Pennsylvania Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness

Description

How to fill out Liquidation Agreement Regarding Debtor's Collateral In Satisfaction Of Indebtedness?

Choosing the best authorized file design could be a have difficulties. Needless to say, there are a variety of themes accessible on the Internet, but how would you find the authorized form you require? Utilize the US Legal Forms internet site. The service offers thousands of themes, such as the Pennsylvania Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness, that can be used for business and private demands. All the forms are examined by specialists and meet state and federal requirements.

When you are presently signed up, log in to the bank account and then click the Down load button to find the Pennsylvania Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness. Make use of bank account to check from the authorized forms you might have acquired in the past. Go to the My Forms tab of your bank account and obtain another duplicate of the file you require.

When you are a brand new customer of US Legal Forms, here are easy directions so that you can comply with:

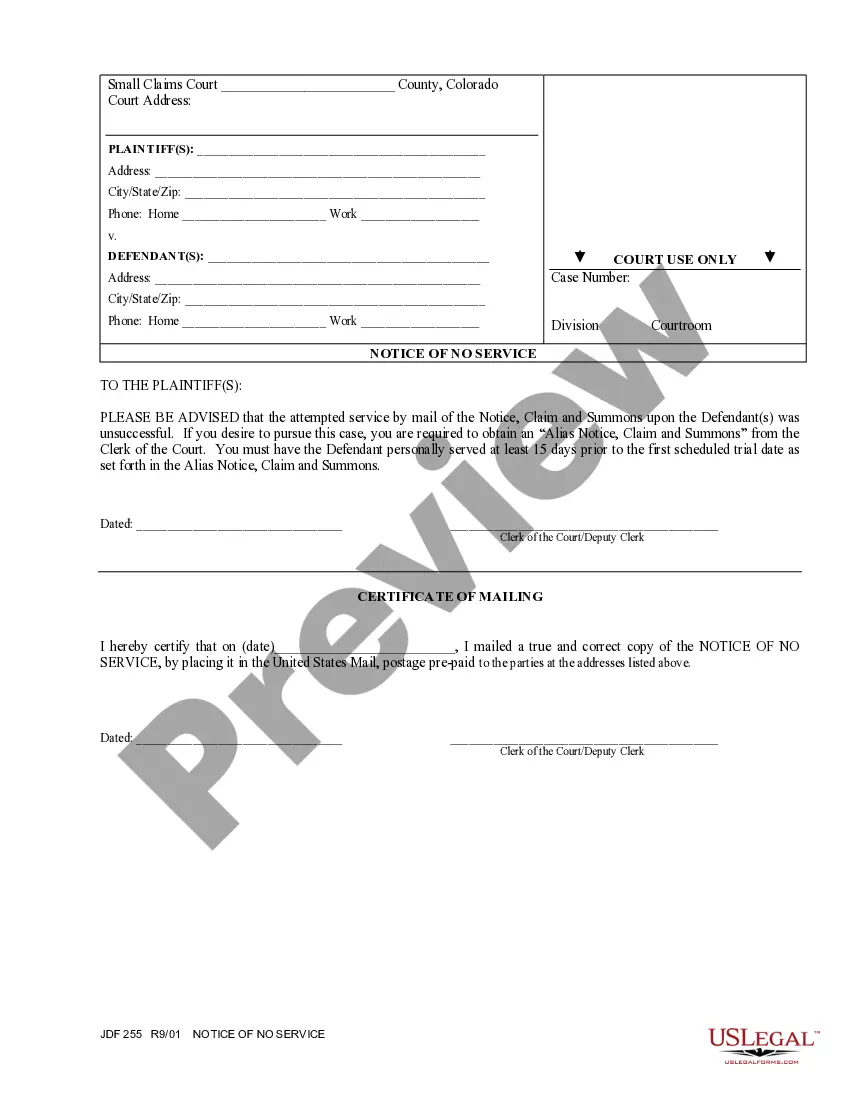

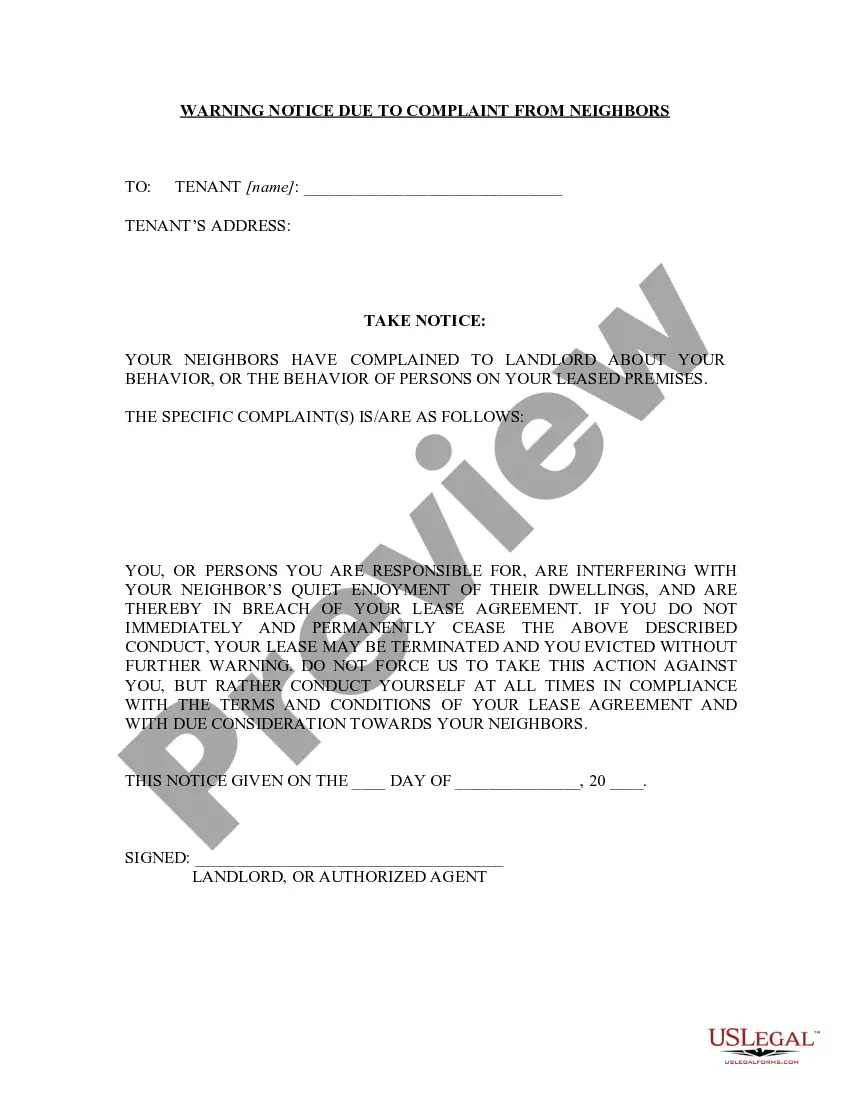

- Initial, make certain you have selected the appropriate form to your city/county. You may check out the shape using the Review button and look at the shape outline to make certain it will be the best for you.

- When the form does not meet your requirements, utilize the Seach discipline to discover the appropriate form.

- Once you are certain the shape is acceptable, click on the Get now button to find the form.

- Pick the pricing plan you want and type in the essential details. Create your bank account and pay money for the transaction with your PayPal bank account or credit card.

- Opt for the document structure and down load the authorized file design to the system.

