Pennsylvania Notice that use of Website is Subject to Guidelines

Description

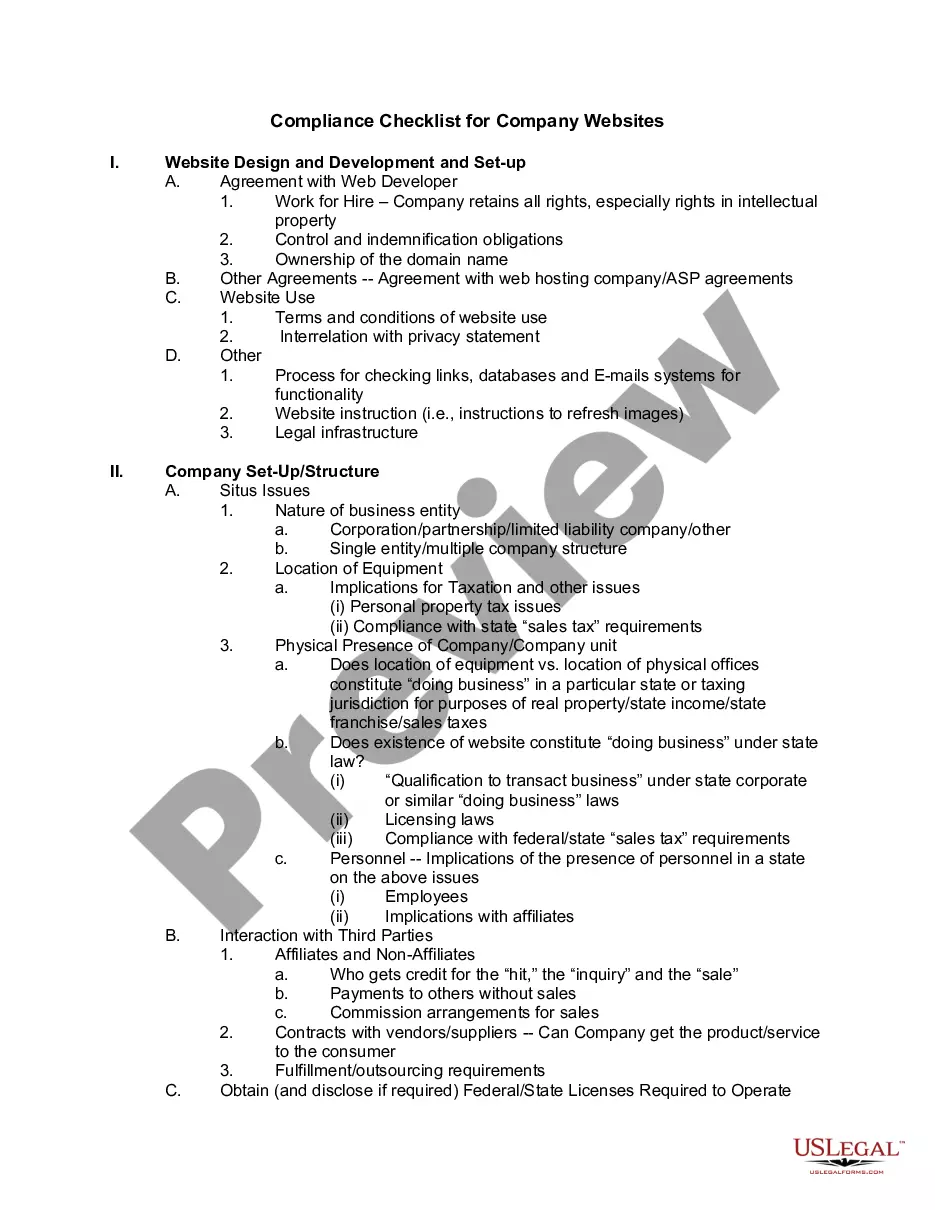

How to fill out Notice That Use Of Website Is Subject To Guidelines?

You might spend various hours online looking for the legal document template that meets the federal and state criteria you need.

US Legal Forms offers thousands of legal forms that are assessed by experts.

You can easily download or print the Pennsylvania Notice that use of Website is Subject to Guidelines from your service.

