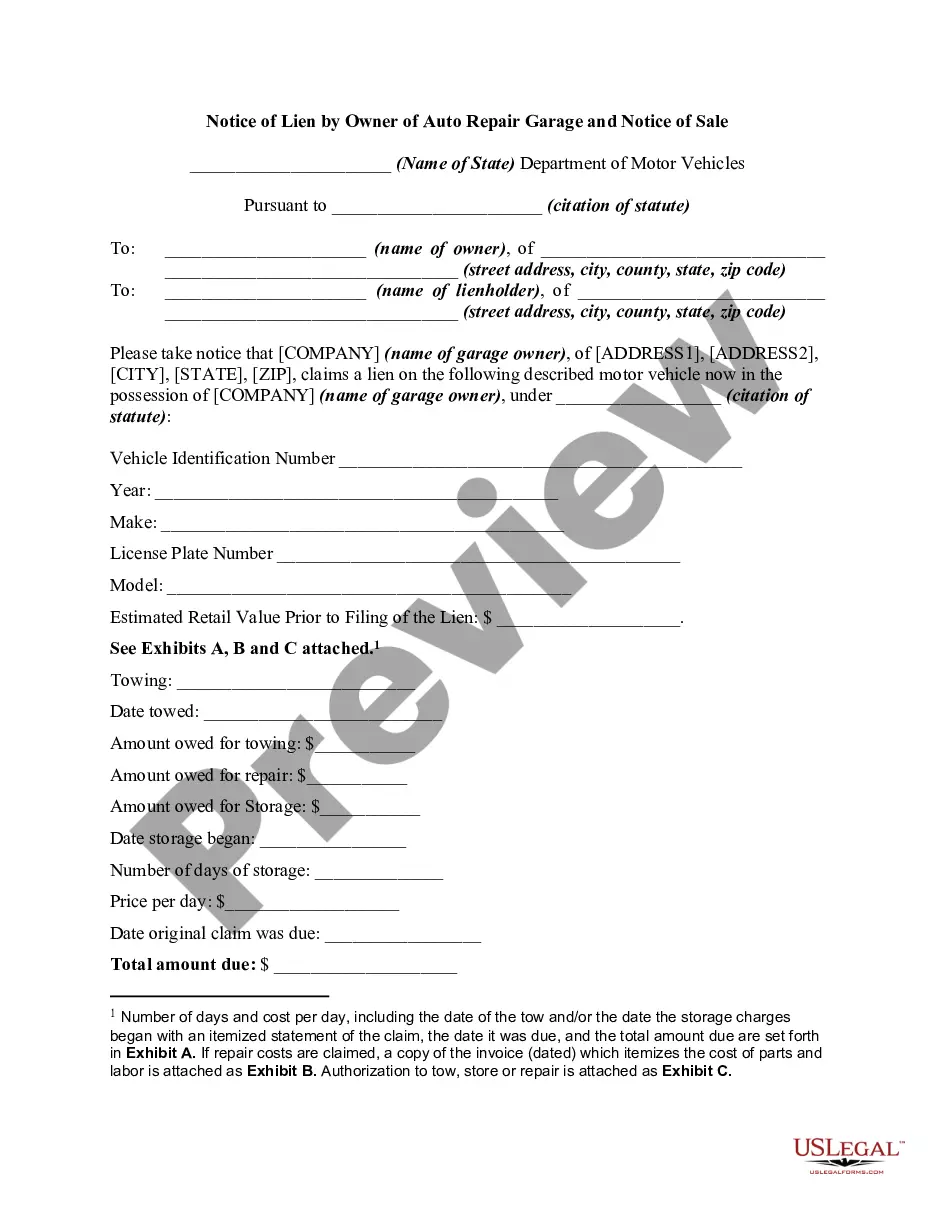

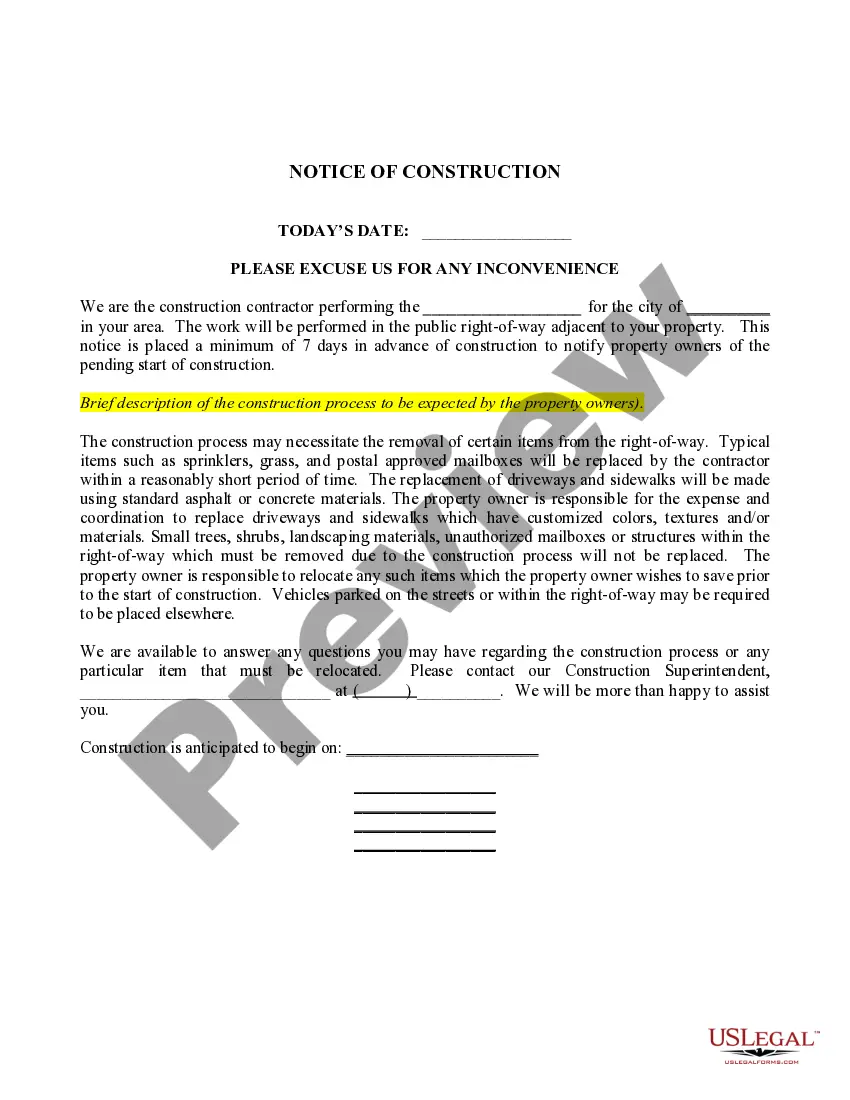

Pennsylvania Lien Notice

Description

How to fill out Lien Notice?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal form templates you can obtain or print.

By using the website, you can discover thousands of forms for business and personal use, sorted by categories, states, or keywords. You can find the latest versions of forms like the Pennsylvania Lien Notice in moments.

If you have an account, Log In to get the Pennsylvania Lien Notice from the US Legal Forms directory. The Download button will appear on every form you view. You can also access all previously acquired forms in the My documents section of your profile.

Every template added to your account does not expire and is yours indefinitely. Therefore, if you want to download or print another copy, just navigate to the My documents section and click on the form you need.

Access the Pennsylvania Lien Notice through US Legal Forms, one of the most extensive repositories of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

