a circumstance where you require documents for occasional business or particular purposes almost daily.

There are numerous legal document templates available online, but finding reliable ones isn't easy.

US Legal Forms offers a vast array of form templates, including the Pennsylvania Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner inclusive of Assignment, which are crafted to comply with state and federal regulations.

If you find the appropriate form, just click Get now.

Select the pricing plan you prefer, enter the required information to create your account, and place an order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Pennsylvania Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct jurisdiction/area.

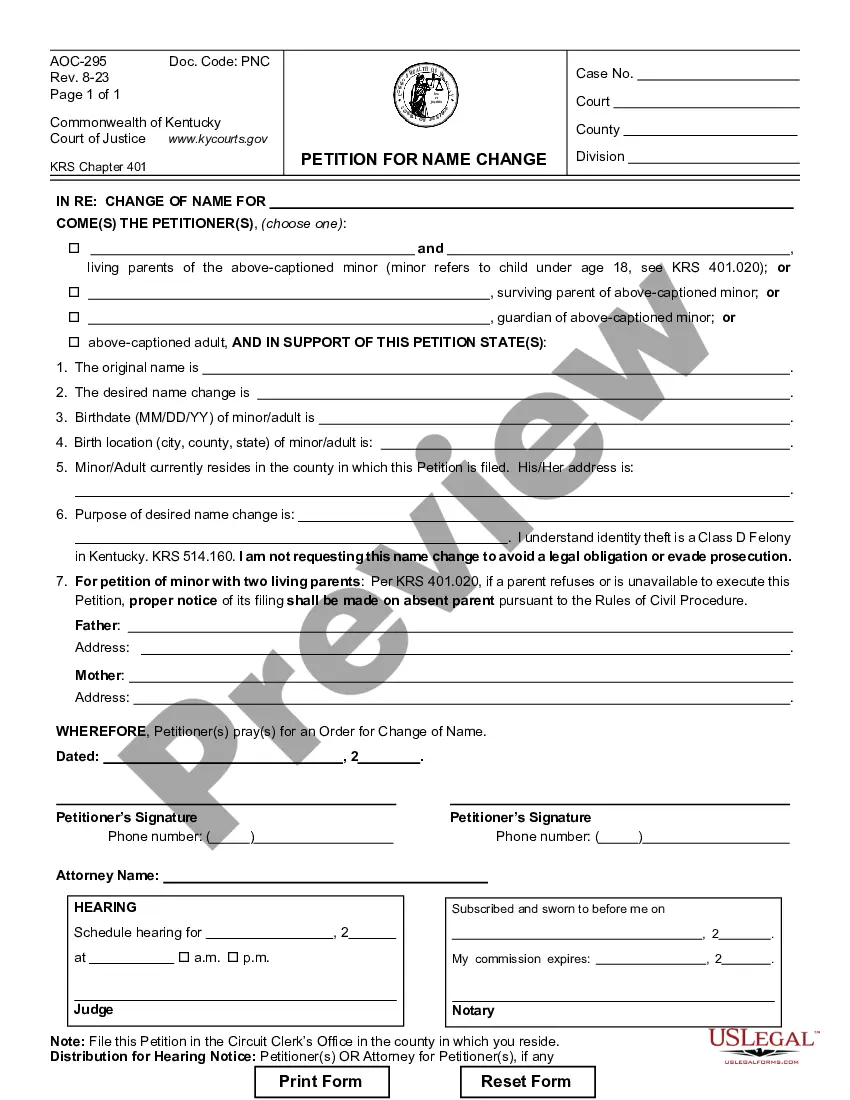

- Utilize the Preview button to view the form.

- Check the description to ensure that you have selected the accurate form.

- If the form isn't what you're looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

The transfer of partnership interest from one partner to another involves formally assigning the rights and obligations associated with that interest. This process typically requires the approval of the remaining partners as outlined in the partnership agreement. A well-structured Pennsylvania Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can facilitate this transfer, ensuring all legal aspects are addressed efficiently. Engaging with a legal platform can help make this transition smooth.

To report the sale of your partnership interest, gather all relevant financial documents reflecting the sale. You will report the transaction on your individual tax return, utilizing IRS Form 1065 to report the partnership income. Ensure you account for your share of insight into any gains or losses incurred during the sale. Consider the Pennsylvania Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment for clarity and legal backing in your reporting.

When reporting the sale of partnership interest, you typically need to disclose the details on your tax return. The sale must be reported using IRS Form 1065 for partnerships and Schedule K-1 for each partner's share of profits and losses. It's essential to calculate any gain or loss from the transaction, which may vary based on various deductions. Utilize resources like the Pennsylvania Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment to streamline the process.

To form a partnership in Pennsylvania, start by choosing a unique name for your partnership. You will need to prepare a partnership agreement that outlines the roles, responsibilities, and contributions of each partner. Once your agreement is in place, you can register your partnership with the state and obtain any necessary licenses or permits. Additionally, consider using a Pennsylvania Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment for future transactions.

To form a limited partnership in Pennsylvania, you need to file a Certificate of Limited Partnership with the Pennsylvania Department of State. This document should detail the partnership name, the address of the principal office, and the names of both general and limited partners. It’s essential to create a comprehensive partnership agreement that aligns with the Pennsylvania Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment. This agreement outlines each partner's rights and responsibilities, helping to prevent potential disputes in the future.

When accounting for the sale of partnership interest, it is crucial to follow the guidelines set forth in the Pennsylvania Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment. Begin by documenting the transaction clearly, specifying the value of the partnership interest sold. Then, adjust the capital accounts of partners in accordance with the terms outlined in your agreement. This process ensures that all partners are informed of any changes to their financial standing.

An assignment of an interest in a general partnership refers to the process where a partner transfers their rights and obligations under the partnership agreement to another party. Typically formalized through a Pennsylvania Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment, this process allows for smooth transitions of partnerships. The assignee may gain the profits and responsibilities tied to the interest but does not usually become a partner unless explicitly stated. Engaging legal services can facilitate these assignments efficiently.

Yes, an interest in a partnership can be gifted, but certain legal formalities must be observed. The process often requires a Pennsylvania Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment to document the transfer of interest. Additionally, donors must consider potential tax implications when gifting partnership interests. Consulting a financial advisor is beneficial to navigate these situations.

To report a sale of partnership interest, you must follow specific guidelines set by the IRS and state regulations. A Pennsylvania Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment typically includes all necessary details to complete this process. Both buyers and sellers should ensure they file appropriate tax forms reflecting the sale. It is advisable to consult with a tax professional to ensure compliance.

Yes, you can transfer partnership interest to another person, but this must be done in accordance with the terms set out in your partnership agreement. The process typically requires a Pennsylvania Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment to formalize the transfer. Proper documentation ensures all involved parties are aware of new rights and responsibilities. Legal guidance can facilitate a smooth transfer.