Maine Depreciation Schedule

Description

How to fill out Depreciation Schedule?

Selecting the finest authorized document template can be a challenge. There are numerous options available online, but how do you find the legal form you require? Utilize the US Legal Forms platform. This service provides thousands of templates, such as the Maine Depreciation Schedule, suitable for business and personal use. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Maine Depreciation Schedule. Use your account to review the legal documents you have previously purchased. Navigate to the My documents section of your account to download another copy of the document you require.

If you are a new user of US Legal Forms, here are some simple instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can preview the document using the Preview button and read the description to confirm it is suitable for you.

US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize this service to download properly crafted documents that adhere to state requirements.

- If the form does not satisfy your needs, use the Search feature to find the appropriate form.

- Once you are certain that the form is correct, click the Buy Now button to acquire the form.

- Select the pricing plan you prefer and input the necessary information.

- Create your account and pay for the purchase using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, modify, print, and sign the downloaded Maine Depreciation Schedule.

Form popularity

FAQ

To get a depreciation tax shield, you must calculate the depreciation expense for your assets. This shield reduces your taxable income, resulting in lower taxes. Utilizing the Maine Depreciation Schedule can help you effectively determine your depreciation expense and maximize your tax benefits.

For tax years 2015 through 2017, first-year bonus depreciation was set at 50%. It was scheduled to go down to 40% in 2018 and 30% in 2019, and then not be available in 2020 and beyond. The Tax Cuts and Jobs Act, enacted at the end of 2018, increases first-year bonus depreciation to 100%.

The total section 179 deduction and depreciation you can deduct for a passenger automobile, including a truck or van, you use in your business and first placed in service in 2021 is $18,200, if the special depreciation allowance applies, or $10,200, if the special depreciation allowance does not apply.

States that have adopted the new bonus depreciation rules:Alabama.Alaska.Colorado.Delaware.Illinois.Kansas.Louisiana.Michigan.More items...

Eligible Property - In order to qualify for 30, 50, or 100 percent bonus depreciation, the original use of the property must begin with the taxpayer and the property must be: 1) MACRS property with a recovery period of 20 years or less, 2) depreciable computer software, 3) water utility property, or 4) qualified

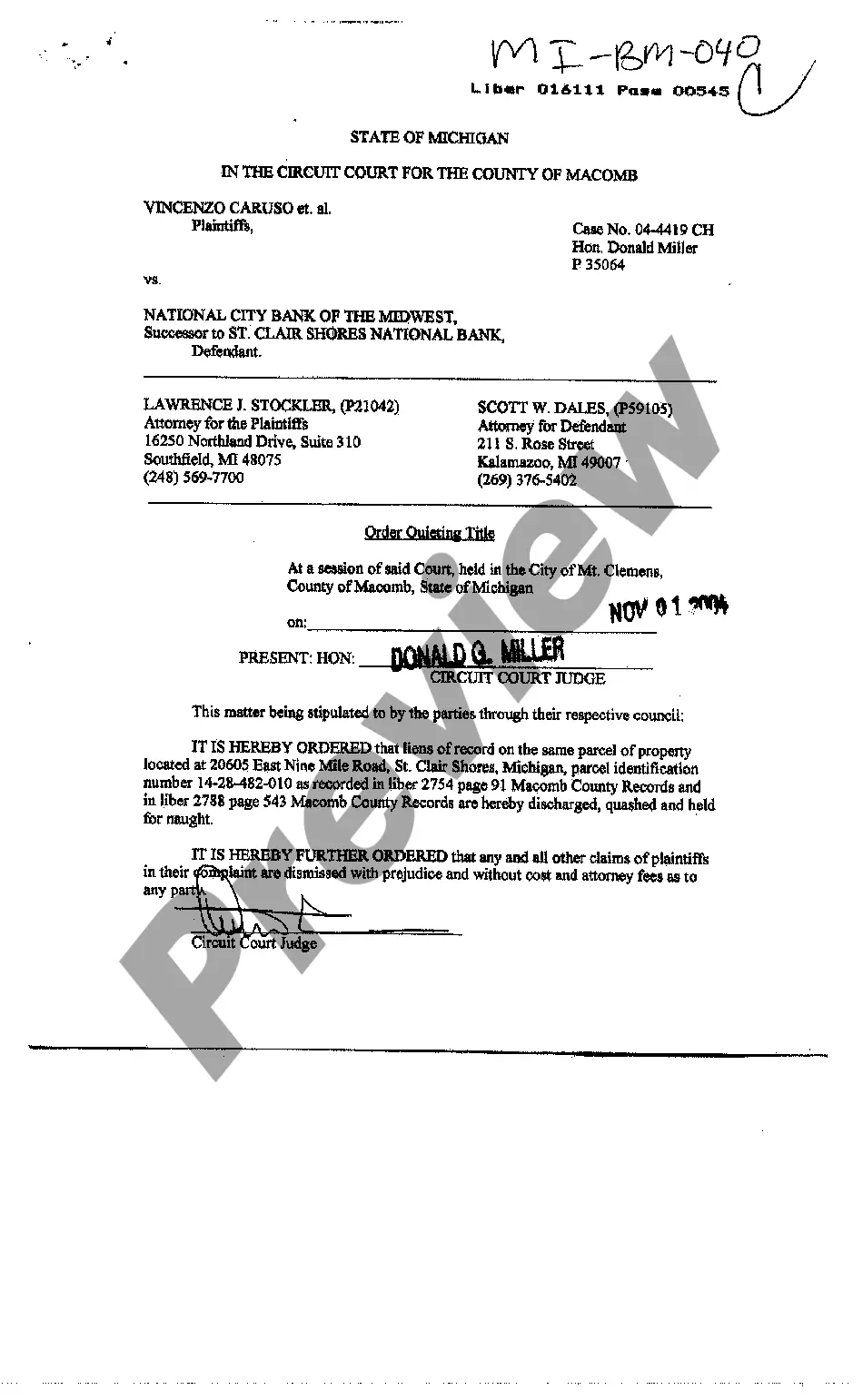

Maine conformed to the federal FDII deduction for tax years beginning before January 1, 2020. The federal rate-setting deduction is only available to corporations, not individual taxpayers. Taxpayers who choose to own an international business in a noncorporate form may elect corporate taxation.

27, 2017, and placed in service during calendar year 2020, the depreciation limit under Sec. 280F(d)(7) is $18,100 for the first tax year; $16,100 for the second tax year; $9,700 for the third tax year; and $5,760 for each succeeding year, all unchanged from 2019. Under Sec.

Qualified leasehold improvement property, qualified restaurant property, and qualified retail improvement property are allowed a Section 179 deduction, even if the properties relate to a Schedule E rental property, as long as the lessor considers the rental an active trade or business.

Maine's legislative responseBeginning with tax year 2002, Maine decoupled from federal bonus depreciation and, for all tax years beginning on or after January 1, 2003, the increases in section 179 expense limitations (including increases in the phase-out threshold and indexing).

The portion of the business standard mileage rate that is treated as depreciation will be 27 cents per mile for 2020, 1 cent more than 2019, one of the few amounts that is increasing.