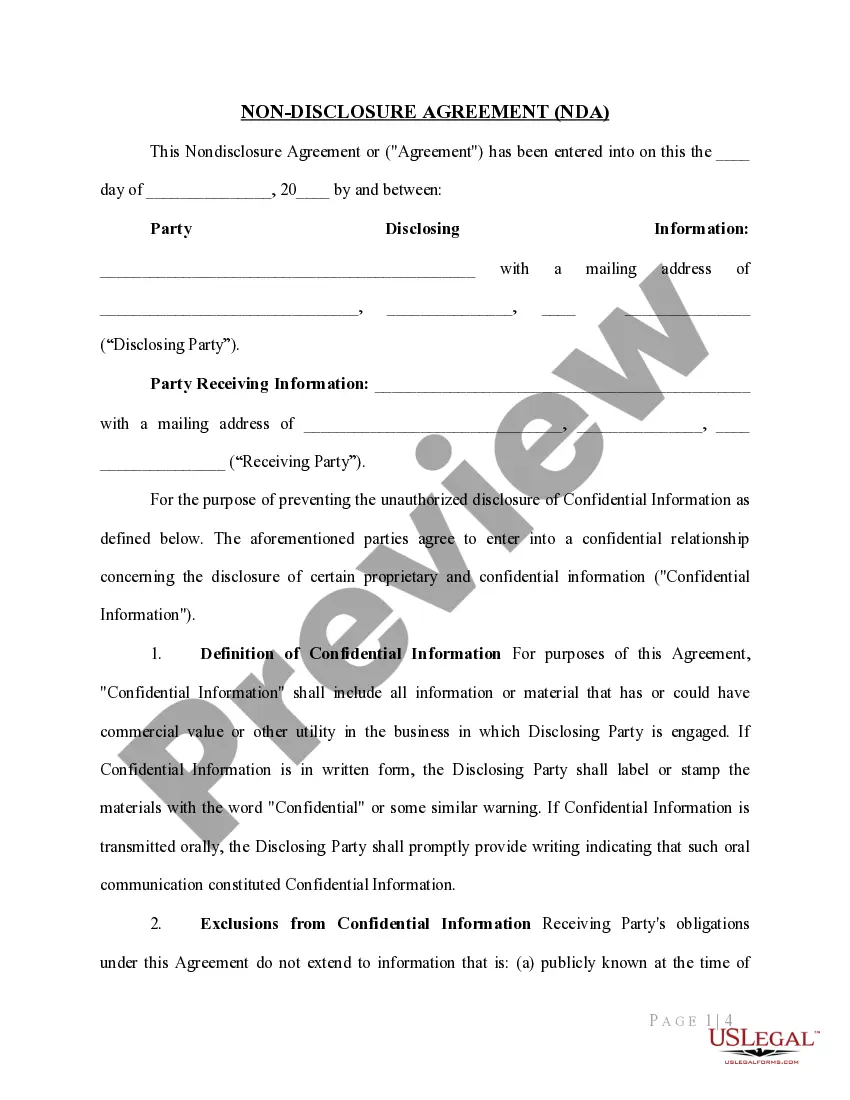

- Ensure that you have selected the correct form for your city/region. Click the Preview button to review the form's details. Check the form description to ensure you have chosen the correct one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, select the pricing plan you prefer and provide your information to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

- Choose the format and download the form to your device.

- Make edits. Fill out, modify, print, and sign the downloaded Pennsylvania Lien Notice.

Form popularity

FAQ

The lien law in Pennsylvania provides a legal framework for creditors to secure payment by placing a lien on a property. This process begins with filing a Pennsylvania lien notice, which serves to inform property owners and potential buyers of the existing claim. The law outlines the rights and obligations of both the lienholder and property owner, ensuring fairness in transactions. To navigate these complexities, you can rely on US Legal Forms to access comprehensive legal documents and resources tailored to Pennsylvania's lien laws.

A Pennsylvania lien notice typically remains effective for a period of five years from the date it is filed. However, this duration can extend if you take legal action to enforce the lien, such as initiating a lawsuit. It's important to understand that timely action is crucial to protect your rights under Pennsylvania's lien laws. For complete guidance on managing lien notices, consider using the resources available on US Legal Forms.

Selling a house with a lien in Pennsylvania is possible, but it involves additional steps. You must disclose the lien to potential buyers, and most will require it to be cleared before finalizing the sale. Resolving the lien often requires obtaining a Pennsylvania Lien Notice to show that the issue has been addressed, ensuring a smoother transaction.

The time it takes to receive a lien release in Pennsylvania can vary depending on the lienholder's responsiveness. Generally, if all payments are up to date, you might receive the Pennsylvania Lien Notice within a few days to a couple of weeks. To expedite this process, maintaining good communication with the lienholder is crucial.

To remove a lien in Pennsylvania, you typically need to obtain a release from the lienholder. This could involve paying any outstanding debts or reaching a settlement with them. Once the lienholder provides the necessary Pennsylvania Lien Notice, you can file it with the appropriate county office to officially clear the lien from your property.

In Pennsylvania, lien waivers are not mandatory but can be beneficial in protecting your rights during a construction project. They serve to confirm that a contractor or subcontractor has received payment and will not file a Pennsylvania Lien Notice. Consider implementing lien waivers in your contracts to minimize risks associated with unpaid services.

To request a lien release letter in Pennsylvania, you should contact the lienholder directly. Provide them with the necessary information regarding your property and the lien in question. If you have settled your obligations, request that they issue a Pennsylvania Lien Notice for the release. Utilizing services from platforms like US Legal Forms can streamline this process.

A lien is generally valid in Pennsylvania for a period of five years. After this duration, Pennsylvania Lien Notices may need to be renewed or may become unenforceable. To ensure you have the latest information, consulting an expert or using a platform like USLegalForms can provide clarity on any specific case.

The most common type of lien on property is a mortgage lien. However, Pennsylvania Lien Notices, such as those arising from unpaid taxes or contractor bills, also frequently occur. Knowing the different types of liens can help property owners take proactive measures in managing their property.

To conduct a property title search in Pennsylvania, start by visiting the local county recorder's office or their website. You can look for property records, including any filed Pennsylvania Lien Notices. If you prefer a quicker method, services like USLegalForms offer comprehensive tools that simplify the searching process and provide accurate results.