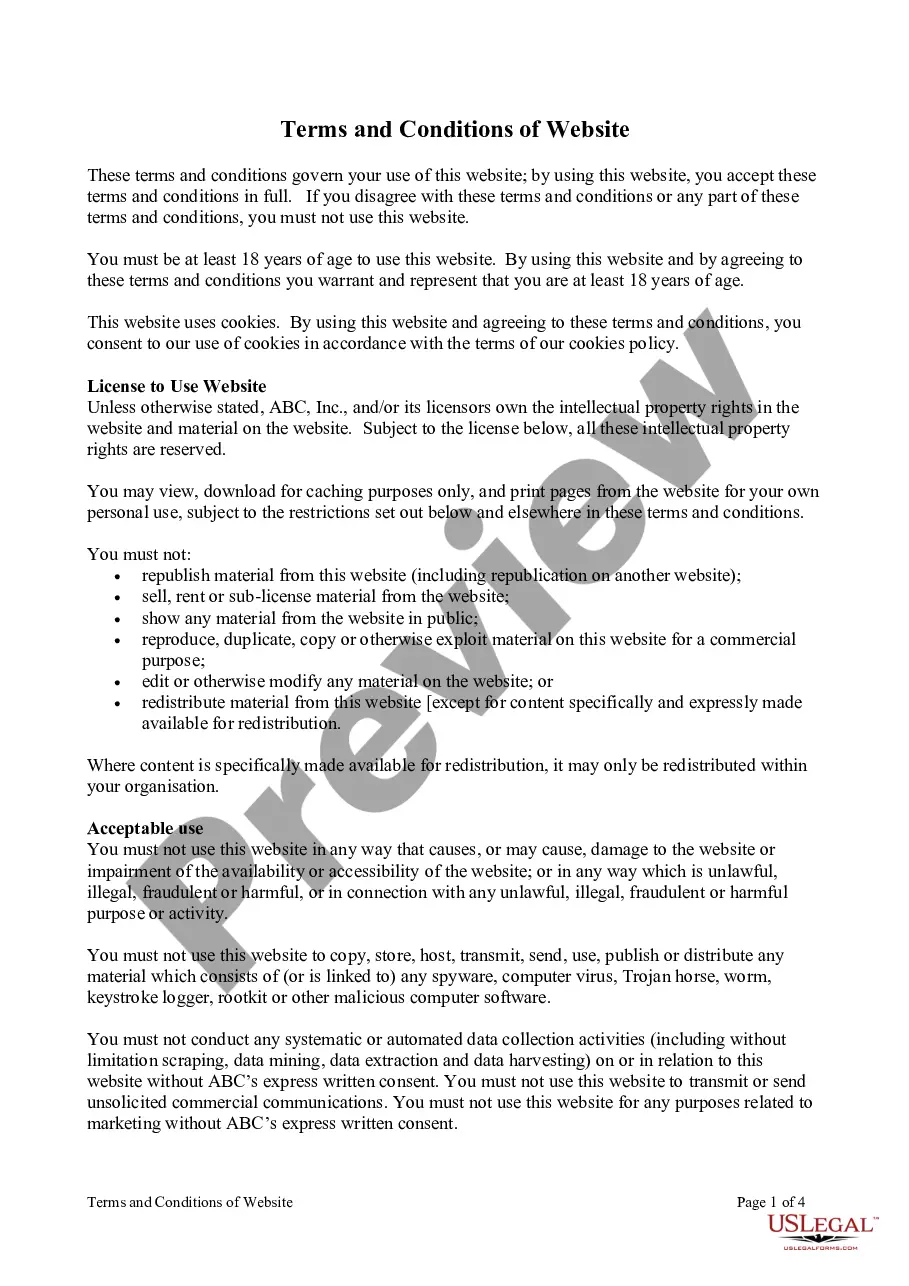

If available, use the Review button to look through the document template as well. If you wish to obtain another version of the form, utilize the Search area to find the template that fits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can fill out, edit, print, or sign the Pennsylvania Notice that use of Website is Subject to Guidelines.

- Each legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/area of your preference.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

The PA-40 form is the Pennsylvania Personal Income Tax Return that residents must file to report their taxable income. This form gathers information on wages, interest, dividends, and other income sources to determine your tax liability. Being accurate and timely with your PA-40 submission is important for compliance, in line with the Pennsylvania Notice that use of Website is Subject to Guidelines. For assistance in filing, consider using uslegalforms for efficient processing.

Public Law 86-272 applies to the taxation of income earned by businesses operating across state lines. Specifically, it protects companies from income tax in states where they have minimal contact or activities. Familiarizing yourself with this law is vital, especially in the context of the Pennsylvania Notice that use of Website is Subject to Guidelines, as it can influence your tax strategy. For detailed information, platforms like uslegalforms can provide helpful insights.

Public Law 86-272 primarily protects businesses from state taxation if they only conduct limited activities within a state. This law exempts income derived from interstate commerce if the business does not have a physical presence in that state. Understanding this can help you navigate complex tax situations and adhere to the Pennsylvania Notice that use of Website is Subject to Guidelines. If you're unsure about your obligations, consult resources like uslegalforms for guidance.

If you fail to file local taxes in Pennsylvania, you may face penalties and interest on the taxes owed. Local authorities often enforce collection actions, which can include wage garnishments or liens on your property. It's crucial to stay informed about your obligations, as the Pennsylvania Notice that use of Website is Subject to Guidelines emphasizes compliance with local law. Consider using platforms like uslegalforms to help you file correctly and avoid complications.

Whether you need a local license to sell online depends on your location and the nature of your business. Many municipalities have specific requirements for businesses, even those operating online. It's advisable to consult local regulations and the Pennsylvania Notice that use of Website is Subject to Guidelines for comprehensive information on licensing requirements.

In general, if you are selling online in Pennsylvania, you may need a business license, especially if your sales exceed certain thresholds. It's essential to research local laws and industry standards to ensure compliance. The Pennsylvania Notice that use of Website is Subject to Guidelines can assist you in understanding what licenses may be applicable to your online business.

Public Law 86-272 is a federal law that provides exemption from state income tax for businesses whose only activity in the state involves solicitation of sales. This law ensures that income from these sales is not taxable under certain conditions. Understanding this law is critical for businesses to determine their tax responsibilities in Pennsylvania, particularly alongside the Pennsylvania Notice that use of Website is Subject to Guidelines.

Yes, if you sell on Etsy and your business is based in Pennsylvania, you may need a business license depending on your local regulations. Ensure that you comply with any local municipal requirements for online retail. Additionally, familiarizing yourself with the Pennsylvania Notice that use of Website is Subject to Guidelines will help inform your obligations when selling online.

To determine if you need a business license in Pennsylvania, you should check local regulations and industry requirements. Different municipalities may have different licensing rules, especially for specific sectors such as retail or services. It's beneficial to review the Pennsylvania Notice that use of Website is Subject to Guidelines to find detailed information regarding your business activities.

Starting an online business in Pennsylvania requires a few key steps, including selecting a business structure, registering your business name, and obtaining necessary licenses. You'll also need to understand local tax obligations and any online sales regulations. The Pennsylvania Notice that use of Website is Subject to Guidelines can help you navigate these requirements effectively.