- Complete, modify and print out and indication the acquired Pennsylvania Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness.

US Legal Forms may be the largest local library of authorized forms where you can see numerous file themes. Utilize the company to down load skillfully-created paperwork that comply with condition requirements.

Form popularity

FAQ

Under Pennsylvania law, parties asserting claims for breach of contract must allege the following three elements: ?(1) the existence of a contract, including its essential terms; (2) a breach of duty imposed by the contract; and (3) resultant damages.? Alpart v. Gen. Land Partners, Inc., 574 F. Supp.

Every U.S. state and the District of Columbia have adopted at least part of the UCC (though it has not been adopted as federal law). Each jurisdiction, however, may make its own modifications (Louisiana has never adopted Article 2), and may organize its version of the UCC differently.

Uniform Commercial Code (UCC) filings allow creditors to notify other creditors about a debtor's assets used as collateral for a secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

Pennsylvania applies a two year statute of limitation for personal injury and property damage and a four year statute of limitations for breach of contract actions.

The PA UCC first took effect on April 9, 2004 with the adoption and use of the ICC's International Codes 2003.

The Commonwealth of Pennsylvania has adopted the National UCC Financing Statement (PDF), the National UCC Financing Statement Amendment (PDF), the Information Request (PDF) and the Information Statement (PDF) as approved by the International Association of Commercial Administrators (IACA).

Pennsylvania has adopted the following Articles of the UCC: Article 3: Negotiable instruments: UCC Article 3 applies to negotiable instruments.

A security interest is taken by a person who, by making advances or incurring an obligation, gives something of value that enables the debtor to acquire the rights in the collateral or to use it.